Restructuring Charges Accounting

advertisement

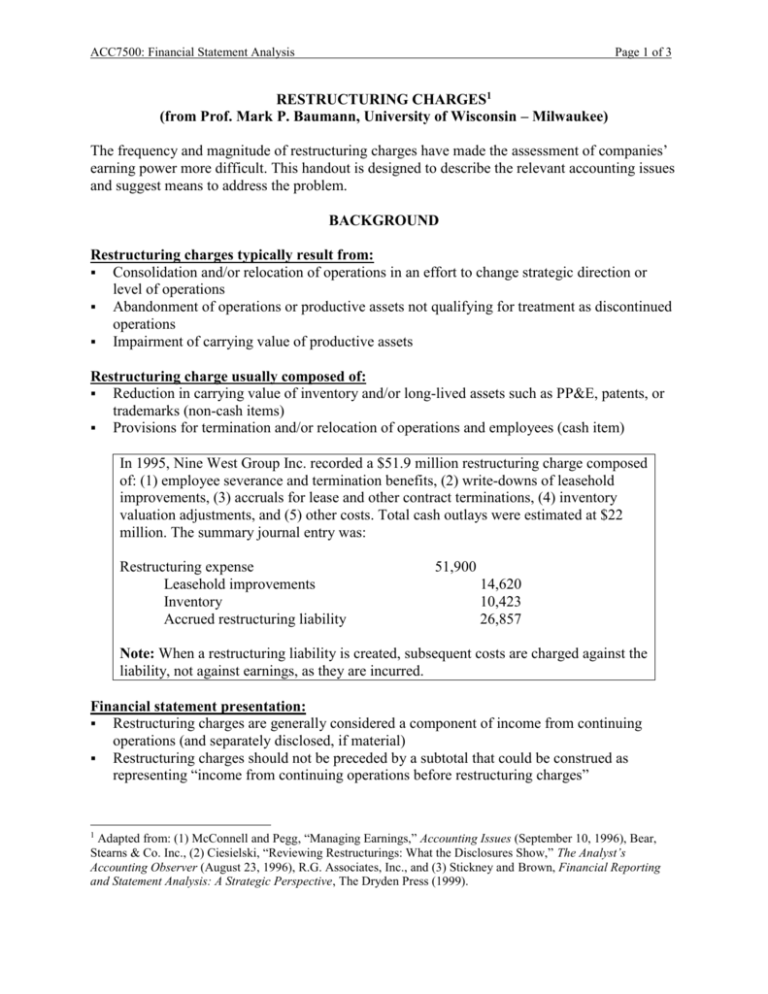

ACC7500: Financial Statement Analysis Page 1 of 3 RESTRUCTURING CHARGES1 (from Prof. Mark P. Baumann, University of Wisconsin – Milwaukee) The frequency and magnitude of restructuring charges have made the assessment of companies’ earning power more difficult. This handout is designed to describe the relevant accounting issues and suggest means to address the problem. BACKGROUND Restructuring charges typically result from: Consolidation and/or relocation of operations in an effort to change strategic direction or level of operations Abandonment of operations or productive assets not qualifying for treatment as discontinued operations Impairment of carrying value of productive assets Restructuring charge usually composed of: Reduction in carrying value of inventory and/or long-lived assets such as PP&E, patents, or trademarks (non-cash items) Provisions for termination and/or relocation of operations and employees (cash item) In 1995, Nine West Group Inc. recorded a $51.9 million restructuring charge composed of: (1) employee severance and termination benefits, (2) write-downs of leasehold improvements, (3) accruals for lease and other contract terminations, (4) inventory valuation adjustments, and (5) other costs. Total cash outlays were estimated at $22 million. The summary journal entry was: Restructuring expense Leasehold improvements Inventory Accrued restructuring liability 51,900 14,620 10,423 26,857 Note: When a restructuring liability is created, subsequent costs are charged against the liability, not against earnings, as they are incurred. Financial statement presentation: Restructuring charges are generally considered a component of income from continuing operations (and separately disclosed, if material) Restructuring charges should not be preceded by a subtotal that could be construed as representing “income from continuing operations before restructuring charges” Adapted from: (1) McConnell and Pegg, “Managing Earnings,” Accounting Issues (September 10, 1996), Bear, Stearns & Co. Inc., (2) Ciesielski, “Reviewing Restructurings: What the Disclosures Show,” The Analyst’s Accounting Observer (August 23, 1996), R.G. Associates, Inc., and (3) Stickney and Brown, Financial Reporting and Statement Analysis: A Strategic Perspective, The Dryden Press (1999). 1 ACC7500: Financial Statement Analysis Page 2 of 3 If charges relate to activities for which the associated revenues and expenses have historically been included in “operating income,” they should generally be classified as an operating expense (and separately disclosed, if material) If charges relate to activities previously included under “other income and expense,” they should be similarly classified (and separately disclosed, if material) American Cyanamid Company recorded a $292 million restructuring which was allocated among cost of goods sold, selling and advertising expense, research and development expense, administrative and general expense, interest, royalties and other income, and equity in net earnings of associated companies. ACCOUNTING REQUIREMENTS UNDER GAAP The FASB prescribes the accounting for restructuring liabilities in Emerging Issues Task Force Consensus No. 94-3, Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (Including Certain Costs Incurred in a Restructuring).2 Employee Termination Benefits Record expense (debit) and liability (credit) when: Management approves and commits firm to a plan of termination Management establishes the benefits that current employees will receive upon termination Plan specifically identifies