5000 was borrowed from a bank

advertisement

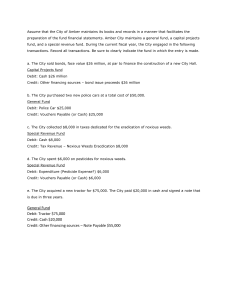

MODULE 2 RECORDING TRANSACTIONS Demonstration Problem 1 Debits and Credits For each of the following accounts, indicate the side of the account that should be used to record an increase in that account. Account Name Owners' Equity Sales Revenue Equipment Utilities Expense Supplies Expense Service Revenue Supplies Rent Expense Notes Payable Cost of Goods Sold Side used to Record Increases Credit Credit Debit Debit Debit Credit Debit Debit Credit Debit 26 Demonstration Problem 2 Debits and Credits For each of the following independent transactions, identify the account that would be debited and the account that would be credited. Transaction 1. Purchased furniture on credit. Debit Furniture Credit Accounts Payable 2. Purchased inventory for cash. Inventory Cash 3. Sold goods to customers on credit. Accounts Receivable Sales Revenue 4. Record cost of goods sold on the previous sale. Cost of Goods Sold Inventory 5. Purchased supplies. Supplies Cash 6. Borrowed money from a bank. Cash Notes Payable 7. Paid employee wages for the month. Wages Expense Cash 8. Paid for the furniture purchased previously. Accounts Payable Cash 9. Paid rent for the month. Rent Expense Cash 10. Collected cash from a customer for goods sold Cash Accounts previously. Receivable 27 Practice Problem 1 Debits and Credits For each of the following accounts, indicate the side of the account that should be used to record an increase in that account. Account Name Owners' Equity Service Revenue Cash Furniture Utilities Expense Supplies Sales Revenue Accounts Payable Accounts Receivable Cost of Goods Sold Side used to Record Increases Credit Credit Debit Debit Debit Debit Credit Credit Debit Debit 28 Practice Problem 2 Debits and Credits For each of the following independent transactions, identify the account that would be debited and the account that would be credited. Transaction 1. Purchased a computer for cash. 2. Purchased inventory on credit. 3. Purchased supplies. 4. Sold goods to customers on credit. 5. Record the cost of the goods sold. 6. Borrowed money from a bank. 7. Paid employee wages for the month. 8. Paid for the inventory purchased previously. 9. Collected cash from a customer for goods sold previously. 29 Debit Computer Inventory Supplies Accounts Receivable Cost of Goods Sold Cash Wages Expense Accounts Payable Cash Credit Cash Accounts Payable Cash Sales Revenue Inventory Notes Payable Cash Cash Accounts Receivable Homework Problem 1 Debit and Credit Terminology For each of the following accounts, indicate the side of the account that should be used to record an increase in that account. Account Name Cash Supplies Expense Accounts Payable Utilities Expense Owners' Equity Service Revenue Supplies Rent Expense Notes Payable Salaries Expense Debit Debit Debit Credit Credit Debit Credit Credit Debit Debit Credit Debit 30 Homework Problem 2 Debit and Credit Terminology For each of the following accounts, indicate the side of the account that should be used to record an increase in that account. Account Name Supplies Expense Cash Accounts Payable Equipment Owners' Equity Service Revenue Furniture Rent Expense Notes Payable Salaries Expense Debit Debit Debit Credit Credit Debit Credit Credit Debit Debit Credit Debit 31 Homework Problem 3 Debit and Credit Terminology For each of the following independent transactions, identify the account that would be debited and the account that would be credited. 1. 2. 3. 4. 5. Transaction Borrowed money from a bank. Purchased inventory for cash. Purchased inventory on credit. Sold goods to customers for cash. Sold goods to customers on credit. Debit Cash Inventory Inventory Cash Accounts Receivable Wages Expense Utilities Expense Supplies Expense Accounts Payable Note Payable 6. Paid employee wages for the month. 7. Paid utilities for the current month. 8. Recorded supplies used during the month. 9. Paid for equipment purchased previously. 10. Repaid the note to the bank. 32 Credit Notes Payable Cash Accounts Payable Sales Revenue Sales Revenue Cash Cash Supplies Cash Cash Homework Problem 4 Debit and Credit Terminology For each of the following independent transactions, identify the account that would be debited and the account that would be credited. Transaction 1. Borrowed money from a bank. 2. Purchased supplies for cash. 3. Purchased equipment on credit. 4. Sold goods to customers for cash. 5. Sold goods to customers on credit. 6. Paid employee wages for the month. 7. Paid utilities for the current month. 8. Recorded supplies used during the month. 9. Paid for the equipment purchased previously. 10. Repaid the note to the bank. Debit Credit Cash Notes Payable Supplies Cash Equipment Accounts Payable Cash Sales Revenue Accounts Receivable Sales Revenue Wages Expense Cash Utilities Expense Cash Supplies Expense Supplies Accounts Payable Cash Notes Payable 33 Cash Homework Quiz Debits and Credits 1. The Equipment account's proper classification is: a. Revenue b. Liability c. Expense d. Asset 2. The Supplies account's proper classification is: a. Asset b. Revenue c. Liability d. Expense 3. The Cost of Goods Sold account's proper classification is: a. Asset b. Revenue c. Liability d. Expense 4. The Fees Earned account's proper classification is: a. Asset b. Liability c. Owner's equity d. Revenue 5. The Accounts Payable account's proper classification and normal account balance are: a. Asset b. Liability c. Owner's equity d. Revenue 6. The Inventory account's proper classification is: a. Revenue b. Expense c. Liability d. Asset 7. The Accounts Receivable account's proper classification is: a. Asset b. Liability c. Owner's equity d. Revenue 34 8. Altoona Plumbing acquired Office Supplies on account. Which of the following entries properly records