Problem Set 2 due

advertisement

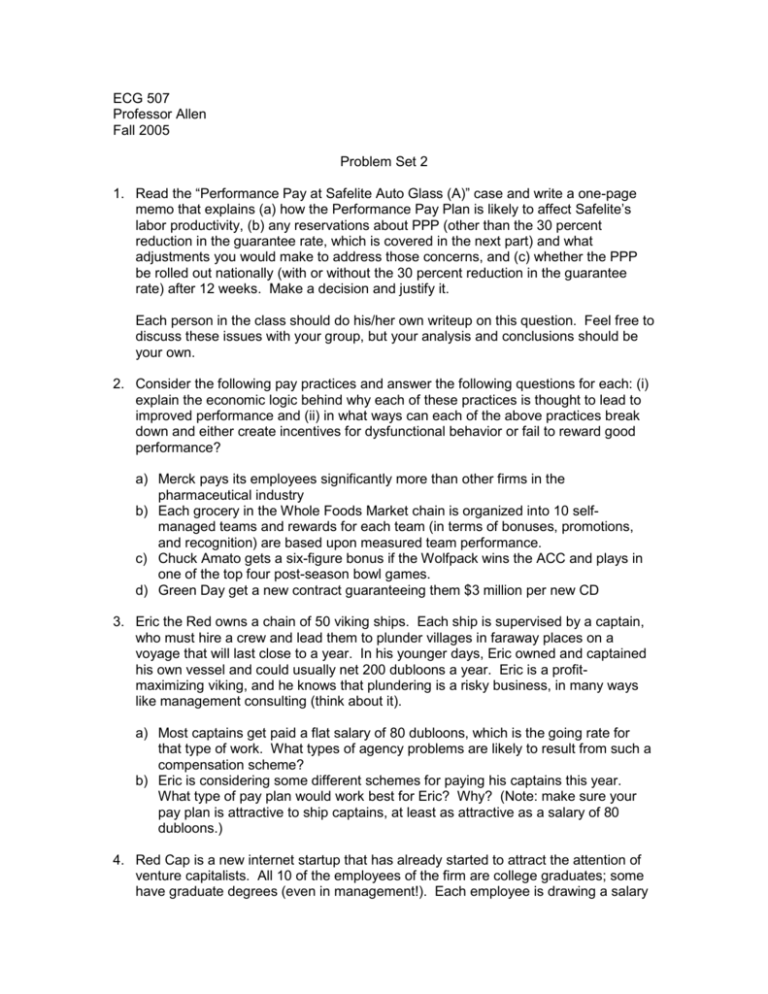

ECG 507 Professor Allen Fall 2005 Problem Set 2 1. Read the “Performance Pay at Safelite Auto Glass (A)” case and write a one-page memo that explains (a) how the Performance Pay Plan is likely to affect Safelite’s labor productivity, (b) any reservations about PPP (other than the 30 percent reduction in the guarantee rate, which is covered in the next part) and what adjustments you would make to address those concerns, and (c) whether the PPP be rolled out nationally (with or without the 30 percent reduction in the guarantee rate) after 12 weeks. Make a decision and justify it. Each person in the class should do his/her own writeup on this question. Feel free to discuss these issues with your group, but your analysis and conclusions should be your own. 2. Consider the following pay practices and answer the following questions for each: (i) explain the economic logic behind why each of these practices is thought to lead to improved performance and (ii) in what ways can each of the above practices break down and either create incentives for dysfunctional behavior or fail to reward good performance? a) Merck pays its employees significantly more than other firms in the pharmaceutical industry b) Each grocery in the Whole Foods Market chain is organized into 10 selfmanaged teams and rewards for each team (in terms of bonuses, promotions, and recognition) are based upon measured team performance. c) Chuck Amato gets a six-figure bonus if the Wolfpack wins the ACC and plays in one of the top four post-season bowl games. d) Green Day get a new contract guaranteeing them $3 million per new CD 3. Eric the Red owns a chain of 50 viking ships. Each ship is supervised by a captain, who must hire a crew and lead them to plunder villages in faraway places on a voyage that will last close to a year. In his younger days, Eric owned and captained his own vessel and could usually net 200 dubloons a year. Eric is a profitmaximizing viking, and he knows that plundering is a risky business, in many ways like management consulting (think about it). a) Most captains get paid a flat salary of 80 dubloons, which is the going rate for that type of work. What types of agency problems are likely to result from such a compensation scheme? b) Eric is considering some different schemes for paying his captains this year. What type of pay plan would work best for Eric? Why? (Note: make sure your pay plan is attractive to ship captains, at least as attractive as a salary of 80 dubloons.) 4. Red Cap is a new internet startup that has already started to attract the attention of venture capitalists. All 10 of the employees of the firm are college graduates; some have graduate degrees (even in management!). Each employee is drawing a salary of $20,000 per year. In return for working below market rates, each is expecting to receive stock options once Red Cap goes public. Red Cap’s “offices” are in the third floor of a house in Apex. The owner of the house allows Red Cap to use the space and phone lines rent-free. The mortgage on the house is $2000 per month and the floor-space used by Red Cap represents onefourth of the space in the