s05a-02-gms

advertisement

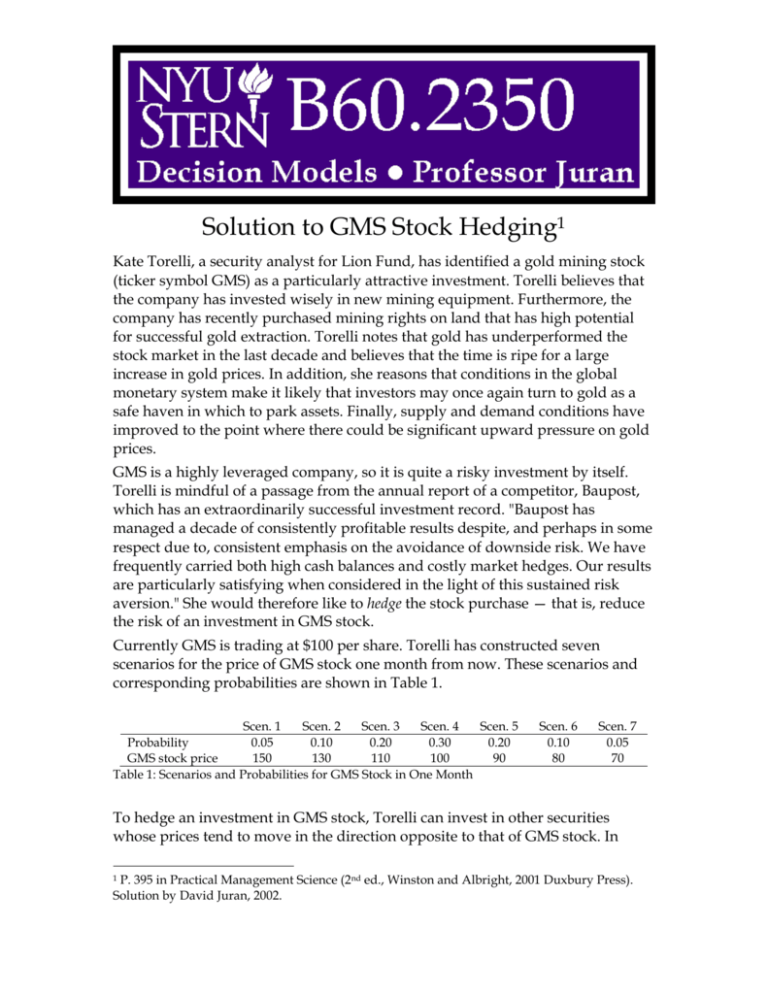

Solution to GMS Stock Hedging1 Kate Torelli, a security analyst for Lion Fund, has identified a gold mining stock (ticker symbol GMS) as a particularly attractive investment. Torelli believes that the company has invested wisely in new mining equipment. Furthermore, the company has recently purchased mining rights on land that has high potential for successful gold extraction. Torelli notes that gold has underperformed the stock market in the last decade and believes that the time is ripe for a large increase in gold prices. In addition, she reasons that conditions in the global monetary system make it likely that investors may once again turn to gold as a safe haven in which to park assets. Finally, supply and demand conditions have improved to the point where there could be significant upward pressure on gold prices. GMS is a highly leveraged company, so it is quite a risky investment by itself. Torelli is mindful of a passage from the annual report of a competitor, Baupost, which has an extraordinarily successful investment record. "Baupost has managed a decade of consistently profitable results despite, and perhaps in some respect due to, consistent emphasis on the avoidance of downside risk. We have frequently carried both high cash balances and costly market hedges. Our results are particularly satisfying when considered in the light of this sustained risk aversion." She would therefore like to hedge the stock purchase — that is, reduce the risk of an investment in GMS stock. Currently GMS is trading at $100 per share. Torelli has constructed seven scenarios for the price of GMS stock one month from now. These scenarios and corresponding probabilities are shown in Table 1. Scen. 1 Scen. 2 Scen. 3 Scen. 4 Scen. 5 Probability 0.05 0.10 0.20 0.30 0.20 GMS stock price 150 130 110 100 90 Table 1: Scenarios and Probabilities for GMS Stock in One Month Scen. 6 0.10 80 Scen. 7 0.05 70 To hedge an investment in GMS stock, Torelli can invest in other securities whose prices tend to move in the direction opposite to that of GMS stock. In P. 395 in Practical Management Science (2nd ed., Winston and Albright, 2001 Duxbury Press). Solution by David Juran, 2002. 1 particular, she is considering over-the-counter put options on GMS stock as potential hedging instruments. The value of a put option increases as the price of the underlying stock decreases.2 For example, consider a put option with a strike price of $100 and a time to expiration of one month. This means that the owner of the put has the right to sell GMS stock at $100 per share one month in the future. Suppose that the price of GMS falls to $80 at that time. Then the holder of the put option can exercise the option and receive $20 (= 100 - 80). If the price of GMS falls to $70, the option would be worth $30 (= 100 - 70). However, if the price of GMS rises to $100 or more, the option expires worthless. Torelli called an options trader at a large investment bank for quotes. The prices for three (European-style) put options are shown in Table 2. Torelli wishes to invest $10 million in GMS stock and put options. Put Option A Put Option B Strike price 90 100 Option price $2.20 $6.40 Table 2: Put Option Prices (Today) for GMS Case Study Put Option C 110 $12.50 For a brief introduction to options see, for example, Cox and Rubinstein (1985), pp.1-8, or Jarrow and Turnbull (1996), pp. l4-18. 