Jul 18, 2013

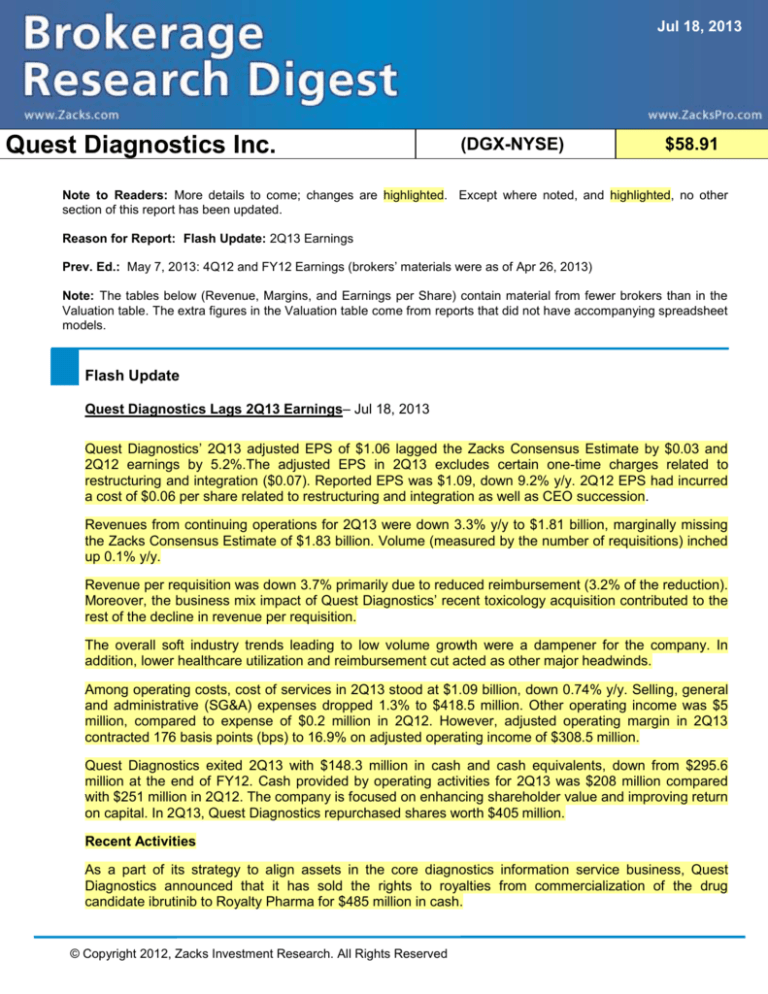

Quest Diagnostics Inc.

(DGX-NYSE)

$58.91

Note to Readers: More details to come; changes are highlighted. Except where noted, and highlighted, no other

section of this report has been updated.

Reason for Report: Flash Update: 2Q13 Earnings

Prev. Ed.: May 7, 2013: 4Q12 and FY12 Earnings (brokers’ materials were as of Apr 26, 2013)

Note: The tables below (Revenue, Margins, and Earnings per Share) contain material from fewer brokers than in the

Valuation table. The extra figures in the Valuation table come from reports that did not have accompanying spreadsheet

models.

Flash Update

Quest Diagnostics Lags 2Q13 Earnings– Jul 18, 2013

Quest Diagnostics’ 2Q13 adjusted EPS of $1.06 lagged the Zacks Consensus Estimate by $0.03 and

2Q12 earnings by 5.2%.The adjusted EPS in 2Q13 excludes certain one-time charges related to

restructuring and integration ($0.07). Reported EPS was $1.09, down 9.2% y/y. 2Q12 EPS had incurred

a cost of $0.06 per share related to restructuring and integration as well as CEO succession.

Revenues from continuing operations for 2Q13 were down 3.3% y/y to $1.81 billion, marginally missing

the Zacks Consensus Estimate of $1.83 billion. Volume (measured by the number of requisitions) inched

up 0.1% y/y.

Revenue per requisition was down 3.7% primarily due to reduced reimbursement (3.2% of the reduction).

Moreover, the business mix impact of Quest Diagnostics’ recent toxicology acquisition contributed to the

rest of the decline in revenue per requisition.

The overall soft industry trends leading to low volume growth were a dampener for the company. In

addition, lower healthcare utilization and reimbursement cut acted as other major headwinds.

