E. COPAS Bulletins - Thompson & Knight LLP

advertisement

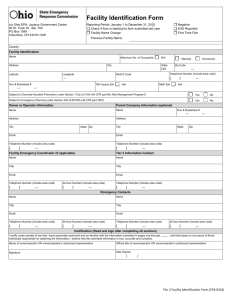

Cowboy COPAS: A Primer for Attorneys 27th Annual Ernest E. Smith Institute Houston, Texas March 30, 2001 By Jolisa Melton Thompson & Knight LLP 1700 Pacific Avenue Suite 3300 Dallas, Texas 75201 214/969-1675 214/969-1751 (Fax) meltonj@tklaw.com TABLE OF CONTENTS I. COPAS A. Formation B. Organizational Structure II. COPAS Documents A. Accounting Procedure B. Bulletins C. Interpretations/Education Documents III. COPAS and Industry Custom and Practice IV. Accounting Procedure Areas A. No Gain or Loss Principle B. Direct and Indirect Charges 1. Labor 2. Facilities 3. Mega Fixed rate 4. Overhead V. Operator Changes to the Accounting Procedure VI. 1995 COPAS Accounting Procedure Improvements VII. Payments, Audits and Exceptions VIII. Areas for Improvement A. No Gain or Loss Principle B. Conflict between the Joint Operating Agreement and the COPAS Accounting Procedure C. Auditing Standards D. Overhead E. COPAS Bulletins IX. Conclusion Jolisa Melton Cost allocation among interest owners is inherently a litigious issue, especially when oil and gas questions are concerned. Naturally, an individual owner, who is not operating the well, wishes to maximize the return on their investment. This can be accomplished by minimizing the costs that the owner must bear in developing and producing the property. When multiple owners or co-tenants of a potentially producing property join together, they typically enter into a Joint Operating Agreement. This agreement specifies who will be the operator of the property. The operator’s goals sometimes conflict with the non-operating owners. The operator also wants to maximize the return on its investment. In so doing, the operator will want to be sure that it has passed on a proportionate share of all costs incurred in the development and production of the property to non-operators. The operator will have to “eat” all costs not passed on to others. This becomes a downward spiral for the operator if these costs also exceed the operator's share of production revenue, resulting in the operator incurring a loss solely because each owner is not paying their share of the costs. The possibility for conflict between the parties is clear to see. With each party fiercely protecting their investment, such conflicts can quickly escalate into litigation. There is a greater likelihood for dispute when oil and gas prices are depressed because owners may not be struggling to maximize their return on the investment, but rather fighting to minimize their losses. These conflicts often involve accounting disputes that arise under The Council of Petroleum Accountants Societies’ (COPAS) accounting procedure. This procedure is included in the form of an incorporated exhibit to the Joint Operating Agreement. It provides what costs are allowable, and how these costs will be 1 Jolisa Melton allocated. COPAS and the COPAS accounting procedure have a rich history of evolution and litigation. I. COPAS A. Formation Standardization was the driving force behind the formation of The Council of Petroleum Accountants Societies, Inc. (COPAS). COPAS was formed in 1961 and initially named The Council of Petroleum Accountants Societies of North America. The phrase of “of North America” was removed in 1980.1 Initially, there were twelve local societies comprising COPAS.2 Now, this number has grown to twenty-three.3 In 1979, a National office was established, and in 1985, a Board of Directors was elected.4 The National Council was formed to avoid duplication and inconsistencies that may result from having multiple individual societies trying to solve common problems in the oil and gas industry.5 Another reason for its formation was to consolidate the authority of the individual societies into a stronger voice of understanding in petroleum 1 COPAS History, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage24.html>. 2 The initial twelve societies were Denver, Colorado; Dallas, Fort Worth, and Houston, Texas; Wichita, Kansas; Los Angeles, California; Midland, Texas; New Orleans, Louisiana; Oklahoma City, and Tulsa, Oklahoma; San Antonio, Texas; and Canada. COPAS History, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage24.html>. San Francisco joined in 1976. Id. The additional societies making up today’s COPAS organization are Anchorage, Alaska; Lafayette, Louisiana; Corpus Christi, Texas; Michigan; Mississippi; Artesia and Farmington, New Mexico; Utah; Bakersfield, California; and Wichita Falls, Texas. COPAS Membership (visited March 12, 1999) <http://www.copas.org/newpage7.html>. 3 4 Id. 5 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-4. 2 Jolisa Melton accounting.6 The formation resulted not only in a stronger and more thorough understanding, but also in a common source of industry custom and practice. The goal of COPAS is to “enhance competition by suggesting model forms, interpretive bulletins, and guidelines for the most practical methods of accounting, auditing, and record keeping in the oil and gas industry.” Anti-Trust, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/anti-tru.hmtl>. This is accomplished through the following objectives, as detailed in Article I of the Bylaws of The Council of Petroleum Accountants Societies: “… (B) Study and analyze accounting and other problem areas of the petroleum industry (C) Formulate and disseminate petroleum industry accounting practices, procedures and pronouncements through the use of bulletins and interpretive statements … (F) Cooperate in the education of the public concerning the petroleum industry (G) Assist educational institutions through contributions of papers, books, speakers and scholarships…” Bylaws, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage27.hmtl >. B. COPAS Organizational Structure COPAS has several different levels of membership for the individual societies. Participating societies are those that adopt a set of bylaws, conduct at least 3 meetings per year, have been in existence for at least one year, consist of at least thirty-five members representing five or more companies, and have two accounting study committees.7 These 6 Id. 7 Bylaws of The Council of Petroleum Accountants Societies, Art. II, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage27.hmtl>. 3 Jolisa Melton societies are admitted into COPAS membership upon two-thirds approval of the current Participating societies.8 Participating societies can vote and have full COPAS participation rights.9 Associate societies have eligibility requirements similar to Participating societies except they only have fifteen or more members representing 3 or more companies, and do not have accounting study committees.10 Admission into COPAS is the same as for Participating societies.11 However, Associate societies may not vote.12 Therefore, an Associate society only has limited participation rights. International societies are composed solely of members who reside outside of the United States.13 Membership requirements for an International society are similar to the Associate societies’ requirements except that an International society need not conduct at least 3 meetings per year, and all members must not be a resident of the United States.14 Admission into membership is also the same.15 International societies have limited participation rights and are not eligible to vote.16 8 Id. 9 Id. 10 Id. 11 Id. 12 Id. 13 Id. 14 Id. 15 Id. 16 Id. 4 Jolisa Melton The last type of COPAS membership is the Individual membership. Individual membership is available for limited members or academic members. A limited member is someone who is involved in the petroleum industry but does not have a Participating society in his area.17 “Involved in the petroleum industry” means that the individual must be “actively engaged” in accounting, public accounting, or education – directly related to the petroleum industry.18 Academic membership is open to accounting students who want to learn more about the COPAS organization.19 The Executive Director of COPAS admits Individual members into COPAS; a vote by the Participating societies is not required.20 Individual members receive only limited participation rights and are not eligible to vote.21 An individual society may be suspended, upon two-thirds vote by the Participating societies, for any of the following reasons: failure to pay its assessed portion of COPAS operating costs, failure to participate in national COPAS activities, becoming an inactive society, or failure to meet membership requirements.22 A suspended society has participation rights in COPAS functions but cannot vote.23 17 Id. 18 Id. 19 Id. 20 Id. 21 Id. 22 Id. 23 Id. 5 Jolisa Melton II. COPAS Documents A. Accounting Procedure A Joint Operating Agreement is the most common contract used when multiple owners want to produce oil or gas, whether as cooperating owners of separate properties or as co-tenants.24 The Joint Operating Agreement designates the operator of the property, and also provides that the operator will bear the exploration and production costs and then bill the other non-operators.25 The methods for allocating costs incurred by the operator, defining which costs are allowable charges, and the procedures for billing the other parties are set out in an accounting procedure. This procedure is often attached to the Joint Operating Agreement as an exhibit. COPAS was organized to standardize the accounting procedure. Prior to the formation of COPAS, each geographic area had their own accounting procedure.26 The Petroleum Accountants Society of Oklahoma – Tulsa developed an accounting procedure that was widely used in the mid-continent and gulf coast region, and also served as the basis for the first COPAS accounting procedure.27 “COPAS was started in 1962 when the need was recognized for an accounting exhibit to accompany the AAPL Operating 24 Gary W. Davis ET AL., 5 BUSINESS AND COMMERCIAL LITIGATION IN FEDERAL COURTS §79.4 (West Group 1998) 25 Id. 26 The West Coast used the accounting procedure developed by the Petroleum Accountants Society of Los Angeles. Canada used the accounting procedure developed by the Petroleum Accountants Society of Canada. The mid-continent and gulf-coast region used the accounting procedure developed by the Petroleum Accountants Society of Oklahoma-Tulsa. This latter form was modified by the Petroleum Accountants Society of Texas, for use in Texas. John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-10. 