this transaction? a. Debit: Office Supplies; Credit: Cash b. Debit: Cash; Credit: Office Supplies c. Debit: Office Supplies; Credit: Accounts Payable d. Debit: Accounts Payable; Credit: Office Supplies 9. Altoona Plumbing acquired Equipment by making a Cash down payment and issuing a note to finance the remaining balance. Which of the following entries properly records this transaction? a. Debit: Equipment; Credit: Cash, Accounts Payable b. Debit: Equipment; Credit: Cash, Notes Payable c. Debit: Equipment; Credit: Cash d. Debit: Equipment; Credit: Cash, Accounts Payable, Notes Payable 10. Altoona Plumbing made its monthly office rent payment. Which of the following entries properly records this transaction? a. Debit: Cash; Credit: Rent Expense b. Debit: Rent Expense; Credit: Cash c. Debit: Rent Expense; Credit: Accounts Payable d. Debit: Accounts Payable; Credit: Rent Expense 11. Altoona Plumbing recorded its monthly service revenue reflecting both cash sales and sales on account. Which of the following entries properly records this transaction? a. Debit: Accounts Receivable; Credit: Service Revenue b. Debit: Service Revenue; Credit: Accounts Receivable, Cash c. Debit: Accounts Receivable, Cash; Credit: Service Revenue d. Debit: Cash; Credit: Accounts Receivable 12. Josephine Marlow, M.D. just recorded her billing to clients for services rendered. Which of the following entries properly records this transaction? a. Debit: Accounts Receivable; Credit: Fees Earned b. Debit: Accounts Receivable; Credit: Cash c. Debit: Fees Earned; Credit: Accounts Receivable d. Debit: Cash; Credit: Fees Earned 13. Josephine Marlow, M.D. recorded the collection of cash from her cash customers. Which of the following entries properly records this transaction? a. Debit: Fees Earned; Credit: Cash b. Debit: Fees Earned; Credit: Accounts Receivable c. Debit: Cash; Credit: Fees Earned d. Debit: Accounts Receivable; Credit: Fees Earned 14. Josephine Marlow, M.D., a sole proprietor, collected cash from customers for services performed and billed previously. Which of the following entries properly records this transaction? a. Debit: Fees Earned; Credit: Cash b. Debit: Fees Earned; Credit: Accounts Receivable c. Debit: Cash; Credit: Accounts Receivable d. Debit: Accounts Receivable; Credit: Fees Earned 35 15. Ronald's Appliance Shop purchased Office Supplies for $1,000 on account. After inspecting the purchase, $200 of the goods was found to be defective and returned. Which of the following entries properly records the return of these goods? a. Debit: Cash, $200; Credit: Office Supplies, $200 b. Debit: Cash, $800; Credit: Office Supplies, $800 c. Debit: Accounts Payable, $200; Credit: Office Supplies, $200 d. Debit: Accounts Payable, $800; Credit: Office Supplies, $800 16. Richard Valort, owner of Valort Landscaping Service, recently issued paychecks to his employees. The proper entry to record this transaction includes: a. A debit to the Drawing account b. A debit to Wages Payable c. A debit to Wages Earned d. A debit to Wages Expense 17. An employee of Valort Landscaping Service, a sole proprietorship reported an overpayment error to the owner, Richard Valort. (The error was made in computing and paying the employee's wages.) Valort receives cash from the employee for the amount of the overpayment, which of the following entries will Valort make? a. Cash, debit; Wages Expense, credit b. Wages Payable, debit; Wages Expense, credit c. Wages Expense, debit, Cash, credit d. Wages Expense, debit; Wages Payable, credit 18. Overstreet Computer Services bills all customers on account. Overstreet billed clients $80,000 during July. Overstreet's beginning Accounts Receivable balances for July was $32,200. How would July's customer billing be reflected on Overstreet's books? a. Debit Accounts Receivable, $32,200; Credit Fees Earned, $32,200 b. Debit Accounts Receivable, $28,000; Credit Fees Earned, $28,00 c. Debit Accounts Receivable, $80,000; Credit Fees Earned, $80,00 d. Debit Cash, $32,200; Credit Fees Earned, $32,200 19. Overstreet Computer Services bills all customers on account. Overstreet billed clients $80,000 during July (Debit, Accounts Receivable; Credit, Fees Earned). No cash collections from customers were received during July. Overstreet's beginning Accounts Receivable balance for July was $32,200. Overstreet's ending Accounts Receivable balance for July was: a. $ 28,000 b. $ 47,800 c. $ 80,000 d. $ 112,200 20. Overstreet Computer Services bills all customers on account. Overstreet billed clients $80,000 during July and collected $25,500 in customer payments. Overstreet's beginning Accounts Receivable balances for July was $32,200. How would July's customer payments be reflected on Overstreet's books? a. Debit Cash, $25,500; Credit, Accounts Receivable, $25,500 b. Debit Cash, $32,200; Credit, Accounts Receivable, $32,200 c. Debit Cash, $80,000; Credit, Accounts Receivable, $80,000 d. Debit Cash, $32,200; Credit, Fees Earned, $32,200 36 21. Which of the following account is increased by debits? a. Notes Payable b. Accounts Receivable c. Revenue d. Owners' Equity 22. Which of the following account is increased by credits? a. Supplies Expense b. Accounts Payable c. Inventory d. Accounts Receivable 23. Tony's Landscaping Service borrowed $7,500 from a bank. To record this transaction: a. Notes Payable must be credited; Cash must be debited b. Cash must be credited; Notes Payable must be debited c. Cash debited; Notes Receivable must be credited d. Cash credited; Notes Receivable must be debited 24. Tony's Landscaping Service purchased a truck for $2,500. $1,000 was paid in cash and a note payable was signed for the balance. To record this transaction: a. Notes Payable must be credited b. Notes Payable must be debited c. Cash must be debited d. Trucks must be credited 25. A