A Review of African Infrastructure Initiatives

advertisement

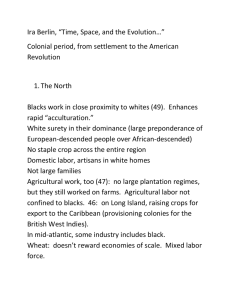

Bricks, Mortar, Policy and Development: Aid and Building African Infrastructure Greg Mills1 Executive Summary Donors – and Africans – now attached a greater priority to infrastructure spending. This is partly due to the realisation that the inflows of private capital for infrastructure development anticipated in the 1980s and 1990s have not been forthcoming. However, while there are many infrastructure projects in the (largely donor) pipeline, there are a number of past problems which need to be examined, including: the lack of commercial underpinning and distortion of the commercial focus; a confusion of donors; weak national and regional capacity; an indistinct model for private investors; and the variance in the governance performance of African states. Two sets of key challenges exist in spending aid on infrastructure: First, to tailor spending to specific countries based both on their record and demand. Today there is much focus on the relative amounts of foreign aid, rather than their quality and targeting. Second, to ensure donor co-ordination and, where possible, place infrastructure expenditure onto a commercial footing. Introduction Two sets of supply-side constraints exist to Africa’s development: One, policyrelated constraints which have mitigated against the development of export industries; and, Two, structural constraints, which include the economic dependence on a limited range of exports, a low technological base, poor legal and regulatory institutions and capacity; limited access to credit; and inadequate infrastructure. Unsurprisingly, thus, a number of recent initiatives have focused attention on ‘what to do’ about the state of African infrastructure. For example, the African Commission established by British Prime Minister Tony Blair argues for additional aid expenditure on infrastructure of US$10 billion annually to 2010, increasing possibly to US$20 billion per annum for the next five years to 2015. The main investment sectors are those with pro-poor and pro-growth benefits, notably power, roads, irrigation, ports, energy and telecoms. This push for more aid for infrastructure is designed, in part, according to the Commission to make up for DR GREG MILLS heads the Brenthurst Foundation, dedicated to strengthening African economic performance. www.thebrenthurstfoundation.org. This paper is based partly on research conducted by the Foundation in conjunction with Dr Jeffrey Herbst, and on a series of interviews conducted across the continent between August 2004 and January 2006. 1 2 the failure of the policies of the 1990s which anticipated an increase in private sector investment in infrastructure. The European Union’s Africa policy, EU and Africa: Towards a Strategic Partnership, agreed to in December 2005, commits to ‘Facilitate a betterconnected Africa, to itself and the rest of the world; including by establishing an EU-Africa Infrastructure Partnership, which will be complementary to the new Infrastructure Consortium for Africa and include existing initiatives on transport and to facilitate peoples’ access to water and sanitation, energy and information technology.’. The document also committed the Union to ‘Increase our aid, by delivering on our collective commitment to give as official development assistance 0.56% of EU gross national income by 2010, with half of the additional €20 billion going to Africa, and 0.7% of GNI by 2015 in the case of 15 member-states, whilst other member-states will strive to increase their ODA to 0.33% by 2015.’2 In February 2006, the MOU creating a Trust Fund in support of infrastructure in Africa was agreed and signed. The Trust Fund is a financial instrument of the EU-Africa Partnership on Infrastructure. In the start-up phase (2006-2007) the Commission intends to mobilise up to €60 million in grants and the European Investment Bank (EIB) up to €260 million in loans for the operation of the Fund. The largest provider of development assistance in Africa, the World Bank, which shifted expenditure away from infrastructure in the 1980s (partly due to pressure from NGOs), plans today to increase its funding for infrastructure projects in Africa by 30% over the next few years in a bid to accelerate development and poverty alleviation on the world's poorest continent. The Bank’s Africa Action Plan, unveiled in September 2005, aims to ‘Strengthen drivers of growth’ through some 25 initiatives and 133 suggested actions, focusing on three broad areas: Building capable states and improving government; Creating a vibrant private sector, expanded exports, infrastructure investment, increased agricultural productivity, as well as investments in education, health, and access to economic opportunity for the poor; and Increasing the impact of partnerships among governments, donor countries, and development agencies.3 The Action Plan makes specific commitments, such as increased financial support for free primary education in 15 countries and more funding for roads, power, and other infrastructure. ‘In 2000 we were lending about US$600 million to the African continent for infrastructure and this year we are going to lend $1.8 billion,’ said Michel Wormser, the World Bank's director for infrastructure in Africa, in June 2005. “We are foreseeing a further 30% increase, so by the end of the next couple of years, we will probably be at US$2.4 billion to US$2.6 billion a year. Infrastructure is absolutely critical for growth and there has to be about US$20 billion which would have to be spent in Africa to reach the [UN] millennium development goals,’ argued Wormser. ‘Today we are at US$10 billion, so much more than US$3 billion a year’ that donors are today providing ‘has to be put into Africa if we want results.’ he said. He argued that private funding for African infrastructure projects also needed to increase.4 (In 2004, International 2 At http://europa-eu-un.org/articles/en/article_5499_en.htm. At http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/AFRICAEXT/0,,contentMDK:20687937~menuPK: 258649~pagePK:146736~piPK:226340~theSitePK:258644,00.html. 4 Cited in the Financial Express, 7 June 2005 at http://www.financialexpress.com/fe_full_story.php?content_id=93048. 