27 Id. 6 Jolisa Melton Agreement to be used in joint oil and gas operations." What is COPAS?, (visited Feb. 24, 1999) <http:///www.copas.org/copas.html>. Accounting procedures were issued by COPAS in 1963 (titled the 1962 Accounting Procedure), 1968, 1975 (titled the 1974 Accounting Procedure), 1984, 1995 and 1998.28 Additional accounting procedures were developed for offshore operations and issued in 1976 and 1986.29 These accounting procedures are published by Kraftbilt Products (P.O. Box 800, Tulsa, OK 74101), and are also located with their guidelines, the COPAS bulletins.30 The 1984 accounting procedure is the most widely used procedure that currently regulates operational accounting today.31 The 1984 procedure was widely accepted by the industry because it was established through a group effort by all of the societies.32 The 1995 and 1998 accounting procedures have not been well received. Normally when a new accounting procedure is issued by COPAS, the previous accounting procedure is no longer published. However the 1995 accounting procedure was only issued by COPAS, upon narrow approval, as an alternative accounting 28 COPAS History, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage24.html>, E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 102 (unpublished manuscript on file with Jolisa Melton), and Al E. McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton). 29 COPAS History, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage24.html>. 30 COPAS 1962 is located in Bulletin No. 5. COPAS 1968 is located in Bulletin No. 8. COPAS 1984 is located in Bulletin No. 22. John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-12. In addition COPAS 1995 is located in Bulletin No. 33. 31 John Burritt McArthur, A Twelve-Step Program for COPAS to Strengthen Oil and Gas Accounting Protections, 49 SMU L. REV. 1447, 1449 (1996). 32 Id. at 1454. 7 Jolisa Melton procedure.33 This accounting procedure contained provisions to accommodate the energy task force which was mainly comprised of majors and large independents.34 A major concern on this new accounting procedure was the ability of the operator, or its affiliate, to charge commercial rates for services and materials and hence make a profit35 a radical change from the No Gain or Loss Principle, discussed below. In addition, a 1998 accounting procedure was issued for use by project teams between large and major companies and as a result of this special use, it is also an alternative accounting procedure.36 Because of the limited applicability of the 1998 accounting procedure, the 1984 accounting procedure remains the most widely used accounting procedure today. A standardized accounting procedure evens out the power between the parties to a contract. This can be seen with the Association of International Petroleum Negotiators’ Model Form Joint Operating Agreement. The model form increased the non-operators understanding by over 300%.37 An operator’s individual joint operating agreement form was no longer forced upon the non-operator as the only option available. The nonoperator had a model form available – which provides all of the options that are available 33 Al E. McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton.) 34 Id. 35 Id. 36 Id. 37 Host Government Contracts Showcase, Lecture by Frank Alexander, Jr., AIPN April 1999 Conference Presentation (April 8, 1999). 8 Jolisa Melton to the non-operators.38 This information may not have been known to a non-operator lacking the financial resources to perform extensive research.39 B. Bulletins COPAS Bulletins are the highest level of COPAS documents. A majority of the Participating Societies must approve of the bulletin for it to be issued.40 The process for developing a bulletin begins with research into the accounting topic by a task force. The task force recommendations are then forwarded to the committee, which performs a review and forwards it to the Board of Directors. After review, the Board of Directors makes a recommendation to the individual Participating societies, who then vote on the bulletin.41 Because the oil and gas industry assists in the research and development of the COPAS bulletins, these bulletins reflect, common but not necessarily exclusive, industry practice and custom.42 Custom is a practice that is so widely used and accepted that it acquires the force of law.43 The bulletins are intended to serve as an interpretational guideline for the accounting procedures. However, some courts are using the bulletins as industry standards – although they are not intended as such.44 38 Id. 39 Id. 40 Telephone interview with Jon Gear, National Director of COPAS (March 4, 1999). 41 Id. 42 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-4. 43 21A Am. Jur.2d Customs and Usages §1 (1998). 44 Telephone interview with Jon Gear, National Director of COPAS (March 4, 1999). 9 Jolisa Melton To date, COPAS has issued 34 bulletins. A listing of these bulletins, including date and title follows.45 Bulletin Number 1 2 Date Title 4/90 9/65 3 1/94 4 5 6 7 8 9 10/91 9/66 4/90 4/93 10/69 4/92 10 11 12 13 14 15 16 17 18 19 20 21 22 23 4/90 5/71 4/00 10/75 11/75 10/77 4/88 4/88 4/00 24 25 26 27 28 29 30 31 4/91 9/87 Classifications for use in summary form billing Determination of values for well cost adjustments joint operations Expenditure audits in the petroleum industry: protocol and procedures guidelines Oil and gas accounting procedures Accounting procedure joint operations (1962 COPAS) Material classification manual Gas accounting manual Accounting procedure joint operations 1969 Accounting for Farmouts/Farmins, net profits interest, carried interest Petroleum industry accounting educational training manual Accounting for unitizations Field computer and communication systems Accounting procedure joint operations 1975 Accounting procedure arctic operations 1974 Accounting procedure offshore joint operations Overhead – joint operations Oil accounting manual Marine and aircraft offshore transportation Merged into Bulletin 18 Shore base facilities and offshore staging areas Material pricing manual Accounting procedure joint operations 1984 Guidelines for revenue audits in the petroleum industry: protocol and procedure guidelines Producer gas imbalances Accounting procedure offshore joint operations Merged into bulletin 3 Guidelines for cash flow budgeting in the petroleum industry Joint task force guidelines on natural gas administrative issues Guidelines for contractor audits in the petroleum industry Guidelines for investigation of suspected irregularities Guidelines for an internal review of an oil and gas production 45 4/00 3/98 10/85 10/92 4/89 4/90 4/90 4/90 4/90 COPAS, Index (Kraftbilt 1999) 10 Jolisa Melton 32 33 34 12/96 12/96 7/98 and exploration division Gas processing systems material classification manual COPAS 1995 accounting procedure interpretation COPAS Project team accounting procedure interpretation C. Interpretations, Education Documents An interpretation, or education document, is similar to a COPAS bulletin; however, it does not provide a single guideline concerning the COPAS accounting procedure. An interpretation is usually developed when a bulletin fails to receive a majority vote by the Participating societies.46 When a majority is not reached, the COPAS Board of Directors develops an interpretation which provides all of the alternatives available for that specific accounting issue.47 An interpretation, therefore, does not reflect industry custom and practice because there is not a majority of petroleum accountants following one particular approach. To date, COPAS has issued 31 interpretations. A listing of these interpretations, including date and title follows.48 46 Id. 47 Id. 48 COPAS, Index (Kraftbilt 1999). 