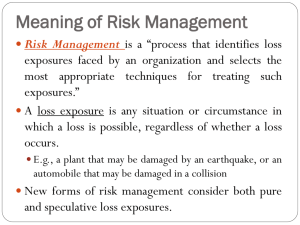

g. capital markets and event risks

advertisement

UNIVERSITY OF FLORIDA WARRINGTON COLLEGE OF BUSINESS ADMINISTRATION RMI 4305: Risk Management, Spring, 2003 INSTRUCTOR: COMMUNICATION: EMAIL: David Nye 329 Stuzin Hall Voice: Office: 392-6649; Cell: 262-6649; FAX: 392-0301 dnye@ufl.edu CLASS MEETING TIMES: T R 11:45 – 1:15 OFFICE HOURS: MAT 103 TBA GENERAL OBJECTIVE The objective of this course is to introduce students to corporate risk management. Students will develop a core level of knowledge on the principles of risk management and will learn how to apply financial and statistical tools to make risk management decisions within a general corporate finance framework. Emphasis is placed on the identification, evaluation and financing of pure or event risks. SPECIFIC OBJECTIVE: Upon completion of this course, the student should be able to: 1. Define and explain the concept of risk management, 2. Identify and evaluate property and personnel exposures to loss arising out of corporate activities, 3. Create and evaluate risk treatment plans (including avoidance, simple retention, self-insurance, non-insurance transfer and insurance). INSTRUCTIONAL TECHNIQUE The course format will be lecture and discussion of readings as well as case analyses. Periodic assignments also will be made and graded. Student involvement is important - "One who never asks a question either knows everything or nothing", M. Forbes (Former Publisher) GRADING Exam I Exam II Exam III Total exam weight Assignments Total Default Weight Elected Weight 30% 25% - 35% 30% 25% - 35% 30% Remainder% 90% 90% 10% 100% Weight elections for exams 1 and 2 MUST BE COMMUNICATED TO ME IN WRITING NO LATER THAN TWO (2) WEEKS PRIOR TO THE LAST CLASS OF THE SEMESTER. If no election is made within the allowed time period, the default weights will apply. REQUIRED READINGS: 02/12/16 Risk Management and Insurance, Harrington & Niehaus, Irwin McGrawHill, 1999 Articles listed under each subject heading OTHER READINGS: Wall Street Journal Risk Financing (Volume I and II) A Guide to Insurance Cash Flow Insuring Your Business, Mooney, 1992, Insurance Information Institute Financing Risk & Reinsurance Newsletter Please visit my home page at http://bear.cba.ufl.edu/nye This page contains a variety of information including sites to visit to obtain jobs in almost any industry. RETENTION Class materials will be retained for ten days after the third exam date. If you wish to extend this deadline, you must notify me in writing by the final exam date. NOTE Students should consider taking some CPCU exams. Your business school classes have already prepared you to successfully take some of these exams and passing them will enhance your marketable skills in the risk management and insurance area. This could enhance your job marketability by offering potential employers a more diverse range of subjects studied. OVERVIEW Corporate managers and owners generally recognize that one of their goals is to maximize firm value. This is achieved partly by combining physical assets with personnel assets to produce a good or service that is demanded in the marketplace. Destruction of or damage to corporate assets could frustrate the attainment of management goals. Risk management is about identifying risks, preventing losses and financing the recovery from damage to firm assets. Examples of such damage are destruction of real property, third party claims against the organization, premature death of a key person and competitors who seek to hire the firm's employees. Our study of risk management takes place within a general corporate finance setting where we show how the possibility of financial distress can erode firm value. In fact, it does not matter whether the source of distress is financial leverage, business risk or insurable risks. The important point is that all types of risk can affect value and managers must assess and treat all significant risks in an integrated way. Risk treatment techniques vary widely from complex hedging strategies to manage commodity price risk to sophisticated risk financing techniques to manage insurable risks. Regardless of the method, the management of insurable risks is conceptually identical to management of other business and financial risks borne by shareholders. In spite of these conceptual similarities, there are special institutional mechanisms for financing and/or transferring what we refer to as insurable risks. In order to know how to use these institutional arrangements to maximize shareholder wealth, students must learn how to identify, measure and treat a range of firm risk exposures. Although business school students receive instruction in the fundamentals of accounting, finance, marketing and management, they are usually unaware of the fundamentals of how to identify loss exposures, assess their significance and finance the claims that do occur. Untreated, these threats to corporate