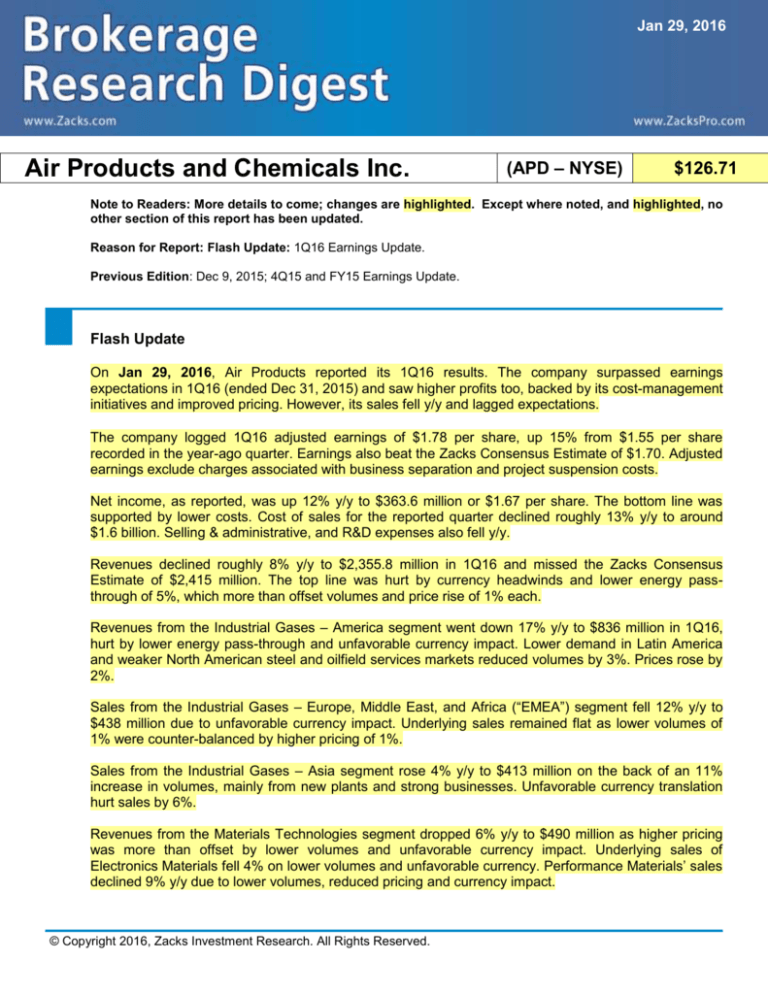

Jan 29, 2016

Air Products and Chemicals Inc.

(APD – NYSE)

$126.71

Note to Readers: More details to come; changes are highlighted. Except where noted, and highlighted, no

other section of this report has been updated.

Reason for Report: Flash Update: 1Q16 Earnings Update.

Previous Edition: Dec 9, 2015; 4Q15 and FY15 Earnings Update.

Flash Update

On Jan 29, 2016, Air Products reported its 1Q16 results. The company surpassed earnings

expectations in 1Q16 (ended Dec 31, 2015) and saw higher profits too, backed by its cost-management

initiatives and improved pricing. However, its sales fell y/y and lagged expectations.

The company logged 1Q16 adjusted earnings of $1.78 per share, up 15% from $1.55 per share

recorded in the year-ago quarter. Earnings also beat the Zacks Consensus Estimate of $1.70. Adjusted

earnings exclude charges associated with business separation and project suspension costs.

Net income, as reported, was up 12% y/y to $363.6 million or $1.67 per share. The bottom line was

supported by lower costs. Cost of sales for the reported quarter declined roughly 13% y/y to around

$1.6 billion. Selling & administrative, and R&D expenses also fell y/y.

Revenues declined roughly 8% y/y to $2,355.8 million in 1Q16 and missed the Zacks Consensus

Estimate of $2,415 million. The top line was hurt by currency headwinds and lower energy passthrough of 5%, which more than offset volumes and price rise of 1% each.

Revenues from the Industrial Gases – America segment went down 17% y/y to $836 million in 1Q16,

hurt by lower energy pass-through and unfavorable currency impact. Lower demand in Latin America

and weaker North American steel and oilfield services markets reduced volumes by 3%. Prices rose by

2%.

Sales from the Industrial Gases – Europe, Middle East, and Africa (“EMEA”) segment fell 12% y/y to

$438 million due to unfavorable currency impact. Underlying sales remained flat as lower volumes of

1% were counter-balanced by higher pricing of 1%.

Sales from the Industrial Gases – Asia segment rose 4% y/y to $413 million on the back of an 11%

increase in volumes, mainly from new plants and strong businesses. Unfavorable currency translation

hurt sales by 6%.

