units abundant

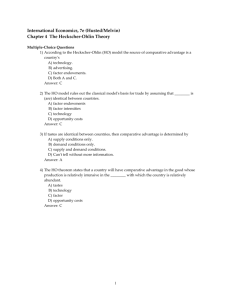

UNIT TWO

International Trade: Enduring Issues

CHAPTER THREE

Sources of Comparative Advantage

I. Fundamental Issues

1.

What is the factor proportions explanation of comparative advantage?

2.

What is the Heckscher-Ohlin theory of trade?

3.

How well does the factor proportions approach explain trade patterns?

4.

What is the relationship between trade and factor prices?

5.

What is the relationship between trade and real income?

6.

How does economic growth affect trade patterns?

II. Chapter Outline

1.

The Factor Proportions Explanation of International Trade a.

The Factor Proportions Approach b.

The Heckscher-Ohlin Theorem and International Trade c.

Visualizing Global Economic Issues: Factor Endowments and the Production Possibilities

Frontier d.

Visualizing Global Economic Issues: The Heckscher-Ohlin Theorem

2.

How Well Does the Factor Proportions Approach Explain Trade? a.

The Leontief Paradox b.

More Recent Tests of the Factor Proportions Approach c.

Online Globalization: India’s Online Business Services Industry

3.

Trade, Factor Prices, and Real Income a.

Factor Price Equalization b.

Visualizing Global Economic Issues: The Factor Price Equalization Theorem c.

Trade and Real Income

4.

International Production and Comparative Advantage a.

The Internationalization of Production b.

Management Notebook: Do Manufacturers Really Need a Factory? c.

Kaleidoscopic Comparative Advantage

5.

Economic Growth and International Trade a.

Economic Growth b.

The Rybczynski Theorem c.

Growth and Trade d.

Visualizing Global Economic Issues: The Rybczynski Theorem

6.

Questions and Problems

20

Sources of Comparative Advantage 21

III. Chapter in Perspective

This chapter introduces Unit Two — International Trade: Enduring Issues. The chapter uses the

Heckscher-Ohlin model of factor proportions and the model’s implications to explain sources of, and changes in, comparative advantage. In particular, the chapter discusses the internationalization of production in which different stages of the value chain may optimally be located in different countries to exploit differences in comparative advantages. The implications of the Samuelson-Stolper and the

Rybczynski theorems for international trade are integrated into the discussion.

IV. Teaching Notes

1.

The Factor Proportions Explanation of International Trade a.

The Factor Proportions Approach

The factor proportions explanation of international trade suggests that endowments of factors of production, and relative intensity of use of the factors in the production of goods and services, can be used to explain comparative advantage and international trade. The simplest version of a factor proportions model assumes that labor and capital are the two factors of production and that two countries produce two goods. Labor and capital have identical productivities in both countries and the two countries utilize identical production technologies. Factors may move freely from industry to industry, but may not move between countries. Goods and services, however, may move freely and costlessly between nations. Citizens of both countries are assumed to have identical preferences for the two goods. The only differences allowed between the two nations are factor endowments and the extent ( intensity of use ) to which a factor is required to produce a given product. Endowments and intensity of use are measured relative to each other as follows:

EXAMPLE OF DIFFERENT FACTOR ENDOWMENTS

Capital-to-Labor ratio

Labor-to-Capital ratio

Relative Abundance

Country A

Labor Capital

Country B

Labor Capital

2000 units 1000 units

½ unit capital/unit labor

2 units labor/unit capital

1000 units 2000 units

2 units capital/unit labor

½ unit labor/unit capital

Relatively Capital Abundant Relatively Labor Abundant

Country A is a relatively capital abundant nation and Country B is a relatively labor abundant nation.

22 Chapter 3

Suppose that the two goods under consideration are textiles and machinery. Machinery requires 3 units of capital and 1 unit of labor to produce. Textiles require 4 units of labor and 1 unit of capital to produce.

