Association of Accounting Technicians

advertisement

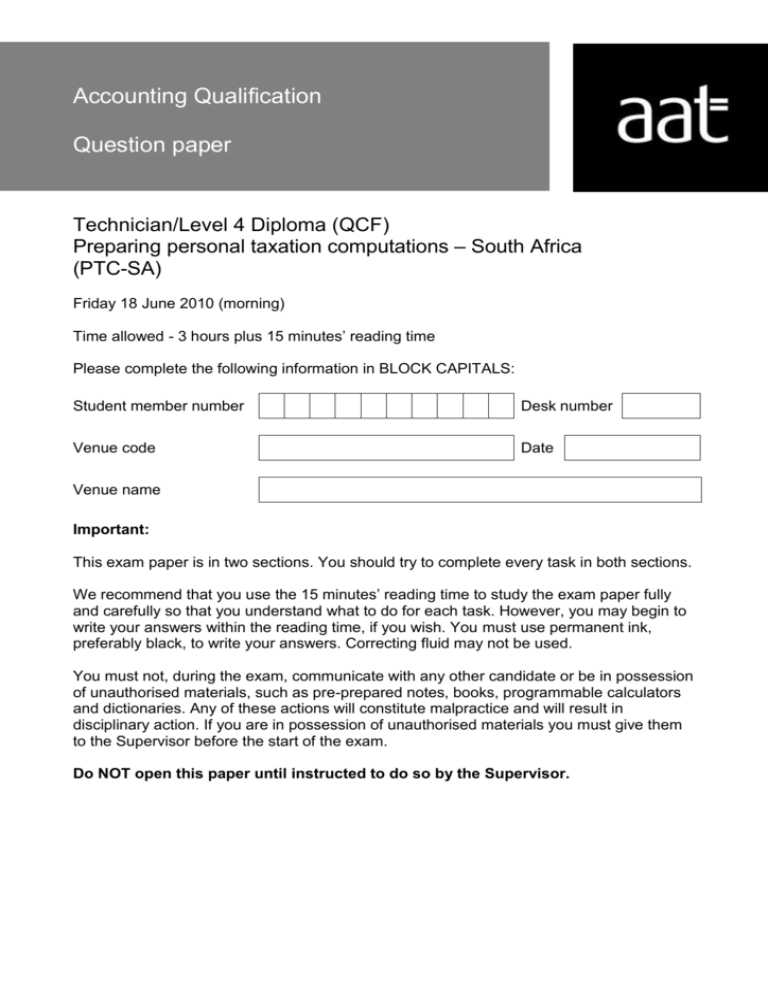

Accounting Qualification Question paper Technician/Level 4 Diploma (QCF) Preparing personal taxation computations – South Africa (PTC-SA) Friday 18 June 2010 (morning) Time allowed - 3 hours plus 15 minutes’ reading time Please complete the following information in BLOCK CAPITALS: Student member number Desk number Venue code Date Venue name Important: This exam paper is in two sections. You should try to complete every task in both sections. We recommend that you use the 15 minutes’ reading time to study the exam paper fully and carefully so that you understand what to do for each task. However, you may begin to write your answers within the reading time, if you wish. You must use permanent ink, preferably black, to write your answers. Correcting fluid may not be used. You must not, during the exam, communicate with any other candidate or be in possession of unauthorised materials, such as pre-prepared notes, books, programmable calculators and dictionaries. Any of these actions will constitute malpractice and will result in disciplinary action. If you are in possession of unauthorised materials you must give them to the Supervisor before the start of the exam. Do NOT open this paper until instructed to do so by the Supervisor. Note: You may use this page for your workings. 2 Note: This page is perforated. You may remove it for easy reference. Taxation tables for personal tax – 2009/10 Tax rates: Taxable income Rate of tax R0 – R132,000 18% of each R1 R132,001 – R210,000 R23,760 plus 25% of the amount over R132,000 R210,001 – R290,000 R43,260 plus 30% of the amount over R210,000 R290,001 – R410,000 R67,260 plus 35% of the amount over R290,000 R410,001 – R525,000 R109,260 plus 38% of the amount over R410,000 R525,001 + R152,960 plus 40% of the amount over R525,000 Rebate: Primary rebate Secondary rebate (over 65) R 9,756 5,400 Interest exemptions: Under 65 21,000 Over 65 30,000 For each, first R3,500 of the exemption is applicable to foreign dividends and foreign interest Car allowance: Maximum vehicle cost for actual expenses 400,000 Deemed expenditure table (see next page) Fringe benefit (company car): Benefit percentage Reduction for all private fuel paid Reduction for all maintenance paid 2.5% 0.22% 0.18% Pension contribution deduction: Limited to the higher of R1,750 or 7.5% of retirement funding employment income Retirement fund contribution deduction: Limited to the highest of: R1,750 or R3,500 less pension contribution allowed or 15% of non-retirement funding employment income after the deductions or allowances applicable to such income Note: Taxation tables continue on page 4. 3 Note: This page is perforated. You may remove it for easy reference. Medical tax-free monthly contributions: Single member Member plus one dependent Each additional dependent R625 R1,250 R380 SARS official rate 12% Capital gains tax: Annual exclusion R17,500 Primary residence exclusion R1,500,000 Primary residence proceeds R2,000,000 or less, exclude entire capital gain or capital loss Inclusion rate 25% Time apportionment formula: Y = B + [(P – B) x N / (T + N)] Travel allowance deemed expenditure table For years of assessment commencing on or after 1 March 2008 Value of the vehicle (including VAT but excluding finance charges or interest) R 0 40,000 40,001 80,000 80,001 120,000 120,001 160,000 160,001 200,000 200,001 240,000 240,001 280,000 280,001 320,000 320,001 360,000 360,001 400,000 Exceeds R400,000 Fixed cost Fuel cost Maintenance cost R p.a. 14,672 29,106 39,928 50,749 63,424 76,041 86,211 96,260 106,367 116,012 116,012 c/km 58.6 58.6 62.5 68.6 68.8 81.5 81.5 85.7 94.6 110.3 110.3 c/km 21.7 21.7 24.2 28.0 41.1 46.4 46.4 49.4 56.2 75.2 75.2 Reimbursement based on actual business kilometres travelled and no other compensation is paid to such employee, kilometres travelled for business does not exceed 8 000, prescribed