Among operating costs, cost of services in 2Q13 stood at $1.09 billion, down 0.74% y/y. Selling, general

and administrative (SG&A) expenses dropped 1.3% to $418.5 million. Other operating income was $5

million, compared to expense of $0.2 million in 2Q12. However, adjusted operating margin in 2Q13

contracted 176 basis points (bps) to 16.9% on adjusted operating income of $308.5 million.

Quest Diagnostics exited 2Q13 with $148.3 million in cash and cash equivalents, down from $295.6

million at the end of FY12. Cash provided by operating activities for 2Q13 was $208 million compared

with $251 million in 2Q12. The company is focused on enhancing shareholder value and improving return

on capital. In 2Q13, Quest Diagnostics repurchased shares worth $405 million.

Recent Activities

As a part of its strategy to align assets in the core diagnostics information service business, Quest

Diagnostics announced that it has sold the rights to royalties from commercialization of the drug

candidate ibrutinib to Royalty Pharma for $485 million in cash.

© Copyright 2012, Zacks Investment Research. All Rights Reserved

Further, in June, the company completed the acquisition of lab-related clinical outreach service

operations of Calif.-based Dignity Health and Concentra's toxicology business. Quest Diagnostics

believes that these acquisitions remain consistent with its strategy of delivering 1%–2% growth from

acquisitions. The acquisitions are also a part of the company’s recently initiated five-pronged strategy,

which includes disciplined capital deployment.

In April, the company completed the divesture of HemoCue diagnostics products business. In December,

Quest Diagnostics divested its OralDNA Labs salivary-diagnostics business in order to refocus its

resources to core diagnostic information services.

In addition, the company’s acquisition of UMass Medical Lab in Jan 2013 is in sync with its goal to create

a planned 'lab of the future.' According to the company, this will help it increase long-term growth

opportunities in the rapidly growing esoteric markets.

Outlook

Quest Diagnostics provided an updated FY13 outlook. Currently, revenues are expected to be down 1%–

2% from the prior-year as compared to the earlier projection of flat y/y revenues. The current Zacks

Consensus Estimate of $7.28 billion remains above the guided range. EPS is expected to remain in the

range of $4.35−$4.50 (earlier band was $4.35−$4.55). The Zacks Consensus Estimate of $4.35 matches

the lower end of the range. However, the company did not alter its estimate for capital expenditure ($250

million) and cash provided by operations ($1.0 billion).

Portfolio Manager Executive Summary

Quest Diagnostics Inc. (DGX) is the leading provider of clinical laboratory services in the US. The

company has a significant market share in clinical laboratory testing (testing on body fluids such as blood

and urine), anatomic pathology (testing on tissues and organs), esoteric testing (non-routine tests), and

testing for drugs and substance abuse.

Of the 16 firms providing ratings on Quest Diagnostics, 13 firms (81.3%) assigned neutral ratings, 2

(12.5%) rendered negative ratings and 1 (6.2%) firms provided a positive rating.

Neutral and negative or equivalent outlook – 15/16 –The firms are disappointed with Quest

Diagnostics’ 1Q13 results that fell short of the Street’s estimates owing to weak volume, pricing trends

and revenue per requisition. Following poor performance in 1Q13, the company also lowered its revenue

guidance, which according to the firms seems difficult to achieve, in light of the prevailing headwinds.

Moreover, the firms are also concerned about the company missing its adjusted operating margin target

for the reported quarter. According to most of the firms, Quest Diagnostics’ disappointing FY13 guidance

indicates that although the ongoing 5-point strategy may be able to return the company to revenue

growth, it is a longer-term affair. Despite the unimpressive performance, some firms are optimistic about

the change in management. According to the firms, invigorate introduced to trim the cost is effective, but

is offset by pricing pressures. They also believe that acquisition of UMass and another outreach lab will

contribute to the revenue in a significant way. Despite this, the firms are of the opinion that multiple

expansion will depend on top-line performance. While some firms foresee positive long-term

fundamentals for the clinical lab industry and view Quest to be well placed within the industry, they

remain cautious over the near term based on inconsistent healthcare utilization trends. Additional

challenges for the company include a proposed 5% reimbursement cut effective from Jan 1, 2013, insourcing of lab testing by physician offices, which is particularly an issue for Quest, and the potential

market share loss as a result of the company’s aggressive cost-cutting initiatives. The firms are

disappointed with the company’s lack of initiatives to counter these challenges.