11 Jolisa Melton Interpretation Number 1 Date Title 4/80 2 3 4/80 4/80 4 5 4/80 4/80 6 7 8 6/82 4/80 4/80 9 10 11 7/84 5/81 1/94 12 13 10/82 11/90 14 12/84 15 16 17 18 19 20 5/86 10/86 9/87 9/88 9/88 7/89 21 22 23 24 2/90 8/91 5/92 12/96 25 4/96 26 27 28 29 30 1/97 1/97 1/97 7/97 7/97 Pricing tubular foods at Eastern Mill base price v. lowest prevailing price Definition of railway receiving point Selection of mode of hauling – for computing freight – mill to railway receiving point Pricing of line pipe movements less than 30,000 pounds Pricing of casing, tubing and drill pipe used for purpose other than originally intended Loading, transportation and unloading costs Coating and wrapping costs Repricing of transferred mill rejects and limited service tubular goods Transportation costs – zone priced material Premium priced material Employee benefits – chargeable to joint operations and subject to percentage limitation Employee benefits limitation Valuation of crude oil volumes in the event of price changes during the month Definition of published price – tubular goods material transfers Computerized equipment pricing system Definitions – Operator and related entities Disposition of surplus joint account material and equipment Freight rates: change of information source Discounts Freight rates: revised method of determining freight rates for tubular goods Documentation supporting joint interest expenditures 24 month audit period audit and accounting adjustments Material transfer valuation Cost of self-insurance for workers’ compensation and employers’ liability insurance Market adjusted – loading, transportation and unloading costs Transfer pricing for used materials Charging of training costs to the joint accounts Documentation requirements for electronic invoices Audit rights for non participating, non consenting parties Chargeability of incentive compensation programs 12 Jolisa Melton 31 III. 2/98 Documentation on requirements for procurement card (P-Card) and convenience check charges COPAS and Industry Custom and Practice Industry involvement in COPAS’s understanding of oil and gas accounting issues is reflected in all of the documents issued by COPAS. Such industry involvement, and widespread use of COPAS procedures and related bulletins, has lead to COPAS bulletins being regarded on the level of industry custom and practice. However, there are other reasons that COPAS’s knowledge base reflects industry custom and practice. One function that also enables COPAS to maintain such an extensive knowledge of oil and gas accounting is participation in the establishment of the National Oil and Gas Accounting School. COPAS assisted the Professional Development Institute (PDI) and the American Institute of Certified Public Accountants (AICPA) in the establishment of the school in 1979.49 Between 1994 and 1995 COPAS developed the Accredited Petroleum Accountant Program.50 During that time, COPAS, with the assistance of industry experts, established a comprehensive certification standard of what a petroleum accountant should know.51 This certification process tests an accountant in the following areas: Operations, Law, Financial Reporting, Revenue, Joint Interest, Tax, Managerial, 49 COPAS History, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage24.html>. 50 APA, (visited March 12, 1999) <http://www.copas.org/apa/newpage4.hmtl>. 51 Id. 13 Jolisa Melton and Auditing accounting.52 Accountants wishing to sit for the exam must have 5 years experience in oil and gas accounting, a four-year college degree with 12 hours of accounting, and a CPA license.53 The certification program is intended to recognize the special skills of petroleum accountants and to aid employers with employee selection.54 In addition, the COPAS bylaws establish standing committees to research and report on industry custom and practice.55 These committees cover the areas of audit, education, financial reporting, international, joint interest, refining and marketing, revenue, small oil and gas companies, and tax.56 COPAS’ wealth of information places it in the unique position to portray industry accounting custom and practice. COPAS constantly receives information from members working in the industry and is always striving to keep this knowledge current. In addition, the COPAS organization is continually researching various areas of oil and gas accounting to not only understand and establish custom and practice but to assist in solving accounting problems that arise. The best recommendation for COPAS comes directly from the industry when it looks to COPAS bulletins as a source of industry practice. In fact, the name COPAS sells. A previous President of COPAS and 32 year veteran of the industry recognized that although the bulletins and interpretations lack “legal standing” since they are not incorporated into the Joint Operating Agreement or 52 Id. 53 Id. 54 Id. 55 Bylaws of The Council of Petroleum Accountants Societies, Art. IV, (visited March 12, 1999) <http://www.copas.org/toolbox%20items/newpage27.hmtl>. 56 What is COPAS?, (visited Feb. 24, 1999) <http://www.copas.org/copas.html>. 14 Jolisa Melton COPAS accounting procedure, “most of those in the oil and gas industry believe that anything COPAS publishes, without consideration of form or the approval process within COPAS, establishes acceptable industry accounting practices and procedures.”57 Status as industry custom and practice is important because a court will look to industry custom and practice to fill in the blanks of an ambiguous contract or one that is silent on certain issues. See Luling Oil and Gas Co. v. Humble Oil and Refining Co., 191 S.W.2d 716, 724 (Tex. 1945) (holding that industry custom and practice can be used to supplement obscure or silent portions of a contract). However, there are limitations imposed by some courts on the extent industry custom and practice can be used. For example, industry custom and practice cannot be used to add new terms to the contract. See Smith v. Abel, 316 P.2d 793, 803 (Or. 1957); Barnard & Bunker v. Houser, 137 P. 227, 228 (Or. 1913). The requirements for industry custom to be used as part of the contract were explained in Montgomery v. United States National Bank of Portland, 349 P.2d 464 (Or. 1960). The first requirement is that an industry custom exist.58 The second is that the party actually knows of the industry custom, either actually or constructively. 59 Constructive knowledge arises when the industry custom is of a general nature.60 Knowledge is implied because persons engaged in a particular trade or business are 57 Al E. McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton). 58 Id. at 565. 59 Id. 60 Simms v. Sullivan, 198 P. 240 (Or. 1921). 15 Jolisa Melton imposed with the obligation to learn about the relevant industry customs and practices.61 The third is that the custom does not contradict the contract.62 The burden of proof for applying industry custom and practice is clear and convincing evidence.63 In fact, one court has followed COPAS bulletins because they reflected industry custom and practice. In Atlantic Richfield Co. v. Holbein, 672 S.W.2d 507, 507 (Tex. App. – Dallas 1984), the parties argued over the proper calculation of royalty. The court retrieved the correct calculation method from COPAS because it represented industrywide practice.64 ARCO was the party asking the court to apply the COPAS procedure.65 Therefore the court must have held that Holbein, a mineral trust, was a sophisticated party because courts will not bind parties to industry custom and practice if the party is not familiar with it, such as lessors.66 However, one cannot rely upon a court looking to COPAS guidelines in reaching a decision because sometimes a court will not look outside of the actual accounting procedure, and at other times, the court feels no need to defer to COPAS.67 Another interesting question that comes to mind is whether unsophisticated parties, such as lessors, can use industry custom and practice against the operator to their 61 Hazard’s Adm’r v. New England Marine Ins. Co., 33 U.S. 557 (1834). 62 349 P.2d at 565 63 Wendling v. Puls, 610 P.2d 580, 585 (Kan. 1980). 64 Id. at 515-516. 65 Id. 66 Garman v. Conoco, Inc., 866 P.2d 652, 660 (Colo. 1994). 67 Willard Pease Oil and Gas Co. v. Pioneer Oil and Gas Co., 899 P.2d 766 (Utah 1995), Torch Operating Co. v. Louis Dreyfus Reserves Corp., 1994 WL 117786 (E.D.La. 1994). 16 Jolisa Melton benefit. If they are not bound to industry custom and practice, can they enforce it? The courts have yet to decide this issue. It is interesting to note how some practitioners ask the courts to apply COPAS bulletins. One Oklahoma practitioner has requested COPAS Bulletin #2, Determination of values for well cost adjustments joint operations, for the allocation of costs under a forced pooling order. The Oklahoma Corporation Commission granted the request and allowed the COPAS Bulletin to control the relationship between the parties to the forced pooling order relating to certain costs.68 The acceptance of COPAS as industry custom and practice is far reaching. IV. Accounting Procedure Areas A. No Gain or Loss Principle The Former Executive Director of COPAS, John Jolly, best describes the principle that the operator should neither profit nor suffer a loss from operating. “It has always been the intent of the operating agreement that the operator should not make a profit or conversely suffer a loss just because he is the operator. … When accountants first began developing printed accounting procedures to be attached as exhibits to the operating agreement, as far back as the early 1930’s, this concept was more pronounced. … When COPAS began publishing their recommended accounting exhibits, this concept remained unchanged even though the lengthy, descriptive, allinclusive detail has increased in recent years.” John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-26-27. 