business paid $100 for utilities. To record this transaction: a. Utilities Expense must be credited;Cash must be debited b. Cash and Utilities Expense must be debited c. Cash and Utilities Expense must be credited d. Utilities Expense must be debited; Cash must be credited 26. A business paid $100 to buy supplies. To record this transaction: a. Supplies Expense must be credited b. Accounts Payable must be debited c. Supplies must be debited d. Supplies must be credited 27. A business sold goods to customers for $1,800 on credit. To record this transaction: a. Accounts Receivable must be credited b. Accounts Payable must be debited c. Accounts Receivable must be debited d. Accounts Payable must be credited 37 28. A business paid $475 to a supplier for inventory purchased previously. To record this: transaction a. Accounts Payable must be credited; Cash must be debited b. Cash must be credited; Accounts Payable must be debited c. Cash debited; Accounts Receivable must be credited d. Cash credited; Accounts Receivable must be debited 29. Cash was collected from a customer for services provided previously. To record this: transaction a. Accounts Receivable must be credited b. Accounts Payable must be debited c. Accounts Receivable must be debited d. Accounts Payable must be credited 30. Supplies costing $80 were used by a business. To record this transaction: a. Supplies Expense must be credited b. Supplies Expense must be debited c. Supplies must be debited d. Cash must be credited 38 MODULE 2 Sole-Proprietorships Demonstration Problem 1 Clean-Rite Service This example analyzes the transactions for Clean-Rite Service for March 2000. Clean-Rite Service is a sole-proprietorship. The transactions are recorded in the journal and posted to the ledger. Mar. 1 Mar. 2 Mar. 4 Mar. 9 Mar. 11 Mar. 15 Mar. 17 Mar. 22 Mar. 24 Mar. 31 DATE 2000 Mar. 1 Mar. 2 Mar. 4 Mar. 9 Mar. 11 Mar. 15 Mar. 17 Mar. 22 Mar. 24 Mar. 31 Lisa used $500 of her own money to start Clean-Rite Service. Lisa's company borrowed $1,500 from her dad. Clean-Rite Service paid $400 for a used vacuum cleaner and shampoo machine. Clean-Rite Service purchased a used truck for $1,000 from Fuller Trucks Inc. Lisa paid $250 down and signed a note payable for the balance. Clean-Rite Service paid $115 for cleaning supplies. During the first half of March, Clean-Rite Service performed $450 of cleaning services. Customers paid $200 in cash and promised the remaining payment by March 30. Clean-Rite Service used $80 of the cleaning supplies. $250 was collected from customers for services performed previously. Lisa's company paid back $500 to her dad. Lisa withdrew $100 from the business. ACCOUNT Cash Lisa, Capital Cash Notes Payable Equipment Cash Truck Cash Notes Payable Supplies Cash Cash Accounts Receivable Service Revenue Supplies Expense Supplies Cash Accounts Receivable Notes Payable Cash Lisa, Drawings Cash DEBIT CREDIT 500 500 1,500 1,500 400 400 1,000 250 750 115 115 200 250 450 80 80 250 250 500 500 100 100 39 Practice Problem 1 Burton Precision Tools This assignment lists some transactions for Burton Precision Tools for January 2000. You have to analyze the accounts affected by each transaction and record it in the general journal. Jan. 2 Jan. 3 Jan. 3 Jan. 9 Jan. 11 Jan. 12 Jan. 17 Jan. 28 The business purchased inventory for $5,800 on credit. Sold goods for $7,200 to customers for cash. The cost of the goods sold in the previous transaction was $5,100. Purchased supplies for $150. Paid $4,800 to suppliers for the inventory purchased previously. Paid $85 for utilities. Supplies costing $45 were used in January. Paid rent of $500 for January. DATE 2000 Jan. 2 Jan. 3 Jan. 3 Jan. 9 Jan. 11 Jan. 12 Jan. 17 Jan. 28 ACCOUNT Inventory Accounts Payable Cash Sales Revenue Cost of Goods Sold Inventory Supplies Cash Accounts Payable Cash Utilities Expense Cash Supplies Expense Supplies Rent Expense Cash DEBIT CREDIT 5,800 5,800 7,200 7,200 5,100 5,100 150 150 4,800 4,800 85 85 45 45 500 500 40 Practice Problem 2 East West Travels East West Travels began operations in April 2000. The company is a sole-proprietorship. This assignment requires you to record the transactions for April in the general journal. Apr. 1 Apr. 2 Apr. 4 Apr. 9 Brian Smith started East West Travels by investing $40,000. $15,000 was borrowed by issuing a note payable. $500 was paid to purchase office supplies. Travel arrangement services performed for customers totaled $2,000. Of this amount, $800 was collected in cash. Office supplies costing $200 were consumed. An additional $300 of supplies were purchased. A payment of $5,000 was made on the note payable. $600 of accounts receivable was collected. Services totaling $450 were performed ($200 for cash with the balance on credit). $150 of supplies were consumed. $200 of outstanding accounts receivable was collected. Brian withdrew $500 from the business for personal use. Apr. 11 Apr. 14 Apr. 17 Apr. 18 Apr. 22 Apr. 28 Apr. 29 Apr. 30 DATE 2000 Apr. 1 Apr. 2 Apr. 4 Apr. 9 Apr. 11 Apr. 14 Apr. 17 Apr. 18 Apr. 22 Apr. 28 Apr. 29 Apr. 30 ACCOUNT Cash Brian, Capital Cash Notes Payable Supplies Cash Cash Accounts Receivable Service Revenue Supplies Expense Supplies Supplies Cash Notes Payable Cash Cash Accounts Receivable Cash Accounts Receivable Service Revenue Supplies Expense Supplies Cash Accounts Receivable Brian, Drawings Cash DEBIT CREDIT 40,000 40,000 15,000 15,000 500 500 800 1,200 2,000 200 200 300 300 5,000 5,000 600 600 200 250 450 150 150 200 200 500 500 41 Homework Problem 1 Aiken Consulting This assignment lists some typical transactions for Aiken Consulting for March 2000. You have to analyze the accounts affected by each transaction and record it in a journal. Mar. 1 Mar. 2 Mar. 4 Mar. 9 Mar. 11 Mar. 15 Mar. 17 Mar. 31 $12,000 was borrowed from a bank. Purchased supplies