the number of employees to be terminated by job classification or function and location Benefit arrangement is communicated to employees in sufficient detail to enable them to determine the type and amount of benefit they will receive if terminated Period of time to complete the plan indicates significant changes are not likely Financial statement disclosures required in all periods until plan complete: Amount of benefits accrued and charged to expense Classification of costs in the income statement Number of employees to be terminated Description of employee groups to be terminated Amount of actual termination benefits paid and charged against the liability Number of employees actually terminated as result of plan Amount of any adjustment to the liability 2 EITF Consensus No. 94-3 has been in effect since November 17, 1994. Financial statement disclosures prior to that date are often incomplete. ACC7500: Financial Statement Analysis Page 3 of 3 Costs to Exit an Activity Record expense (debit) and liability (credit) when: Management approves and commits to exit plan All significant actions to be taken to complete the exit plan are specifically identified, including: (1) activities that will not be continued, (2) method of disposition, (3) location of activities, and (4) expected date of completion Period of time to complete exit plan indicates that significant changes to plan are not likely Financial statement disclosures required if costs recorded at commitment date are material or the activities that will not be continued are material to the company’s revenues or operating results: Description of major actions comprising the plan, including: (1) activities that will not be continued, (2) method of disposition, and (3) anticipated date of completion Description of type and amount of exit costs recognized as liabilities and the classification of those costs in the income statement ANALYTICAL CONSIDERATIONS It can be argued that items included in restructuring charges are normal costs incurred by firms in the long run. Analysts can undo the timing of a charge by (1) removing the after-tax effects of the charge from net income, and (2) running expenditures through the income statement in the period they flow through the restructuring liability. SEC-mandated disclosures are designed to help identify which portion of charge will require cash and which portion is actually nonrecurring. Firms employing conservative accounting policies (e.g., short useful lives and immediate expensing of plant-related expenditures) will have smaller amounts to write off. Some firms may take restructuring charges for several years in an effort to avoid a large, single-year earnings hit. Other firms may maximize amount of charge in a given year to convey all bad news at one time. If the estimated restructuring charge proves too large (small), income from continuing operations in a later period will include a correction that increases (decreases) reported earnings. This provides a means for firms to shift income across periods. In 1991, Oshkosh B’Gosh Inc. recorded a $5.6 million restructuring charge. In the following year, it reduced its estimate of restructuring costs “due to the efficient and orderly winding down of operations and favorable settlement of lease obligations.” This adjustment increased 1992 pre-tax operating income by $2.8 million. Some firms include in restructuring charges costs more appropriately expensed as part of future operations. This will make future operations appear more profitable. For example, recording an excessive plant write-down today will reduce depreciation expense in future years.