68 Order No. 436269, Oklahoma Corporation Commission (1999). 17 Jolisa Melton One problem is that this principle is no longer expressly, nor clearly stated in the COPAS accounting procedure. Why is such a principle so important? Preventing an operator from making a profit merely because it is an operator makes its income dependent upon the success of the joint operation. Therefore, the operator’s incentive is the same as the other owners. This protects other owners, whose interests are similar to investors, by enticing the operator to maximize the profit from the joint property – for the benefit of all.69 A strong argument could be made for the operator deserving a profit. Operating the joint property involves risks: the risk of nonpayment by financially troubled owners, the risk of litigation by disgruntled owners, and the risk of not recovering all costs that the operator was forced to bear. A typical investment offers a return commensurate with the risk involved. Following this typical investment principle, shouldn’t the operator receive some profit in return for the risk borne? Obviously, the industry has not felt the same way. One industry contact argued that the operator actually bears minimal risk because the Joint Operating Agreement dictates that all owners in the property will share any costs from the risks described above. Therefore, the operator need not be compensated for such risks. However in an unsuccessful development program and hard times, the operator cannot get “blood from a stone.” COPAS attempts to achieve an actual cost billing (no gain nor loss concept) through the definition of allowable costs, and the allocation of those costs. Although this no gain or loss principle is threaded throughout the principles in the COPAS accounting 69 John Burritt McArthur, A Twelve-Step Program for COPAS to Strengthen Oil and Gas Accounting Protections, 49 SMU L. REV. 1447, 1459 (1996). 18 Jolisa Melton procedure and guidelines in the COPAS bulletins, it is never stated directly. The problem is multiplied because the COPAS publications provide rules and guidelines for a variety of costs. Some of these costs are inherently more prone to litigation than others because detection of errors or fraud is difficult. Others are more prone to litigation because differences of opinion arise between the parties to the Joint Operating Agreement. Misunderstandings may arise because of connotations or because of contract ambiguity. Some of the more troublesome cost items are discussed below. Disputes over costs are typically centered around whether they may be charged directly to the joint account and borne by all owners, or whether they should be absorbed into the overhead rate that the operator charges to cover indirect charges. B. Direct and Indirect Charges The differences between direct charges and indirect charges are easy to explain. Direct charges are costs incurred by the operator which will be shared by all of the joint property owners in proportion to their ownership percentages. This is accomplished by establishing a joint account, into which all direct charges are placed. The account balance is then billed out to the owners, in proportion to their ownership, at the end of every month. Indirect charges are not billed to all of the joint property owners. Instead, when the Joint Operating Agreement is entered into, the parties negotiate an overhead rate, This overhead rate is a fixed or variable monthly fee paid to the operator by the other owners. Overhead is intended to compensate the operator for all other costs (indirect 19 Jolisa Melton costs). The operator incurs and pays for all indirect costs, but these costs are not charged to the joint account. 1. Labor The history behind labor charges has a divided past. This is a common area of dispute because it represents a large portion of the total exploration and development costs. The classification of labor as a direct or indirect charge varies by geographic region. Traditionally, in the mid-continent region, labor was considered a direct charge only if the employee was physically located on the joint property while performing a job.70 This is commonly referred to as “on the property.” The reason behind such a stringent requirement was ease of audit. It provides a bright line test requiring only verification of the physical location of an employee. In contrast, the west coast region employed the “in the operation of” method. In this function oriented approach, direct charges of labor are allowed if the employee’s task was in the operation of the joint property.71 With this method, the physical location of the employee is immaterial. The function of the employee is what matters. The only problem with this method is the increased complexity of auditing labor charges. Every labor charge must be traced back to what the employee was working on, versus where the employee was working. The increased audit difficulty and chance for manipulation is obvious. 70 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-20. 71 Id. 20 Jolisa Melton Since the 1962 COPAS accounting procedure was based on Oklahoma’s regional accounting procedure (i.e. used in the mid-continent region), it is not surprising that the initial procedure provided for an “on the property” labor allocation. COPAS changed the form in 1968 to include the “in the operation of” labor allocation as an option.72 This was an effort to entice the west coast region to increase their use of the COPAS accounting procedure.73 COPAS reversed itself again in the 1974 accounting procedure by removing the “in the operation of” option out of the 1974 accounting procedure.74 COPAS must have felt that the increased risk of manipulation and increased complexity of auditing was not warranted as a trade off for increased use of the standard accounting procedure. Then, in 1984, COPAS once again added “in the operation of” as an option.75 The driving force behind the change in the procedure this time was fairness to smaller operators.76 Large operators have extensive in-house staffs focusing on individual operations.77 This makes it easy to move the staffs to the location and thus be able to charge their labor costs directly. However, smaller operators must outsource some of their labor needs.78 These employees may not be dedicated solely to an individual property, even though a portion of their activity is directly related to the property in 72 Id. 73 Id. 74 Id. 75 Id. 76 Id. 77 Id. 78 Id. 21 Jolisa Melton question. Under the “on the property” approach to labor, because they are not physically located on the property the labor charge is not allowed as a direct cost. The 1984 accounting procedure provides some flexibility by allowing the parties to the contract to select either the “on the property” or the “in the operation of” clause.79 The 1995 accounting procedure introduces a creative solution to this dilemma. Following suit with the flip-flopping between the two options, the 1995 procedure switched back to a location determinative method. 80 However, it also allows for the parties to the Joint Operating Agreement to agree that designated off-site facilities are to be considered directly chargeable.81 Under such an agreement, a smaller operator could directly charge for labor located at an agreed offsite facility. This is better than the “in the operation of” option because the parties agree to what is chargeable before the charges are incurred, and the bright line test for auditing is preserved. 2. Facilities Historically, the COPAS accounting procedure has offered many choices for charging facilities. The general concept was that the operator should charge an amount that reflects the commercial fair market rental value.82 The 1995 accounting procedure changed the facility cost allocation. First, facilities are divided into two types: 79 Id. 80 Id. 81 Id. 82 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-26. 22 Jolisa Melton production facilities, and other facilities.83 Production facilities continue to follow the previous accounting procedures – charging a commercial fair market rental value. 