the Expense Recognition Principle

advertisement

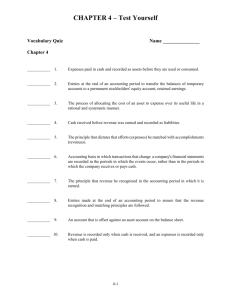

CHAPTER 4 Accrual Accounting Concepts Learning Objectives 1. Explain the revenue recognition principle and the expense recognition principle. 2. Differentiate between the cash basis and the accrual basis of accounting. 3. Explain why adjusting entries are needed, and identify the major types of adjusting entries. 4. Prepare adjusting entries for deferrals. 5. Prepare adjusting entries for accruals. 6. Describe the nature and purpose of the adjusted trial balance. 7. Explain the purpose of closing entries. 8. Describe the required steps in the accounting cycle. 9. Understand the causes of differences between net income and cash provided by operating activities. 10. Describe the purpose and the basic form of a worksheet. *11. Compare the procedures for revenue recognition under GAAP and IFRS. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-1 Chapter Outline Learning Objective 1 - Explain the Revenue Recognition Principle and the Expense Recognition Principle Determining the amount of revenues and expenses to report in a given accounting period can be difficult. Accounting divides the economic life of a business into artificial time periods. This is the periodicity assumption. Many transactions affect more than one of these periods. Determining the amount of revenues and expenses to report in a given accounting period can be difficult. Proper reporting requires an understanding of the nature of the company’s business. Two principles are used as guidelines: o Revenue recognition principle o Expense recognition principle The revenue recognition principle requires that revenue be recognized in the accounting period in which the performance obligation is satisfied. When a company agrees to perform a service or sell a product to a customer, it has created a performance obligation. A service company recognizes (records) revenue when the services are performed. TEACHING TIP Service businesses recognize revenue when the services are performed, although many customers may have been billed for the services (on account). The cash has not been received; however, the services have been performed. Therefore, revenue should be recognized. Does Delta Airlines record revenue when you buy a plane ticket on May 1 for a flight on June 15? Has the service been provided? The answer to both of these questions is no. Delta cannot recognize revenue on May 1 because the service has not been provided. The revenue will be recognized on June 15 when the ticket holder takes the flight. The expense recognition principle requires that efforts (expenses) be matched with accomplishments (revenues). 4-2 The critical issue is determining when the expense makes its contribution to revenue. Expenses need to be matched with the revenue in the period when the company makes efforts to generate those revenues. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) TEACHING TIP Returning to the service business example, suppose employees are paid every two weeks. When preparing financial statements for May, the accountant realizes that employees were last paid on Friday, May 22. By May 31, nine days have elapsed and many of the employees have worked seven or more days. The wages of these employees must be included in expenses. The same accountant, however, notices that on May 1 the business renewed its insurance coverage by paying the $12,000 premium on a one-year insurance policy. Is all of the $12,000 an expense of May? No. The insurance policy will be in effect for 12 months. Therefore, $1,000 ($12,000/12 months) should be recognized as expense each month. Learning Objective 2 - Differentiate Between the Cash Basis and the Accrual Basis of Accounting Accrual-basis accounting means that transactions that change a firm’s financial statements are recorded in the periods in which the events occur, even if cash was not exchanged. With cash basis accounting, revenue is recognized (recorded) when cash is received. Expenses are recognized (recorded) only when cash is paid. Accrual basis accounting requires accountants to adhere to the revenue recognition principle and the expense recognition principle. Cash basis accounting does not satisfy the requirements of Generally Accepted Accounting Principles (GAAP), whereas accrual basis accounting does. Accrual basis accounting provides an objective measurement of net income. TEACHING TIP Return to the illustration of service businesses and the airlines. If the service business used cash basis accounting, revenue would be recognized only when cash was received. Delta would recognize revenue on May 1 when the ticket was purchased. All expenses of both a service business and Delta would be recorded when cash was paid. Point out that with cash basis accounting, the net income figure is easy to manipulate. