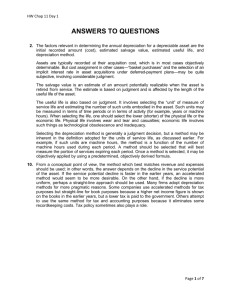

Chapter 8

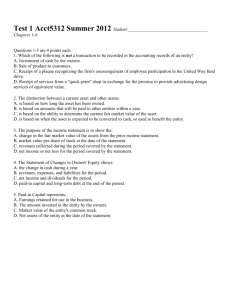

advertisement