May 7, 2013

Zacks Investment Research

Page 2

www.zackspro.com

Overview

Based in Teterboro, N.J., Quest Diagnostics Inc. offers a broad range of clinical laboratory testing

services and advanced information technology solutions to physicians, managed care organizations,

hospitals, employers, and other independent clinical laboratories. These include routine clinical (including

substance abuse testing), anatomic pathology, and more complex esoteric testing (genetics,

immunology, and oncology). In addition, the company performs clinical lab tests in the form of research

trials for new drugs. It is one of the largest listed healthcare facilities companies in the market. More

information on the company is available at www.questdiagnostics.com.

The analysts identified the following factors for evaluating the investment merits of DGX:

Key Positive Arguments

Economies of scale, a key competitive

advantage in an industry characterized by huge

fixed costs, provide Quest with a lower cost

structure and competitive pricing power.

National level prominence gives Quest a

competitive edge in winning new business and

adding incremental volumes via opportunistic

acquisitions.

The new management’s efforts to improve

operations and execution combined with the

‘invigorate’ cost cutting initiative are expected to

rebound the company’s growth performance in

the upcoming quarters.

Key Negative Arguments

Pressure on volume owing to difficult macro

economic situation and pricing constitute the

primary risk for Quest Diagnostics.

Quest Diagnostics faces intense competition from

LabCorp, which is evident from the re-negotiation of

contracts with managed care companies at lower

prices.

The company expects the revenue per requisition to

be impacted by 3% owing to the reimbursement

pressures.

NOTE: Quest’s fiscal references coincide with the calendar year.

May 7, 2013

Long-Term Growth

Quest Diagnostics continues to face a difficult time due to general slowdown in physician office visits.

However, the company undertook several initiatives to prepare itself for an economic recovery, which

included controlling its cost structure that would improve margins over the long term and upgrading the

sales force. Moreover, the company has also adopted various cost cutting initiatives to improve its bottom

line.

The firms widely hold the view that the company’s recent change in top management is expected to

benefit the company and likely to set it on the path of growth once again. They believe that the recent

operational improvement and execution strategy of the company’s new CEO Steve Rusckowski along

with his ‘Invigorate’ cost cutting plan will help the company to improve its position even amid the difficult

industry trend. They believe that Quest's initiatives to reduce costs, enhance efficiency, and improve

productivity are encouraging.

The firms, based on the company’s positive long-term fundamentals for the clinical lab industry, view

Quest as well positioned within the industry. They are, to some extent, cautious as there has not been a

sustained recovery in healthcare utilization trends. Also, the company’s higher exposure to physician insourcing trends and limited financial flexibility after recent acquisitions emerge as points of concern.

Zacks Investment Research

Page 3

www.zackspro.com

The company has also organized specialty sales force that would cater to physicians, hospitals and

cancer patients. Moreover, the deals with Athena and Celera have brought in specialty sales force for

neurological disorders and cardiovascular diseases. Quest has been investing in esoteric, gene-based

and anatomic pathology to demarcate cancer diagnostics from cardiovascular disease, infectious disease

and neurological disorders. The company believes that these four platforms with specialty force will act

as the growth engine for the future. The company is already witnessing some traction from these steps,

which should further lead to gradual top-line growth and margin expansion.

Increased knowledge of a disease at the genetic level and the emergence of biological therapeutics have

increased the importance of early detection of ailments and the role of mainstream clinical testing.

Consequently, clinical laboratories are increasingly providing more sophisticated and high-value

specialties such as gene-based and esoteric testing, in addition to the traditional high-volume serum

testing. The fragmented US laboratory testing market has been valued at approximately $50 billion in

which Quest Diagnostics holds approximately 15% market share. Demand is expected to grow further

with the rise in aging population, increased recognition of the value of more specialized and sophisticated

tests in genomics and proteomics and the low-cost benefits of testing to improve health.

May 7, 2013

Target Price/Valuation

Rating Distribution

Positive

6.2%↑

Neutral

81.3%↓

Negative

12.5%↑

Avg. Target Price

$59.16 ↓

Maximum Target

$65.00↑

Minimum Target

No. of analyst with target

price/Total

$53.00↓

Average upside from current

4.9%↑

Maximum upside from current

15.7%↑

Minimum downside from current

5.6%↓

16/16

Risks to the target price include acceleration of pricing competition as a way to gain incremental volumes,

slow development of esoteric tests which generate the highest revenue per test, and government

reimbursement, which could come under pressure for the next several years.

Recent Events

On Apr 17, 2013, Quest Diagnostics reported its 1Q13 results. Highlights are as follows:

Quest Diagnostics reported 1Q13 EPS from continuing operations of $0.72, down from

$0.97 in 1Q12. However, after taking into account certain charges related to restructuring

and integration ($0.17), adjusted EPS from continuing operations came in at $0.89, down

15.2% y/y.