EXAMPLE OF DIFFERENT FACTOR INTENSITIES

Capital-to-Labor ratio

Labor

Textiles

Capital

4 units 1 unit

¼ unit capital/unit labor

Machinery

Labor

1 unit

Capital

3 units

3 units capital/unit labor

Labor-to-Capital ratio

Relative Intensity

4 units labor/unit capital 1/3 unit labor/unit capital

Relatively Labor Intensive Relatively Capital Intensive

Because both countries have the same production technologies, relative factor endowments and relative factor intensities define a nation’s comparative advantage and provide a motivation for international trade. b.

The Heckscher-Ohlin Theorem and International Trade

The Heckscher-Ohlin (hereafter H-O) Theorem states that the country that is relatively labor

(capital) abundant will have a comparative advantage in the production of the good or service that is relatively labor (capital) intensive in its production process.

Teaching Tip:

This is a very simple proposition that can be related to supply and demand. The abundant resource will tend to have a lower cost due to its greater supply. As a result, the country can produce the product that relies more on its abundant resource at a cheaper price than the other country, creating a comparative advantage in that good or service.

Recall from Chapter 2 that the good in which the country has the comparative advantage will be the export good. It follows then that the relatively labor (capital) abundant nation will export the relatively labor (capital) intensive good.

Because advanced economies tend to be relatively capital abundant, the H-O theorem predicts that advanced economies should have a comparative advantage in the production of relatively capital intensive goods and should export relatively capital intensive goods, and import relatively labor intensive goods. Text Table 3-1 shows international trade of goods and services for various countries. The trade patterns generally conform to the H-O predictions, with more advanced economies exporting chemicals, a relatively capital intensive industry, and importing relatively more labor intensive goods such as machinery and transport equipment and manufactured goods.

Sources of Comparative Advantage 23 c.

Visualizing Global Economic Issues: Factor Endowments and the Production Possibilities

Frontier

For Critical Analysis: Suppose Eastisle has many fewer residents and resources as compared to Northland. Do any of the points made above change?

With less labor and capital, Eastisle’s PPF shifts inward. If the declines in labor and capital are equal, the shift is parallel. In this case, the slope of the tangent line is the same and none of the conclusions about comparative advantage and trade change. d.

Visualizing Global Economic Issues: The Heckscher-Ohlin Theorem

For Critical Analysis: Why, in (Text) Figure 3-2, do residents of Northland and Eastisle consume identical baskets of food and computers?

The model assumes that residents of each country have identical tastes and preferences. Under free trade, residents of both countries face the same price ratio. Hence, residents of both countries consume identical baskets of food.

2.

How Well Does the Factor Proportions Approach Explain Trade? a.

The Leontief Paradox

Wassily Leontief used input-output analysis to examine how well trade data supported the H-O model in 1954. Given that the U.S. was a relatively capital abundant nation, the H-O model implied that U.S. exports should be relatively more capital intensive than U.S. imports. Leontief found the opposite result, hence the name Leontief Paradox. There were numerous data problems in his study however, to name one; he could only infer factor proportions in other countries based on U.S. data.

Teaching Tip:

Lack of empirical support does not invalidate the usefulness of a model. A model is a simplification of reality; it is not intended to be the real thing and we should not be surprised when results confirm this conclusion. Nevertheless, the H-O model is extremely valuable for two reasons: 1) because of what it teaches us about the motivation for international trade and comparative advantage and 2) because it serves as a springboard for thought to help build a more realistic model that furthers our understanding even more. The results of empirical tests may help the latter function.

24 Chapter 3 b.

More Recent Tests of the Factor Proportions Approach

The H-O model aggregates the inputs at a very high level. More recent models allow labor to be broken down into skilled and unskilled components based on their human capital , allow factor mobility between nations, and allow different preferences for relatively labor intensive and capitalintensive goods in different countries. For instance, Adrian Wood found that advanced economies with relatively more skilled labor tend to export relatively skilled labor-intensive products. c.

Online Globalization: India’s Online Business Services Industry

For Critical Analysis: Advances in telecommunications and the Internet enable India to provide business services to firms in other nations. How might further advances, such as voice-recognition software, affect India’s ability to remain cost competitive?