Revenues from the Materials Technologies segment dropped 6% y/y to $490 million as higher pricing

was more than offset by lower volumes and unfavorable currency impact. Underlying sales of

Electronics Materials fell 4% on lower volumes and unfavorable currency. Performance Materials’ sales

declined 9% y/y due to lower volumes, reduced pricing and currency impact.

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

Air Products expects earnings from continuing operations for 2Q16 to be in the range of $1.78–$1.83

per share, up 15%−18% from the prior-year quarter. The company, however, reiterated its earnings

guidance for FY16 in the band of $7.25–$7.50 per share.

Air Products also sees capital expenditures of around $1.3 billion for FY16.

MORE DETAILS WILL COME IN THE IMMINENT EDITIONS OF ZACKS RD REPORTS ON APD.

Portfolio Manager Executive Summary

Air Products and Chemicals Inc. (APD) is the second largest industrial gas supplier in North America

and the fourth largest in the world. The company serves customers in industrial, energy, technology

and healthcare markets worldwide with a unique portfolio of atmospheric gases, process and specialty

gases, performance materials, and equipment and services.

Out of the 11 firms covering the stock, 6 firms (54.55%) provided neutral ratings and 5 firms (45.45%)

assigned positive ratings, while none of the firms rated the stock negative. All the 11 firms provided

target prices.

Neutral or equivalent stance (54.55%; 6/11 firms) – The firms feel that FY15 was an impressive year

for Air Products as the company posted about 14% earnings per share (EPS) growth despite a tough

external environment with industrial demand turning negative in Brazil and N. America. The firms see

the spinoff of the Materials Technologies unit as a solid strategic move that should unlock incremental

value for both companies. Although the firms believe that Air Products possesses attractive earnings

growth potential along with the possibility of margin expansion due to cost-savings and restructuring

measures, they are concerned about the impact of the global macro backdrop and negative currency

translations on the company. Air Products revealed that it has completed the first $300 million cost

savings target (well ahead of the initial plan) and has set the goal for a second $300 million in savings

over the next four years, with a $75 million cost reduction expected in FY16. This self-help initiative is

the key to EPS growth given weakness in the energy and North American steel industries; soft

conditions in Latin America and a slow rebound in China.

Positive or equivalent stance (45.45%; 5/11 firms) – These firms are optimistic about Air Products

based on its accelerating operational improvements, expanding profit margins, a transforming corporate

culture, a $3.2 billion project backlog, excellent long-term prospects in hydrogen and oxygen, and low

EPS volatility from long-term take-or-pay contract structures in the on-site business.

Zacks Investment Research

Page 2

www.zackspro.com

Jan 29, 2016

Overview

Key investment considerations as identified by the analysts are as follows:

Key Positive Arguments

Well positioned: The company has been a

leader in accessing high-growth end markets

with important market positions in electronics,

hydrogen and liquefied natural gas (LNG)

heat exchangers, and in select areas in its

chemical businesses.

Strong and stable financials: The duration

of typical gas contracts makes most of the

revenues from gas, fairly stable. The company

has made significant progress in reducing

variability/raw material sensitivity in its

chemical businesses.

Attractive industry: The company is

optimistic about the overall intermediate-term

prospects of the industrial gas companies,

given the solid end-market drivers, continued

industry consolidation

and

focus

on

profitability.

Key Negative Arguments

High energy and raw material costs: Air

Products is exposed to natural gas and energy

costs, which are expected to remain high in the

near term and in turn, limit the potential for rapid

margin expansion.

New projects: The company relies on new

projects to maintain growth, particularly in the

tonnage gases segment. Increasing competition

for these projects can make the economy less

attractive.

Sensitive: Air Products is sensitive to underlying

GDP growth/industrial production, and to the

cyclicality of the electronics/semiconductor

market.

Volatile Electronics franchise: The electronics

franchise operates in a volatile, high-growth

industry. The company’s primary exposure is to

semiconductors and LCDs, which are high-growth

businesses with tough pricing environments.

Pennsylvania-based Air Products and Chemicals Inc., founded in 1940, has established itself in a

leading position in key growth markets, such as semiconductor materials, refinery hydrogen, home

healthcare services, natural gas liquefaction, and advanced coatings and adhesives. Air Products has

operations in over 50 countries with 21,600 employees around the globe. It serves customers from food

and beverage, health and personal care to energy, electronics, chemicals, metals, transportation,

semiconductors and manufacturing markets worldwide. The company has a unique portfolio of

products, services and solutions that include atmospheric, process and specialty gases, performance

materials, equipment and technology.

Air Products has restructured its business into seven reporting segments, which came into effect from

Oct 1, 2014. The new reporting segments are: Industrial Gases – Americas, Industrial Gases –

Europe, Middle East, and Africa (EMEA), Industrial Gases – Asia, Industrial Gases – Global, Materials

Technologies, Energy-from-Waste and Corporate and other. Earlier, the company had four segments –

Merchant Gases, Tonnage Gases, Electronics and Performance Materials, and Equipment and Energy.