2 B60.2350 2 Prof. Juran Some Preliminaries In this approach to portfolio optimization (called the scenario approach), the universe of possible outcomes is considered to be confined to a finite number of scenarios, as given in Table 1. Define xi to be the number of thousands of dollars allocated to investment i. Each investment i has a percent return under each scenario j, which we will represent with the symbol rij. For example, under scenario 1 GMS stock has a 50% return, so if r1, 1 represents the return of GMS stock under scenario 1, then r1, 1 = 0.50. For GMS stock, the return under any scenario j is given by: r1 j S1 j S0 S0 Where S0 is the initial price of the GMS stock, and S1 is the final price. For a put option i, the return under any scenario j is given by: rij MAX K i S1 j ,0 C i Ci Where Ki is the strike price and Ci is the cost of the option. Using these formulas, we can expand Table 1 to include the returns on each possible investment under each scenario. Probability GMS stock price Return on GMS stock (r1) Return on Option A (r2) Return on Option B (r3) Return on Option C (r4) Scen. 1 0.05 $150 50% -100% -100% -100% Scen. 2 0.10 $130 30% -100% -100% -100% Scen. 3 0.20 $110 10% -100% -100% -100% Scen. 4 0.30 $100 0% -100% -100% -20% Scen. 5 0.20 $90 -10% -100% 56% 60% Scen. 6 0.10 $80 -20% 355% 213% 140% Scen. 7 0.05 $70 -30% 809% 369% 220% Note: We don’t know what the return would be under any scenario unless we know how much money was invested in each of the four instruments. B60.2350 3 Prof. Juran The return on the portfolio is represented by the random variable R. 4 R ri x i i 1 The portfolio return under any scenario j is given by: 4 R j rij x i i 1 (Note that we are using r as a percent and R as thousands of dollars.) Let Pj represent the probability of scenario j occurring. The expected value of R is given by: 7 R R j Pj j 1 The standard deviation of the portfolio’s return is given by: R R 7 j 1 j R 2 Pj Example: Let’s say Kate buys $7 million worth of GMS stock, and $1 million worth of each put option. This means that (x1, x2, x3, x4) = (7000, 1000, 1000, 1000). Under scenario 3, her return would be r3 4 ri 3 x i i 1 r13 x 1 r23 x 2 r33 x 3 r43 x 4 0.107000 1.001000 1.001000 1.001000 700 1000 1000 1000 $2300 Using the same procedure, it can be shown that for this particular allocation of assets, the seven scenarios would have returns as follows: Scenario 1 2 3 4 5 6 7 B60.2350 4 Return 500 -900 -2,300 -2,200 -538 5,670 11,878 Prof. Juran Therefore, the expected return on this particular allocation of assets is calculated as follows: R 7 R j Pj j 1 R1 P1 R2 P2 R3 P3 R4 P4 R5 P5 R6 P6 R7 P7 500 0.05 900 0.1 2300 0.2 2200 0.3 538 0.2 5670 0.1 11878 0.05 25 90 460 660 108 567 594 132 Finally, to calculate the standard deviation of the returns under this particular allocation of assets: R R 7 j 1 j R 2 Pj R1 R 2 P1 R2 R 2 P2 R3 R 2 P3 R4 R 2 P4 R5 R 2 P5 R6 R 2 P6 R7 R 2 P7 500 132 2 0.05 900 132 2 0.1 2300 132 2 0.2 2200 132 2 0.3 538 132 2 0.2 5670 132 2 0.1 11878 132 2 0.05 632 2 0.05 768 2 0.1 2168 2 0.2 2068 2 0.3 406 2 0.2 5802 2 0.1 12010 2 0.05 19 ,942 59 ,054 940 ,449 1,283,565 32 ,962 3,366 ,307 7 ,211,937 12 ,914 ,216 3,594 So, in English, if Kate buys $7 million worth of GMS stock, and $1 million worth of each put option, then her return on investment in dollar terms is a random variable with an expected value of about -$132,000 and a standard deviation of about $3,594,000. B60.2350 5 Prof. Juran 1. Based on Torelli's scenarios, what is the expected return of GMS stock? What is the standard deviation of the return of GMS stock? The expected one-month return is 2%. The standard deviation is 18.33%. Here is a spreadsheet model for the calculations: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 A GMS price B C 100 D =(B5-$B$1)/$B$1 Scenarios for GMS stock in one month Scenario GMS price Probability 1 150 0.05 2 130 0.10 3 110 0.20 4 100 0.30 5 90 0.20 6 80 0.10 7 70 0.05 =SUMPRODUCT(D5:D11,C5:C11) Mean return Stdev of return B60.2350 Return 50% 30% 10% 0% -10% -20% -30% E F =(D6-$B$13)^2 SqDev 0.2304 