for $250. Consulting services were provided to clients for $2,800 on credit. Paid wages of $1,000 to the secretary. $1,200 was collected from customers for services provided previously. The cost of supplies used in March was $80. $2,000 of the note payable was paid. A payment of $700 was made for rent. DATE 2000 Mar. 1 Mar. 2 Mar. 4 Mar. 9 Mar. 11 Mar. 15 Mar. 17 Mar. 31 ACCOUNT Cash Notes Payable Supplies Cash Accounts Receivable Service Revenue Wages Expense Cash Cash Accounts Receivable Supplies Expense Supplies Notes Payable Cash Rent Expense Cash DEBIT CREDIT 12,000 12,000 250 250 2,800 2,800 1,000 1,000 1,200 1,200 80 80 2,000 2,000 700 700 42 Homework Problem 2 Annie’s Bakery This assignment lists some typical transactions for Annie's Bakery for November 2000. You have to analyze the accounts affected by each transaction and record it in the journal. Chart of Accounts Nov. 1 Nov. 2 Nov. 4 Nov. 9 Nov. 9 Nov. 14 Nov. 17 Nov. 18 Nov. 22 $5,000 was borrowed from a bank. Merchandise costing $750 was purchased on 30-day credit. Purchased supplies for $75. Goods were sold for $1,400 in cash. The cost of the goods sold was $500. $85 was paid for utilities. Supplies costing $35 were used in November. Paid $750 to the supplier for the merchandise purchased previously. Paid rent of $500 for November. DATE ACCOUN DEBIT CREDIT T 2000 Nov. 1 Nov. 2 Cash Notes Payable Inventory Accounts Payable Nov. 4 Supplies Nov. 9 Cash Cash Sales Revenue Nov. 9 Nov. 14 Nov. 17 Nov. 18 Cost of Goods Sold Inventory 5,000 5,000 750 750 75 75 1,400 1,400 500 500 Utilities Expense Cash 85 Supplies Expense Supplies 35 Accounts Payable 750 85 35 750 Cash Nov. 22 Rent Expense Cash 500 500 43 Homework Problem 3 Carlson Realty I On June 1, 2000, George Carlson started Carlson Realty. The company is a sole-proprietorship.This assignment requires you to record the transactions for the first month of operations in the accounting system. Jun. 1 Jun. 2 Jun. 4 George invested $8,000 in the business. Supplies were purchased on credit for $520. Furniture was purchased for $5,500. $2,500 was paid in cash and a note was signed for the balance. $250 was paid for the supplies purchased previously. The business earned sales commissions of $11,000. The customers paid cash. The receptionist was paid a salary of $2,400 for June. Rent of $1,400 was paid for June. The business paid $1,350 for automobile expenses. $140 was paid for utilities for June. Supplies costing $135 were used in June. George withdrew $1,000 for personal use. Jun. 9 Jun. 11 Jun. 29 Jun. 29 Jun. 30 Jun. 30 Jun. 30 Jun. 30 DATE ACCOUN DEBIT CREDIT T 2000 Jun. 1 Jun. 2 Jun. 4 Jun. 9 Jun. 11 Jun. 29 Jun. 29 Jun. 30 Jun. 30 Jun. 30 Jun. 30 Cash George, Capital Supplies Accounts Payable Furniture Cash Notes Payable Accounts Payable Cash Cash Service Revenue Salaries Expense Cash Rent Expense Cash Automobile Expense Cash Utilities Expense Cash Supplies Expense Supplies George, Drawings Cash 8,000 8,000 520 520 5,500 2,500 3,000 250 250 11,000 11,000 2,400 2,400 1,400 1,400 1,350 1,350 140 140 135 135 1,000 1,000 44 Homework Problem 4 Jackie’s Floral Designs Jackie's Floral Designs sells plants, flowers, and silk and dried arrangements. The company is a soleproprietorship. This assignment requires you to record the transactions for February 2000 in the accounting system. Feb. 1 Feb. 5 Feb. 7 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Jackie Simmons started Jackie's Floral Designs by investing $12,500. Merchandise costing $5,700 was purchased on 30-day credit. $350 was paid for supplies. Goods were sold for $8,000. $5,500 was collected in cash. The cost of the goods sold was $5,000. Supplies costing $175 were used during February. Employees were paid $1,200 in wages for February. A payment of $1,700 was made for the merchandise purchased previously. A payment of $800 was made for rent for February. $150 was paid for utilities for February. Jackie withdrew $500 for personal expenses. DATE ACCOUN DEBIT CREDIT T 2000 Feb. 1 Feb. 5 Feb. 7 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Feb. 28 Cash Jackie, Capital Inventory Accounts Payable Supplies Cash Cash Accounts Receivable Sales Revenue Cost of Goods Sold Inventory Supplies Expense Supplies Wages Expense Cash Accounts Payable Cash Rent Expense Cash Utilities Expense Cash Jackie, Drawings Cash 12,500 12,500 5,700 5,700 350 350 5,500 2,500 8,000 5,000 5,000 175 175 1,200 1,200 1,700 1,700 800 800 150 150 500 500 45 Homework Quiz Sole-Proprietorships 1. A business, operated for profit and owned by one person, is called a: a. Nonprofit organization b. Partnership c. Corporation d. Sole Proprietorship 2. A business entity can be organized in one of three major types. They are: a. Corporations, partnerships, and sole proprietorships b. Corporations, associations, and nonprofit organizations c. Profit, nonprofit, and corporate organizations d. Institutions, partnerships, and corporations 3. A sole proprietorship can obtain financial resources from which of the following types of accounts? a. Liabilities b. Owner's Equity c. Assets d. Both a and b 4. In a sole proprietorship, which of the following accounts reflects the owner's financial position in the business? a. Capital Stock b. Retained Earnings c. Inventory d. Owner's Capital 5. In a sole proprietorship, the Owner's Capital account balance appears in: a. The Owner's Equity section of the balance sheet. b. The Asset section of the balance sheet. c. The Liability section of the balance sheet. d. Both the Asset and Owner's Equity sections of the balance sheet. 6. Robert Pringle, a sole proprietor, invested $10,000 in his business to fund initial operations. This transaction will be reflected as a: a. Debit to Cash and a credit to Note Payable. b. Debit to Cash and a credit to Accounts Receivable. c. Debit to Cash and a credit to Robert Pringle, Capital. d. Debit to Cash and a credit to Fees Earned. 