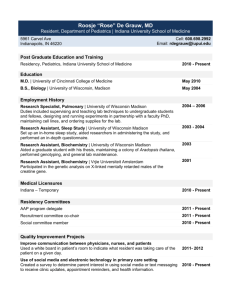

VITA - University of Wisconsin

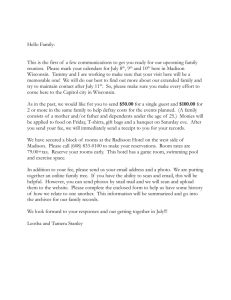

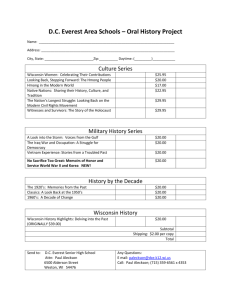

advertisement