Services generally require the use of labor. India currently has a large competitive advantage in wages over the U.S. even among college-educated, English speaking workers. Low transportation and communication costs allow India to exploit this comparative advantage and provide medical transcription services, handling customer inquiries and providing accounting services, etc. Further technological advances, such as voice-recognition software, may allow U.S. firms to automate some of these services, reducing the need for labor (reducing relative labor intensity). If this happens, India’s comparative advantage in the provision of these services may be reduced.

3.

Trade, Factor Prices, and Real Income

The distribution of income that results from free trade remains a contentious issue. Factor proportions models can be used to predict relative real income changes in various situations. a.

Factor Price Equalization

The Factor Price Equalization (FPE) theorem predicts that uninterrupted trade results in equalization of both goods’ prices and factor prices across nations. Thus, wage rates (w) and rental rates on capital (r) should converge and eventually become equal across nations. The mechanism that equates factor prices is the equalization of the prices of goods and services. This convergence has not happened yet (nor do we have uninterrupted trade), so there is little reason to expect wages or capital rates to have fully converged. Over the long run, there has been some convergence of wages and convergence is greater in economies that are more open.

Sources of Comparative Advantage 25 b.

Visualizing Global Economics Issues: The Factor Price Equalization Theorem

For Critical Analysis: Suppose both nations open their borders to trade, but retain policies that constrain trade to a level lower than under free-trade conditions. How would this affect the adjustment of factor prices, and how would you illustrate this situation in (Text)

Figure 3-3?

Logically, some convergence in goods’ prices and factor prices would occur, but equalization would not be expected under the assumptions of the model. In the graph, the ratios would not equate. c.

Trade and Real Income

The Stolper-Samuelson theorem states that free trade raises (lowers) the real earnings to owners of the nation’s relatively abundant (scarce) factor. As the nations move to free trade, the good that uses the abundant (scarce) factor (less) intensively is exported (imported). The result is that as nations move from autarky to free trade, the price of the good that intensively uses the abundant factor will rise due to foreign demand for that export good. Increased imports of the good that intensively uses the scarce factor (increased supply) will reduce the price of that good and will thus also reduce the earnings accruing to the scarce factor.

According to the magnification principle , the change in the price of a factor is greater than the change in the price of the good or service that uses the relatively intensively in its production process. This principle ensures that the above conclusion about real incomes holds.

Returning to the earlier example for Country A and B and the production of textiles and machinery:

EXAMPLE OF DIFFERENT FACTOR ENDOWMENTS

Capital-to-Labor ratio

Labor-to-Capital ratio

Relative Abundance

Country A

Labor Capital

Country B

Labor Capital

2000 units 1000 units

½ unit capital/unit labor

2 units labor/unit capital

1000 units 2000 units

2 units capital/unit labor

½ unit labor/unit capital

Relatively Capital Abundant Relatively Labor Abundant

26 Chapter 3

EXAMPLE OF DIFFERENT FACTOR INTENSITIES

Labor

Textiles

Capital

Machinery

Labor Capital

Capital-to-Labor ratio

Labor-to-Capital ratio

Relative Intensity

4 units 1 unit

¼ unit capital/unit labor

4 units labor/unit capital

1 unit 3 units

3 units capital/unit labor

1/3 unit labor/unit capital

Relatively Labor Intensive Relatively Capital Intensive

Country A has a comparative advantage in producing machinery, and if free trade is allowed, exports machinery according to the H-O theorem. Country B has a comparative advantage in producing textiles and exports textiles to Country A. The result is an increase in aggregate welfare for both countries as illustrated in Chapter 2. However, the distributional effects

( redistributive effects of trade ) differ in the two countries.

With autarky, labor in Country A is relatively scarce and can command relatively higher wages than returns on capital, R. The opposite holds in Country B so W

A

/R

A

> W

B

/R

B

. If free trade is allowed, Country A shifts production to produce more machinery and fewer textiles. This uses relatively more capital and less labor, increasing R

A

relative to W

A

, reducing the ratio. The opposite occurs in Country B and W

B

/R

B

begins to rise, and the relative ratios converge.