3 3 Development Association (IDA), the World Bank's arm that gives grants and interest free-loans to the poorest countries, funded 334 projects in infrastructure, agriculture, regional trade integration, health, nutrition, education, community-driven development and capital flows, totaling US$16.6 billion.) Such views correspond with that of the New Partnership for Africa’s Development (NEPAD) – essentially the development wing of the African Union (AU) – which recognises the key role to be played by infrastructure in Africa’s development, as the vehicle, too, for regional integration. The NEPAD Infrastructure Action Plan is underpinned by the belief that ending Africa’s international economic marginalisation is dependent on development which hinges, in turn, on increasing trade. Virtually every regional economic community (and there are 14 of them on the continent), the African Development Bank (ADB) and continental business-body is in on the infrastructure-promotion act, as are bilateral and multilateral donors. But there has for a long time been a long list of regional and continental infrastructure projects, but far fewer have seen the light of day. Indeed, the record on donor spending on Africa is a testament to the difficulty in managing infrastructure projects, at least in a manner that offers sustainable development. With this in mind, this paper focuses on three inter-linked issues: First, it provides a current ‘lie of the land’ in both infrastructure capacity and spending in Africa. Second, it defines a number of problems with the current approach to African infrastructure development. Third, it offers, in conclusion, some alternative thinking on infrastructure development. A Picture of African Infrastructure Capacity and Needs Why is infrastructure important? Studies show that governments which spend money on essential public services realize very high rates of return. One shows, for example, that for every one percent of GDP invested in transport and communications, growth increased by 0.6%. The rate of return on basic infrastructure including drainage and irrigation, telecoms, airports, highways, seaports, railways, electricity, water supply and sanitation, and sewerage averages 16-18% per annum; and on maintenance spending to existing infrastructure as high as 70%.5 Infrastructure is key to accessing markets and enables the development of other sectors and industries, notably agriculture. It puts communities, especially those poverty-stricken in the rural areas, in closer touch with the market-place – local, regional and international. It is also a facilitator of human development. Electricity improves literacy, and health-care, delivering lighting, water pumps, and refrigeration among other essential services. It lowers transaction costs and the costs both of inputs and exports. Cited in William Easterly, The Elusive Quest for Growth: Economists’ Misadventures in the Tropics. Boston: MIT, 2002, p.234. 5 4 In summary, infrastructure is a necessary interface – of the conduit – between good development intentions and the delivery of productive capacity. The measure of African infrastructure can partly be assessed from the delivery of basic services: Energy: With 13% of the world’s population, the continent consumes just 3% of global commercial energy. Less than one-quarter of households are connected to electricity networks, the lowest connectivity world-wide. Connectivity: Sub-Saharan Africa has 15 telephone mainlines per 1,000 people (the average for low and middle income countries is 270/1,000), while the cost of a local call (US$0.09 per 3 minutes) and international call (US$3.55) is the highest for any region world-wide (the world averages are US$0.06 and US$2.09 respectively). It has 16 internet users per 1,000 people compared to the global average of 131 and the East Asian figure of 44. Transport: It is the continent with the greatest number of landlocked countries, but poor transport networks and very high transport transaction costs. Measured as a share of the value of exports, transport and insurance payments are very high: 55.5% in Malawi, 51.8% in Chad, 48.4% in Rwanda, 35.6% in Mali, 35.5% in Uganda, and 32.8% in the Central African Republic. The world average is under 5.4%; and in developing countries 8.2%.6 For the majority of countries in sub-Saharan Africa, ‘transport cost incidence for exports (the share of international shipping costs in the value of trade) is five times higher than tariff cost.’7 Africa has the lowest density of roads for any region – 0.86km/1,000 people versus South Asia’s 1.8km or the world average for middle-income countries of 8.5km. Port facilities, apart from those found in parts of Southern Africa and in Egypt are considered deficient; while notable airport activity is restricted to a few hubs including Johannesburg, Dakar, Cairo and Nairobi.8 Water and Sanitation: While access to clean water in sub-Saharan Africa increased from 49% of the population in 1990 to 58% in 2002, this is still well short of the MDG target of 75%. Moreover, less than 20% of the continent’s irrigation potential has been utilized effectively.9 However, the picture across Africa with regard to infrastructure provision is extraordinarily differentiated as the Table (below) suggests. This reflects acute differences in governance, private sector involvement, level of economic activity, conditions of peace and stability, and demand – factors which are more-oftenthan-not inter-related. Inasmuch as this is an indicator, across the seven categories of infrastructure, only one country (South Africa) is in the top ten for all seven; two others (Mauritius and Tunisia) in six of seven; three (Algeria, Morocco and Swaziland) in five of seven; two in four sectors; three in three; four in two sectors; fifteen in just one sector; and nineteen were not in the top ten for any of the seven sectors. This would seem to suggest that, while in the top few categories governance is important, in most of the cases, infrastructure penetration reflects a variety of other factors including colonial legacy. Of course, At http://www.eclac.cl/Transporte/noticias/bolfall/2/11072/FAL191e.htm. Hildegunn Kyvik Nordås and Roberta Piermartini, ‘Infrastructure and Trade’. WTO Staff Discussion Paper, August 2004, at http://www.wto.org/English/res_e/reser_e/ersd200404_e.doc. 8 NEPAD’s ‘Comprehensive Africa Agriculture Development