rate is R2.92 per kilometre. Residential fringe benefit: B = R54,200 C = 17% or 18% or 19% Section 10(1)(x) Exemption is R30,000 4 Note: This page is perforated. You may remove it for easy reference. This exam paper is in TWO sections. You must show competence in BOTH sections. So, try to complete EVERY task in BOTH sections. Section 1 contains 5 tasks and Section 2 contains 7 tasks. You should spend about 90 minutes on each section. Against each task is the recommended time for that task, but please note that these times are guidelines only. There is blank space for your workings on pages 2, 18 and 19, but you should include all essential workings and calculations in your answers. Section 1 Data You work in the tax department of Entebbe Limited. You have the following information, in respect of one of the employees of Entebbe for 2009/10. 1. James has the use of a company car for business travelling as a sales representative. The car originally cost R302,325 (including VAT). James pays for all his private fuel which cost R2,100 for the year. Entebbe pays for all repairs and maintenance of the motor car. On 28 February 2010 Entebbe replaced James’s company car. Entebbe sold the old car to James for R80,000 on the same date, when the market value was R85,000. 2. James has the use of a cell phone purchased by Entebbe for R675 (including VAT). His calls per month cost about R800 and he estimates that about 10% of these are private calls. 3. On 1 May 2009, James purchased a new home and Entebbe assisted by paying half of his mortgage bond interest to a third party. The mortgage bond was for R200,000 and James and Entebbe each paid 7% per year to the lender from 1 May 2009. Interest rates dropped rapidly in 2009/10 and on 1 February 2010 Entebbe and James only had to pay interest of 4% per year each to the lender. 4. James had a gross annual salary of R300,000. James contributed 8% of this amount to the company pension fund. He earned an additional R350,000 in commission from his sales. 5. James contributes R15,400 to a retirement annuity fund each year. There is a balance of R600 of previous years’ contributions which have been carried forward. His employer does not take his RAF contributions into account (that is, these are excluded from the employment trade). 6. James incurs entertainment expenditure in carrying out his salesman duties. Entebbe has reimbursed him directly for R6,750 he spent on instructions from them. He incurred a further R4,000 in the course of his duties but was not reimbursed for this amount. 7. Entebbe does not contribute to any medical scheme on behalf of its employees or withhold any portion of employees’ remuneration on their behalf to fund their medical contributions. As a result, James is a member of his own private medical scheme. His wife and child are dependents on the scheme. James contributes R2,200 per month to the scheme and incurred additional costs of R23,500 which were not recovered from the medical scheme. 8. He received other net income of: South Africa interest Interest earned on a UK bank account (converted to Rands) Local (South African) dividends 5 R 19,000 6,000 1,050 Note: This page is intentionally blank. You should NOT use it for workings. 6 Task 1.1 (15 minutes) Calculate the fringe benefit inclusion for James’s year of assessment ended 28 February 2010 for: (a) (b) Company car use Purchase of the company car 7 Task 1.2 (15 minutes) Calculate the total fringe benefit inclusions for James for the year of assessment ended 28 February 2010, indicating any benefits to which no value is attached. Task 1.3 (15 minutes) Calculate the taxable income from the employment trade for the year of assessment ended 28 February 2010. 8 Task 1.4 (40 minutes) Calculate the total taxable income for the year of assessment ended 28 February 2010. 