Further information on the company is available at: http://www.airproducts.com.

Note: The company’s fiscal year ends on Oct 25; all fiscal references differ from the calendar year. 1

1, 2

Dec 9, 2015

Zacks Investment Research

Page 3

www.zackspro.com

Long-Term Growth

Despite the unprecedented volatility in the global economy, management remains committed to its

long-term goals of improving margins and returns, and capturing substantial growth opportunities in the

markets, going forward.

Key secular themes in the industrial gas and supply business include rising energy demand and prices,

increasing environmental regulation and growth of emerging economies. The firms expect Air Products

to capitalize on these dynamics while driving greater operating efficiency. In the energy market, the

company seeks to benefit from hydrogen for oil refining, oxygen for coal gasification and capital

expenditures for LNG heat exchangers. Increasing environmental consciousness has given Air

Products the opportunity to provide clean coal, clean fuel, carbon sequestration, and electronic gases

for thin-film solar. The company is also widening its investment in emerging markets. For example, twofourths of capital expenditures over the next five years will be targeted at faster-growing economies

such as China and India.

The company has entered into a number of contracts, which are likely to reap long-term profitability and

add to its earnings. Air Products has been a leader in accessing high-growth end markets, occupying

the top market positions in electronics, hydrogen and LNG heat exchangers, and strong positions in

select areas in its chemical businesses. It has displayed a consistent focus in pursuing new growth

areas, with many core areas of activity (electronics, hydrogen).

The company expects to deliver enhanced revenue growth and sustained margins. Air Products has a

record of setting and meeting its long-term goals with a strong presence in the energy, environmental

and emerging markets, worldwide. Thus, by implementing these strategic actions, the company intends

to continue to reduce costs, improve returns and gain a greater competitive advantage over its peers.

Dec 9, 2015

Target Price/Valuation

The Zacks Digest average price target is $153.91 (↓ $1.36 from the previous report, up 15% from the

current price.)

Rating Distribution

Positive

Neutral

45.45% ↑

Negative

Avg. target Price

Digest High

Digest Low

0.00% ↓

54.55% ↓

$153.91

$175.00

$132.00

No. of Analysts with Target Price/Total

Zacks Investment Research

Page 4

11/11

www.zackspro.com

Risks to the target price include a slowdown in global economy, increasing competition in refinery

hydrogen, softness in the electronics gas market, weakness in Performance Materials owing to slowing

North American coatings, autos and housing end markets, and a weak economic scenario in Europe,

slump in the industrial production-related markets, deterioration in capital discipline, rapidly rising

energy costs and raw material prices. A strengthening U.S. dollar is also expected to adversely affect

EPS.

Recent Events

On Oct 29, 2015, Air Products reported its 4Q15 and FY15 results.

The company logged adjusted earnings of $1.82 per share in 4Q15, up from $1.66 per share recorded

in the year-ago quarter.

Net income from continuing operations, as reported, jumped more than three-fold y/y to $345 million or

$1.58 per share in 4Q15.

In FY15, adjusted earnings were $6.57 per share.

Revenues slipped roughly 9% y/y to $2,449 million in 4Q15.

In FY15, revenues fell 5% y/y to around $9,895 million.

Air Products expects earnings from continuing operations for 1Q16 to be in the range of $1.65 to $1.75

per share. For FY16, the company anticipates earnings from continuing operations in the band of $7.25

to $7.50 per share, a 10%-14% y/y rise.

Revenue

According to the company, revenues slipped roughly 9% y/y to $2,449 million in 4Q15. The top line was

hit by currency headwinds and lower energy pass-through. Currency translation had a 7% unfavorable

impact on 4Q15 sales.

For FY15, revenues fell 5% y/y to around $9,895 million. Underlying sales increased by 3% on 2%

higher volumes, driven by Industrial Gases – Asia and Materials Technologies, and 1% higher pricing.

Segment Revenue

Air Products realigned its reporting segments under a new structure from Oct 1, 2014. The new

reporting segments are: Industrial Gases – Americas, Industrial Gases – EMEA, Industrial Gases –

Asia, Industrial Gases – Global, Materials Technologies, Energy-from-Waste, Corporate and other.

Zacks Investment Research

Page 5

www.zackspro.com

Industrial Gases – Americas

Revenues from the Industrial Gases - America segment went down 13% y/y to $902 million in 4Q15,

hurt by lower energy pass-through and unfavorable currency impact. However, underlying sales

remained flat y/y as higher pricing was offset by lower volumes.

In FY15, the segment recorded sales of $3,693.9 million, down 9.4% y/y.