Revenues from continuing operations for 1Q13 were down 6.4% y/y to $1.8 billion.

Zacks Investment Research

Page 4

www.zackspro.com

Quest Diagnostics expects revenue growth to be flat y/y, in comparison with previously

provided band of 0%–1%. The company reiterated the EPS to be in the range of

$4.35−$4.55 and expects to incur $250 million of capital expenditure and $1.0 billion as

cash provided by operations.

Revenue

Quest Diagnostics reported net revenues from continuing operations for 1Q13 of $1.8 billion, down 6.4%

y/y. Decrease in revenue is attributable to low number of requisitions, lesser business days and

unseasonably mild winter, partially offset by contribution from the UMass acquisition. According to the

Zacks Digest, 1Q13 revenue was approximately in line with the company’s report.

Provided below is a summary of revenue as compiled by Zacks Digest:

Revenue ($ in million)

Total Revenue

Digest High

Digest Low

YoY Growth

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

2015E

$1,908.7

$7,382.7

$1,786.6

$1,839.9↓

$1,858.6

$1,829.2

$7,318.4↓

$7,437.6↓

$7,434.8

$1,908.7

$7,383.0

$1,787.0

$1,863.2↓

$1,901.5

$1,854.2

$7,405.5↓

$7,585.3↓

$7,434.8

$1,908.7

6.4%

$7,382.6

-0.1%

$1,786.6

-6.4%

$1,804.3↓

-2.0%↓

$1,834.0

2.0%

$1,809.0

3.1%

$7,253.4↓

-0.9%↓

$7,366.7↓

1.6%

$7,434.8

0.0%

5 Point Strategy

In 2012, Quest Diagnostics introduced a five-point business strategy. The points being:

1. Refocus on diagnostic information services: During 2012, the company conducted a review of

portfolio, to evaluate all strategically fit assets. As a result of the review, Quest Diagnostics has been

focusing on areas with high potential such as gene-based esoteric testing for cancer, cardiovascular

disease, infectious disease and neurological disorders. The company has experienced increasing

demand for gene-based and esoteric tests compared with routine tests on the back of increased esoteric

mix contributed by Athena and Celera. In addition, the company decided to refocus on the electronic

health record business as well as wants to pursue partnerships with top EHR vendors to jointly

strengthen value proposition. Also, it sold the OralDNA salivary diagnostics business and HemoCue

diagnostic products business.

2. Drive Operational excellence: The company plans to focus on four strategic requirements which are to

enhance end-to-end customer value chain, enterprise information technology architecture, business

performance tools and cost excellence.

Cost excellence Program: In 2012, Quest Diagnostics launched a multi-year Invigorate program

designed to support its $600 million in cost savings by the end of FY14. The company is pursuing

opportunities to increase this total to $1 billion beyond 2014. Invigorate consists of six flagship programs,

with structured plans in each, to drive savings and improve performance across the customer value

chain: organization excellence; information technology excellence; procurement excellence; service

excellence; lab excellence; and billing excellence. This effort is expected to improve operating profitability

and quality. As per the plan, the company expects roughly one-third of the savings from client

support/billing, procurement and supply chain; one-third from laboratory operations and specimen

acquisition; and one-third from selling, general and administrative expenses, including information

technology. Common themes across many of the opportunities include standardizing systems and

processes and data bases, increased use of automation and technology, and centralizing and selective

outsourcing of certain activities.

The company also announced a voluntary retirement program which is expected to deliver $40 million in

annualized cost savings, a portion of which will be realized in at the end of 1Q13. Of the total estimated

pre-tax charges for employee separation costs noted below, we expect to incur approximately $50 million

Zacks Investment Research

Page 5

www.zackspro.com

in connection with the voluntary retirement program, approximately $44 million of which has been

incurred through December 31, 2012.

On Jan 1, 2013, most of the organizational changes became operational, according to which the

company plans to remove three management layers. 400 to 600 management positions are planned to

be eliminated by the end of FY13.

3. Restore Growth: The company has adopted seven tactical approaches to restore growth such as sales

and marketing excellence; grow esoteric testing through a disease focus; partner with hospitals and IDNs

succeed internationally; create value from information assets; lead in companion diagnostics; and extend

in adjacent markets.