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-3 TEACHING TIP Explain to students that many businesses use the cash basis of accounting. These businesses outgrow the method when accounts receivable and accounts payable become substantial. Also, if the businesses need audited financial statements, they must comply with GAAP and use the accrual basis. Remind them that companies can use the cash method and that its use does not mean that income is being manipulated. Without this discussion, some students may unfairly criticize an employer, relative or friend who is using the cash basis of accounting. Learning Objective 3 - Explain why Adjusting Entries are Needed, and Identify the Major Types of Adjusting Entries Adjusting entries are needed to ensure that the revenue recognition and expense recognition principles are followed. The trial balance may not contain up-to-date and complete data for several reasons: Some events are not recorded daily because it is not efficient to do so. Some costs are not recorded during the accounting period because these costs expire with the passage of time rather than as a result of recurring daily transactions. Some items may be unrecorded. Adjusting entries are required every time a company prepares financial statements. Every adjusting entry will include one income statement account and one balance sheet account. Adjusting entries can be classified as either deferrals or accruals. Each of these classes has two subcategories. Deferrals can be prepaid expenses or unearned revenues. Accruals are either accrued revenues or accrued expenses. TEACHING TIP Explain that cash is not adjusted at the end of the accounting period, thus students should not use cash in the adjusting process. 4-4 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Learning Objective 4 - Prepare Adjusting Entries for Deferrals Deferrals fall into two categories—prepaid expenses and unearned revenues. Prepaid expenses - expenses paid in cash and recorded as assets until they are used or consumed. Prepaid expenses are costs that expire with the passage of time (i. e. rent and insurance) or through use (i. e. supplies). Unearned revenues – cash received and recorded as liabilities before the services are performed. An adjusting entry for prepaid expenses will result in an increase (a debit) to an expense account and a decrease (a credit) to an asset account. An adjusting entry for unearned revenues will result in a decrease (a debit) to a liability account and an increase (a credit) to a revenue account. An adjusting entry for deferrals (prepaid expenses or unearned revenues) will decrease a balance sheet account and increase an income statement account. TEACHING TIP Go through the examples of adjusting entries for the following deferrals including; insurance, supplies, depreciation, and unearned revenue. Review the concepts of depreciation, depreciation expense and accumulated depreciation. TEACHING TIP Discuss the effects on the income statement and balance sheet if adjustments are not made. Learning Objective 5 - Prepare Adjusting Entries for Accruals Accruals fall into two categories—accrued revenues and accrued expenses. Accrued revenues - revenues for services performed but not yet received in cash or recorded at the statement date. an adjusting entry for accrued revenues will result in an increase (a debit) in an asset account and an increase (a credit) to a revenue account. Accrued expenses - expenses incurred but not yet paid in cash or recorded at the statement date. an adjusting entry for accrued expenses results in an increase (a debit) to an expense account and an increase (a credit) to a liability account. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-5 an adjusting entry for accruals (accrued revenues or accrued expenses) increases both a balance sheet and an income statement account. TEACHING TIP Go through the examples of adjusting entries for accrued interest, accrued salaries and accrued revenues. TEACHING TIP Discuss the effects on the income statement and balance sheet if adjustments are not made. Summary of basic relationships: Type of Adjustment Accounts Before Adjustment Prepaid expenses Assets overstated Expenses understated Unearned revenues Liabilities overstated Revenues understated Accrued revenues Assets understated Revenues understated Accrued expenses Expenses understated Liabilities understated Adjusting Entry Dr. Expenses Cr. Assets Dr. Liabilities Cr. Revenues Dr. Assets Cr. Revenues Dr. Expenses Cr. Liabilities Learning Objective 6 - Describe the Nature and Purpose of the Adjusted Trial Balance The adjusted trial balance is prepared after all adjusting entries have been journalized and posted. The adjusted trial balance shows the balances of all accounts, including those that have been adjusted, at the end of the accounting period. The purpose of the adjusted trial balance is to prove the equality of the total debit balances and total credit balances in the ledger after all adjustments. Financial statements are prepared from the adjusted trial balance. TEACHING TIP Show students an adjusted trial balance and demonstrate how easy it is to prepare financial statements from the information contained in the trial balance. 4-6 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Learning Objective 7 - Explain the Purpose of Closing Entries Closing entries transfer net income (or net loss) and dividends to Retained Earnings. This causes the ending balance of Retained Earnings (amount shown on the Balance Sheet) to agree with the balance shown on the Retained Earnings Statement. Close the revenue accounts to the Income Summary account. Close the expense accounts to the Income Summary account. Close the Income Summary account to Retained Earnings. Close Dividends to Retained Earnings. Closing entries produce a zero balance in each temporary account (revenues, expenses, and dividends) These accounts are then ready to accumulate data for the next accounting period. Permanent accounts (assets, liabilities, common stock and retained earnings) are not closed. TEACHING TIP Tell students to look at the date on the income statement in Illustration 4-27. The date is “For the Month Ending October 31, 2014.” How can one be sure the revenues and expenses reported on the income statement are just for that period? Closing entries transfer the temporary account balances to the stockholders’ equity account and reduce the balances in the temporary accounts to zero. Therefore, at the beginning of the period the temporary accounts have a balance of zero and the revenues and expenses accumulated are for that particular period. After the closing entries have been journalized and posted, a post-closing trial balance is prepared. The post-closing trial balance shows the balances of all of the permanent accounts. The permanent account balances are carried forward to the next accounting period. All of the temporary accounts have a zero balance. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-7 Learning Objective 8 - Describe the Required Steps in the Accounting Cycle Analyze business transactions. Journalize the transactions. Post to ledger accounts. Prepare a trial balance. Journalize and post adjusting entries—deferrals and accruals. Prepare an adjusted trial balance. Prepare financial statements: Income statement Retained earnings statement Balance sheet Journalize and post closing entries. Prepare a post-closing trial balance. TEACHING TIP Encourage students not to memorize the steps in the accounting cycle. Rather, they should think about what must be done in order to “capture” the financial transactions and to make sure the transactions are ultimately reported in the financial statements. Quality of Earnings Earnings management is the planned timing of revenues, expenses, gains, and losses to smooth out bumps in net income. The quality of earnings is greatly affected when a company manages earnings up or down to meet some targeted earnings number. A company that has a high quality of earnings provides full and transparent information that will not confuse or mislead users of the financial statements. A company with questionable quality of earnings may mislead investors and creditors, who believe they are relying on relevant and reliable information. Companies manage earnings in a variety of ways: 4-8 Use of one-time items to prop up earnings numbers (i.e. nonrecurring gains). Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Inflate revenue numbers in the short-run (to the detriment of the long-run). Improper adjusting entries As the result of investor pressure and the Sarbanes-Oxley Act, many companies are trying to improve the quality of their financial reporting. Learning Objective 9 – Understand the Causes of Differences Between Net Income and Cash Provided by Operating Activities Net income is based on accrual basis accounting and is accomplished through the adjusting entry process. Cash provided by operating activities is determined by comparing cash received from operating activities to cash expenditures from operating activities. Cash provided by operating activities is essentially net income determined under the cash-basis of accounting. TEACHING TIP Discuss the example provided, paying particular attention to the differences between cashbasis and accrual-basis accounting when recognizing revenues and expenses. Learning Objective 10 – Describe the Purpose and the Basic Form of a Worksheet The worksheet is a multiple-column form that may be used in the adjustment process and in preparing financial statements. Today most accountants use computer spreadsheets. A worksheet is not a permanent accounting record. TEACHING TIP Use the worksheet, Illustration 4A-1, provided in the appendix to discuss its parts and how it facilitates preparation of the financial statements. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-9 Learning Objective11- Compare the procedures for revenue recognition under GAAP and IFRS. IFRS It is often difficult for companies to determine in what time period they should report particular revenues and expenses. Both the IASB and FASB are working on a joint project to develop a common conceptual framework, as well as a revenue recognition project, that will enable companies to better use the same principles to record transactions consistently over time. KEY POINTS In this chapter, you learned accrual-basis accounting applied under GAAP. Companies applying IFRS also use accrual-basis accounting to ensure that they record transactions that change a company’s financial statements in the period in which events occur. Similar to GAAP, cash-basis accounting is not in accordance with IFRS. IFRS also divides the economic life of companies into artificial time periods. Under both GAAP and IFRS, this is referred to as the periodicity assumption. IFRS requires that companies present a complete set of financial statements, including comparative information annually. GAAP has more than 100 rules dealing with revenue recognition. Many of these rules are industry-specific. In contrast, revenue recognition under IFRS is determined primarily by a single standard. Despite this large disparity in the amount of detailed guidance devoted to revenue recognition, the general revenue recognition principles required by GAAP that are used in this textbook are similar to those under IFRS. Revenue recognition fraud is a major issue in U.S. financial reporting. The same situation occurs in other countries, as evidenced by revenue recognition breakdowns at Dutch software company Baan NV, Japanese electronics giant NEC, and Dutch grocer Ahold NV. A specific standard exists for revenue recognition under IFRS (IAS 18). In general, the standard is based on the probability that the economic benefits associated with the transaction will flow to the company selling the goods, providing the service, or receiving investment income. In addition, the revenues and costs must be capable of being measured reliably. Under IFRS, revaluation of items such as land and buildings is permitted. IFRS allows depreciation based on revaluation of assets, which is not permitted under GAAP. The terminology used for revenues and gains, and expenses and losses, differs somewhat between IFRS and GAAP. For example, income under IFRS is defined as: Increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from shareholders. 