7. Robert Pringle, a sole proprietor, borrowed $10,000 from a local bank. It will be repaid with interest over the next year. This transaction will be reflected as a: a. Debit to Cash and a credit to Note Payable. b. Debit to Cash and a credit to Accounts Receivable. c. Debit to Cash and a credit to Robert Pringle, Capital. d. Debit to Cash and a credit to Fees Earned. 46 8. Robert Pringle, a sole proprietor, repaid $2,000 of the $10,000 he recently borrowed from a local bank. The payment applied exclusively to the principal borrowed. This transaction will be reflected as a: a. Debit to Note Payable and a credit to Robert Pringle, Capital. b. Debit to Note Payable and a credit to Accounts Receivable. c. Debit to Note Payable and a credit to Cash. d. Debit to Notes Payable and a credit to Fees Earned. 9. Robert Pringle, a sole proprietor, purchased Supplies on account for $2,500 during June. These items will be used over the next 18 months. This transaction will be recorded as a: a. Debit to Supplies Expense and a credit to Cash. b. Debit to Supplies Expense and a credit to Accounts Payable. c. Debit to Supplies and a credit to Cash. d. Debit to Supplies and a credit to Accounts Payable. 10. Of the supplies purchased in question #9, $1,500 was used in the current year. The entry reflecting this consumption will include a: a. Debit to Supplies b. Debit to Supplies Expense c. Credit to Supplies Expense d. Credit to Supplies Revenue 11. Ruth's Computer Consulting, a sole proprietorship, purchased computer supplies and recorded the acquisition as a debit to the asset account, Supplies. The entry to record the cost of supplies used during an accounting period is: a. Debit Supplies; credit Accounts Payable b. Debit Accounts Payable; credit Supplies c. Debit Supplies Expense; credit Supplies d. Debit Supplies Expense; credit Accounts Payable 12. Ruth's Computer Consulting, a sole proprietorship, purchased supplies during July of $3,000 and recorded the acquisition as a debit to the asset account, Supplies. At the end of July, the supplies on hand at July 31 totaled $2,800. The amount to be recorded as Supplies Expense for July is: a. $200 b. $2,800 c. $3,000 d. $5,800 13. Ruth's Computer Consulting is a sole proprietorship. The balance in her Office Supplies account on March 1 was $3,200. Supplies purchased during March amounted to $2,800, and the supplies on hand at March 31 were $2,500. The amount to be used for debited to Supplies Expense on March 31st is: a. $3,500 b. $2,800 c. $3,200 d. $2,500 47 14. Ruth's Computer Consulting is a sole proprietorship. Her Office Supplies account has a balance of $1,950 at the beginning of the year and was debited during the year for $5,600, representing the total of supplies purchased during the year. If $1,500 of supplies is on hand at the end of the year, the supplies expense to be reported on the income statement for the year is: a. $1,500 b. $1,950 c. $5,600 d. $6,050 15. Ruth's Computer Consulting is a sole proprietorship. She recently purchased Computer Equipment costing $15,000. One third was paid in cash and the remainder was on account. To record this entry, Ruth should include a: a. Debit to Computer Equipment of $5,000. b. Debit to Computer Equipment for $10,000. c. Debit to Computer Equipment of $15,000. d. Debit to Computer Expense of $10,000. 16. Ruth's Computer Consulting is a sole proprietorship. She recently purchased Computer Equipment costing $15,000. One third was paid in cash and the remainder was on account. To record this entry, Ruth should include a: a. Credit to Cash for $5,000. b. Credit to Cash for $10,000. c. Credit to Cash for $15,000. d. Credit to Cash for some other amount. 17. Ruth's Computer Consulting is a sole proprietorship. She recently purchased Computer Equipment costing $15,000. One third was paid in cash and the remainder was on account. To record this entry, Ruth should include a: a. Credit to Accounts Payable for $5,000. b. Credit to Accounts Payable for $10,000. c. Credit to Accounts Payable for $15,000. d. Credit to Accounts Payable for some other amount. 18. Ruth's Computer Consulting is a sole proprietorship. During August, she billed clients $12,000 for services rendered on account. To record this entry, Ruth should: a. Debit Cash and credit Fees Earned. b. Debit Accounts Receivable and credit Fees Earned. c. Debit Cash and credit Accounts Receivable. d. Debit Fees Earned and credit Cash. 19. Ruth's Computer Consulting is a sole proprietorship. During September, she billed clients $15,000 for services rendered and received $10,000 in payment of prior Accounts Receivable. Ruth's entries for September should include a: a. Debit to Cash for $5,000. b. Debit to Cash for $10,000. c. Debit to Cash for $15,000. d. Debit to Cash for $25,000. 48 20. Ruth's Computer Consulting is a sole proprietorship. During September, she billed clients $15,000 for services rendered and received $10,000 in payment of prior Accounts Receivable. Ruth's entries for September should include a: a. Debit to Accounts Receivable for $5,000. b. Debit to Accounts Receivable for $10,000. c. Debit to Accounts Receivable for $15,000. d. Debit to Accounts Receivable for $25,000. 