Rubber and Miscellaneous Plastics Products

advertisement

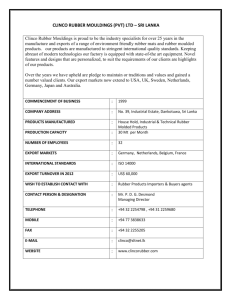

Employment Security Department Labor Market & Economic Analysis Branch Rubber and Miscellaneous Plastics Products Overview During the 1990s, rubber and miscellaneous plastics products has been the fastest growing manufacturing industry in the United States. Employment gains in rubber and plastics products have been at a healthy pace; an average annual rate of 1.8 percent during the 1990s. In 1998, rubber and plastics products employed over 1.01 million workers and shipped product worth $160 billion in 1998. Rubber and plastic products are used by virtually all industries. On the rubber side, the dominant market is automotive and other transportation (e.g., tires and inner tubes, hoses and belts, gaskets and seals); industrial/machinery and building/construction are significant end-use markets along with consumer and institutional markets. The versatility of plastics allows it to be used in everything from car parts to toys, from soft drinks to appliances. Major end-use markets for plastics are packaging (e.g., bottles and containers, bags and tubes); building and construction (e.g., pipe, conduit and fittings, other building materials; consumer and institutional (e.g., serviceware, kitchenware, toys and sporting goods, laboratory supplies); transportation (e.g., motor vehicles and parts); electrical and electronic (e.g., appliances, electronic components, wire and cable coverings); furniture and furnishings (e.g., household and office furniture); and adhesives, inks, and coatings (e.g., sealants, printing ink, paints and enamels). Definition of rubber and miscellaneous plastics products industry This industry report uses industry definitions and concepts that underlie the U.S. government's Standard Industrial Classification (SIC) system. In the SIC system, rubber and miscellaneous plastics products (SIC 30) is a major industry, one of twenty such industries that form the manufacturing sector. According to the Standard Industrial Classification, there are five separate rubber and miscellaneous plastics products subsectors and 15 market segments defined by broad product categories. Each of the 16,700 rubber and miscellaneous plastics products establishments operating in the United States in 1997 was placed in one of these five industry subsectors: Tires and inner tubes (SIC 301)—including pneumatic casings, inner tubes, and tires for all types of vehicles, tire repair and retreading materials; Rubber and plastic footware (SIC 302)—including rubber and plastic soles, injection moldings, and protective footware, such as boots, overshoes, and gaiters; Gaskets, packing, and sealing devises and rubber and plastics hose and belting (SIC 305)— including rubber and plastics hose and belting, gaskets, and packing and sealing devises; Fabricated rubber products, not elsewhere classified (SIC 306)—including molded and extruded rubber goods, industrial rubber goods, miscellaneous rubber specialties and sundries; and Miscellaneous plastic products (SIC 308)—including plastics film and sheet, rods and tubes, laminated plate and sheet, plastic pipe, bottles and foam products, custom compounding, plumbing fixtures, and miscellaneous specialties and sundries. Although this industry covers most rubber and plastic products, some important rubber and plastics products are classified elsewhere. These products include boats, which are classified under transportation equipment (SIC 37); and buttons, toys and buckles, which are grouped under miscellaneous manufacturing (SIC 39). Buttons, toys and buckles are classified according to the final product rather than by process because these products are not entirely made out of rubber or plastic. The rubber and miscellaneous plastics products industry does include tire manufacture; however, the recapping and retreading of automobile tires are classified under SIC 7534 (tire retreading and repair shops) due to the utilization of different processes. Current Status In 1998, the Washington rubber and miscellaneous plastics products industry employed 9,200 workers; representing about 2.5 percent of the state’s manufacturing workforce. Growth in the number of rubber and miscellaneous plastics industry establishments in Washington has been steady; between 1981 and 1998, establishments were added at an average pace of 2.7 percent, with miscellaneous plastics capturing