Fin721 (Corporate Finance)

advertisement

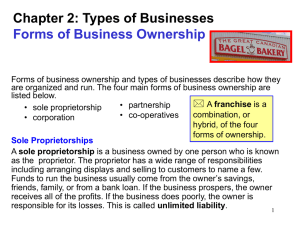

Chapter 1 – Introduction to Corporate Finance I. Corporate Finance and the Financial Manager II. Three Forms of Business Organizations III. The Goals of Corporations IV. Agency Relationships V. Financial Markets and the Corporation I. Corporate Finance and the Financial Manager Corporate Finance (or corporate financial management) is the concern of four major decisions a typical corporate financial manager faces. 1. The LT Financing Decision A. Determining the maturity and type of funds raised in financial markets is part of the financing decision. B. The selection and mix of long-term debt and equity securities sold in capital markets determines the capital structure of the firm. 2. The Investment (Capital Budgeting) Decision A. The decision as to the amount and which real assets to acquire is a capital budgeting decision. B. Where cash is invested affects the amount of future cash flows generated, the timing of those cash flows, and the variability or riskiness of those future cash flows and thus, the value or worth of the capital budgeting decisions. 3. Dividend (Profit-sharing) Decision A. How much to retain and reinvest within the business and how much to pay out as dividends to shareholders. 4. The Working Capital Decision How to manage current assets and liabilities? The Financial Manager A. The financial manager refers to anyone responsible for a significant corporate investment or financing decision. The term is more oriented to the decisions rather than a specific title or job position. B. The classic financial manager titles are the treasurer and the controller, with the former being more associated with financing, cash management, and financial market relationships, and the latter being associated with more traditional accounting functions of financial statements, budgeting, and auditing. 1 II. Three Forms of Business Organizations: Three basic forms of business organizations: Forms % of the business forms 1. Sole Proprietorship: 80 2. Partnership: 10 3. Corporation: 10 % of business sales 13 7 80 1. Sole Proprietorship: Advantages: Single taxation (no corporate level taxes, only pays personal level taxes). Disadvantages: Unlimited liability (business losses can result in personal bankruptcy). 2. Partnership: Same pros and cons as sole proprietorships do. Many big businesses start as proprietorships or partnerships and then convert to corporations when the disadvantages outweigh the advantages. 3. Corporation: It is a legal entity created by a state, separate and distinct from its owners and mangers. Pay attention to the difference between private and public corporations. Advantages: Limited liability (losses are limited to the actual funds invested). Disadvantages: Double taxation (because earnings are taxed both at corporate level and individual level when earnings are paid out as dividends to shareholders). Hybrid forms of organizations: 1. Limited Partnership (LP): 2. Limited Liability Partnership (LLP or LLC): 3. S-Corporation: A type of corporation with single taxation. Usually the number of owners is limited and small. No more than 75 owners. 2 III. The Goals of the Corporation: 1. The most important goal of corporations is to maximize stockholders’ wealth (the stock price of the corporation or MV). The maximization of stock price is different from maximization of firm’s net income (earnings) or EPS. 2. Factors that Affect Stock Price: Size of the expected cash flows Timing of the expected cash flows Risk of the expected cash flows While maximizing stock price is the most important goal for a corporation, EPS or profit is also one of the important indicators of the corporation’s financial performance. The numbers are also watched closely by market participants. IV. Agency Relationships: An agency relationship exists whenever a principal hires an agent to act on his or her behalf. Agency problem causes agency costs which include direct costs (i.e., perks and monitoring) and indirect costs (i.e., lost opportunities). Within a corporation, two major agency relationships: Shareholders and managers Shareholders and creditors Agency conflict I: Shareholders vs. Managers Four ways to reduce this agency problem: Managerial compensation plans Direct intervention by shareholders The threat of firing The threat of takeover V. Financial Markets and the Corporation: 1. Primary markets: where corporations raise capital by issuing new securities to get fresh capital. The relationships happen between corporations and investment banks (e.g., pre-IPO market). 2. Secondary markets: where existing, already outstanding securities are traded among investors, after securities are issued by corporations. Corporations do not receive any new funds from transactions in secondary markets (e.g. NYSE, AMEX and OTC, etc.) 3