84 The difference arises in the charging of the other facilities.85 They are not chargeable unless agreed upon by the parties to the contract.86 If no agreement is reached, the default rule is that the operator must absorb these costs into overhead. If the parties agree to directly charge for a facility, a variety of methods are available. The operator may charge a fixed rate, commercial fair market rental value, or actual costs.87 In addition, if any facilities are added after the date of the Joint Operating Agreement, the parties must amend the accounting procedure to include this facility and the way it will be charged.88 If direct charges are not agreed upon and as a result the costs of other facilities are absorbed into overhead, the operator may be placed in a bad position because its initial calculation of the overhead rate may not have included the costs of an additional facility. If an operator fears that unforeseeable additional facilities will be required, it may also fear having to absorb the cost of these facilities into overhead. This is a risk. If this forces the operator to bear a loss, it violates the principle that the operator should not 83 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 106 (unpublished manuscript on file with Jolisa Melton). 84 Id. 85 Other facilities include, but are not limited to, roads, canals, clocks, laboratories, transportation, living quarters, SCADA systems, shore bases, heliports, hangers, field offices, training, spill containment, health, research, environmental, production platforms, telecommunication, and computer facilities per the 1995 Accounting Procedure Interpretation. See COPAS, Bulletin 33 COPAS 1995 Accounting Procedure Interpretation R (Kraftbilt 1996). 86 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 106 (unpublished manuscript on file with Jolisa Melton). 87 Id. 88 Id. 23 Jolisa Melton profit nor bear a loss as a result of operating the property. In response, an operator may wish to pad its overhead rate to protect itself from being saddled with these additional charges. The level of padding would be proportionate to the operator’s risk aversion. Yet, this additional padding could result in a windfall to the operator. Any profit would also violate the principle that the operator should not profit nor bear a loss as a result of operating the property. Additionally, if an item does not clearly fall into the classification of another facility, a creative operator can directly charge the expense to the joint account by classifying as an other expense. Such other expenses could be directly charged under a classification of materials or equipment if sufficiently ambiguous. 3. Mega Fixed Rate The 1995 accounting procedure allows for a mega fixed rate as a variation. The mega fixed rate offers the huge advantage of cost control. With the mega fixed rate, the operator charges one rate to cover most direct and all indirect charges.89 The mega fixed rate is just as it sounds – one rate is charged for all costs, with a few exceptions. Direct charges that are not absorbed into the mega fixed rate include: royalties, production or severance taxes, ad valorem taxes, controllable material, downhole well work, and drilling wells and projects.90 Royalties and production or severance taxes are excluded because these costs are based upon production rates, which vary; thus, estimating these 89 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 107 (unpublished manuscript on file with Jolisa Melton). 90 Susan R. Richardson, Joint Interest Audits in the Oil and Gas Industry: Provisions, Protocol, Procedures and Precedent, December 17, 1996, Houston Bar Association, Oil, Gas & Mineral Law Section, Luncheon Program. 24 Jolisa Melton costs would be impossible.91 Ad valorem taxes are excluded because investment and tax rate changes vary the amount that are chargeable to the individual parties and thus are not amenable to fixed rate estimation.92 Controllable materials are excluded because all owners in the well will need to know their basis and maintain asset records for subsequent dispositions.93 Down hole well work and drilling wells are excluded because they are considered non-routine expenses.94 The non-operator can easily budget their total investment if virtually all of the costs are fixed, such as with the mega fixed rate. One problem with a fixed rate is that the operator must have the ability to accurately estimate costs. Otherwise, they will bear a loss or receive a gain from operating the joint property. This would violate the actual cost recovery principle of the Joint Operating Agreement and accounting procedure. Also, in the case of the loss, the operator may experience financial difficulty. 4. Overhead Overhead is a constant source of dispute in the billing area. The source of the conflict is readily apparent. Operator’s want to maximize the costs directly charged to the joint account in order to minimize the indirect charges that must be absorbed into overhead. On the other side of the coin, the other owners want to maximize the costs classified as indirect charges and absorbed into overhead. This not only increases the return on their investment but also provides them with the feeling that their payments 91 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 103 (unpublished manuscript on file with Jolisa Melton). 92 Id. 93 Id. 25 Jolisa Melton towards overhead are being put to good use. The Former Executive Director of COPAS aptly described overhead as “probably the most misunderstood and mishandled charge in the joint operation…” John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-29. As a result of the inherent difficulties with overhead, the methods of calculating overhead have changed over time. The 1962 COPAS accounting procedure offered two methods of overhead calculation – fixed rate or actual costs plus a mark-up.95 The mark-up is intended to compensate the operator for hard to calculate expenses, such as administrative overhead. The 1968 accounting procedure changed the method of calculating overhead to a percentage of specific direct costs listed in specific sections of the accounting procedure.96 This method, commonly referred to as percentage basis recovery, was initially used by west coast operators, and subsequently picked up by the regions of Alaska and Canada.97 A percentage overhead calculation method allows for automatic rate adjustment. The rates will adjust to follow two economic assumptions: (1) inflation, and (2) direct costs. Actual costs increase with inflation. The percentage method of overhead calculation accommodates inflation because the overhead rate will also increase in proportion to cost increases.98 Additionally, overhead is considered a variable cost. That is, it shifts with the direct costs incurred. A basic assumption causing this shift is 94 Id. John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-30. 95 96 Id.; COPAS, Bulletin 33 – COPAS 1995 accounting procedure interpretation 25 (Kraftbilt 1996) 97 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-34. 98 Id. 26 Jolisa Melton that as more costs are incurred, administrative costs will also increase. Why? Because more manpower will be used to incur these costs (such as ordering materials, establishing supplier relations, etc.), to track and pay these costs, to charge these costs to the joint account, to allocate the joint account to the owners, and to track payment from the owners. Therefore, indirect costs, represented by overhead, should increase as direct costs increase. The percentage method for overhead calculation provides for the automatic adjustment of the overhead rate to mirror changes in direct charges.99 However, this overhead calculation method is not without disadvantages. When calculating overhead as a percentage of direct charges, an inefficient operator may receive a windfall.100 The windfall results from direct charges being higher than those of an efficient, and cost conscious, operator. Secondly, percentage overhead received by the operator may exceed or be less than the operator’s actual costs, thereby violating the actual cost recovery principle followed by the Joint Operating Agreement and accounting procedure. The fixed rate overhead method also has the same disadvantage. The percentage overhead calculation method also fails to offer an incentive for the operator to operate at the lowest cost possible. This is in contrast to the fixed rate overhead which provides an incentive for the operator to operate at a low cost. The 1974 and 1984 accounting procedures offered the same overhead calculation method – fixed rate. The fixed rate method is now the most accepted method in the industry.101 The fixed rate is established during contract negotiations, and the operator 99 Id. 100 Id. 101 Id. at 21-33. 27 Jolisa Melton charges this fixed amount on a monthly basis. The advantages of this method are that it is easy to audit and allows for some cost control on the part of the non-operators. The complexity of auditing is greatly reduced because the non-operator need only verify that the operator charged the agreed upon rate. Any supporting data for charges need not be verified – only direct charges need to be audited. Cost control is achieved in part because the overhead charges will not vary. The 1995 accounting procedure changed gears to allow percentage basis, or a variation of fixed fee. One concern with a fixed rate is that the indirect charges of the operator will change over time and the fixed rate provided for in the accounting procedure will not properly compensate the operator for actual costs. If adjustments were not allowed, then the fixed rate overhead calculation method would violate the actual cost recovery principle. “All COPAS accounting procedures have provided that the overhead rates shall be adjusted annually based on data received from the United States Department of Labor.” John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-35. In addition, the 1995 accounting procedure allows the operator to unilaterally recalculate the fixed overhead rate every two years.102 However, the operator is required to either change or substantiate this recalculation if a majority of non-operators have information contrary to the operator’s unilateral change.103 This challenge can be made every four years.104 It is important that the accounting procedure 102 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 105 (unpublished manuscript on file with Jolisa Melton). 