Programme’, November 2002, at http://www.fao.org/documents/show_cdr.asp?url_file=/docrep/005/y6831e/y6831e-07.htm. 9 Ibid. 6 7 5 this Table does not provide an indication as to the use and functioning of the transport network. (In the Table, the top ten performers in each category are highlighted in bold.) Country Algeria Angola Benin Botswana Burkina Faso Burundi Cameroon CAR Chad Congo Côte d'Ivoire DRC Egypt Eq Guinea Eritrea Ethiopia Gabon Gambia Ghana Guinea Guinea-Biss Kenya Lesotho Liberia Libya Madagascar Malawi Mali Mauritania Mauritius Morocco Mozambique Namibia Niger Nigeria Rwanda Senegal Sierra Leone Somalia South Africa Sudan Swaziland Tanzania Togo Tunisia Uganda Zambia Zimbabwe Elec’ity Consmtn per Capita (KWhours) Aircraft Dep’s per 10,000 citizens 866 125 75 1,001 24 73 226 29 12 137 233 93 1,129 49 61 30 1,214 95 404 97 43 140 21 174 4,021 51 76 34 61 1,592 569 70 308 41 154 23 151 55 31 4,313 81 822 85 125 1,106 66 598 950 13.2 3.6 2.4 40 3.0 2.1 3.7 4.0 1.9 18.3 2.4 1.5 7.4 -9.4 4.1 58.8 14.7 2.5 5.9 9.7 9.7 1.3 11.8 14.3 4.7 1.4 14.4 102.8 15.5 3.8 27.5 1.4 1.0 4.1 1.0 0.4 25.1 2.5 24.9 1.8 3.3 20.8 0.1 6.2 10.9 Density of Road Network (km of road/km2 of territory) -0.06 0.06 0.18 0.05 -0.07 -0.03 0.04 0.17 0.07 0.07 -0.03 0.03 0.03 0.25 0.16 0.13 0.13 0.11 -0.10 -0.09 -0.02 0.01 1.02 0.08 0.04 0.08 0.01 0.21 -0.07 0.16 0.03 0.30 0.01 0.22 0.09 0.13 0.11 --0.05 Density of Rail Network (Km of rail/km2 of territory) 1.7 2.2 4.1 1.5 2.3 -2.1 --2.6 2.0 1.6 5.1 2.5 0.6 2.7 4.0 4.5 0.1 4.4 1.5 6.8 0.6 --4.3 3.9 2.9 -3.9 -4.6 --18.6 1.8 17.7 3.1 -13.1 1.1 1.7 7.9 % Population with Access to Improved Sanitation Facilities 92 44 23 66 29 88 79 25 29 -52 21 98 -13 12 53 37 72 58 56 87 49 -97 42 76 69 33 99 68 43 41 20 54 8 70 66 -87 62 -90 34 84 79 78 62 % Population with Access to Improved Water Tele Density Mnlines per 1,000 Aid per Capita US$, 2002 89 38 63 95 42 78 58 70 27 -81 45 97 -46 24 86 62 73 48 56 57 78 --47 57 65 37 100 80 57 77 59 62 41 78 57 -86 75 -68 54 80 52 64 83 61 6 9 87 5 3 7 2 2 7 20 0 110 -9 5 25 28 13 3 9 10 13 2 118 4 7 5 12 270 38 5 65 2 6 3 22 5 10 107 21 34 5 10 117 2 8 25 12 32 34 22 40 24 40 16 28 115 65 16 19 -54 19 55 44 32 32 41 13 43 16 2 23 35 42 128 20 21 112 68 26 2 44 46 68 21 14 11 23 35 11 49 26 63 15 If infrastructure is so important to African development, why has it not been built? 6 The Lie of the Funding Land While it is very difficult to disaggregate funding expenditure, as best as can be ascertained the following allocations are made to African infrastructure expenditure from both public ad private sources: NEPAD: There are essentially three different types of NEPAD infrastructure projects: First, those ‘attractive at face value to investors, mainly in the energy field’; Second, those that ‘require seed money’, such as railroads; Third, those that have ‘no commercial value’ and will rely on grants for roll-out, notably from the World Bank, such as roads and bridges. The total cost of projects identified in NEPAD’s Short-Term Action Plan (STAP) is about US$8.1 billion. Half of the STAP is to be financed by the private sector. The African Development Bank (ADB) is currently financing a total of US$372.5 million for NEPAD STAP projects with a total requirement of US$1.96 billion, and the World Bank had committed to US$300 million by 2005. The ADB had, by 2005, another US$600 million in potential projects lined-up and the World Bank a further US$210 million. SADC: Although often portrayed as the most important and successful regional economic institution in Africa, the Southern African Development Community (SADC) has been mired in a continuous process of reorganisation and redefinition, this tautology reflecting an absence of political will and organisational capacity as well as the difficulties of forging a coherent, unified agenda among 13 diverse and geographically disparate countries. SADC is apparently well aware of the mounting infrastructure problems hindering integration, trade and development. At the Heads of State annual summit in 2003, a Regional Indicative Strategic Development Plan (RISDP) was adopted, a ten-year programme designed to ‘connect the region’. The RISDP proposes ‘100% connectivity to the regional power grid for all members by 2012; liberalise[d] regional transport markets by 2008; and harmonised water-sector policies and legislation by 2006’. In spite of such planning, SADC has been unable to prioritise regional infrastructure projects. As a result, the 400 ‘priority’ projects remain largely unfounded and well short of the US$6 billion targeted. Currently US$10 million of the SADC Secretariat’s US$16 million annual budget is funded by member-states, the remainder by donors. Donors were, by 2005, supplying another US$30 million to SADC projects, though this amount has been steadily falling over the past few years mainly on account, from donor feedback, of SADC’s failure to prioritise and expedite projects. COMESA: The Common Market for Eastern and Southern Africa (COMESA) commenced in December 1994 when it was formed to replace the former Preferential Trade Area (PTA), which had existed since 1981. With its 20 member states, a population of over 385 million and annual import bill of about US$32 billion, COMESA forms a major market place for both internal and external trading. COMESA is currently funded by contributions from member-states (calculated on a formula of GDP/trade/population, with no state to contribute more than 17% of the total US$6 million (which Zimbabwe, Kenya and Egypt do) and no less than 1% (which Seychelles does). The remainder of the annual budget of US$30 million is made up of donor contributions from mainly the World Bank, African Development Bank, USAID, and bilateral donors such as France. Like other African RECs, COMESA has a number of infrastructure development 7 programmes, most of which are still in the discussion or ‘feasibility’ stages. Indeed, COMESA’s own staff admit that the infrastructure schemes ‘have not really taken off’. Nonetheless, COMESA has prioritised four groups of infrastructure projects: transport and trade facilitation; air transport; lake transport; and telecommunications. ECOWAS: The Economic Community of West African States (ECOWAS) has identified regional infrastructure as key to real economic integration. Leaders of the region have