4-10 Income includes both revenues, which arise during the normal course of operating activities, and gains, which arise from activities outside of the normal sales of goods and services. The term income is not used this way under GAAP. Instead, under GAAP income refers to the net difference Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) between revenues and expenses. Expenses under IFRS are defined as: Decreases in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrences of liabilities that result in decreases in equity other than those relating to distributions to shareholders. Note that under IFRS expenses include both those costs incurred in the normal course of operations, as well as losses that are not part of normal operations. This is in contrast to GAAP, which defines each separately. The procedures of the closing process are applicable to all companies whether they are using IFRS or GAAP. LOOKING TO THE FUTURE: The IASB and FASB are now involved in a joint project on revenue recognition. The purpose of this project is to develop comprehensive guidance on when to recognize revenue. Presently, the Boards are considering an approach that focuses on changes in assets and liabilities (rather than on earned and realized) as the basis for revenue recognition. It is hoped that this approach will lead to more consistent accounting in this area. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-11 Chapter 4 Review What is the revenue recognition principle? What is the expense recognition principle? What are the differences in the cash basis and the accrual basis of accounting? Which is required by GAAP? Why? Why are adjusting entries needed? What are the major types of adjusting entries? Identify types of prepayments and discuss the adjusting entry for each. What happens if the adjusting entry is not made? Identify types of accruals and discuss the adjusting entry for each. What happens if the adjusting entry is not made? Describe the nature and purpose of the adjusted trial balance. Discuss the purpose of closing entries. List the required steps in the accounting cycle. Discuss quality of earnings issues. 4-12 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Discuss the differences between net income and cash provided by operating activities. How do cash-basis and accrual-basis accounting apply? Discuss the use of the worksheet in the preparation of the financial statements. Define the difference between the terminology used by GAAP and IFRS for revenues and gains, and expenses and losses. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-13 Vocabulary Quiz Name _______________ Chapter 4 1. Expenses paid in cash and recorded as assets before they are used or consumed. 2. Entries at the end of an accounting period to transfer the balances of temporary accounts to a permanent stockholders’ equity account, Retained Earnings. 3. The process of allocating the cost of an asset to expense over its useful life. 4. Cash received before a company earns revenues and recorded as a liability until the services are performed. 5. The principle that dictates that efforts (expenses) be matched with accomplishments (revenues). 6. Accounting basis in which companies record, in the periods in which the events occur, transactions that change a company’s financial statements, rather than in the periods in which the company receives or pays cash. 7. The principle that revenue be recognized in the accounting period in which the services are performed. 8. Entries made at the end of an accounting period to ensure that the revenue recognition and expense recognition principles are followed. 9. An account that is offset against an asset account on the balance sheet. 10. Expenses incurred but not yet received in cash or recorded. 4-14 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Solutions to Vocabulary Quiz Chapter 4 1. Prepaid expenses 2. Closing entries 3. Depreciation 4. Unearned revenues 5. Expense recognition principle 6. Accrual basis accounting 7. Revenue recognition principle 8. Adjusting entries 9. Contra asset account 10. Accrued expenses Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-15 Multiple Choice Quiz Name _______________ Chapter 4 1. Accountants have developed two principles to use as guidelines in determining the amount of revenues and expenses to be reported in a given period. These principles are the: a. cash basis accounting principle. b. revenue recognition principle. c. expense recognition principle. d. both cash basis accounting principle and revenue recognition principle are correct. 