103 Id. at 110. 104 COPAS, Bulletin 33 – COPAS 1995 accounting procedure interpretation (Kraftbilt 1996). 28 Jolisa Melton provide for this ability to challenge, otherwise the non-operators may run the risk of being bound to the unilateral change. Moreover, in Hondo Oil and Gas Co. v. Texas Crude Operator, Inc., 970 P.2d 1433, 1437-1438 (5th Cir. 1992), the court held that if a party to the accounting attachment consents to the unilateral change of the other party, then they are bound to the modification. V. Operator Changes to the Accounting Procedure Parties to the accounting procedure frequently make changes to the form in order to customize the agreement. An industry contact has provided examples of offshore and onshore accounting procedures with modifications. In the 1976 offshore accounting procedure modifications were made to the interest rate and payment grace period. See Appendix 1 for a copy of this accounting procedure. In the 1986 accounting procedure, changes were made to accommodate the type of project involved, such as deep-water prospects. As with the offshore accounting procedure, a modification was made for the payment grace period, but other modifications were also made. For example, “subsea production facilities and production facilities” were added to the equipment list to be provided by the operator. Also, billing procedures and allocations were added for the use of integrated project teams. See Appendix 2 for a copy of a 1986 accounting procedure with modifications. VI. 1995 COPAS Accounting Procedure Improvements The latest provision of the accounting procedure contains several changes intended to provide bright line rules to reduce disputes between the parties. Although the 29 Jolisa Melton 1995 accounting procedure has failed to receive wide acceptance, these improvements could be made as revisions by the person negotiating a 1984 accounting procedure. Training charges are limited to training that the government requires.105 For legal expenses, title and curative work are now directly chargeable.106 Shut-in wells no longer qualify for overhead treatment; while source water wells do receive overhead treatment.107 The exclusion of shut in wells for overhead treatment prevents the charging of a flat fee for a well that receives little or no work and more closely follows the actual cost approach. The interest rate charged for late payment by the non-operator and for over-billing by the operator is now a floating rate tied to treasury bills.108 A floating rate helps to avoid an outdated accounting procedure and more closely match the operator’s cost of funds. Previously, this rate had been tied to a bank to be named by the parties. 109 Treasury bills eliminate the need for the parties to agree upon a bank, and provides a ready source for the interest rate. Also, the 1995 accounting procedure dictates that the books for an affiliate of the operator, who is performing services or providing materials, are also open to audit.110 105 E.M. Wilson, COPAS-1995 Accounting Procedure: A New Direction 107 (unpublished manuscript on file with Jolisa Melton). 106 Id. at 107. 107 Id. 108 Id. at 109. 109 Id. 110 Susan R. Richardson, Joint Interest Audits in the Oil and Gas Industry: Provisions, Protocol, Procedures and Precedent, December 17, 1996, Houston Bar Association, Oil, Gas & Mineral Law Section, Luncheon Program. 30 Jolisa Melton VII. Payments, Audits and Exceptions The accounting procedure provides for quick payment from the non-operators to the operator. The reason for this is simple. The operator incurs all costs of development and production, but does not serve as the bank for non-operators. If the operator is intended to recover only actual costs, then it would be unfair to force the operator to bankroll the operation. Also, such a financial burden on the operator may be more than the operator can bear. The accounting procedure clearly states that even disputed charges must be paid quickly.111 However, with such an absolute payment requirement, the accounting procedure must also provide a dispute mechanism for charges.112 The COPAS accounting procedures have consistently provided an unambiguous exception provision. This provision clearly provides that payment of the charges will not prejudice any rights of the non-operator to dispute the charges.113 The COPAS accounting procedure grants audit rights to non-operators, including the review of the operators books and records.114 Most audits are conducted according to the terms of the accounting procedure, or according to COPAS guidelines.115 However, the accounting procedure also dictates that all charges to which an exception has not been made within 111 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-17. 112 Id. 113 Id. 114 Susan R. Richardson, Joint Interest Audits in the Oil and Gas Industry: Provisions, Protocol, Procedures and Precedent, December 17, 1996, Houston Bar Association, Oil, Gas & Mineral Law Section, Luncheon Program. 115 Id. 31 Jolisa Melton 24 months shall be conclusively presumed to be true and correct, and no longer open to attack.116 This 24-month limitation period has been challenged as unlawfully limiting an non-operators rights under statutory limitation periods. The argument is that state law should trump the provision of the contract. However, courts tend to enforce the accounting provision limitation period. In Woods Petroleum Corp. v. Hummel, 784 P.2d 242 (Wyo. 1989), the Supreme Court of Wyoming upheld the 24-month limitation period in the accounting procedure. In this case, the operator filed suit to recover under-billed expenses incurred in drilling, completing and operating an oil well.117 The court held that the operator is also bound by the 24-month limitation period, just as the non-operators are bound, and therefore could not challenge the accuracy of the billing after the limitation period.118 See also Anderson v. Vinson Exploration, Inc., 832 S.W.2d 657 (Tex. App.-El Paso 1992). One court has rejected the argument that the accounting procedure limitation clause is unconscionable. The court in In re Antweil, 115 B.R. 299, 304 (Bankr. D.N.M. 1990), reasoned that the Joint Operating Agreement and the attached accounting procedure were standard agreements in the oil and gas business. Both parties to the contract were familiar with the contracts, and had used the same model form in previous transactions.119 This, coupled with the fact that the parties to the agreement are industry 116 Id. 117 784 P.2d at 242. 118 Id. at 243. 119 115 B.R. at 304. 32 Jolisa Melton participants, means that neither party was forced to use of the contract.120 Thus, the limitation period of the accounting procedure does not violate public policy nor is it grossly unfair and is not considered unconscionable.121 The court noted that it hated the result in this case since the non-operator failed to receive credit for its contributions of materials but a contract is a contract. Other courts have upheld the limitation period by declaring that it does not foreclose a party’s claim. The limitation period is avoidable with a showing a fraud, badfaith breach of contract, or misrepresentation. In Exxon Corp. v. Crosby-Mississippi Resources, Ltd., 40 F.3d 1474 (5th Cir. 1995), the United States Court of Appeals for the 5th Circuit held that the accounting procedure limitation created a presumption, but did not bar suit.122 The court reasoned that whether or not this clause restricted the statute of limitations was not even an issue because although it was a conclusive presumption it was rebuttable with evidence of fraud or bad-faith breach of contract.123 See also Calpetco 1981 v. Marshall Exploration, Inc., 989 F.2d 1408 (5th Cir. 1993) (creating exception to COPAS accounting attachment’s 24-month limitation period for fraudulent concealment, waiver, or estoppel). In addition to the burden of proof that the nonoperator bears to show one of the exceptions, courts have added an additional requirement of reliance upon the fraudulent misrepresentation. This additional 120 Id. 121 Id. 122 40 F.3d at 1485. 123 Id. at 1486. 