Industrial Gases – EMEA

Sales from the Industrial Gases - Europe, Middle East, and Africa (“EMEA”) segment fell 12% y/y to

$460 million in 4Q15 due to unfavorable currency impact. Underlying sales were up 2%.

In FY15, the segment reported sales of $1,864.9 million, down 13.3% y/y.

Industrial Gases – Asia

Sales from the Industrial Gases - Asia segment rose 7% y/y to $428 million in 4Q15 on the back of a

15% increase in volumes, mainly from new plants. Unfavorable currency translation hurt sales by 7%.

In FY15, the segment’s sales were $1,637.5 million, up 7.2% y/y.

Materials Technologies

Revenues from the Materials Technologies segment slipped 13% y/y to $490 million in 4Q15 as higher

pricing was more than offset by lower volumes and unfavorable currency impact. Underlying sales of

Electronics Materials fell 9% on lower delivery systems. Performance Materials’ sales dropped 8% y/y

due to lower volumes.

In FY15, the segment reported sales of $2,087.1 million, up 1.1% y/y.

Margins

Operating income of $515 million in 4Q15 increased 9% y/y, and operating margin of 21% improved

340 basis points (bps), driven by higher pricing and good cost performance. Adjusted EBITDA of $785

million increased 2% y/y, and EBITDA margin of 32.1% improved 350 bps, reflecting strong operating

leverage.

In FY15, operating income of $1.9 billion increased 14%, and operating margin of 19% improved 310

bps. Adjusted EBITDA of $3.0 billion improved 8% and EBITDA margin of 30.1% improved 360 bps.

Segment Operating Income (as reported by the company)

Industrial Gases – Americas

The segment’s operating income of $209 million decreased 5% and adjusted EBITDA of $330 million

decreased 3% y/y in 4Q15, as unfavorable currency and lower energy pass-through more than offset

the benefits of restructuring actions. Record operating margin of 23.1% improved 190 basis points

(bps), and record EBITDA margin of 36.6% improved 370 bps over prior year.

Operating income for FY15 was $808.4 million, compared with $762.6 million in FY14.

Zacks Investment Research

Page 6

www.zackspro.com

Industrial Gases – EMEA

Operating income of $91 million in 4Q15 decreased 2% y/y, as strong pricing and cost performance

were neutralized by unfavorable currency impact. On a constant currency basis, operating income was

up 11%. Record operating margin of 19.7% increased 190 bps, and record EBITDA margin of 32.9%

increased 220 bps y/y, supported by the benefits of restructuring actions. Adjusted EBITDA of $151

million decreased 5% y/y.

Operating income in FY15 was $330.7 million, compared with $351.2 million in FY14.

Industrial Gases – Asia

Operating income of $104 million in 4Q15 increased 44% y/y, and operating margin of 24.4% improved

620 bps y/y on higher volumes from the new plants and strong cost performance. Adjusted EBITDA of

$165 million increased 17%, and EBITDA margin of 38.5% increased 330 bps.

Operating income in FY15 was $380.5 million, compared with $310.4 million in FY14.

Materials Technologies

Operating income was $116 million in 4Q15, and operating margin of 23.8% was up 160 bps. Adjusted

EBITDA was $140 million, and EBITDA margin of 28.5% was up 130 bps. For the fiscal year, Materials

Technologies adjusted EBITDA of $572 million was up 19% and EBITDA margin of 27.4% was up 410

bps.

Operating income in FY15 was $476.7 million, compared with $379 million in FY14.

Earnings Per Share

The company logged adjusted earnings of $1.82 per share in 4Q15, up from $1.66 per share recorded

in the year-ago quarter. Adjusted earnings exclude one-time items, including charges associated with

business restructuring and cost-saving actions.

Net income from continuing operations, as reported, climbed more than three-fold y/y to $345 million or

$1.58 per share in 4Q15. The bottom line was supported by lower costs. Cost of sales for the reported

quarter fell roughly 12% y/y to around $1.7 billion. Selling & administrative and R&D expenses also fell

y/y.

In FY15, adjusted earnings were $6.57 per share.

Outlook

Air Products expects earnings from continuing operations for 1Q16 to be in the range of $1.65 to $1.75

per share, up 6%-13% from the prior-year quarter. For FY16, the company anticipates earnings from

continuing operations in the band of $7.25 to $7.50 per share, a 10%-14% y/y rise.

Zacks Investment Research

Page 7

www.zackspro.com

Jan 29, 2016

Analyst

Poulomi Chakraborty

Copy Editor

Content Editor

Lead Analyst

QCA

No. of brokers reported/total

brokers

Reason for Update

Sayani Roy

Anindya Barman

Anindya Barman

Anindya Barman

Zacks Investment Research

Flash

Page 8

www.zackspro.com