21. A business paid $800 for rent. To record this transaction: a. Rent Expense must be credited; Cash must be debited b. Rent Expense must be debited; Cash must be credited c. Cash debited; Rent Revenue must be credited d. Cash credited; Rent Revenue must be debited 22. A sole-proprietorship and its owners are distinct entities: a. From a legal standpoint b. From an accounting standpoint c. From an accounting and legal standpoint d. None of the above 23. The account used by sole-proprietorships to record owner investments is: a. Capital b. Retained Earnings c. Capital Stock d. Drawings 24. A business paid $100 to buy supplies. To record this transaction: a. Supplies Expense must be credited b. Supplies must be debited c. Supplies must be credited d. None of the above 25. To record the payment of cash for inventory purchased on credit earlier: a. Accounts Payable must be debited b. Accounts Payable must be credited c. Accounts Receivable must be debited d. Accounts Receivable must be credited 26. The account used to record withdrawals of cash by owners of sole-proprietorships is: a. Capital b. Retained Earnings c. Capital Stock d. Drawings 49 27. Owner investments in sole-proprietorships are recorded by: a. Debiting Capital; crediting Cash b. Debiting Cash; crediting Capital c. Debiting Capital Stock; crediting Cash d. Debiting Cash; crediting Capital Stock 28. Which of the following accounts are increased by credits? a. Supplies b. Accounts Receivable c. Inventory d. Revenue 29. Withdrawals of cash by owners of sole-proprietorships is recorded by: a. Debiting Drawings; crediting Cash b. Debiting Cash; crediting Drawings c. Debiting Dividends; crediting Cash d. Debiting Cash; crediting Dividends 30. A business paid salaries of $1,800 for November. To record this transaction: a. Salaries Expense must be credited b. Salaries Expense must be debited c. Cash must be debited d. None of the above 50 MODULE 2 Corporations Demonstration Problem 1 Music Stop This example analyzes the transactions for Music Stop for April 2000. The company is a corporation. The transactions are recorded in the general journal and posted to the general ledger. Apr. 2 Apr. 2 Apr. 4 Apr. 9 Apr. 11 Apr. 11 Apr. 17 Apr. 22 Apr. 24 Apr. 30 DATE 2000 Apr. 2 Apr. 2 Apr. 4 Apr. 9 Apr. 11 Apr. 11 Apr. 17 Apr. 22 Apr. 24 Apr. 30 Music Stop issued stock for $10,000. The company signed a two year note for $40,000. Merchandise costing $20,000 was purchased on credit. The company paid $12,000 for equipment. Goods were sold to customers for $5,500. The cost of the goods sold in the previous transaction was $3,000. Employees were paid $1,000 in wages. The company paid the utility bill of $100. A payment of $5,000 was made for the merchandise purchased previously. Music Stop declared and paid dividends of $1,000. ACCOUNT Cash Capital Stock Cash Notes Payable Inventory Accounts Payable Equipment Cash Cash Sales Revenue Cost of Goods Sold Inventory Wages Expense Cash Utilities Expense Cash Accounts Payable Cash Dividends Cash DEBIT CREDIT 10,000 10,000 40,000 40,000 20,000 20,000 12,000 12,000 5,500 5,500 3,000 3,000 1,000 1,000 100 100 5,000 5,000 1,000 1,000 51 Practice Problem 1 Downtown Fitness Center This assignment lists some typical transactions for Downtown Fitness Center for April 2000. After analyzing the transactions, you must record them in the general journal. Apr. 2 Apr. 2 Apr. 4 Apr. 9 Apr. 11 Apr. 15 Apr. 17 Apr. 28 Apr. 30 $5,000 was borrowed from a bank. Purchased equipment on credit for $10,000. Purchased supplies for $200. Paid cash. Services were provided to customers on credit for $3,500. Paid the utilities bill of $105 for April. Paid employees’ salaries of $1,000 for April. Rent of $600 was paid for April. $2,500 was paid to the supplier for the equipment purchased previously. $1,500 was collected from customers for services provided previously DATE 2000 Apr. 2 Apr. 2 Apr. 4 Apr. 9 Apr. 11 Apr. 15 Apr. 17 Apr. 28 Apr. 30 ACCOUNT Cash Notes Payable Equipment Accounts Payable Supplies Cash Accounts Receivable Service Revenue Utilities Expense Cash Salaries Expense Cash Rent Expense Cash Accounts Payable Cash Cash Accounts Receivable DEBIT CREDIT 5,000 5,000 10,000 10,000 200 200 3,500 3,500 105 105 1,000 1,000 600 600 2,500 2,500 1,500 1,500 52 Practice Assignment 2 O’Grady Building Supplies This assignment analyzes the transactions for O'Grady Building Supplies for July 2000. This companyt is a corporation. After analyzing the transactions, you must record them in the general journal. July 1 July 2 July 5 July 31 July 31 July 31 July 31 July 31 The owners started the business by investing $50,000. O’Grady Building Supplies issued stock for $50,000. The business purchased inventory on credit for $22,500. The business purchased supplies for $500. Goods were sold to customers for $18,000. The customers paid cash. The cost of goods sold for the month was $13,500. Supplies costing $100 was used during the month. Rent of $1,800 was paid for July. $6,000 was paid to suppliers for inventory purchased previously. DATE 2000 Jul. 1 Jul. 2 Jul. 5 Jul. 31 Jul. 31 Jul. 31 Jul. 31 Jul. 31 ACCOUNT DEBIT Cash Capital Stock 50,000 Inventory Accounts Payable 22,500 Supplies Cash 50,000 22,500 500 500 Cash Sales Revenue 18,000 Cost of Goods Sold Inventory 13,500 Supplies Expense Supplies CREDIT 18,000 13,500 100 100 Rent Expense Cash 1,800 Accounts Payable Cash 6,000 1,800 6,000 53 Homework Problem 1 Osborne Office Supplies This assignment lists some typical transactions for Osborne Office Supplies for January 2000. You have to record each transaction in the general journal. Jan. 1 Jan. 2 Jan. 4 Jan. 4 Jan. 11 Jan. 11 Jan. 17 Jan. 18 Jan. 22 Jan. 28 Jan. 29 $15,000 was borrowed by issuing a note payable. Merchandise costing $3,000 was purchased on credit. Office supplies were sold to customers on credit for $2,000. The cost of the supplies sold was $1,100. Goods were sold to customers for $2,700 for cash. The cost of the goods sold in the previous transaction was $1,400. Paid $2,000 to the supplier for the merchandise purchased previously. $600 of accounts receivable was collected. Rent of $600 was paid for January. $100 was paid for utilities for January. Employees were paid $800 for wages. DATE 2000 Jan. 1 Jan. 2 Jan. 4 Jan. 4 Jan. 11 Jan. 11 Jan. 17 Jan. 18 Jan. 22 Jan. 28 Jan. 29 ACCOUNT Cash Notes Payable Inventory Accounts