Sample Farm BUSINESS PLAN

advertisement

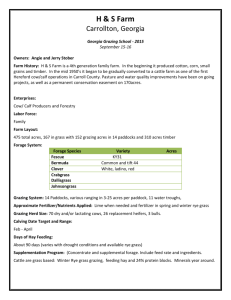

SAMPLE FARM BUSINESS PLAN Outline of What Your Plan Should Include Business Plan (Sample Plan Attached) I. Management A. Current Farm Description B. Current Farm Equipment & Facilities C. Past SOACDF Funding (General Agriculture, Agricultural Diversification or Educational Assistance) D. New Plan II. Income and Expense Projections A. Income Generated *Critical Piece of Your Plan* B. Projected Income C. Projected Expenses III. Cash Flow for Tier 2 only (2009 actual, 2011 & 2012 projections) IV. Summary V. Attachments Business Plan I. Management A. Current Farm Description People reviewing your business plan may not know you and they will not have the opportunity to visit your farm, so use this section to help them understand your farm operation – what you have been doing and how you do it. Describe your current farm activity. Include information such as: 1. Your name and your farm name if you have one. 2. Legal structure (sole proprietor, partnership, LLC, etc.) 3. Identify sources of income generated by your farm. 4. Size and scope of your operation : Description of your CURRENT FARMING ENTERPRISE: (Please insert numbers.) Crops: Corn Acres _____ Soybean Acres _____ Wheat Acres _____ Tobacco Acres _____ Forage (hay & pasture) _____ Horticulture Acres _____ All other Acres _____ Livestock: Cattle – number of head _____ Hogs – number of head _____ Sheep – number of head _____ Other – number of head _____ 5. Describe characteristics that make your farm unique. Doe Farms is located in _______ county in southern Ohio. It is a family business owned by John and Jane Doe and management includes their son Johnny, forming a general partnership. The farm consists of 325 total acres with about 160 acres in grain and 150 acres in hay and pasture. John and Jane manage production and record keeping for the grain enterprise which includes of 100 acres of corn and 60 acres of soybeans. Grain is stored on the farm, held to be marketed at local elevators during peak season prices and to be fed in the cattle operation in which feeder calves are sold at local stockyards. Jane also performs record keeping for the beef enterprise, in addition to working full-time off the farm. The beef enterprise is solely managed by their son Johnny. Labor for seasonal work is shared by all. Johnny has assumed the role of managing the 40 head cow/calf herd for the past three years with good results. Since returning to the farm he has made key management improvements by implementing a grazing plan, a nutrient management plan, a synchronized breeding/palpation schedule, a performance based culling/replacement program, and establishing a comprehensive herd health program which includes scheduled treatments with Ivomec, IBR, BVD, PI3, BRSV/Vibriosis and Leptospirosis. Johnny performs all artificial insemination and selection of AI sires for important production traits. He is the fourth generation in his family to pursue a career on this farm. All buildings, property, and equipment are insured with First Rate Insurance Group and there are no federal or state liens against any of the farm’s assets. The Does are in good standing with the American Bank. B. Current Farm Equipment, Facilities, & Livestock Inventory Use the chart below to describe what you currently own or have available to work with. List major equipment currently used or which could be used each year in the normal operation of the farming business and the proposed project. Include age, make, model, and current condition. Also specify livestock age and condition if applicable. If you need to add additional lines to this, or any chart in the business plan, your cursor in the bottom right cell, and then hit the “TAB” key on your keyboard. EQUIPMENT / FACILITY/LIVESTOCK AGE AVAILABLE John Deere 6410 7 years old tractor/loader CONDITION Excellent OWNED or A John Deere 4050 tractor 13years old Excellent A John Deere 535 baler 11 years old, Good A John Deere 935 MoCo 8 years old Good A 15’ Bush Hog mower 3 years old Excellent A John Deere 9400 combine 12 years old Good A Sitrex MX 12 hay rake 4 years old Excellent A Equipment Storage Building 9 years old Excellent A Livestock Barn 42 years old Good A 3 grain bins – 32,000 bu total cap. 16 years old Good New Holland 358 grinder/mixer 19 years old Good A Avg 6 years old Good Own 6 Head 40 head Angus Cattle A C. Past SOACDF Funding In 2009, Johnny received cost share from the General Agricultural program for the purchase of a hay rake. This purchase allowed him to cut field time for raking hay in half. The new rake has greatly improved the quality and efficiency in the hay making process which has allowed him to be more productive in other areas of the farm operation. In 2008, he purchased a feed wagon with help from the General Ag grant. The feed wagon has helped reduce feed waste and has made winter feeding much more manageable. In 2007, he received cost share from the Agricultural Diversification program to purchase a disc mower/conditioner which was a major upgrade from the sicklebar mower they’d used for over 20 years which. This has improved hay quality by 20% per year. In 2004 and 2005, he received the Educational Assistance grant while completing his junior and senior year in college. D. New Plan People reviewing your business plan may not be familiar with all types of agricultural development projects. Provide any information you can to help them understand your ideas and convince them that you know what you are talking about, especially if you are proposing a unique project. Use this section to help the reviewers understand your new project and how it fits with your existing operation. Describe the new project you are planning. Provide the following information: 1. What you plan to do and how you are going to do it. 2. Why you are doing this specific project. 3. How this new project “fits” with your current operation. 4. Describe the specific details of all new components. (buildings, equipment, livestock, etc.) 5. Provide cost estimates or actual quotes of all project components. 