Chapter 9: Analysis Of Conflict

advertisement

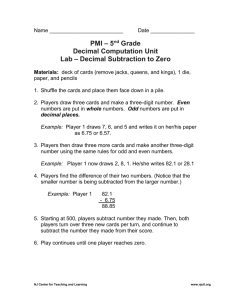

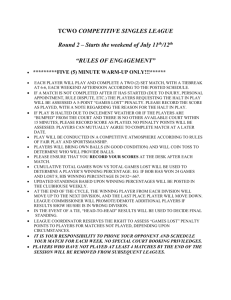

Chapter 9 Analysis on Conflict Summary and Quiz Chapter 9 ANALYSIS OF CONFLICT 9.2 – GAME THEORY Game Theory attempts to model and predict outcomes of conflict between rational individuals. It models the interaction between two or more players in the presence of uncertainty and information asymmetry. Game Theory requires that players formally take the actions of the other players into account, making it more complex than decision theory and theory of investment. The number of players in a game theory is sufficiently small that the actions of one player do influence the other players. One way to classify these games is as cooperative (parties enter into a binding agreement) and noncooperative. 9.3 – NON-COOPERATIVE GAME MODEL OF MANAGER-INVESTOR CONFLICT When making decisions, investors are aware that managers do not always reveal all information. It is too difficult and costly to provide each investor with desired information about the company. Game Theory assumes each player chooses a strategy without knowing the strategy choice of the other. Strategy Pair is a statement of the strategy taken by each party. Nash Equilibrium is the only strategy pair, such that given the strategy choice of the other player, each player is content with their strategy and does not wish to depart from their choice. Nash equilibrium is the predicted outcome of a noncooperative game. In single-person decision theory, nature is an impartial force that does not think and the strategy chosen by an investor does not affect these probabilities of nature. This theory breaks down when the payoffs are generated by a thinking opponent (a manager) rather than by nature, which leads us to the game theory. 9.4 – COOPERATIVE GAME THEORY Players engage in a game situation when entering into agreements they perceive as binding (i.e. contracts). There are two important contracts: 1. Employment contracts - between firm and its managers 2. Lending contracts - between the firm and its lender In these contracts, one party is the principal and the other is the agent. Agency theory is a branch of game theory that studies the design of contracts between two or more people. It motivates a rational agent to act on behalf of a principal when the agent’s interests would otherwise conflict with those of the principal. It has characteristics of both cooperative and non-cooperative games. Two parties do not specifically agree to take certain action but rather the actions are motivated by the contract itself. 9.4.2 – AGENCY THEORY: EMPLOYMENT CONTRACT It assumes the payoffs are observable by both parties. It puts onus on firm’s accounting policies to report information fully and accurately, so both parties in the game are willing to accept reported net income as a measure of the payoff. Reservation utility is the minimum utility a manager will accept before deciding to go elsewhere. One player will not choose an act desired by another player because that player says so. Each player chooses the act that maximizes his or her own expected utility. Utility maximizing behaviour by all parties is one of the important and distinguishing characteristics of positive accounting theory and economic theory of games. Effort-Adverse - the manager dislikes effort; the greater the level of effort, the greater the dislike. This disutility of effort by the agent is subtracted from the utility of remuneration of the agent. As a result, the agent will choose to shirk instead of work hard and this creates a moral hazard situation. Options available to control moral hazard: 1. Hire manager and accept the shirk work – unlikely to occur 2. Direct monitoring (First-Best contract) Ex. manager is paid $25 if alt. 1 is chosen and $12 if alt.2 is chosen Gives the owner maximum attainable utility and gives the agent reservation utility. Risk-sharing properties – risk-neutral owner bears all the risk; if owner is risk-adverse, manager and owner share risk. First-best contract often unattainable – difficult to determine effort of manager. 3. Indirect monitoring Does not work for fixed support cases - possible payoffs is fixed regardless which action is taken Moving support – the set of possible payoffs differ depending on the actions taken Cannot ensure first-contracts will be attained because many contracts use fixed support If the moving support holds, legal/institutional factors prevent owner from penalizing manager sufficiently to force a better alternative. 4. Owner rents firm to manager Owner guaranteed fixed rent no matter what and does not care about the actions of the manager (this is called internalizing the manager’s decision problem) Manager bears all the risk 5. Give manager a share of the payoff (most efficient alternative after first-best) Manager given a certain percentage of the payoff Contract motivates the manager to choose the best alternative for the principal (called incentive-compatibility because manager’s incentive is compatible with owner’s interests) – interests are aligned Risk is shared Second-best - most efficient contract short of first-best Summary Agency theory studies how to design the optimal contract with the lowest possible cost. Contracts can only be written in terms of performance measures that are jointly observable by both principal and agent. - If the agent’s effort can be observed, directly or indirectly, a fixed salary is the optimal solution when the principal is risk neutral. (Effort is the performance measure) - If effort cannot be observed, but payoff can, the optimal contract will give the agent a share of the payoff. Agent will be motivated but is second best because of the additional risk imposed on the agent. (Payoff is the performance measure). Payoff is usually measured in terms of net income. The higher the correlation between net income with effort, the closer the second-best contract is to first-best contract and the lower the agency costs for the owner (“hard income”). - If neither payoff nor effort can be observed, the optimal contract is a rental contract, where the principal rents the firm to the manager for a fixed rental rate, thus internalizing the agent’s effort decision (no performance measure) Share price is another way to measure firm’s performance and most efficient payoff depends on firm’s organizational structure and environment. 