The Value of Perfect Information: The Case of the U.S. Cattle Industry

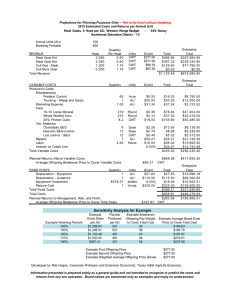

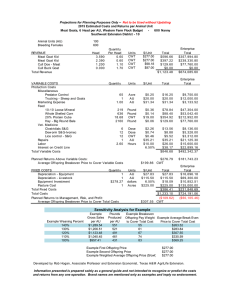

advertisement

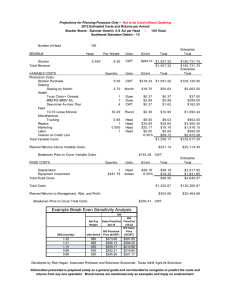

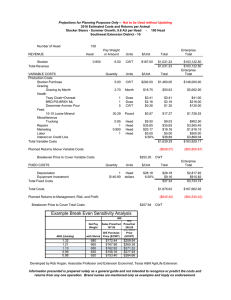

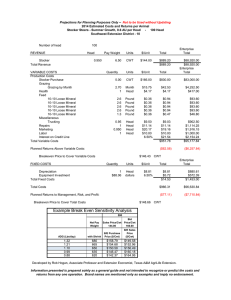

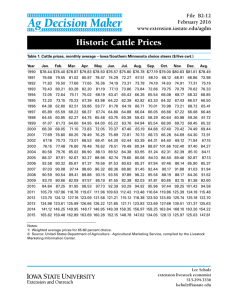

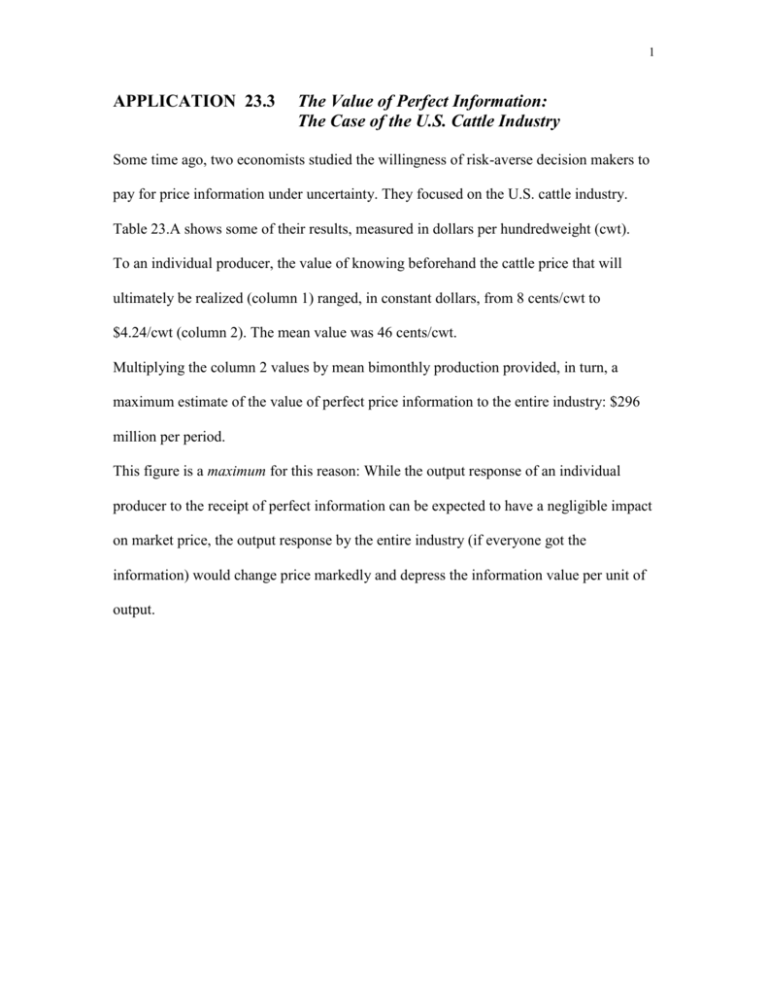

1 APPLICATION 23.3 The Value of Perfect Information: The Case of the U.S. Cattle Industry Some time ago, two economists studied the willingness of risk-averse decision makers to pay for price information under uncertainty. They focused on the U.S. cattle industry. Table 23.A shows some of their results, measured in dollars per hundredweight (cwt). To an individual producer, the value of knowing beforehand the cattle price that will ultimately be realized (column 1) ranged, in constant dollars, from 8 cents/cwt to $4.24/cwt (column 2). The mean value was 46 cents/cwt. Multiplying the column 2 values by mean bimonthly production provided, in turn, a maximum estimate of the value of perfect price information to the entire industry: $296 million per period. This figure is a maximum for this reason: While the output response of an individual producer to the receipt of perfect information can be expected to have a negligible impact on market price, the output response by the entire industry (if everyone got the information) would change price markedly and depress the information value per unit of output. 2 TABLE 23.A U.S. Cattle Market Data 1978 Period Jan./Feb. Mar./Apr. May/June July/Aug. Sept./Oct. Nov./Dec Realized Price ($ per cwt) (1) 20.82 23.92 26.15 25.20 26.34 26.30 Value of Perfect Information ($ per cwt) (2) .59 1.38 1.57 1.63 .80 .42 1979 Jan./Feb. Mar./Apr. May/June July/Aug. Sept./Oct. Nov./Dec 30.33 34.23 32.21 29.03 29.28 28.05 1.13 4.24 2.55 .83 .29 .11 1980 Jan./Feb. Mar./Apr. May/June July/Aug. Sept./Oct. 27.85 25.92 24.73 25.65 24.55 .08 .23 .80 .36 .12 For example, if a couple of individual ranchers knew ahead of time that the cattle price a year from now was going to be unusually high, they could step up production now and make a financial killing in a year. Yet, if all ranchers had that information and acted accordingly, the huge increase in supply in a year would depress the price and falsify the expected result. Source: Adapted from Terry Roe and Frances Antonovitz, "A Producer's Willingness to Pay for Information under Price Uncertainty: Theory and Applications," Southern Economic Journal, October 1985, pp. 382-391. See also the more advanced discussion by 3 the same authors in "A Theoretical and Empirical Approach to the Value of Information in Risky Markets," The Review of Economics and Statistics, February 1986, pp. 105-114.