Payable Accounts Receivable Sales Revenue Cost of Goods Sold Inventory Cash Sales Revenue Cost of Goods Sold Inventory Accounts Payable Cash Cash Accounts Receivable Rent Expense Cash Utilities Expense Cash Wages Expense Cash DEBIT CREDIT 15,000 15,000 3,000 3,000 2,000 2,000 1,100 1,100 2,700 2,700 1,400 1,400 2,000 2,000 600 600 600 600 100 100 800 800 54 Homework Problem 2 Discount Books This assignment lists some transactions for Discount Books for September 2000. You have to analyze the accounts affected by each transaction and record it in the general journal. Sept. 1 Sept. 2 Sept. 5 Sept. 5 Sept. 9 Sept. 12 Sept. 16 Sept. 16 Sept. 22 Sept. 28 Boston Bank loaned the firm $16,000 in exchange for the firm's one year note payable. Merchandise costing $8,000 was purchased on 30-day credit. Goods were sold for $3,000 in cash. The cost of the goods sold was $2,000. Employees were paid $1,000 in wages. A payment of $2,000 was made for the merchandise purchased previously. Goods were sold for cash totaling $4,500. The cost of the goods sold was $3,000. $1,800 of notes payable was paid. A payment of $800 was made for rent. DATE ACCOUN DEBIT CREDIT T 2000 Sept. 1 Sept. 2 Sept. 5 Sept. 5 Sept. 9 Sept. 12 Sept. 16 Sept. 16 Sept. 22 Sept. 28 Cash Notes Payable 16,000 16,000 Inventory Accounts Payable 8,000 Cash Sales Revenue 3,000 Cost of Goods Sold Inventory 2,000 Wages Expense Cash 1,000 Accounts Payable Cash 2,000 Cash Sales Revenue 4,500 Cost of Goods Sold Inventory 3,000 Notes Payable Cash 1,800 Rent Expense Cash 800 8,000 3,000 2,000 1,000 2,000 4,500 3,000 1,800 800 55 Homework Problem 3 The Audio Exchange The Audio Exchange sells used audio equipment and provides repair services. Below are the transactions occurring during November 2000. This assignment requires you to prepare journal entries for these transactions. Nov. 1 Nov. 1 Nov. 4 Nov. 7 Nov. 8 Nov. 10 Nov. 12 Nov. 16 Nov. 18 Nov. 24 Nov. 24 Nov. 30 Audio exchange issued stock for $12,000. Supplies were purchased for $500. An inventory of audio equipment was purchased on credit for $15,000. $700 was paid for advertising that appeared in the paper during the month. $120 was paid for repairs. $6,000 was paid to the supplier for the inventory purchased earlier. Services provided to clients for cash totaled $3,300. Services totaling $2,500 were performed on credit. Audio equipment was sold to customers for $4,000. The cost of the equipment sold was $2,500. $200 of the supplies were used during the month. Audio Exchange declared and paid dividends of $1,000. DATE 2000 Nov. 1 Nov. 1 Nov. 4 Nov. 7 Nov. 8 Nov. 10 Nov. 12 Nov. 16 Nov. 18 Nov. 24 Nov. 24 Nov. 30 ACCOUNT Cash Capital Stock Supplies Cash Inventory Accounts Payable Advertising Expense Cash Repairs Expense Cash Accounts Payable Cash Cash Service Revenue Accounts Receivable Service Revenue Cash Sales Revenue Cost of Goods Sold Inventory Supplies Expense Supplies Dividends Cash DEBIT CREDIT 12,000 12,000 500 500 15,000 15,000 700 700 120 120 6,000 6,000 3,300 3,300 2,500 2,500 4,000 4,000 2,500 2,500 200 200 1,000 1,000 56 Homework Problem 4 Hoffman Consulting The transactions for the first month of operations of Hoffman Consulting Inc. are given below. This assignment requires you to prepare journal entries for these transactions. Oct. 1 The owners started the business by investing $25,000. Hoffman Consulting Inc. issued stock for $25,000. A computer system was purchased for $2,000 on credit. $400 was paid for office supplies. Services were performed for $2,500 on credit. $1,000 was paid for the computer purchased previously. Services were performed for $8,000. The customers paid cash. $275 was paid for advertisements in October. $155 was paid for utilities for October. Supplies costing $135 were used in October. Customers paid $1,500 for services performed previously on credit. $1,800 was paid as rent for the office for October. Oct. 5 Oct. 10 Oct. 17 Oct. 21 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 DATE 2000 Oct. 1 Oct. 5 Oct. 10 Oct. 17 Oct. 21 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 Oct. 31 ACCOUNT Cash Capital Stock Computer Accounts Payable Supplies Cash Accounts Receivable Service Revenue Accounts Payable Cash Cash Service Revenue Advertising Expense Cash Utilities Expense Cash Supplies Expense Supplies Cash Accounts Receivable Rent Expense Cash DEBIT CREDIT 25,000 25,000 2,000 2,000 400 400 2,500 2,500 1,000 1,000 8,000 8,000 275 275 155 155 135 135 1,500 1,500 1,800 1,800 57 Homework Quiz Corporations 1. Which organizational form allows the business to be a separate, distinct entity from the owners? a. Proprietorship b. Partnership c. Corporation d. All of the above 2. The Retained Earnings account is unique to which of the following forms of business organization? a. Partnership b. Proprietorship c. Corporation d. A Retained Earnings account is used in all of the above choices. 3. The issuance of a cash dividend: a. Increases a corporation's retained earnings balance. b. Decreases the value of outstanding stock. c. Increases the number of shares of outstanding stock. d. Decreases a corporation's retained earnings balance. 4. Which of the following is true of a corporation's Retained Earnings account? a. It usually equals cash on hand. b. It includes all of the Corporation's Liabilities. c. It includes the transfer of dividends declared during the period. d. It is shown as a section of the corporation's income statement. 