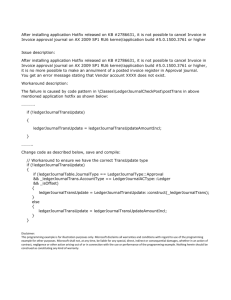

Census Condition Override Codes.

advertisement