therefore agreed to accelerate priority infrastructure projects in areas of transport, communications and energy, including a West African Gas Pipeline (WAGP) Project, a West African Power Pool (WAPP), various telecommunications initiatives and the development of trans-highway corridors. The ECOWAS Fund is the initial driver and supporter of the various infrastructure projects ranging from trans-highway networks, to oil and gas pipelines – all of which contribute to the economic development of the region. Besides the political and economic progress that has been achieved in the West African region in recent years – which will help to facilitate joint infrastructure initiatives and better integration – ECOWAS has received substantial support from a broad range of international organisations, notably the World Bank, which has reportedly pledged US$2.3 billion to infrastructure projects in the ECOWAS region. EAC: Institutional development in the East African Community (EAC) has focused on rail and, to a lesser extent, road transport in an effort to improve trade facilitation. In line with the NEPAD STAP, priority projects for the EAC include: concessioning of the railways in Kenya and Uganda (which occurred in October 2005 when a 25-year concession was sold to Rift Valley Railways which plans to spend US$25 million in Kenya and US$15 million in Uganda in the next five years), Tanzania and TAZARA; rehabilitation of selected railways for concessioning; and the East African Road Network. IN the latter regard, in 2003, the World Bank confirmed the availability of US$400-500 million for the EAC states’ national road sector programmes for the next three years and the EU has pledged an additional €375 million over a five-year period. ADB has also pledged continued support for the regional projects. UMA: In the 1990s, the Arab Maghreb Union undertook a number of programmes to improve basic infrastructure in the region, particularly in the transport and communication sectors. However, while the potential in various rail and telecommunication projects does exist, the lack of political commitment from the members of UMA continues to hinder any serious progress to region-wide infrastructure initiatives. ECCAS/CEEAC: Plagued by conflict, instability, poverty and underdevelopment, the Central African ECCAS region has been slow to implement any infrastructure initiatives of relevance. But rich mineral deposits and the recent discovery of exploitable oil reserves have prioritised infrastructure programmes in the region. The stakeholders involved include the private sector, international organisations (notably the World Bank), donor organisations and the respective governments of ECCAS. The ECCAS region is reported to have close to 100 infrastructure projects under discussion, most of which are still in the ‘talk-shop’ phase or have achieved little or no progress since the STAP was detailed. A study on electrical networks funded by the ADB was launched in January 2004. In September 2003 8 US$3.44 million was secured from the African Development Fund (ADF). The assessment will cost approximately US$3.7 million with the ADF Grant accounting for 93%, the remainder being met directly by ECCAS. The ChadCameroon Pipeline Project is the most significant development in the region. Launched in 2000, the project is expected to stretch over a 25-30 year period, involving the development of 300 oil wells in southern Chad with a 1,070 km pipeline to storage facilities off the Cameroon coast. With an estimated cost of US$3.7 billion, the project is the largest private infrastructure investment in subSaharan Africa. The project is funded 19%:81% by the World Bank, and an international consortium consisting of Exxon Mobil and Chevron Texaco both from the US, and Malaysia’s Petronas. AFRICAN DEVELOPMENT BANK: The ADB Group consists of three separate lending institutions: The African Development Bank, which had a subscribed capital at end of 2003 of US$32 billion, though only 13 regional member states are presently eligible for ADB loans and investments; The African Development Fund, offering development finance on concessional terms to low-income regional member states that are unable to borrow from the Bank on non-concessional terms, and whose subscribed capital at end of 2003 was US$18.7 billion; and The Nigeria Trust Fund, established by the government of Nigeria to provide financing for projects of national or regional importance in the poorest regional member states of the ADB. Its subscribed capital at end of 2003 was US$559 million. The ADB’s functions are constrained by long-term risks such as the highindebtedness of 32 regional member states and persistent conflict in several. The ADB, consequently, puts emphasis on both the African Peer Review Mechanism and the African Union’s nascent Peace and Security Council to strengthen governance and encourage stability. The ADB group has already approved US$372.5 million for NEPAD infrastructure projects, and has committed to providing an additional US$580 million to project preparation (feasibility studies, for example). Total group lending in 2003 amounted to US$2.62 billion. In addition to allocating its own funds, the Bank Group has also mobilised US$67.8 billion in co-financing with external partners benefiting 802 projects. DEVELOPMENT BANK OF SOUTHERN AFRICA: The DBSA, like the ADB, represents an important resource in identifying potential and ‘bankable’ projects as well as initiating partnerships among public and private-sector entities. Among development finance institutions based in South Africa, the DBSA carries the mandate for infrastructure projects, which in this context refers to energy, transport, ICT, water and sanitation and tourism. The South African government is the only shareholder and the minister of finance, currently Trevor Manuel, acts as governor. The DBSA has an independent board of directors and has two operational clusters: The Africa Partnership Unit, which supports NEPAD infrastructure projects; and the International Finance Unit, which finances SADC initiatives. Support comes in the form of investment (grants, loans, concessions and equity investment), technical advice and public-private-partnerships (PPPs). It tends to prefer public initiatives and works closely with the South African national treasury to involve