7 Asset Management - Queensland Health

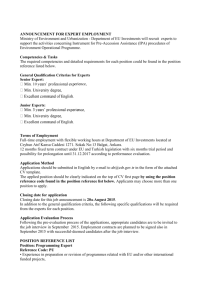

advertisement