Indo US FTA: Prospects for IT-Enabled/BPO services

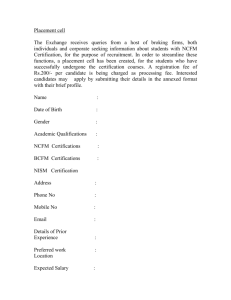

advertisement