0.0784 0.0064 0.0004 0.0144 0.0484 0.1024 =B13*10000000 0.0200 $ 200,000.00 0.1833 $ 1,833,030.28 =B14*10000000 =SQRT(SUMPRODUCT(E5:E11,C5:C11)) 6 Prof. Juran 2. After a cursory examination of the put option prices, Torelli suspects that a good strategy is to buy one put option A for each share of GMS stock purchased. What are the mean and standard deviation of return for this strategy? Torelli’s strategy will have an expected return of 1.76% with a standard deviation of 15.59%. In other words, it is less risky than the stock by itself, but also has a lower expected return. Here is the spreadsheet model. Note the use of “IF” functions in cells D5:D11 to incorporate the returns on the put option. This could also be done using the “MAX” function. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 A GMS price B C D E F G 100 =(B5-$B$1+IF(B5-$B$15>0,0,$B$15-B5)-$B$16)/($B$1+$B$16) Scenarios for GMS stock in one month Scenario GMS price Probability 1 150 0.05 2 130 0.10 3 110 0.20 4 100 0.30 5 90 0.20 6 80 0.10 7 70 0.05 Portfolio Return Sqdev 47% 0.202588 =(D5-$B$19)^2 27% 0.064721 8% 0.003447 -2% 0.001532 -12% 0.018765 -12% 0.018765 -12% 0.018765 Put options on GMS stock that expire in one month Option A B C Strike price 90 100 110 Option price $2.20 $6.40 $12.50 =SUMPRODUCT(D5:D11,C5:C11) Portfolio with one unit of GMS stock and one put A Mean 0.0176 $ 176,125.24 Stdev 0.1559 $ 1,559,430.28 B60.2350 =SQRT(SUMPRODUCT(E5:E11,C5:C11)) 7 Prof. Juran 3. Assuming that Torelli's goal is to minimize the standard deviation of the portfolio return, what is the optimal portfolio that invests all $10 million? (For simplicity, assume that fractional numbers of stock shares and put options can be purchased. Assume that the amounts invested in each security must be nonnegative. However, the number of options purchased need not equal the number of shares of stock purchased.) What are the expected return and standard deviation of return of this portfolio? How many shares of GMS stock and how many of each put option does this portfolio correspond to? Managerial Formulation Decision Variables Torelli needs to invest $10 million in some combination of GMS stock and three types of put options. Objective Minimize risk (standard deviation of the portfolio’s return). Constraints All $10 million must be invested. No shorting. Mathematical Formulation Decision Variables The decision variables are four amounts: x1, x2, x3, and x4, representing GMS stock, Put Option A, Put Option B, and Put Option C, respectively. Objective Minimize Z = R R 7 j 1 j R 2 Pj Constraints 4 x i 1 i 10 ,000 x i 0 for all investments i. B60.2350 8 Prof. Juran Solution Methodology Here’s the spreadsheet model: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 A GMS price B C D E F G H I J K L 100 Scenarios for GMS stock in one month Returns from one unit of Scenario GMS price Probability GMS Put A 1 150 0.05 50% -100% 2 130 0.10 30% -100% 3 110 0.20 10% -100% 4 100 0.30 0% -100% 5 90 0.20 -10% -100% 6 80 0.10 -20% 355% 7 70 0.05 -30% 809% =(B11-$B$1)/$B$1 each investment Put B Put C -100% -100% -100% -100% -100% -100% -100% -20% 56% 60% 213% 140% 369% 220% Portfolio Return Sqdev 500 398835 -900 590540 -2300 4702244 -2200 4278551 -538 164808 5670 33663072 11878 144238735 Returns here are in thousands of dollars =(H11-$K$19)^2 =(IF($B11>B$15,0,B$15-$B11)-B$16)/B$16 Put options on GMS stock that expire in one month Option A B C Strike price 90 100 110 Option price $2.20 $6.40 $12.50 =SUMPRODUCT($B$20:$E$20,D11:G11) Investment decision (thousands of dollars spent on each investment) GMS Put A Put B Put C Total 7000 1000 1000 1000 10000 = Budget 10000 Return from portfolio ($1000) Mean -132 Stdev 3594 Units of investments purchased (shares for GMS, number of puts for options) GMS