2. Which of the following is NOT true concerning cash basis accounting? a. Does not follow GAAP. b. Records revenue when cash is received. c. Matches expenses with the revenues they help to produce. d. Records expenses when cash is paid. 3. In order for revenues to be recorded in the period in which the services are performed, and for expenses to be recognized in the period in which they are incurred: a. adjusting entries are made. b. cash basis accounting is used. c. closing entries are made. d. none of these answer choices are correct. 4. Unearned revenues are: a. deferrals. b. liabilities. c. temporary accounts. d. both deferrals and liabilities are correct. 5. All of the following are examples of prepaid expenses except: a. prepaid rent. b. prepaid insurance. c. supplies. d. unearned revenues. 6. Depreciation is: a. the wearing away of an asset. b. the process of an asset becoming obsolete. c. a valuation process. d. The process of allocating the cost of an asset to expense over its useful life. 4-16 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 7. Accumulated depreciation is a: a. contra asset account. b. contra revenue account. c. unearned revenue account. d. expense account. 8. Which of the following companies would probably not have unearned revenue: a. Delta Airlines. b. Hurst Publishing Company. c. Poppa John’s Pizza. d. All State Insurance Company. 9. Adjusting entries for accruals: a. are required in order to record revenues for services performed and expenses incurred in the current accounting period that have not been recognized through daily entries and thus are not yet reflected in the accounts. b. will increase both a balance sheet and an income statement account. c. are not required under GAAP. d. both are required in order to record revenues for services performed and expenses incurred in the current accounting period that have not been recognized through daily entries and thus are not yet reflected in the accounts and will increase both a balance sheet and an income statement account are correct. 10. An assumption that the economic life of a business can be divided into artificial time periods is the: a. cash basis assumption. b. accrual assumption. c. calendar year assumption. d. periodicity assumption. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-17 Solutions to Multiple Choice Quiz Chapter 4 1. d 2. c 3. a 4. d 5. d 6. d 7. a 8. c 9. d 10. d 4-18 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Exercise 1 - World Wide Web Research, Accrual Accounting, and Financial Statement Analysis Activity Chapter 4 Refer to the financial statements in the Annual Report of Target Corporation to answer the following questions. If researching the Web, go to http://www.target.com, click on Investor relations, and then Annual Reports. Go to the most recent Annual Report. 1. What is the date of the financial statements? 2. What is the exact title of Target’s income statement? 3. Which of the accounts found on the income statement and balance sheet (Statement of Financial Position) have, most likely, been adjusted? 4. Which of the accounts found on the income statement and balance sheet have been created as a result of adjusting entries? 5. What is the name of the accounting firm that conducted the external audit of Target? 6. What is meant by ‘consolidated’ in the titles of the financial statements? Solutions: Information available on website Note: The website is constantly being updated. Please check to see that the information requested in this exercise is available. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-19 Exercise 2 - Accrual Accounting Activity Chapter 4 Your roommate, an accounting major, is working part time at Modern Dry Cleaners. She just came home from work and is complaining because the owner wants her to prepare year-end adjusting entries. “Roomie” contends that because the business is relatively small and because they will not make “too significant” an impact on the financial condition of the business, adjusting entries should not be prepared. Use the space provided to try to convince your roommate that adjusting entries should be made. Solution: Unless adjusting entries are made, financial statements will not be correct. Failure to record adjusting entries violates the revenue recognition principle and the expense recognition principle. In addition, accrual basis accounting is not being followed if adjusting entries are not made. Failure to record adjusting entries will, more than likely, cause revenues, expenses, assets, liabilities, and owners’ equity accounts to be over- or under-stated. 4-20 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Exercise 3 - Accrual Accounting and Creative Activity Chapter 4 Return to the financial statements prepared for the new business in Campus Town USA in earlier chapters in answering the following questions: 1. Determine which accounts should be adjusted and make the necessary adjustments. 2. What would have been the consequences had you not made these entries? Be specific. 3. Make the required closing entries. 4. What would have been the consequences had you not made the closing entries? (This activity is intended for group assignment) Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-21 Exercise 4 - World Wide Web Research, Accrual Accounting, and Financial Statements Activity Chapter 4 Obtain an annual report for Tootsie Roll. If you are researching the Web go to http://www.tootsie.com/. Using information found in the financial statements of the Annual Report, make the following closing entries: 1. Make journal entries to close the revenue and expense accounts. 2. Make a journal entry to close the income summary account. 3. Make a journal entry to close the dividend account. 