black economic empowerment entities in PPPs. DBSA disbursements are disproportionately tilted toward projects within South Africa. Of a total R2.73 billion allocated in 2003/4, R2.32 billion went to projects and proposals within South Africa, and the remaining R414 million was divided 9 among initiatives in the other SADC countries. Within South Africa, the DBSA’s key concern is supporting initiatives to promote both job creation and labourforce diversification. An ongoing concern remains rand/dollar volatility; rand strength in the past year resulted in an 11% decrease in overall new financing approvals, most of which affected the SADC countries. In sectoral terms, the DBSA funding portfolio in both South Africa and SADC was dominated by water infrastructure (38% of new approvals) and commercial infrastructure (31%). Other sectors included energy (13%), communications infrastructure (5%), and social, sanitation and roads infrastructure (3% each). As with the ADB, projects and initiatives related to poverty reduction remain a high priority. UK DEPARTMENT FOR INTERNATIONAL DEVELOPMENT: Britain remains a key donor for Africa infrastructure: DFID gives more than £1 billion to Africa, plus contributes about 20% of the EU and World Bank’s Africa funds. With regard to DFID there are three key trends with aid funding towards African infrastructure: First, not to fund new capital projects but rather to create an enabling environment for the management and maintenance of existing projects. The public-private partnership schemes identified above are a key element in DFID’s strategy towards attempting to encourage private sector investment and management in African infrastructure. Second, to establish funds (through petrol taxation) for long-term maintenance and rehabilitation. Third, to fund budgetary support (about 70% of aid expenditure in the case of DFID for example) rather than direct aid. US AGENCY FOR INTERNATIONAL DEVELOPMENT: USAID seldom lends financial assistance to African infrastructure projects beyond technical assistance (i.e. advice) with public-private partnerships and with privatisation programmes. In the case of extreme humanitarian situations as with Liberia, money has gone to infrastructure construction. JAPAN: Most Japanese aid to Africa has comprised technical assistance (i.e. spending on Japanese themselves), small-scale African projects, and soft loans. A prominent feature of Japanese bilateral aid is the significant proportion of loans, representing 55% of total bilateral ODA in 2002. This is easily the most extensive use of loans of any DAC country. In 2001, Japan spent US$7.45 billion on bilateral ODA worldwide, with US$1.09 billion (14.6%) going to Africa, the latter made up of technical co-operation (25.3%, US$276 million), and grant aid (61.9%, or US$675 million). Technical assistance involves the dispatching of experts, invitation of trainees to Japan, loans of equipment, and volunteer activities. This is managed by the Japan International Co-operation Agency (JICA). Grant aids are generally made through the local embassies, providing no more than Yen10 million per project. FRANCE: France contributes around 25% of the European Development Fund. Bilateral aid in 2001 amounted to €2.65 billion (61% of it for Africa, incl. North Africa) as against €4.2 billion in 1995. Topping the list of partner countries is Egypt (€243 million), followed by Morocco (€181 million), Côte d’Ivoire, Senegal and Tunisia. CHINA: Chinese aid to Africa is heavily tied and completely opaque. It might be expected that infrastructure spending will increase to key countries, especially those in the oil and gas sectors. Importantly, there is considerable evidence of 10 the participation of private Chinese rail and road construction companies in building African infrastructure, and it is suspected that much of this is a lossleader for the Chinese government. NORWAY: The total Norwegian aid (including humanitarian, etc) for Africa was NOK 3.6 billion in 2002, 4.1 billion in 2003 and 4.2 billion in 2004. Support for infrastructure (Transport and Storage, Communications, Energy, and Water Supply and Sanitation) was around NOK 350 million annually in 2003 and 2004. More than 50% of this is energy-related. TAIWAN: Taiwan’s annual aid budget to Africa totals an estimated US$100 million, excluding the cost of regular African delegations to Taiwan. Approximately US$30 million was, for example, committed annually to formal aid projects in Senegal alone, Taiwan’s key African diplomatic partner until its decision in late-2005 to shift recognition to mainland China, focusing on road, clinic, dam and training-centre construction. Much of the total is today spent on handouts/budgetary support for those six countries (Burkina Faso, Chad, The Gambia, Malawi, Sao Tomé and Principe, and Swaziland) which continue to recognise Taiwan as the Republic of China. PRIVATE SECTOR SPENDING: Private investment in infrastructure took off in the 1990s as governments around the world sought to improve the efficiency of the basic systems undergirding their economies while seeking the revenue gains from privatisation. Between 1990 and 2001, US$755 billion was invested in approximately 2,500 projects worldwide. Total Private Participation in However, annual African Infrastructure investment has dropped by half since the peak period Electricity of 1997, not least due to 4% the Asian financial crisis. Natural Gas 12% 17% The World Bank estimates that investors spent US$23.4 billion on African infrastructure projects between 1990 and 2001. 67% Water and This was about 3% of the Sewage worldwide private investment in infrastructure. South Africa, with its advanced economy, relatively prosperous private sector, and good levels of governance (by African standards) has been the site of most the projects as measured by dollars invested. Indeed, private investment in Telkom SA, Vodacom and Mobile Telecommunications Network accounted for approximately 43% of all private investment in African infrastructure over a decade. South Africa was also home to the only large-scale investments in transport infrastructure on the continent: the N3 and N4 toll roads. Telecommunications, given the relative ease of revenue collection and worldwide pressure to privatise, has been a favoured sector for investment. Two other telecommunications projects (Côte d’Ivoire Telecom and Econet Wireless Nigeria) were among the ten largest investment in African infrastructure. 