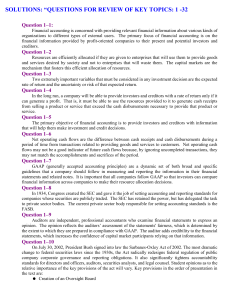

The Financial Reporting System: A Quiz

advertisement