assets could cause financial distress. Extreme distress causes insolvency of the entity. Less severe distress may result in reduced ability of the firm to undertake profitable investments, service debt, pay dividends to shareholders, continue research and development or carry on some other activity deemed important by owners and managers. This course is an important component of a business school curriculum because it focuses on the preservation of corporate value created by production, marketing and finance activities. All students would benefit from the course because it contributes to their general management knowledge. For some, the course may provoke an interest in pursuing a career in risk management and this course will provide a firm foundation on which more specialized knowledge can be added. ASSIGNMENTS Assignments to reinforce class material will be made. These will be done individually. All assignments must be submitted and your score on them will determine your grade for the 10 percent assignment weighting in the course. 02/12/16 9:10 AM 2 TOPIC A. OVERVIEW OF RISK MANAGEMENT Risk and Its Management Objectives of Risk Management READING Text - Chapter 1 Ch. 1, Q. 1 Text - Chapter 2 “An Integrated Approach to Risk Management” in Part V: Risk and Liabilities Management “The Promise and Challenge of Integrated Risk Management”, Lisa Meulbroek, Risk Management and Insurance Review, Spring, 2002 B. EVENT RISK IDENTIFICATION Property, Liability and Personnel Exposures ASSIGNMENT Text - Chapter 12, pp. 265-269 Chapter 14, pp. 329-338, 351-358, Appendix 14 Chapter 16, pp. 387-394 "Property and Income Loss Exposures", Michael F. Grace "Liability Loss Exposures", Jack P. Gibson "Human Resources Loss Exposures", Michael T. Rousseau The above three readings are contained in Section 12, AMA Management Handbook,3rd ed., 1994 Ch. 2, Q. 5 Ch. 14, Q. 1 C. RISK ASSESSMENT 1. Loss Forecasting a. Component Approach 1) Frequency 2) Severity 3) Combining frequency and severity b. Aggregate Approach Text - Chapter 3, Appendix Chapter 12, pp.269-270, 280-283 Doherty, Chapter 4, “Estimation of Loss Distributions” Financial Applications for Risk Management Decisions, Chapter 3, “Loss Forecasting " Ch. 3, Q. 9 2. Loss Simulation Text, Chapter 12, pp. 283-289 Financial Applications for Risk Management Decisions, Chapter 4, “Loss Simulation” FF; Chapter 4, Q 2, 3, 6-10 Text, Chapter 3, Section 3.3-3.4, Appendix Doherty, Chapter 5, “Portfolio Theory and Risk Management” Ch. 3, 5 - 8 Doherty, Ch. 5, Questions 1 & 2 Q. 1, 4 Review Question 4 EXAM 1 3. Event Risk Portfolios a. Building blocks b. Risk definition c. Examples D. RISK FINANCING METHODS 02/12/16 9:10 AM 3 1. Full Transfer - Insurance 2. Partial Transfer Experience Rating Retrospective Rating Large Deductible Plans Self Insured Retention Risk Retention Groups Finite Risk Insurance 3. Full Retention Self-Insurance Fronting Captives: Domestic and Offshore Markets Text - Chapter 11, 17 (Section 17.1, 17.3) “Alternative Risk Financing Plan Discussion”, Risk Financing, Plan Evaluation, VII.B.1VII.B.16 Chapter 11; Q 3,5 Chapter 17; Q 1,7 http://www.captive.com/service/munichamerican/munich_article1.html E. CHOOSING A RISK FINANCING METHOD 1. Selecting Retention levels Text - Chapter 9, Appendix 9 Chapter 10, Appendix 10 Chapter 12 (Section 12.2) Chapter 9; Q 1,6 Chapter 10; Q 5,6 Chapter 12; Q 4,5 “Corporate Insurance Strategy: The Case of British Petroleum”, Doherty and Smith, The Journal of Applied Corporate Finance Chapter 5, “Risk Retention”, Financial Applications for Risk Management Decisions 2. DCF Analysis Chapter 12 (Section 12.5) Chapter 7, “Discounted Cash Flow”, Financial Applications for Risk Management Decisions EXAM 2 3. Selection Factors & Company Characteristics 02/12/16 9:10 AM “Discussion of the Plan Comparison Matrix”, Risk Financing, Plan Evaluation, VII.A.1-VII.A.7 “Case Studies”, Risk Financing, Plan Evaluation, VII.C.1 – C21. “Applying Risk Management Metrics”, Sigma Circle Solutions, undated. 4 F. INSURANCE MECHANISM 1. Risk Pooling and Insurance Institutions Chapter 4 Ch.4, Q6 2. Insolvencies, Solvency Ratings, and Regulation Chapter 5 Ch.5, Q5 3. Insurance Pricing Chapter 6 Ch.6, Q1 4. Risk Aversion and Risk Management by Individuals and Corporations Chapter 7 Ch.7, Q4,8 5. Insurability of Risk, Contractual Provisions and Legal Doctrines Chapter 8 Ch.8, Q7 G. CAPITAL MARKETS AND EVENT RISKS Reducing Risk Through Hedging ad Diversification Chapter 13 "Insurance Derivatives and Securitization: New Hedging Perspectives for the US Cat Insurance Market", Kielholz and Durrer, Geneva Papers on Risk and Insurance, 1/97, 3-16 EXAM 3 H. INTERNATIONAL RISKS (If time) I. RISK MANAGEMENT ORGANIZATION (If time) Marketing Insurance Programs Claims Management Cost Allocation and Performance Measurement Chairman: Dr. Joel Houston, 321 Stuzin hall, 392-0153 READINGS KEY: Doherty, Corporate Risk Management, A Financial Exposition 02/12/16 9:10 AM 5