0% Telecommunicati ons Transport 11 The sectoral distribution of investment in African infrastructure reflects, almost exactly, the global experience. Across the world, about 95% of foreign investment, by dollar value, has been devoted to telecommunications or electricity. The preponderance of investment in these areas reflects the capitalintensive nature of the sectors; the relative attractiveness of companies in these areas; and the relative ease of creating models for revenue creation. Destination of Private Investment in Infrastructure 27% South Africa Côte d'Ivoire Nigeria 55% 3% Tanzania Zimbabwe 4% Rest of Africa 5% 6% Over more than a decade, the only large-scale investments in infrastructure that were not in South Africa or in the telecommunications sector were the Groupement SHEC electricity project in Mali, the Société d’Energie et d’Eau du Gabon water and sewage project, and the African Power investment in Zimbabwe. Private involvement in infrastructure in Africa is still a relatively rare occurrence. In a total of 43 countries reviewed in 2004 across eight sectors in Africa, in only 25% of the cases (86 distinct sectors) wass there any kind of private involvement in infrastructure. Towards a New Model? There is no shortage of opportunities for expenditure in infrastructure in Africa, and no shortage of requirements. Yet a number of problems exist with regard to expenditure in African infrastructure investment projects which until now have made this untenable and thus unlikely: Commercial underpinning: NEPAD is unlikely to succeed as an infrastructure-led development programme, not because it does not intend the right things for Africans, but fundamentally, but so long as it puts the cart before the horse – placing infrastructure generation as a stimulus for increasing productive economic capacity rather than vice versa. This explains why most of the NEPAD infrastructure schemes, while all on paper ‘nice-tohaves’, are essentially dusted-off versions of extant donor-targeted projects hitherto unfunded because of their lack of a sound commercial rationale. A secondary problem is that the projects identified by NEPAD must be implemented by the regional economic communities, which, as cited above, are hobbled by their own constraints. The key stumbling blocks have longsince been identified: inefficient regulatory environments, bloated 12 bureaucracies at the national and regional level, lack of liberalisation and a general failure to identify markets sector by sector. These constraints notwithstanding, NEPAD may offer advantages in terms of providing a stamp of approval for investors or to pressure countries on governance issues. This echoes the sentiments expressed among current and potential actors. Technical experts at the European Union, for example, confirmed the view that NEPAD had simply dusted off extant projects that lacked a commercial or even donor-funding rationale. An aid based strategy for infrastructure development has not yet offered a commercially-sustainable basis for development in Africa; while the long list of projects detailed by both the RECs and NEPAD amounts, in this light, to little more than a note to Santa Claus. Confusion of donors: The lack of uniformity between donors does not help. Each and every donor has their own strategy, reporting structure and, understandably perhaps, national objectives. This is a failing that is, of course, not unique to infrastructure spending. National capacity: Every region and sub-region in Africa has blamed poor infrastructure for inadequate growth, development and integration on the continent. Despite this, little progress has been achieved in launching regionwide initiatives and delivering on them. Faltering national commitment and the absence of comprehensive plans for implementation remain recurring problems throughout Africa’s regions. Regional weakness: In its 2003 review, the ADB, as the lead institution on NEPAD infrastructure development, identified a number of key obstacles, including: Lack of clarity as to what NEPAD really is; Lack of clarity as to what is expected of the RECs and countries; Lack of definition regarding linkages between countries and RECs; Lack of financial and technical capacity in the RECs; and a Lack of alignment of REC programmes and NEPAD programmes. NEPAD has asserted that its programmes are different in two respects from previous African infrastructure schemes: First, in terms of engaging the RECs to kick-start projects ‘which have been there for a long time but have been blocked.’ Regional infrastructure is prioritised in line with the recognition that individual national economies are alone too small to compete in international markets; and, Second, to restore a focus of development activity and spending on both infrastructure and agriculture. Yet, to take SADC as an example, member-states continue to pick and choose areas and issues of commitment. For example, the ratification of the 21 SADC protocols has been a long, drawn-out process. And under the terms of the SADC free trade protocol members are expected to have liberalised 85% of trade by 2008; yet what countries say and what they do in this regard, are two different things. Despite the development of the SADC RISDP, these failings have been exacerbated by the advent of NEPAD and the creation of the African Union, and failure to co-ordinate activities between them. There is also the fear sensed by SADC (and other regional bodies) that NEPAD will shift focus away from regions, and dilute their ability to raise funds for infrastructure projects – even though it is NEPAD’s stated function to shift projects and focus to the RECs. ‘Lack of Indians and too many Chiefs’: The Secretarial ability of both NEPAD and the RECs and their political authority to motivate and expedite projects is limited, reflecting both a lack of regional and continental consensus and a general unwillingness to cede sovereign authority, in spite of the rhetoric to the contrary, to supra-national control. 