the lion’s share of the industry’s growth. Figure 1 Number of Establishments in Washington Rubber & Miscellaneous Plastics Products, 1981-1998 Source: Washington Employment Security Department 300 Number of establishments 250 200 150 100 50 0 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 M isc. plastics products Other rubber & plastics With the exception of one year (1991), the employment picture of Washington rubber and miscellaneous plastics products is one of vigourous growth. For the 1981-1998 period, rubber and miscellaneous plastics products employment grew on average 6.3 percent each year. While growth in other rubber and plastic products (i.e., tires and inner tubes, rubber and plastics footwear, gaskets and seals, and fabricated rubber products) has been significant (6.6 percent per annum), miscellaneous plastics enjoyed robust employment growth (7.3 percent per annum). Rubber and miscellaneous plastics outperformed manufacturing and total statewide employment for most years during the 1981-1998 period. Key factors that affect the demand for many rubber and plastics products include the health of end-use markets, growth in the overall economy, and trends in foreign trade. Plastic products are affected by trends in key end-use markets such as packaging, building and construction, motor vehicles, and electrical and electronics. These markets are in turn affected by trends in consumer spending, overall growth in the national economy, and population growth. Figure 2 Employment in Washington Rubber & Miscellaneous Plastics Products Industry, 1981-1998 Source: Washington Employment Security Department 10,000 9,000 8,000 Total employment 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 M isc. plastics products Other rubber & plastics Figure 3 Annual Percent Change in Employment: Rubber & Miscellaneous Plastics, All Manufacturing, and State Nonfarm, 1982-1998 Source: Washington Employment Security Department 20.0% Annual change in employment 15.0% 10.0% 5.0% 0.0% -5.0% -10.0% 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 Rubber & misc. plastics Total manufacturing State nonfarm Similar to the national industry, rubber and miscellaneous plastics in the state is dominated by the miscellaneous plastics subsector, which accounts for nine-tenths of the industry’s total employment. Rubber and miscellaneous plastics in Washington is largely composed of small companies that manufacture various rubber and plastics products. On average, each rubber and miscellaneous plastics products establishment has about 37 employees compared with the statewide nonfarm average of 13 employees per establishment. Over 56 percent of all rubber and miscellaneous plastics products workers are found in establishments with 100 or more employees. Statewide, three-fifths of all nonfarm workers are employed in establishments with 100 or more employees. Figure 4 Size of Establishments of Washington Rubber & Miscellaneous Plastics Products Industry, 1998 Source: Washington Employment Security Department 50% Share of total employment 45% 40% State 35% Rubber & plastics 30% 25% 20% 15% 10% 5% 0% 1-19 20-49 50-99 100-249 250-499 N umber of employees per establishment Average covered wages for rubber and miscellaneous plastics products workers was $30,601 in 1998, about 10 percent below the statewide nonfarm average of $33,922. In 1998, rubber and miscellaneous plastics products employees’ wages and salaries ranked sixteenth among the nineteen manufacturing industries, and substantially below the statewide manufacturing industry average at $42,247. Real (i.e., without inflation) wage growth has been relatively modest between 1981 and 1998. The distribution of hourly wages for rubber and miscellaneous plastics products is dissimilar to the state, with a pronounced disposition toward lower hourly wages. Two-thirds of all workers in the rubber and miscellaneous plastics products industry earn between $6 and $14 per hour, compared with 44 percent of all nonfarm workers in the state. Only 13 percent of rubber and miscellaneous plastics products industry earn $20 or more per hour compared with 28 percent of all nonfarm workers. Table 1 Real Average Wages: Washington Rubber & Miscellaneous Plastics Products Workers, 1981-1998 (1998 dollars) Sources: Washington Employment Security Department, U.S. Bureau of Economic Analysis Sector 1981 1983 1985 1987 1989 1991 1993 1995 1997 1998 Misc. plastic