4. What is the date of the closing entries? Solutions: Information available on website Note: The website is constantly being updated. Please check to see that the information requested in this exercise is available. 4-22 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Exercise 5 - Accrual Accounting and Creative Activity Chapter 4 Refer to the income statement prepared for Joe’s Tees in the exercises for Chapter 2. Does the income statement prepared in Chapter 2 violate rules of accrual accounting? (Pay particular attention to the requirements of the expense recognition principle.) 1. Amend the income statement so that it better conforms to the practice of accrual accounting. 2. Explain why the statements that you just prepared are superior to those you prepared in Chapter 2. Solutions 1. 2. Revenues Less Expenses: Cost of shirts Depreciation expense – cart License Net income $8,000 $4,480 500 125 5,105 $2,895 This income statement is superior to the one prepared in Chapter 2 because it applies both the revenue recognition principle and the expense recognition principle. By depreciating the cart, a portion of the cart’s original cost is allocated to each accounting period that the cart is used to produce revenues (expense recognition principle). Such expense recognition provides a better indication of the company’s profitability each period. Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-23 Exercise 6 - World Wide Web Research, Accrual Accounting Chapter 4 Obtain an annual report for Tootsie Roll from your school library or on the World Wide Web. If you are researching the Web go to http://www.tootsie.com/. Does Tootsie Roll use cash or accrual accounting? Provide evidence to support your answer. Solutions: Information available on website Note: The website is constantly being updated. Please check to see that the information requested in this exercise is available. 4-24 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Exercise 7 - Accrual Accounting and Ethics Activity Chapter 4 You have just graduated from the local University and landed what you had thought was a great job as an accountant for Crazy House Interiors, an upscale design studio. Your apartment is wonderful and you have made a lot of new friends. However, you boss has just asked you to “do him a favor.” Crazy House is planning to ask one of the local banks for a loan. However, there is some concern because this year’s revenues are considerably lower than the revenues of the previous year. One of the more talented designers has just landed a contract for a large, profitable project. Half of the fee for the project is to be collected when the contract is signed at the end of this week, with the remainder of the money due when the project is completed. Work will begin on the project when the contract is signed. Your boss has asked you to record the initial payment of $125,000 as revenue at the time the money is received. Not wanting to disappoint the boss, you originally agreed to record the transaction as he requested. However, you are having second thoughts about recording the transaction and your ethical responsibilities. What should you do? Why? Solution: Refuse to record the $125,000 advance as revenue until the services have been performed. The $125,000 should be recorded as unearned revenue, a liability account, until the job (or a portion of the job) is completed. In Chapter 1 of this text, you learned that generally accepted accounting principles (GAAP) require accounting information to be reliable. In order to be reliable accounting information must be verifiable and make a faithful representation. Information is verifiable only if it is free of error. Faithful representation means that the information is factual. If the $125,000 advance is reported as revenue before the job is started the accounting information is neither “free of error” nor “factual.” What makes this situation worse is the fact that individuals external to the business are depending on this information in a decision making scenario. The decision Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-25 the bankers make will affect the bank, the banks’ stockholders, and the banks’ employees. 4-26 Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) Exercise 8 - Accounting Insights Activity Chapter 4 1. Name at least three industries in which businesses would have unearned revenue? 2. What is the source of these unearned revenues? Be specific in the examples you cite. 3. When is the revenue recognized and what journal entry would be made at the time of recognition? Solutions: 1. Airlines, magazine publishers, and insurance companies. 2. Cash received for airline tickets purchased on June 1 for trips to be taken July 4 with a return on July 8, would be classified as unearned revenue. Cash received on April 1 for 12-month subscriptions to a magazine would be classified as unearned revenue. Insurance companies have unearned revenue when they receive insurance premiums covering policies of 3 month, 6 month, or 12 month periods. 3. When the services have been performed (i.e. when the airline trip is taken, when the magazine is mailed, or when a portion of the time covered by the insurance policy passes), the revenue can be recognized. The journal entry to recognize revenue would be to decrease unearned revenue (debit unearned revenue) and increase revenue (credit revenue). Copyright © 2013 John Wiley & Sons, Inc. Kimmel, Financial Accounting, 7/e, Instructor’s Manual (For Instructor Use Only) 4-27