13 An indistinct revenue model for private investors: Private investment in African infrastructure projects is inherently risky. There are the normal dangers of investing in Africa: political instability, weak human resource bases, underdeveloped financial systems, poverty, and crime. In addition, infrastructure investments, if they go beyond no-cash management contracts, require an excellent ongoing relationship with government as the private investor will be required to put up a large amount of capital to build and rehabilitate basic infrastructure systems but will only reap returns years later. In addition, government must not interfere with the infrastructure project so that the private investor can operate the enterprises on a commercial basis and therefore make a profit. This has proven to be a problem in the past in Africa as governments have come under political pressure to lower tariffs being charged on basic services such as water and therefore violated basic operating assumptions. Similarly, the tariffs on most road projects have been renegotiated, sometimes several times, over the course of the project to reflect evolving economic circumstances. Finally, governments must continue to promote pro-development policies generally over a long period of time so that economies can prosper and infrastructure investments can therefore garner the rewards of high demands. If the political elite is not fully behind private participation in infrastructure, there is no chance of the project being a success. For these reasons, most private investment in African infrastructure have been low- or no-cost management contracts that expose investors to minimal risk while they operate infrastructure systems for limited periods of time. Also relatively popular have been concessions which require investment of only limited amounts of money and that give private investors rights to operate for defined periods of time. Demonopolisation of infrastructure sectors to allow new entry has been less popular and outright privatisation of infrastructure investments relatively rare. Distortion of the commercial focus: Aid expenditure has not only failed to offer a sustainable means of developing infrastructure, but has undermined the attempts to generate the domestic financial mechanisms and, most importantly, the mindset to fund development from within. Governments approach the private sector on infrastructure projects much in the same way that they approach donors – where they see this, at least in part, as a philanthropic gesture rather than a way to make money. Government involvement in infrastructure: This, as in other areas of the world, tends to ‘crowd out’ private investors, and corrupt the tender and priority-setting process. Paradoxically, the unlikelihood in most African countries of private investors being able to garner significant domestic partners means that foreign investors in African infrastructure will largely be alone and will have to work hard to develop a constructive relationship with individual African governments. They will also have to place a premium on regulatory quality and lack of corruption when selecting destination countries because, as foreigners investing significant sums up-front, they will be especially vulnerable to the pathologies that mar so many African governments. Good governance and demand: There exist only a small number of countries across the continent where good governance and demand for infrastructure services correlates. Profitable investment in infrastructure may of course eventually occur in many African countries if the right conditions develop and if there is enough government commitment. However, in identifying likely target countries now, a premium has to be put on overall 14 government regulatory competence, the relative amount of corruption, and the level of development. Regulatory competence is critical because the profit models of private investors will be affected by government decisions for many years after the initial investment. In general, regulatory quality is low in Africa: procedures like gaining import-export permits and clearing goods from customs are far more difficult, on average, in the region than elsewhere in the world. However, there are important variations that should be noted in any continental analysis. For instance, the World Bank estimates that to enforce a contract in Botswana, a country with relatively high regulatory quality, it takes 22 procedures and 56 days. In Angola, an extremely poorly governed country, it takes 47 different procedures and 941 days. Understanding the variance between countries is critical because so much money is lost to poor governance in the developing world. According to the World Bank, the number of potential infrastructure projects is a multiple of those successfully implemented. The Bank notes that, ‘Nightmare stories abound of investors experiencing lengthy delays or project cancellations because of political, administrative, and legal impediments.’ Across the developing world, underestimating corruption, bureaucratic delays, organised crime and other non-conventional risks on averaged erode expected returns by 8-10%. Some 84% of projects initiated in emerging markets in the late 1990s did not meet financial targets and 26% failed. It is undoubtedly the case that the record in Africa, on all accounts, is much worse. Governments that have a relatively low level of corruption are also more likely to abide by long-term contracts and allow private investors the years necessary to recoup investments. Finally, as market demand is a critical determinant of the viability of infrastructure development, investors are more likely to find success in countries that have relatively high per capita incomes. It is also a simple reality that it is much easier to operate infrastructure projects in those African countries that are at least approaching middle-income status and therefore have relatively robust financial and labour markets.10 10 Infrastructure is not enough: Finally, as with aid projects generally, money is seldom the problem, but rather finding effective and efficient means to expend it is. Aid on infrastructure can only work if the right policies to encourage investors, both foreign and local, in productive sectors, is devised and implemented. Put differently, Africa has to make things to sell and have the appropriate infrastructure to assist in this process. Also, the provision of basic infrastructure has to go hand-in-hand with institutional capacity-building for the public