9.4.3 – AGENCY THEORY: BONDHOLDER-MANAGER LENDING CONTRACT Even in lending contracts, there exists a moral hazard problem where the managers may act contrary to the best interests of the lenders. Rational lenders will raise their interest rates and managers may commit not to act against the lender’s interests by entering into covenants. The manager agrees to limit dividends, or limit additional borrowing while loan is outstanding. With these covenants, a firm is able to lower the interest rates charged by the lender. 9.5 – IMPLICATIONS OF AGENCY THEORY FOR ACCOUNTING Holmstrom’s Agency Model Assumes the agent’s effort is unobservable by the principal, but payoff is jointly observable. Payoffs can be measured through net income, but principal may not believe net income is creditable because the manager controls the accounting system and policies used; thus, GAAP and auditing play a role in contracting. GAAP limits a manager’s incentive to influence reported net income and auditing adds creditability. Contracts based on payoff are less efficient than first-best; raising questions of whether second-best can be made more efficient by biasing it on a second variable such as shareprice. Both net income and share price can be used to reduce agency costs provided both variables are observable and conveys information about manager’s effort. Analysis shows that no matter how noisy the second variable is, as long as it can be used to increase efficiency of the second-best contract, it contains some additional information about effort. 9.5.2 – RIDGITY OF CONTRACTS Contracts tend to be rigid once signed. It is impossible to anticipate all contingencies when entering a contract. Contracts that do not anticipate all possible state realisations are called incomplete. Things that are hard to predict include a change in the way net income or covenant ratios are calculated. Renegotiations are possible for incomplete contracts but all or majority of bondholders would need agreement because bondholders need to be compensated to positive changes in net income. Unforeseen state realizations impose costs on firm and/or manager. 9.6 – RECONCILIATION OF EFFICIENT SECURITIES MARKET THEORY WITH ECONOMIC CONSEQUENCES Net income and other financial statement numbers matter to managers because manager’s remuneration depends on net income and usually long term lending contracts involve covenants where manager commits not to take certain actions that may be contrary to lender’s interests. Nothing in the theory of efficient securities markets conflicts with managerial concern about accounting policies. Considering both theories helps us see that managers may well intervene in accounting policies even though these policies would improve the decision usefulness of financial statement to investors. Agency theory is not the only explanation for economic consequences, but also managers do not accept securities market efficiency, believing that investor reaction and cost of capital are affected by accounting policy choice irrespective of any impact on cash flow. Managers believe that accounting policies are a way to communicate inside info to the market. Chapter 9 Analysis Of Conflict Multiple Choice (18 minutes) Use the following utility table to answer question 1 INVESTOR MANAGER (investor, manager) Honest (H) Distort (D) Buy (B) 12, 8 4, 16 Refuse to Buy (R) 7, 4 7, 6 1. For the non-cooperative game model above, which strategy pair represents the Nash Equilibrium? a.) b.) c.) d.) BH RD BD RH 2. Which one of the following statements about Game Theory is false? a.) Game theory models the interaction of two or more players, frequently in the presence of uncertainty and information asymmetry. b.) The number of players is sufficiently small that the actions of one player do not influence the other players. c.) The conflict aspect of a game is where the players take the actions of the other players into account. d.) Agency theory is a version of game theory that models the process of contracting between two or more persons. 3. One way of classifying game theory is cooperative. A cooperative game is one: a.) Where players in a game can enter into agreements that they perceive as binding. b.) That is concerned with two types of contracts, employment and lending contracts. c.) Where it is difficult to envisage a binding agreement between managers and investors about what specific information is to be supplied. d.) Both (a) and (b) 4. When a manager is said to be Effort-adverse, this means: a.) The manager is indifferent to the effort he or she must contribute. b.) The manager likes effort and the lower the effort level, the greater the dislike. c.) The manager dislikes effort and the greater the level of effort, the greater the dislike. d.) None of the above. 