Put A Put B Put C 70000 454545 156250 80000 The decision variables are in B20:E20. The objective function is in K20. B60.2350 9 Prof. Juran Here’s the optimized spreadsheet: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 A GMS price B C D E F G H I J K L 100 Scenarios for GMS stock in one month Returns from one unit of each investment Portfolio Scenario GMS price Probability GMS Put A Put B Put C Return Sqdev 1 150 0.05 50% -100% -100% -100% 2737 6903774 2 130 0.10 30% -100% -100% -100% 1039 863485 3 110 0.20 10% -100% -100% -100% -660 591400 4 100 0.30 0% -100% -100% -20% -302 169098 5 90 0.20 -10% -100% 56% 60% 56 2852 6 80 0.10 -20% 355% 213% 140% 414 92663 7 70 0.05 -30% 809% 369% 220% 772 438530 Put options on GMS stock that expire in one month Option A B C Strike price 90 100 110 Option price $2.20 $6.40 $12.50 Investment decision (thousands of dollars spent on each investment) GMS Put A Put B Put C Total 8491 0 0 1509 10000 = Budget 10000 Return from portfolio ($1000) Mean 109 Stdev 795 Units of investments purchased (shares for GMS, number of puts for options) GMS Put A Put B Put C 84913 0 0 120694 Conclusions Kate should buy $8,491,000 worth of GMS stock, and $1,509,000 worth of Put Option C. This portfolio will have an expected one-month return of $109,000 (1.09%) and a standard deviation of $795,000 (7.95%). B60.2350 10 Prof. Juran 4. Suppose that short selling is permitted — that is, the nonnegativity restrictions on the portfolio weights are removed. Now what portfolio minimizes the standard deviation of return? Here we simply remove the nonnegativity constraint (by unchecking the box in the Solver Options that says “assume nonnegative”). Here is the new optimal solution: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 A GMS price B C D E F G H I J K L 100 Scenarios for GMS stock in one month Scenario GMS price Probability 1 150 0.05 2 130 0.10 3 110 0.20 4 100 0.30 5 90 0.20 6 80 0.10 7 70 0.05 Returns from one unit of each investment GMS Put A Put B Put C 50% -100% -100% -100% 30% -100% -100% -100% 10% -100% -100% -100% 0% -100% -100% -20% -10% -100% 56% 60% -20% 355% 213% 140% -30% 809% 369% 220% Portfolio Return Sqdev 2446 5201674 786 385978 -873 1077810 198 1068 230 4237 225 3543 219 2912 Now the nonnegativity conditions for the changing cells is removed, and the investor sells short on the put A and B options. This lowers the standard deviation of the portfolio (and also increases its mean). Put options on GMS stock that expire in one month Option A B C Strike price 90 100 110 Option price $2.20 $6.40 $12.50 Investment decision (thousands of dollars spent on each investment) GMS Put A Put B Put C 8297 -8 -665 2376 Total 10000 = Return from portfolio ($1000) Mean 165 Stdev 718 Budget 10000 Units of investments purchased (shares for GMS, number of puts for options) GMS Put A Put B Put C 82972 -3798 -103843 190058 Kate should buy $8,297,000 worth of stock and $2,376,000 worth of Put Option C, and she should short sell $8,000 worth of Put Option A and $665,000 worth of Put Option B. This portfolio will have an expected monthly return of 1.65% and a standard deviation of 7.18%. In other words, it will be more profitable and less risky than the portfolio without shorting. A possible final step: We introduce a constraint on the portfolio’s expected return, and use the right-hand side of this constraint as the input cell for SolverTable, allowing us to create this chart: GMS Risk vs. Return $600 Efficient Frontier with Shorting Expected Return (x 1000) $500 $400 Efficient Frontier - No Shorting $300 Minimum Risk with Shorting $200 Minimum Risk - No Shorting $100 GMS Stock Only "One-for-One" $$- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 Std Dev of Return (x 1000) B60.2350 11 Prof. Juran