house. Red Cap’s only other significant expense is one laptop computer for each worker, costing $2000 each and expected to last four years. This year Red Cap has total revenue of $300,000. a) Estimate to the best of your ability the total cost of operating Red Cap. Use the economist’s definition of cost, not the accountant’s. If you need information that is not provided above, make an estimate that you believe is close to its actual value. b) Assess the profitability of Red Cap. 5. (Borrowed from Steve Margolis) The Darn Close (DC) measurement company makes a line of precision instruments. They face a make-or-buy decision for a new pressure gauge that is a part of their oil well monitoring system. They will need 5000 of these gauges for their current series system. (After that, they expect to replace the series with all new technologies.) This new pressure gauge can be made in the RTP plant that was making the old pressure gauge. For the past year, the costs for the plant for 5000 gauges were as follows: Fixed overhead Variable overhead Direct labor Direct materials 125,000 200,000 100,000 80,000 Production of the new gauge at the RTP plant would be subject to the same costs as the old gauge, except that there would be a one-time fixed investment of $75,000 in new tooling. This new tooling will not have any alternative use when the new technology is introduced in about a year. DC has no alternative production plans for this plant, but could lease it for $80,000 to a nearby manufacturing company. If they do not make the gauge themselves, they can buy them from an outside vendor for $115 each. What should DC do? 6. Lucky Star is a company based in Taiwan that manufactures television sets that are then sold under a variety of well-known brand names. Lucky Star is thinking about expanding their operations, but they want to know how much their costs will increase if they do so. Last year they manufactured 20 million TVs and they are thinking about signing contracts that would allow them to increase their out put to 25 million TVs next year. Here is the income statement for Lucky Star for the last fiscal year, with all items in millions of dollars: 1. Sales revenue 2. Cost of goods sold $2972 1982 3. Gross profit on sales (1-2) 4. Selling expenses Sales commissions Advertising Telephone Travel and entertainment 5. Administrative expenses Officers salaries Depreciation of office building 6. Income from operations (3-4-5) 7. Interest paid 8. Before tax income 9. Income tax 10. Net income 990 453 303 56 44 50 351 276 75 186 90 96 25 71 Manufacturing costs are reported under cost of goods sold. There are three other important sources of costs: selling expenses (sales commissions, advertising, telephone, and travel and entertainment), administrative expenses (officers salaries, depreciation of office building), and interest. To make things simple, assume that income taxes are a straight percentage of before tax income. Use this information to estimate how much it would cost to increase TV output from 20 to 25 million sets. Assuming the increase in revenue is proportional, should Lucky Star expand? 7. Text, chapter 7, problem 1. 8. Text, chapter 7, problem 3. 9. Text, chapter 7, problem 5.