9 Task 1.5 (5 minutes) James has asked your advice in respect of private entertainment expenditure which he incurs. Briefly explain whether or not he can include his private entertainment expenditure with the amount he claims for deduction from his taxable income. Provide TWO reasons to support your answer. 10 This page is perforated. You may remove it for easy reference. Section 2 Data Christy, a relative of yours has asked you to help her with her tax return. She has supplied you with the following information for 2009/10. Christy is 56 years old. Rental trades: 1. Christy runs a bed and breakfast (B&B) operation in a property adjoining her own residence. She has not registered for VAT. During the 2009/10 year of assessment, the following is relevant: B&B gross income Running costs related to the B&B (consumables, maintenance, and so on) R 625,000 250,000 2. During the 2009/10 year, Christy sold one of the fridges used by guests for R200. The cost of the fridge, of R2,000, had been fully written off and the capital gain has already been determined as R0. A new fridge was purchased for R8,000 (including VAT) on 30 June 2009. She also purchased additional items on 1 January 2010 comprising a toaster for R399 and a set of pots for R3,444. Both amounts are VAT inclusive. 3. The demand for her B&B increased and so Christy sold her home and is planning to build additional accommodation for guests by adding another storey onto the current B&B building. She acquired a townhouse for herself to live in. She sold her home for R2,900,000 on 1 January 2010. She had purchased the home in 2004 for R900,000. In 2006 she had made improvements to her home which cost her R 100,000. She incurred selling expenses of R 25,000 in the sale. 4. Christy had made a capital loss on the sale of listed shares in the previous year and a capital loss of R3,400 was carried forward. Other information for 2009/10: Christy received dividend income from SA listed shares of R13,000. She also had SA interest of R24,300. She paid provisional tax of R 109,000. She also made a donation of R10,000 to a qualifying Public Benefit Organisation and received the appropriate section 18A receipt. The Commissioner allows assets qualifying for section 11(e) to be written off over 6 years. 11 Note: This page is intentionally blank. You should NOT use it for workings. 12 Task 2.1 (10 minutes) Calculate the capital allowances in respect of the new fridge, toaster and pots. Task 2.2 (10 minutes) Calculate the taxable income from the bed and breakfast (B&B) operation. 13 Task 2.3 (15 minutes) Calculate the taxable capital gain or assessed capital loss for the year of assessment ended 28 February 2010. 14 Task 2.4 (15 minutes) Calculate the taxable income for the 2009/10 year of assessment. 15 Task 2.5 (10 minutes) Calculate the total income tax liability for the 2009/10 year of assessment. Task 2.6 (15 minutes) Christy had the extension done to her B&B building and she also undertook certain repairs to the existing building. (a) Briefly explain whether or not she can deduct the cost of these repairs from the gross income of the B&B. (b) Can she deduct the cost of the new extension or would she qualify for any capital allowance on such an extension? Support your answer with reasons. 16 Task 2.7 (15 minutes) If Christy had received only R2,000,000 for the sale of her home, recalculate the taxable capital gain or loss from task 2.3 for the year of assessment. Note: A full calculation must be given, that is you must show the capital gain or loss before applying any specific exclusion as part of the calculation of the taxable capital gain or capital loss. 17 Note: You may use this page for your workings. 18 Note: You may use this page for your workings. 19 NVQ qualification codes Technician – 100/2942/4 / G794 24 Unit number (PTC) – H/101/8116 QCF qualification codes Level 4 Diploma – 50041162 Unit number (PTC) – T/103/6455 © Association of Accounting Technicians (AAT) 06.10 140 Aldersgate Street, London EC1A 4HY, UK t: 0845 863 0800 (UK) +44 (0)20 7397 3000 (non-UK) e: aat@aat.org.uk w: aat.org.uk