5. A corporation issuing only one class of stock will usually title it: a. Common Stock b. Treasury Stock c. No-par Stock d. Preferred Stock 6. Bob and Ray recently purchased shares of BR, Incorporated, a corporation, for $100,000 each. This transaction will consist of the following entries to BR, Incorporated's records: a. Debit Accounts Receivable; credit Capital Stock b. Debit Cash; credit Accounts Payable c. Debit Cash; credit Capital Stock d. Debit Accounts Receivable; credit Accounts Payable 7. Bob and Ray organized BR, Incorporated, a corporation for which they are the only stockholders. At the end of the first year of operations, they elect to withdraw dividends in the amount of $2,000 each. This transaction will consist of the following entries on BR Incorporated's records: a. Debit Drawing; credit Cash b. Debit Wages Expense; credit Cash c. Debit Capital Stock; credit Cash d. Debit Dividends; credit Cash 58 8. Bob and Ray have just purchased shares of BR, Incorporated, a corporation, for $100,000 each. This transaction will impact the corporation's Stockholders' Equity by what amount? a. $ -0b. $ 100,000 c. $ 200,000 d. Some other amount. 9. Which of the following properly reflects the transaction to record a Corporation's issuance of stock? a. Capital Stock: Credit; Cash: Debit b. Capital Stock: Debit; Cash: Debit c. Capital Stock: Credit; Cash: Credit d. Capital Stock: Debit; Cash: Credit 10. Which of the following properly reflects a Corporation's issuance of stock on the Capital Stock and Dividends accounts? a. Capital Stock: Increases; Dividends: Decreases b. Capital Stock: Increases; Dividends: No effect c. Capital Stock: No effect; Dividends: Increases d. Capital Stock: Decreases; Dividends: Increases 11. BR, Incorporated, a corporation, pays $4,000 in dividends. This $4,000 payment will: a. Increase the Cash account. b. Increase the Dividends account. c. Increase the Capital Stock account. d. Decrease the Capital Stock account. 12. BR, Incorporated, a corporation, pays $4,000 in dividends. This $4,000 payment will be recorded as a: a. Dividends: Credit; Cash: Debit b. Dividends: Debit; Cash: Credit c. Dividends: No effect; Cash: No effect d. Dividends: Debit; Cash: No effect 13. BR, Incorporated, a corporation, has a $100,000 Capital Stock balance at the beginning of the year. Additional Common Stock of $45,000 was issued during the year. The Capital Stock balance at the end of the year is: a. $ 145,000 b. $ 100,000 c. $ 55,000 d. $ 45,000 14. BR, Incorporated issued $100,000 in Capital Stock to each of its two shareholders. The Corporation paid Dividends of $20,000 during the year. The balance in the Capital Stock account at the end of the year is: a. $ 220,000 b. $ 200,000 c. $ 120,000 d. $ 100,000 59 15. Carriage Company, Inc.'s Capital Stock balance was $38,000 on December 31, 2001. Additional stock of $13,000 was issued during the year. Carriage's Capital Stock balance on January 1, 2001 was: a. $51,000 b. $38,000 c. $25,000 d $13,000 16. StarCo, a newly formed corporation, paid its office rental for the month of April 2001. What accounts are impacted by this transaction? a. Debit Dividends; credit Capital Stock b. Debit Rent Revenue; credit Cash c. Debit Drawings; credit Capital Stock d. Debit Rent Expense; credit Cash 17. StarCo, a newly formed corporation, purchased Inventory on account from a vendor. What accounts are impacted by this transaction? a. Debit Inventory; credit Cash b. Debit Inventory; credit Accounts Payable c. Debit Drawings; credit Cash d. Debit Drawings; credit Accounts Payable 18. The corporation, Joe's Discount Furniture, recorded sales for the month of May 2001 amounting to $200,000. Sixty percent (60%) of these sales were on account. As a result of this transaction, Joe's Accounts Receivable account will increase by: a. $ -0b. $ 80,000 c. $120,000 d. $200,000 19. The corporation, Joe's Discount Furniture, recorded sales for the month of May 2001 amounting to $200,000. Sixty percent (60%) of these sales were on account. As a result of this transaction, Joe's Revenue account will increase by: a. $ -0b. $ 80,000 c. $120,000 d. $200,000 20. The corporation, Joe's Discount Furniture, recorded sales for the month of May 2001 amounting to $200,000. Sixty percent (60%) of these sales were on account. As a result of this transaction, how will the following accounts be impacted? a. Cash: $ -0-; Capital Stock: $200,000 increase b. Cash: $ 80,000 increase; Capital Stock: No effect c. Cash: $120,000 increase; Capital Stock: No effect d. Cash: $200,000 increase; Capital Stock: $200,000 increase 60 21. A corporation and its' owners are distinct entities: a. From a legal standpoint b. From an accounting standpoint c. From an accounting and legal standpoint d. None of the above 22. After analyzing a transaction, it is recorded in: a. The general ledger b. The general journal c. T-accounts d. Trial balance 23. The account used by corporations to record owner investments is: a. Capital b. Retained Earnings c. Capital Stock d. Drawings 24. Which of the following accounts is debited for increases? a. Capital b. Retained Earnings c. Capital Stock d. Dividends 25. The account used by corporations to record reinvested profits is: a. Capital b. Retained Earnings c. Capital Stock d. Drawings 26. Which of the following accounts is debited for decreases? a. Capital b. Cash c. Dividends d. Drawings 27. To record the repayment of a loan to a creditor: a. Notes Payable must be credited b. Cash must be debited c. Notes Payable must be debited d. Both a and b are correct 61 28. Owner investments in corporations are recorded by: a. Debiting Capital; crediting Cash b. Debiting Cash; crediting Capital c. Debiting Capital Stock; crediting Cash d. Debiting Cash; crediting Capital Stock 29. To record the sale of goods to customers on credit: a. Accounts Payable must be debited b. Accounts Payable must be credited c. Accounts Receivable must be debited d. Accounts Receivable must be credited 30. The distribution of cash to investors of corporations are recorded by: a. Debiting Drawings; crediting Cash b. Debiting Cash; crediting Drawings c. Debiting Dividends; crediting Cash d. Debiting Cash; crediting Dividends 62