Teaching Tip:

Here is an alternative version of the same explanation: Under free trade, the price of textiles in

Country A falls as textile imports become available from Country B. The value of the marginal product of labor declines, resulting in a decline in relative wage rates in Country A. Similarly, the price of machinery in Country B falls as machinery imports become available from Country

A, and as a result, relative returns to capital fall in Country B.

Teaching Tip:

This example assumes that citizens are either workers or owners of capital, but not both.

Interestingly, it also implies that all workers are affected equally, regardless of whether they are involved in the import or export sectors; likewise for capital owners.

Because of the real income changes depicted above, the model predicts that owners of capital in the capital abundant nation will be proponents of free trade and the same nation’s workers will be against free trade. Likewise, workers in the labor abundant nation will be proponents of free trade and that nation’s owners of capital (the scarce resource) will be against free trade.

Sources of Comparative Advantage 27

4.

International Production and Comparative Advantage a.

The Internationalization of Production

The production of a good or service can be thought of as a series of activities that add value at each step. Typical stages might include design, manufacturing, assembly, marketing and transportation or delivery. This process is sometimes called the value chain.

Some stages in the value chain tend to be more capital intensive, such as design, marketing and delivery, while manufacturing and assembly may be more labor intensive. The theory of factor proportions suggests that different countries may have a comparative advantage in producing a given step in the value chain. South Korea, for example, is relatively more labor abundant than the United

States and may be expected to have a comparative advantage in manufacturing certain goods.

Competitive firms may improve their margins by outsourcing certain parts of the production process to firms with a comparative advantage in that step. Similarly, a U.S. firm may hire a foreign firm to manufacture the U.S. firm’s product using specifications provided by the U.S. firm. The product may then be marketed by the U.S. firm using its brand name around the world.

This process is termed contract manufacturing . b.

Management Notebook: Do Manufacturers Really Need a Factory?

For Critical Analysis: The Internet plays a very important role in the relationship between electronics firms and contract manufacturers. How do you suppose the Internet facilitates the relationship between the firm that innovates and the firm that produces the actual product?

The Internet is a low cost method of communicating information that allows tighter inventory control, better communications between distant operations and makes incredible amounts of information available to users. Reductions in information and transportation costs have allowed the internationalization of production to become cost feasible. For instance, a computer system can use the Internet to identify an increase in sales of a given item at multiple outlets in the U.S., quickly analyze the data and transmit an order to an overseas manufacturer which produces more of the item and ships it back to the U.S. for distribution. Customer inquiries and service needs can quickly be addressed, and technicians in the production factory can be involved if necessary.

The more rapid the innovations and the greater the demand for customer service, the more important the Internet will become. Note that the Internet will also put pressure on contract manufacturers’ profit margins to decline, because it will make it easier and cheaper for the hiring firm to locate competing manufacturers. c.

Kaleidoscopic Comparative Advantage

The term kaleidoscopic comparative advantage refers to the tendency for comparative advantage to change rapidly over time, requiring firms to respond to changing circumstances and competition in order to remain profitable.

28 Chapter 3

5.

Economic Growth and International Trade a.

Economic Growth

Economic growth in the context of a factor proportions model is evidenced by an increase in available resources (labor or capital) and/or a technological advancement that allows a greater amount of output per unit of input. Both would cause the PPF to shift outwards. Expansion of a given resource will favor the good that uses that input intensively.

Teaching Tip:

There is a difference between an increase in labor or capital endowments and a technological change in the strict factor proportions model. The H-O model assumes that the production technology is the same in both countries, so any technological change would occur in the two countries, whereas an endowment change could occur in one country without occurring in the other. b.

The Rybczynski Theorem

The Rybczynski theorem states that if a resource in a nation increases, at a given opportunity cost , it will produce more of the good that uses the resource intensively and produce less of the other good. In the Country A and Country B example, if Country A, the capital abundant country, has an increase in its capital endowment, it will produce more machinery and less textiles.

Given that the U.S. is a capital abundant nation and that this country continues to receive large capital inflows, we would expect to see more production of capital intensive goods and services and less in labor intensive industries. c.