5. An example of moral hazard is when a manager shirks. There are several ways to control moral hazard, which option is an owner most likely will not choose? a.) b.) c.) d.) Direct Monitoring Hire the manager and put up with the shirking Rent the firm to the manager Give the manager a chare of the payoff 6. _________ is needed as a cost-effective way to put limits on the manager’s incentive to influence reported income by selecting from alternative policies. a.) b.) c.) d.) Risk Premium An Audit Internalizing GAAP 7. It is generally impossible to anticipate all contingencies when entering a contract. Contracts that do not anticipate all possible state realizations re termed: a.) b.) c.) d.) Covenants Complete Incomplete None of the Above 8. Auditing is needed to add ___________ to the reported net income number. a.) b.) c.) d.) Credibility Information Volatility Completeness 9. Agency theory contracts have characteristics of which of the following: a.) b.) c.) d.) Cooperative games Binding Games Non-Cooperative games Both a and b Short Answer Questions (12 minutes) 1. What is agency theory? (2 minutes) 2. Briefly define the two important types of contracts of Cooperative game Theory. (4 minutes) 3. There are different contracts that can be designed to control moral hazard; one option is to use direct monitoring, which formulates a First-best contract. Briefly explain First-best contracts. (6 minutes) Chapter 9 Analysis Of Conflict (Solution Key) Multiple Choice (18 minutes) Use the following utility table to answer question 1 INVESTOR MANAGER (investor, manager) Honest (H) Distort (D) Buy (B) 12, 8 4, 16 Refuse to Buy (R) 7, 4 7, 6 1. For the non-cooperative game model above, which strategy pair represents the Nash Equilibrium? a.) b.) c.) d.) BH RD BD RH 2. Which one of the following statements about Game Theory is false? a.) Game theory models the interaction of two or more players, frequently in the presence of uncertainty and information asymmetry. b.) The number of players is sufficiently small that the actions of one player do not influence the other players. c.) The conflict aspect of a game is where the players take the actions of the other players into account. d.) Agency theory is a version of game theory that models the process of contracting between two or more persons 3. One way of classifying game theory is cooperative. A cooperative game is one: a.) Where players in a game can enter into agreements that they perceive as binding. b.) That is concerned with two types of contracts, employment and lending contracts. c.) Where it is difficult to envisage a binding agreement between managers and investors about what specific information is to be supplied. d.) Both (a) and (b) 4. When a manager is said to be Effort-adverse, this means: a.) The manager is indifferent to the effort he or she must contribute. b.) The manager likes effort and the lower the effort level, the greater the dislike. c.) The manager dislikes effort and the greater the level of effort, the greater the dislike. d.) None of the above. 5. An example of moral hazard is when a manager shirks. There are several ways to control moral hazard, which option is an owner most likely will not choose? a.) b.) c.) d.) e.) Direct Monitoring. Hire the manager and put up with the shirking. Rent the firm to the manager. Give the manager a share of the payoff. Direct Monitoring 6. _________ is needed as a cost-effective way to put limits on the manager’s incentive to influence reported income by selecting from alternative policies. a.) b.) c.) d.) Risk-Premium An Audit Internalizing GAAP 7. It is generally impossible to anticipate all contingencies when entering a contract. Contracts that do not anticipate all possible state realizations re termed: a.) b.) c.) d.) Covenants Complete Incomplete None of the above. 8. Auditing is needed to add ___________ to the reported net income number. a.) b.) c.) d.) Credibility Information Volatility Completeness 9. Agency theory contracts have characteristics of which of the following: a.) b.) c.) d.) Cooperative Games Binding Games Non-Cooperative Games Both (a) and (b) Short Answer Questions 1. What is agency theory? (2 minutes) Agency theory is a type of game theory. It studies the design of contracts to motivate a rational agent to act on behalf of a principal when the agent’s interests would otherwise conflict with those of the principal. 2. Briefly define the two important types of contracts concerned with Cooperative game Theory. (4 minutes) The two types of contracts concerned with cooperative theory are employment contracts and lending contracts. Employment contract is between the firm and its top manager. The main concern of employment contracts is moral hazard due to shirking. The goal here is to align the interests of both the owner and the manager. Lending contract is between the firm and the bondholder. Managers may act contrary to the best interest of the lenders, which causes rational lenders to increase interest rates. Covenants are inserted into lending agreements to get managers to act in the best interest of the lenders. 3. There are different contracts that can be designed to control moral hazard; one option is to use direct monitoring, which formulates a First-best contract. Briefly explain First-best contracts. (6 minutes) Under direct monitoring, a manager’s contract would be amended to pay a salary that depends on the closeness of the manager’s decision to the interest of the owner. For example, paying a salary of $25 for choosing to work hard or $12 for shirking. The owner (principal) receives a maximum attainable utility and gives the manager (agent) the reservation utility. A risk-sharing property arises where the manager bears no risk because a fixed salary is received, regardless of the payoff. If the manager is risk-adverse, this option is desirable. The owner, on the other hand, bears all the risk of the random payoff. If the owner is riskneutral, he or she does not mind bearing all the risks. Usually, first-best contracts are unattainable because it is unlikely the owner could monitor the agent’s effort in a managerial setting. As well, information asymmetry plays a factor due to the fact the owner is unaware of the manager’s effort level; only the manager knows the amount of effort he puts in.