products $28,594 $28,840 $26,703 $25,373 $25,348 $26,559 $27,482 $28,401 $29,154 $30,596 Other rubber & misc. plastic $28,068 $26,282 $26,495 $25,882 $24,743 $26,751 $26,336 $27,116 $30,900 $30,670 Rubber & misc. plastics $28,539 $28,563 $26,687 $25,410 $25,309 $26,574 $27,405 $28,312 $29,262 $30,601 Manufacturing $38,352 $37,909 $38,024 $37,876 $37,338 $37,667 $38,018 $38,942 $40,954 $42,247 Total state nonfarm $28,783 $27,789 $27,313 $27,304 $27,167 $27,928 $28,575 $29,046 $31,504 $33,922 Figure 5 Hourly Wages for Washington Rubber & Miscellaneous Plastics Products Workers, 1997 Source: Washington Employment Security Department 25% State 20% Share of total employment Rubber & plastics 15% 10% 5% 0% <$6 $6-$8 $8-$10 $10-$12 $12-$14 $14-$16 $16-$18 $18-$20 $20-$22 $22-$24 $24-$26 >$26 Hourly wage The labor force in the rubber and miscellaneous plastics products sector is dominated by operatives and laborers. Common rubber and miscellaneous plastics products occupations within this group are machinists, assemblers, laborers, and equipment and machine operators. Clerical and managerial occupations are also important in rubber and miscellaneous plastics products. Table 2 Occupational Profile of Rubber & Miscellaneous Plastics Products Workers in Washington, 1998 and 2008 Source: Washington Employment Security Department Estimated 1998 Projected 2008 Rubber & plastics, SIC 30 Percent of Percent of Estimated Total Projected Total Employment Employment Employment Employment Managerial & administrative 630 6.7% 847 6.9% Professional, paraprofessional & technical 300 3.2% 388 3.2% Sales & related occupations 397 4.2% 531 4.4% Clerical & administrative support 893 9.5% 1,068 8.8% Service occupations 45 0.5% 51 0.4% Production, operating & maintenance 1,188 12.6% 1,545 12.7% Operators, helpers & laborers 4,935 52.3% 6,319 51.8% Undefined occupations 1,056 11.2% 1,459 12.0% TOTAL 9,444 100.0% 12,208 100.0% Contribution of Rubber & Plastics Industry to the Washington State Economy Compared to the nation, the relative importance of rubber and miscellaneous plastics products to the Washington economy is low. Although there has been steady improvement over the years, the index of specialization for Washington rubber and miscellaneous plastics has remained well below 0.5 since 1977 (an index of 1.0 signals the same importance of an industry for Washington as for the U.S.). Since 1992, rubber and miscellaneous plastics products’ relative importance has been just above 0.40 and not trending upward. Although most rubber and miscellaneous plastics products manufacturers in Washington service regional and domestic markets, an increasing share of production is being exported to foreign customers. In 1997, rubber and miscellaneous plastics foreign exports from Washington totaled $116.8 million. Approximately one-fourth of all rubber and miscellaneous plastics products workers are supported by foreign exports. Figure 6 Index of Specialization for Washington Rubber & Miscellaneous Plastics Products Industry, 1977-1997 Source: U.S. Bureau of Economic Analysis, Gross State Product series. 1.00 0.90 0.80 Index of specialization 0.70 0.60 0.50 0.40 0.30 0.20 0.10 0.00 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 Outlook Rubber and miscellaneous plastics products has outperformed the state economy during this decade. Employment in rubber and miscellaneous plastics products has risen at a robust 6.6 percent average annual pace since 1991, significantly more than total nonfarm employment (3.6 percent). Domestic and foreign end-use markets for rubber and miscellaneous plastics are expected to remain strong for the next twenty years. The result of this bright outlook is continued expansion within the Washington rubber and miscellaneous plastics industry. By the year 2020, rubber and miscellaneous plastics manufacturers are forecast to employ 14,480 workers, an average annual growth rate (2000-2020) of 2.2 percent. Virtually all of the growth is projected to occur in the miscellaneous plastics subsector, with employment growing at an annual rate of 2.4 percent. Figure 7 Employment Forecast for Washington Rubber & Miscellaneous Plastics Products Industry, 2000-2020 Sources: Washington Office of Financial Management, Washington Employment Security Department 16,000 Other rubber & misc. plastics 14,000 Miscellaneous plastics 12,000 Total employment 10,000 8,000 6,000 4,000 2,000 0 1995 2000 2005 2010 2015 2020