33 Jolisa Melton requirement was explained by the court in Dime Box Petroleum Corp. v. Louisiana Land and Exploration Co., 717 F. Supp. 717, 723 (D.Co. 1989): “In order to prevail on its claim of deceit based on fraud by misrepresentation or concealment, plaintiff must prove, inter alia, that plaintiff relied on the material false representation or took such action relying on the assumption that the concealed fact did not exist or was different from what it actually was and the plaintiff’s reliance was justified.” This case involved a non-operator who challenged the direct charges for supplies at current fair market value. The non-operator claimed that the operator represented it had inventory of the charged supplies, and therefore, should only have billed the supplies at cost.124 The court rejected this argument finding that the non-operator was aware of the operator’s lack of inventory. Thus, the non-operator could not rely upon the operator’s misrepresentation.125 The additional requirement of proving reliance places a greater burden on the non-operator to meet an exception to the limitation period. In addition to upholding the 24-month limitation period, the 10th Circuit Court of Appeals has held that the audit process does not toll the statute of limitation. In Meridian Oil Production v. El Paso Natural Gas Company, 1992 U.S. App. LEXIS 28932 (10th Cir. 1992) (unpublished opinion), Meridian filed suit against the operator for disputed charges alleging charges for unused material and overcharging for materials.126 Meridian had performed the audit provided by the COPAS accounting procedure and submitted an exception. However, due to extended negotiations, the suit was not filed for over 6 years 124 717 F. Supp at 722-723. 125 Id. at 723. 126 Id. at 4. 34 Jolisa Melton after the completion of the audit.127 The court affirmed the district court’s decision that an audit was not a condition precedent to filing suit and therefore did not toll the statute of limitations on the claim.128 However, some courts have addressed whether the accounting procedures limitation period is void because it places a restriction on a parties enforcement of their rights. For example, in Seim v. Krause, 83 N.W. 583, 584 (S.D. 1900), the Supreme Court of South Dakota applied South Dakota Civil Code which provided that “every stipulation or condition in a contract by which any party thereto is restricted from enforcing his rights under the contract by the usual legal proceedings in the ordinary tribunals … is void.” However, the facts of this case are different from those that typically arise over the COPAS accounting procedure’s limitation period. In Seim v. Krause, the contract involved billings by an architect that were considered final charges.129 The court held that the charges were not final and therefore, the South Dakota statute did not apply.130 However, this statute would likely be applicable to charges after the accounting procedure’s limitation period because at that point they are conclusively presumed correct, i.e. final. In fact, a South Dakota court has applied this statute to the area of natural resources, specifically, to a royalty issue. In Maguire v. Richmond Hill, Inc., 835 F. Supp. 1159, 1160 (S.D.W.S.D. 1993), the court invalidated the presumption 127 Id. 128 Id. at 9. 129 Id. at 584-585. 130 Id. at 585. 35 Jolisa Melton of correctness for a royalty payment on the basis that it invalidated the South Dakota statute. Oklahoma has a similar statute which provides that: “Every stipulation or condition in a contract, by which any party thereto is restricted from enforcing their rights under the contract by the usual legal proceedings in the ordinary tribunals, or which limits the time within which he may thus enforce his rights, is void.” 15 OKLA. STAT. ANN. §216 (West 1998). Therefore, Oklahoma courts may follow the decisions of the South Dakota courts. Thus far Oklahoma courts, outside of the oil and gas area, have been split on the application of this statute to a limitation clause. See Queenan v. Maryland Cas. Co. of Baltimore, 14 F.Supp 989 (N.D.Okla. 1936) (holding that a limitation set forth in a fidelity bond was void because it violated this statute); U.S. Fire Insurance Co. v. Swyden, 53 P.2d 284 (Okla. 1935) (declaring all limitation clauses void unless the limitation period was adopted by statute). But see Atchison, T. & S.F. Ry. Co. v. Cooper, 175 P 539 (Okla. 1918) (holding that parties can limit the time for remedy and such a contract clause will be binding in absence of circumstances excusing non-compliance). In fact, one court has even taken the application a step further and declared that an arbitration clause violates the statute and is therefore void. See Cannon v. Lane, 867 P.2d 1235 (Okla. 1993). Other provisions in the accounting procedures have been upheld. In Oklahoma Oil & Gas Exploration Drilling Program 1983-A v. W.M.A. Corp., 877 P.2d 605 (Okla. Ct. App. 1994), the court was faced with an argument on exactly what amounts due to the operator will bear interest.131 The nonoperator contended that the COPAS accounting 131 Id. at 610. 36 Jolisa Melton procedure only provided for interest on unpaid advances and not on unpaid monthly expenses.132 The court rejected this argument and applied the plain language of the accounting procedure. The accounting procedure provision providing for interest described “Advances and Payments by Non-Operators” and the court held that interest is due on either if not paid.133 As seen above, cases on the COPAS accounting procedures are few and far between. One author explains: “Litigation is time-consuming, expensive, and can virtually destroy the business relationship between the parties. Often, for these reasons, litigation is not pursued by the non-operators and the claim or exception in dispute is automatically resolved in favor of the operator. . . . . More times than not, the issues disputed in litigation between the parties are settled, often at the eleventh hour before trial, and the settlement agreement reached is sealed.”134 Another reason is that COPAS through its accounting procedures and related bulletins and interpretations has really set up an alternative dispute resolution method. For example, disputes to direct charges are discovered and objected to through the COPAS audit process. Then the charges are hopefully resolved using the guidelines for charges set forth in the COPAS bulletins. It is usually only when this entire process proves unsuccessful that litigation is initiated. If the courts consistently uphold and apply COPAS bulletins, the parties to COPAS accounting procedures will be more likely to follow the bulletins as well. As a result, litigation will be further reduced. 132 Id. 133 Id. at 610-611. 134 Al E. McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton). 37 Jolisa Melton VIII. Areas for Improvement No paper would be complete without a section covering areas for improvement. Several authors have provided numerous ideas for strengthening the COPAS accounting procedure. These areas for improvement, in addition to other suggested changes discussed throughout this paper, provide potential points of negotiation on the COPAS accounting procedure. However, “as a practical matter it is sometimes difficult to include non-standard provisions in a published Accounting Procedure.”135 A. No Gain or Loss Principle One idea was to include the actual cost principle (i.e. that the operator shall neither suffer a loss or experience a gain from their role as operator) expressly in the COPAS accounting procedure.136 This would provide clarity as to the intent for this actual cost basis within the four corners of the document. B. Conflict Between the Joint Operating Agreement and the COPAS Accounting Procedure Another suggestion is for the COPAS accounting procedure to trump the Joint Operating Agreement.137 The problem with the accounting procedure being only an exhibit to the Joint Operating Agreement, is that if there is a conflict between the two 135 Susan R. Richardson, Robert C. Bledsoe and David W. Lauritzen, 1995 COPAS Accounting Procedures or It Is A Very Hard Undertaking To Seek To Please Everybody, August 21-22, 1997, Energy Law Section, Dallas Bar Association, Review of Oil and Gas Law XII Seminar. 136 John Burritt McArthur, A Twelve-Step Program for COPAS to Strengthen Oil and Gas Accounting Protections, 49 SMU L. REV. 1447, 1460 (1996). 137 Id. at 1477. 38 Jolisa Melton documents, then the Joint Operating Agreement controls.138 With the accounting procedure trumping, more authority would be shifted to the provisions of the accounting attachment. However, the general intent of the Joint Operating Agreement is that all costs in developing and producing a property should be borne proportionately by each party thereto. If the provisions of the COPAS accounting procedure resulted in general disproportionate allocation, the argument could be raised for the intent of the Joint Operating Agreement to control. However such argument is unlikely as COPAS shares the same intent. C. Auditing Standards Another suggestion for improvement is for the COPAS accounting procedure to define what auditing standards should apply for any audits performed by the nonoperators.139 This would be beneficial for all parties to the contract by providing consistency. Operators would be able to tailor their books and records to the type of auditing guidelines prescribed (such as GAAP- Generally Accepted Auditing Principles) to make retrieval of information easier and reduce audit disruption. Operators must also attempt to tailor their books to the controlling Joint Operating Agreement or COPAS accounting procedure. Since an operator could be subject to several different COPAS accounting procedure versions, and because most accounting systems are set up to be uniform, the accounting system typically only complies with a single accounting 138 Id. at 1478. 