Mortgage Backed Securities in Canada: size of the market and

advertisement

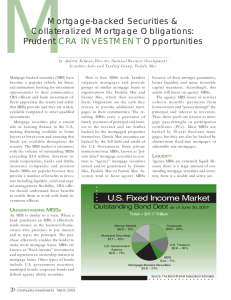

Mortgage Backed Securities in Canada: the size of the market and prospects for the future Jane Londerville Marketing and Consumer Studies Department University of Guelph Guelph, Ontario Canada N1G 2W1 519-824-4120 ext 53091 fax: 519-823-1964 jlonderv@uoguelph.ca Abstract Mortgage Backed securities (MBS) are relatively new in the Canadian mortgage finance system. This paper will describe their development and history (along with mortgage backed bonds) and compare this with other countries through a brief review of mortgage securitization strategies in various parts of the world (U.K., Korea, Latin America, Australia, Japan). The primary uses of MBSs in Canada and positive aspects of securitization will be explored as they have been experienced since the inception of MBS in the late 1980s and as they relate to the basic structure of the mortgage finance system in place before MBSs were introduced. The main focus of the paper will be on the contrast between the MBS markets in the US and Canada. The proportion of national mortgage debt that is packaged into MBSs in both countries will be examined and the paper will discuss reasons for the significantly smaller proportion of debt in Canadian MBS versus the numbers for the United States. Future prospects for growth in the Canadian MBS market will be explored. The paper will conclude with implications for other countries of the experience in North America with mortgage securitization. References Alex J Pollock . (Mar 1999). A new housing finance option in the USA: MPF vs. MBS Housing Finance International 13 (3), p. 3-8 (6 pp.). Chicago Anonymous . (Jun 2001). Australian residential mortgage-backed securities: The PUMA story Housing Finance International 15 (4), p. 13-18 (6 pp.). Chicago Barry, Christopher B , Castaneda, Gonzalo , Lipscomb, Joseph B . (1994). The structure of mortgage markets in Mexico and prospects for their securitization Journal Of Housing Research 5 (2), (32 pp.). Washington . Bruce Kramer . (Jun 2000). Residential securitization in Japan: The outlook for growth and performance Housing Finance International 14 (4), p. 24-31 (8 pp.). Chicago. Frank E Nothaft , James L Freund . (Apr-Jun 2003). The evolution of securitization in multifamily mortgage markets and its effect on lending rates The Journal Of Real Estate Research 25 (2), p. 91-112 Sacramento. Georgette Chapman Poindexter , Wendy Vargas-Cartaya . (2002). En Ruta Hacia El Desarrollo: The emerging secondary mortgage market in Latin America The George Washington International Law Review 34 (2), p. 257-286 (30 pp.). Washington. Ian Witherspoon . (Jun 1999). The National Housing Act Mortgage-Backed Securities program in Canada, Housing Finance International 13 (4), p. 17-22 (6 pp.). Chicago. Joong-hee Lee . (Mar 2003). Mortgage securitization in Korea Housing Finance International 17 (3), p. 24-30 Chicago . Judith Hardt , Jung-Duk Lichtenberger . (Jun 2001). The economic and financial importance of mortgage bonds in Europe Housing Finance International 15 (4), p. 1929 (11 pp.). Chicago Lea, Michael J . (1996). Innovation and the cost of mortgage credit: A historical perspective Housing Policy Debate 7 (1), (28 pp.). Washington Mark Odenbach . (Sep 2002). Mortgage securitization: What are the drivers and constraints from an originator's perspective (Basel I/Basel II)? Housing Finance International 17 (1), p. 52-62 (11 pp.). Chicago. Noah Kofi Karley , Christine Whitehead . (Dec 2002). The mortgage-backed securities market in the U.K.: Developments over the last few years Housing Finance International 17 (2), p. 31-36 (6 pp.). Chicago . Pryke, Michael , Freeman, Tim . (1994). Mortgage-backed securitization in the United Kingdom: The background Housing Policy Debate 5 (3), (36 pp.). Washington. Robert Van Order . (Sep 2001). The structure and evolution of American secondary mortgage markets, with some implications for developing markets Housing Finance International 16 (1), p. 16-31 (16 pp.). Chicago.