The other two parts of the strategy are: Simplify the organization to enable growth and productivity and

Deliver disciplined capital deployment and strategically aligned accretive acquisitions.

Segmental Revenues

Over 90% of Quest Diagnostic’s revenues are derived from DIS with the balance derived from risk

assessment services, clinical trials testing, diagnostic products and healthcare information technology.

The company is currently the leading provider of DIS, including routine testing, esoteric or gene-based

testing and anatomic pathology testing. In addition, the company also offers healthcare organizations and

clinicians information technology solutions.

DIS Revenues (90% total revenues in 1Q13)

In 1Q13, DIS revenues decreased 6.7% y/y. Volume (measured by the number of requisitions) and

revenue per requisition, each declined 3.4% y/y. Sequentially, revenue per requisition declined 3.4% in

1Q13 in comparison with 2% in 4Q12. The decrease in the revenue per requisition is primarily due to the

reduction in commercial fee schedule, Medicare fee schedule and pathology reductions. These

implementations were made effective in Jan.

The firms are concerned with the weak volume growth over the last few quarters. According to them, for

FY13, the average reimbursement pressure will be around 3% while till 2015 reimbursement pressure in

the range of 1% and 2% is expected.

Routine testing refers to the traditional testing of bodily health indicators/parameters, and forms the bulk

of the company’s revenue. This service carries low margins and represents the commodity-like aspect of

Quest’s business, and is an area that benefited from economies of scale and increased automation.

Commonly carried out tests include blood cholesterol level tests, complete blood cell counts, HIV-related

tests, urinalyses, pregnancy and other prenatal tests, alcohol and substance-abuse tests. Anatomic

pathology (including cyto-pathology, e.g. pap smears), or the analysis of human tissue, is a sub-category

and represents approximately 20% of the routine market.

Esoteric testing, by contrast, broadly refers to more complicated tests requiring sophisticated

technology, materials and hands-on professional expertise. The tests experienced a low volume and are

generally not cost effective for most clinical labs to perform. Nonetheless, their complexity attracts a

generally higher reimbursement than routine tests.

The company has experienced increasing demand for gene-based and esoteric tests compared to

routine tests. However, revenues derived from anatomic pathology have been under pressure for the

past few quarters due to in-sourcing of the tests by physicians. Many health plans have made

reimbursement policy changes to address over utilization caused by in-sourcing of certain kinds of

anatomic pathology testing.

Zacks Investment Research

Page 6

www.zackspro.com

Divesture of businesses

As a part of the company’s refocus on DIS, the company recently shed its OralDNA Labs salivarydiagnostics business. Also in Feb 2013 the company announced that Radiometer Medical ApS has

agreed to purchase the HemoCue diagnostic products business for $300 million plus customary

adjustments for cash balances. This would enable the company to refocus its attention on its core

diagnostic information services. Moreover, Quest Diagnostic’s acquisition of UMass Medical Lab is in

sync with its goal to create a planned 'lab of the future' will help it increase long-term growth opportunities

in the faster-growth esoteric markets.

Diagnostic Solutions group (10% total revenues in 1Q13)

This group includes offers a range of solutions for insurers and healthcare providers. The products are

basically healthcare information technology, clinical trials testing, life insurer services and diagnostic

products. Accordingly the company has become the leading provider of risk assessment services for the

life insurance industry. In addition, Quest Diagnostics is a leading provider of testing for clinical trials. In

addition, it offers healthcare organizations and clinicians information technology solutions. For 1Q13,

revenue from Diagnostic Solutions group decreased 2% in comparison with the year-ago quarter.

Following is a graphical representation of segmental revenue:

Please refer to the Zacks Research Digest spreadsheet on DGX for further details on revenue.

Reimbursement Headwind: Medicare (catering to patients of 65 years and older), Medicaid (for lowincome patients) and other insurers have increased their efforts to control the cost, utilization and delivery

of health care services. The company noted that steps taken to regulate health care delivery in general

and clinical laboratories in particular have resulted in reduced prices, added costs and decreased test

utilization for the clinical laboratory industry by increasing complexity and adding new regulatory and

administrative requirements.

Zacks Investment Research

Page 7

www.zackspro.com

In March 2010, the Patient Protection and Affordable Care Act (“PPACA”) was enacted, and among its

provisions were reductions in the Medicare clinical laboratory fee schedule updates, one of which is a

permanent reduction and the other to be applied in 2011 through 2015.