6. Describe your marketing plan and how it will leverage your farm resources. Feeder calf production had been a viable source of income in his family’s cow/calf operation with the cost to produce a feeder calf varying greatly. Johnny’s plan is to raise and sell genetic based first cross (F1) bred heifers to develop a new value added source of income. Upon returning to the family business he began of assisting in the management of their feeder calf operation. Johnny has determined that buying quality replacement heifers is a necessary long term investment. He realizes that there is good demand for replacement heifers and he wants to move into a position to supply that demand. From his ag education he learned heterosis and the benefits of hybrid vigor in cross-breeding programs and sees an opportunity to produce and sell bred heifers and retain more income by selling a $1250-1500 bred heifer instead of a $500 feeder calf. To begin this venture, he will need to purchase 20 head of bred cattle, a cattle chute with palpation cage and scales, and a computer. He will market genetically superior F1 bred heifers that will be palpated, and meet criteria such as a specific health protocol and required pelvic measurements. His goal is in five years to double the size of his herd and establish himself as a source for quality bred replacement heifers. This goal will be accomplished through the following project: 1. $30,000 – 20 head Purebred Angus Cattle This purchase will consist of high quality purebred Angus cattle which are estimated (based on quotes) to cost $1500 per head. The cattle will be coming with their second calf which will be AI cross-bred to select Simmental registered bulls with emphasis on birth weight, wean weight, and milk EPD traits. The semen will also be sexed to produce females in this breeding as well as all subsequent breeding of the base 20 head herd. This next level of management will ensure a high quality consistent supply of breeding quality females without undesired male births. 2. $3,400 – Cattle Handling Chute with Palpation Cage This purchase will enable Johnny to safely vaccinate, AI, and palpate his herd for optimum management. 3. $1,450 – Scale System Adding a scale system to his project will allow him to take accurate birth weights, wean weights, and pinpoint breeding weight of heifers he will offer for sale. He will use the information to develop database of the breeding results to continually improve his new business. 4. $675 - Laptop Computer Johnny needs to also purchase a laptop computer system. This will be used to record data and to market his heifers on his website he will develop. The laptop will also be useful in keeping informed with internet connections for key decision making tools. The total cost of the project is estimated to be $35,525. II. Income and Expense Projections *CRITICAL PIECE OF YOUR BUSINESS PLAN* Income Generated A. Include any comments you think are important in further explaining the financial section of your business plan. In your own words explain how this project increases profitability. *DO NOT LEAVE BLANK* B. Projected Income (For Grant Request Only – Not Entire Farm Operation) Sold To: Private Treaty Buyer Products/services, quantity, price: Gross Income: 18 Head Bred Heifers @ $1250/ea $22,500 * Assumes 10% mortality/cull of heifers C. Projected Expenses (For Grant Request Only – Not Entire Farm Operation) Cost: Loan Principle/Interest Feed costs (supplement and mineral) When: Expense: Fuel Repairs and Maintenance Breeding and Veterinary Supplies, etc. Utilities Insurance Hired Labor Rent/Lease Payment Real Estate Tax Miscellaneous III. Cash Flow Tier II Applicants must include Cash Flow (2009 actual, 2011 & 2012 projections) spreadsheets for the proposed plan. (See attachment) IV. Summary Summarize the key points that you have written in your business plan in this section. Be convincing that you need this project to generate income, you have the ability to complete the project by the end of next May, and that there is a market – people who will pay for your products/services. Draw highlights from materials within the plan to include in this section. What are the compelling reasons that this project will be a success? If approved, describe long-term financial impact this will have on your farm operation in the next five years. Be specific and identify why it makes financial sense. Describe what makes your project unique. Provide a chart of project costs (source and use of funds). This project for bred cattle and basic handling equipment will help Johnny Doe purchase some very essential items which will help him get a start in his own agricultural enterprise. His successful farming experience and education will help make sound and practical decisions. Developing female calves by selective genetic based breeding and then breeding them back upon the same value added concept to sell as replacement heifers creates a more valuable animal. His goals 5 years from now are to double his purebred herd size to 40 head by purchasing 5 head of “F1” bred heifers each year. As purebred numbers increase he will reduce numbers from existing cow/calf operation to maintain appropriate grazing hd/ac ratio. Long term goals are to ultimately replace the farms income from feeder calves to income from bred heifer sales. Project Costs Estimated Amount Project Component Source $30,000 $3,400 $1,450 $674 2nd calf bred heifers @ 1500/hd Handling chute w/palp cage Scale system Laptop Computer Top Choice Cattle Co. Chute Supply Center Scales-R-Us Best Deal Computers $35,524 Total Project Cost (Personal and SOACDF funds) $17,762 $17,762 Personal Funds Amount Requested from SOACDF 50% 50% V. ATTACHMENTS List what items are included in the attachments, then delete this text and use this page as a cover page for the attachments. Attach any supporting documentation that supports your business plan. This should include COST ESTIMATES, CONTRACTS, CERTIFICATES OF TRAINING, ETC. Suggestion: Use dealer quotes or contractor estimates where possible. Equipment advertisements appear generic since these items will not likely be available 3 months after the application. Delete this text when preparing your business plan.