- The University of Sydney

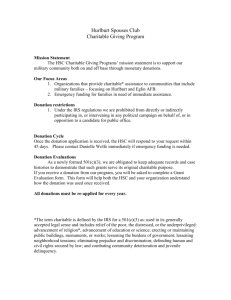

advertisement