Visualizing Global Economic Issues: The Rybczynski Theorem

For Critical Analysis: Does the increase in capital make Northland’s residents more or less likely to trade? What if labor were to increase instead of capital?

The increase in capital induces Northland to produce more computers, the relatively capital intensive good, and fewer baskets of food. Computers are the export good (Northland is capital abundant) so this leads to more exports of computers and more imports of food. Trade is increased. If labor were to increase rather than capital, the opposite would occur. Northland would produce more food and fewer computers, leading to fewer computer exports and fewer baskets of food imports. Trade would be reduced. (See d. below) d.

Growth and Trade

From the Rybczynski theorem, an increase in the abundant resource in a country will obviously lead to the production of more of the export good (the good that uses the abundant resource intensively) and less of the other good. This will in turn lead to more exports and more imports as more production is shifted to the dominant good. The effect is pro-trade . However, an increase in the scarce resource in a country will lead to local production of more of the import good and less of the export good. As a result, there are fewer imports and exports. In this case the outcome is anti-trade .

Sources of Comparative Advantage 29

When Country A receives an increase in its capital endowment it produces more machinery, which is the export good, and fewer textiles. It exports the additional machinery (an increase in exports) and imports more textiles (an increase in imports). The effect is thus pro-trade. If

Country B receives an increase in its capital endowment, it too will produce more machinery and fewer textiles. In this case, however, this means fewer machinery imports and fewer textile exports, reducing overall trade.

6.

Answers to End of Chapter Questions

1. Utopia’s ratio of labor to capital is 100/75 = 1.33, and Idealand’s is 75/50 = 1.5. Hence, Idealand is relatively labor abundant and Utopia is relatively capital abundant.

2. The capital to labor requirement of sandwiches is 0.5/1 = 0.5, and the capital to labor requirement of bicycles is 0.9/0.9 = 1. Hence, bicycles are relatively capital intensive in their production process while sandwiches are relatively labor intensive in their production process.

3. Because Utopia is relatively capital abundant and bicycles are relatively capital intensive in their production process, Utopia has a comparative advantage in bicycles and will export them to Idealand.

Likewise, because Idealand is relatively labor abundant and sandwiches are relatively labor intensive in their production process, Utopia has a comparative advantage in bicycles and will export them to

Idealand.

4. Because Utopia has a comparative advantage in bicycles and Idealand has a comparative advantage in sandwiches, then, under autarky, Utopia will have the higher price in sandwiches and Idealand will have the higher price in bicycles. Because Utopia is relatively capital abundant and Idealand is relatively labor abundant, Utopia has a higher wage rate relative to the rental rate of capital. When the two nations begin to trade, the wage rate relative to the rental rate will begin to decline in Utopia and rise in Idealand.

5. According to the Stolper-Samuelson theorem, real returns to the holders of the relatively abundant factor in Utopia, capital, will rise with free trade while returns to the holders of the relatively scarce factor, labor, will decline. The opposite occurs in Idealand.

6. The gains from specialization are completely exhausted when the opportunity costs are equal between the two nations. A common slope of the line tangent to the production possibilities frontiers illustrates this outcome.

7. HP is likely to have a comparative advantage in the high-skill areas of production such as design, marketing, and delivery. A developing nation is likely to have a comparative advantage in assembly and the manufacture of components.

8. According to the Rybczynski theorem, the increase in capital stock will lead to an increase in the production of capital-intensive goods and a decrease in the production of labor-intensive goods. The trade pattern of the emerging nations is likely to change to reflect this.

9. According to the Rybczynski theorem, the economic growth that took place may or may not increase trade for these nations, depending on which sector experienced the growth. It may be that, if the nation is capital scarce, growth in the capital-intensive sector leads the nation to import fewer capitalintensive goods, thereby reducing trade.

10. If the United States is relatively capital abundant, the increase in the labor stock would lead to an expansion in the labor-intensive sector. Because the United States is a large country, however, it is unlikely that opportunity costs remain the same. This example shows that we must consider this aspect when applying the Rybczynski theorem to large countries.