The Medicare Clinical Laboratory Fee Schedule for 2013 is decreased by 2.95% (excluding

sequestration) from 2012 levels. In Dec 2012, Congress delayed by one year a potential decrease of

approximately 26% in the physician fee schedule that otherwise would have become effective from Jan 1,

2013, but implemented relative value unit changes significantly impacting physician fee schedule

reimbursement for tissue biopsies that are expected to reduce reimbursement for tissue biopsy services.

Also, an additional 2% reduction in the Medicare Clinical Laboratory Fee Schedule for 2013, associated

with sequestration, has been delayed till Apr 1, 2013.

Quest Diagnostics currently derives 13% and 3% of its revenues from clinical lab fee schedule and

physician fee schedule, respectively. The company expects to record a negative impact of $40–$50

million on its revenues, which will largely be offset by the benefits from payroll rationalization.

Margins

Among operating costs, cost of services in 1Q13 stood at $1.09 billion, flat y/y. Selling, general and

administrative (SG&A) expenses dropped 9.3% to $447.9 million. Other operating income was $0.6

million, compared to expense of $0.4 million in 1Q12. Adjusted operating margin in 1Q13 contracted

120 basis points (bps) to 15.2% on adjusted operating income of $271.5 million.

According to the Zacks Digest, 1Q13 operating margin was in line with the company’s report.

Provided below is a summary of margins as compiled by Zacks Digest:

Margins

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

Gross

Operating

Pretax

Net

42.1%

41.6%

39.9%

40.5%↓

41.0%

40.7%

40.5%↓

41.0%↓

2015E

16.6%

17.8%

15.2%

17.4%↓

18.5%

17.6%

17.2%↓

17.7%↓

18.3%

15.1%

16.1%

13.5%

15.9%↑

16.9%

15.6%

15.5%↓

16.1%↓

16.8%

8.8%

9.5%

8.0%

9.1%↓

9.9%

9.5%

9.2%↓

9.6%↓

10.0%

Outlook: For FY13, Quest Diagnostics expects operating margin, to remain in between flat and down

100 bps based on the amount of share repurchase.

As per the Zacks Digest model, on a pro forma basis cost of service would go up 0.9% y/y in FY13 and

1.0% in FY14; and SG&A expense would decline 2.9% y/y in FY13 and a marginal decline of 0.2% in

FY14. In comparison, revenues would decline 0.9% y/y in FY13 and increase 1.6% y/y in FY14.

Please refer to the Zacks Research Digest spreadsheet on DGX for further details on margins.

Earnings per Share

Quest Diagnostics reported from continuing operations of $0.72 in 1Q13, down considerably from $0.97

in 1Q12. However, after taking into account certain charges related to restructuring and integration

($0.17), adjusted EPS from continuing operations came in at $0.89, down 15.2% y/y. The 1Q13 EPS had

incurred a cost of $0.08 per share each, related to restructuring and integration as well as CEO

succession costs.

According to the Zacks Digest, 1Q13 adjusted EPS were in line with the company’s report.

Provided below is a summary of EPS as compiled by Zacks Digest:

Zacks Investment Research

Page 8

www.zackspro.com

EPS ($/share)

Digest High

Digest Low

Digest Avg.

Digest Y/Y

Growth

1Q12A

2012A

1Q13A

2Q13E

3Q13E

4Q13E

2013E

2014E

2015E

$1.06

$1.05

$1.05

$4.39

$4.36

$4.37

$0.89

$0.89

$0.89

$1.13↓

$0.98↓

$1.08↓

$1.27

$1.17

$1.21

$1.21

$1.11

$1.16

$4.43↓

$4.26↓

$4.35↓

$4.98↓

$4.74↑

$4.85↓

$5.35

$5.35

$5.35

16.4%

1.7%

-15.5%

-6.6%↓

4.6%

15.1%

-0.4%↓

11.5%↑

10.3%

Outlook: Quest Diagnostics’ FY13 EPS is expected to remain in the range of $4.35−$4.55.

Please refer to the Zacks Research Digest spreadsheet on DGX for further details on EPS.

May 7, 2013

StockResearchWiki.com – The Online Stock Research Community

Discover what other investors are saying about Quest Diagnostics, Inc. (DGX) at:

DGX profile on StockResearchWiki.com

Analyst

Urmimala Biswas

Copy Editor

Content Ed.

No. of brokers reported/Total

brokers

Reason for Update

Urmimala Biswas

QCA

Rajiv Mukherjee

Lead Analyst

Urmimala Biswas

Zacks Investment Research

Flash

Page 9

www.zackspro.com