sector agencies managing these facilities. And there are things that can be done apart from infrastructure that will make a difference – indeed, an overwhelming focus on infrastructure will reinforce notions of a ‘silver-bullet’ approach to African development. Using existing infrastructure better would be a good place to start, including removing unnecessary bureaucratic and policy obstacles, which often go hand-in-hand with vested political interests. As the World Bank has noted, ‘Currently, entrepreneurs face more business obstacles in sub-Saharan Africa than in any other region. The combination of high regulatory costs, unsecured land property rights, inadequate and high-cost infrastructure, unfair competition from wellconnected companies, ineffective judiciary systems, policy uncertainty, and corruption makes the cost of doing business in Africa 20-40 percent above that of other developing regions. Firms in the region, particularly small and I am grateful to my colleague Jeffrey Herbst for this insight. 15 medium-sized companies, also complain of high financing costs, or little or no access to credit.’11 Conclusion: Some New Thinking Necessary? Aid flows to Africa appear deliberately opaque: the point is apparently to be seen to be giving rather than to chart the flows and their efficiency. Exact figures on aid infrastructure flows are impossible to determine both given the percentage towards budgetary support (which is then potentially spent on infrastructure under recipient national government programmes), as well as the degree of overlap between regional and national projects, and regional, national and continental projects such as NEPAD. More than half of aid given is tied to the donor through debt relief, technical assistance, emergency relief and interest charges. Until now, together the EU and World Bank contribute 60% of concessional aid spending in Africa. Britain also remains key: DFID gives more than £1 billion to Africa, plus contributes about 20% of the EU and World Bank’s Africa funds. Until Gleneagles, there were five trends with aid funding towards African infrastructure: First, not to fund new capital projects but rather to create an enabling environment for the management and maintenance of existing projects. Second, to focus on longterm maintenance and rehabilitation rather than construction. Third, to fund budgetary support (about 70% of aid expenditure in the case of DFID, for example) rather than direct aid. Fourth, that there is negligible spending by donors on infrastructure; this is confined to poorer countries elsewhere such as, in SADC, Zambia, Mozambique and Malawi. Fifth, donors have been largely of the opinion that projects such as toll-roads and other self-funding initiatives are a non-starter outside South Africa, given low levels of population income. The infrastructure schemes of regional bodies are wide-ranging and ambitious in scope, but until now historically of very limited value in terms of delivery. There is much process, but little delivery, and an increasingly negative aid environment towards these bodies. NEPAD essentially replicates many extant regional integration schemes, previously dismissed and disregarded on the basis of their commercial viability and fundability. Regardless of the status of NEPAD projects, it is the design of NEPAD to transfer all implementation responsibilities to the RECs, the RECs thus being the level at which most donors would need to engage. In trying to improve the impact and extend the legacy of aid, much recent attention has been on improving skills. As Eritrea’s president Issaias Afewerki famously put it in 1998, ‘If you teach someone to fish, instead of giving him fish, then he has a sustainable future. … in the long term, success can only come from inside us.’ Eritrea is not a good example given its subsequent lurch towards war with its neighbour Ethiopia and Issaias’ internal security crackdown, destroying any governance value. And although training efforts should not be abandoned, their impact cannot be isolated from the need for general improvements in governance and the related need for a meritocracy in which they can be 11 At http://web.worldbank.org/WBSITE/EXTERNAL/COUNTRIES/AFRICAEXT/0,,contentMDK:20639324%7Emenu PK:258649%7EpagePK:146736%7EpiPK:226340%7EtheSitePK:258644,00.html. 16 employed. They are at best an ‘over-the-horizon’ solution, taking much longer than the tenure of current political leadership. Hence the debate around aid has to shift, fundamentally, to find ways in which such transfers can be used as a seed – a catalyst – for higher rates of growth in the short-term, even though some African states will still require aid as a form of charity for humanitarian relief. No one doubts the value of improved infrastructure to development. The main challenge is thus for Africa to devise a new formula for using aid in a manner that is both commercially sustainable and provides those services which will encourage wider private sector investment in the economy. A fresh focus on private-public-partnerships in infrastructure could assist. This requires, however, first the identification of those sectors in which the return of capital – whether public or private – is greatest from a perspective which emphasises long-term returns in terms of human welfare, productivity and economic growth. Understanding the drivers – the likely sectors – of economic growth country-by-country and prioritizing them is a necessary first step in this regard. A second is the attraction of private funds on a matching basis for infrastructure projects, inherently serving to reduce risk and encourage a longterm investment view. Third, the identification and establishment of a suitable management structure for these funds on a commercial basis by the publicprivate consortiums involved. From a business perspective, this would apply a commercial logic to project rollout; from a partner-governmental perspective it would offer both the necessary expertise and the efficient use of funding resulting in a positive donorgovernment-business delivery cycle. This type of management structure necessarily privileges and prioritises those African states that have a demonstrable capacity to deliver this management and related policy reliability, thus differentiating and favouring those with good governance records. *****