139 Harris E. Kerr and Susan R. Richardson, Auditing Problems Under the COPAS Accounting Procedure, November 12, 1992, Petroleum Accountants Society of the Permian Basin Fall 1992 Oil and Gas Seminar, Midland, Texas; and May 21, 1993, 20th Annual North American Petroleum Accounting Conference, Dallas, Texas. 39 Jolisa Melton procedure selected by the operator.140 This can lead to incorrect billing and the need to audit. In addition, the accounting procedure should state whether the non-operators who did not participate in the audit, but who will receive benefit from the audit exceptions, should share in the costs of the performing the audit.141 Catching up with the times is another suggested improvement for auditing guidance by COPAS. “Moving the gas from the wellhead to the burner tip has become even more complex”142 as additional entities become involved and split up the revenue pie. An auditing guideline facing these complexities is suggested. D. Overhead Given that COPAS does not provide the amount for any fixed rate overhead charges if that overhead method is selected, this determination is left to the operator. The operator is actually in the best position to estimate actual costs.143 However, as discussed above, the incentive to the risk averse and profit minded operator is not to closely tie the overhead rate with the actual costs. This also leaves the fixed rate charge vulnerable to contract negotiations between the parties, and much more the result of joint efforts. The importance of the negotiation for these rates which may bind all parties for several years 140 Al E. McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton). 141 Harris E. Kerr and Susan R. Richardson, Auditing Problems Under the COPAS Accounting Procedure, November 12, 1992, Petroleum Accountants Society of the Permian Basin Fall 1992 Oil and Gas Seminar, Midland, Texas; and May 21, 1993, 20th Annual North American Petroleum Accounting Conference, Dallas, Texas. 142 McClellan, Joint Operating Agreements Part Two: Accounting Procedures and Audits (unpublished manuscript on file with Jolisa Melton). 143 John E. Jolly, The COPAS Accounting Procedures Demystified, 34 ROCKY MTN. MIN. LAW INST. 21-1, 21-33. 40 Jolisa Melton (until production and development cease) has been recognized by the American Association of Professional Landmen.144 It is important that a landman, as the typical negotiator of an accounting procedure, “be aware of the longevity of the agreement and endeavor to cover all present and future contingencies.”145 Several accounting procedures, including the 1984 accounting procedure, provide a method for adjusting these fixed overhead rates. On April 1 of each year, the overhead rate is adjusted by the percentage increase or decrease in the annual average of the weekly earnings of Crude Petroleum and Gas Production Workers as compared to the previous year.146 In the last 36 years, the rate has decreased only twice in 1988 and 1993.147 Continuous escalation of overhead rates can lead to excessively high rates. Negotiation of overhead rate provisions which provide for periods of readjustment is the way to avoid excessive rates. Some suggested provisions include: (1) no overhead rate escalation when well production declines by a specified percentage, (2) negotiating a new rate when ownership or operation of the well changes, (3) decreasing the rate by the percentage decrease in the sales prices of production, (4) delete or limit the COPAS overhead rate adjustment provisions, and/or (5) set lower rates for gas wells than oil wells since gas wells are cheaper to operate.”148 Other suggestions include: (1) negotiate 50 to 75% of average survey rates since they are typically too high, (2) require the operator to 144 R.G. Woodard, All About COPAS AAPL Update (January, 2000). 145 Id. 146 Id. 147 Id. 148 Id. 41 Jolisa Melton consider current market rates each year based on the well economics, or (3) negotiate a flat rate to be renegotiated each year.149 E. COPAS Bulletins Most importantly, referencing COPAS bulletins in the accounting procedure, brings these guidelines into the four corners of the document.150 Inclusion makes sense because the parties to the agreement are well aware that COPAS issues bulletins as guidelines to the accounting procedure, and the parties to the Joint Operating Agreement intend to follow these guidelines.151 The 1995 accounting procedure is the first to provide for incorporation of specific Interpretations or Bulletins.152 However, all Bulletins could be incorporated. Interpretations may create confusion through incorporation since they often provide multiple alternatives to follow but they could be used to limit the decision of the court should litigation arise. Courts have looked favorably upon the validity of the COPAS accounting attachment and have generally found the terms of the procedure to be clear. In Willard Pease Oil and Gas Co. v. Pioneer Oil and Gas Co., 899 P.2d 766, 770 (Utah 1995), the court held that the COPAS accounting procedure was clear and unambiguous and 149 Robin Fort, COPAS: Tips For The Non-Operator In Interpreting, Negotiating and Drafting 41 ROCKY MTN. MIN. L. INST. 21-1 (1995). 150 Harris E. Kerr and Susan R. Richardson, Auditing Problems Under the COPAS Accounting Procedure, November 12, 1992, Petroleum Accountants Society of the Permian Basin Fall 1992 Oil and Gas Seminar, Midland, Texas; and May 21, 1993, 20th Annual North American Petroleum Accounting Conference, Dallas, Texas. 151 Id. at 2. 152 Susan R. Richardson, Robert C. Bledsoe and David W. Lauritzen, 1995 COPAS Accounting Procedure or It Is A Very Hard Undertaking To Seek To Please Everybody, August 21-22, 1997, Energy Law Section, Dallas Bar Association, Review of Oil and Gas Law XII Seminar. 42 Jolisa Melton therefore, extrinsic evidence is unnecessary to explain the intent of the parties to the contract. See also Torch Operating Co. v. Louis Dreyfus Reserves Corp., 1994 WL 117786 (E.D.La. 1994) (holding that accounting procedure can be given clear and definite legal meaning through the plain language of the agreement, and is therefore not ambiguous). Some courts, or administrative parties refuse to consider COPAS bulletins because they are merely offered as guidelines. In C.F. Braun & Co. v. Corporation Comm’n, 609 P.2d 1268, 1272 (Okla. 1980), the court heard recommendations that costs on a pooled unit be allocated according to a COPAS bulletin. However, the court upheld the Corporation Commission’s method of setting their own cost allocation method without consideration of the COPAS bulletin’s allocations because the bulletin is simply a guide.153 The court reasoned that the Commission is not restrained by these guidelines. In deciding on whether bulletins should be used to determine the practices between the parties, the courts must consider some additional factors: (1) bias, and (2) bulletin availability. Because each COPAS society has one vote towards approving a bulletin, the composition of the individual societies is a concern. Is the society operator or non-operator oriented? The national COPAS office does not track this composition. A review of the individual societies shows that a typical society is composed of mainly operators.154 A bias towards operators is definitely possible and if found, should be 153 Harris E. Kerr and Susan R. Richardson, Auditing Problems Under the COPAS Accounting Procedure, November 12, 1992, Petroleum Accountants Society of the Permian Basin Fall 1992 Oil and Gas Seminar, Midland, Texas; and May 21, 1993, 20th Annual North American Petroleum Accounting Conference, Dallas, Texas. 154 17 societies were contacted to obtain composition information. Some societies refused to release such information. Other societies were more than willing to help. The statistics received consistently showed 43 Jolisa Melton adjusted for by the courts. However, this bias may be mitigated by the fact that even though an oil company may be an operator on one joint property, it may also be a nonoperator on another joint property. In which case, the company, through COPAS membership, would vote on a bulletin that protects both interests. Bulletin availability is another prevalent problem. If bulletins are to be used as the source of industry custom and practice and binding to all parties to the contract, the bulletins must be available to the parties. In researching this paper, the only way to review copies of the COPAS bulletins was to purchase a set for approximately $500. The bulletins were not available through community, university, or even school of accounting libraries. For an operator, it is cost beneficial to maintain a library of the bulletins because they are dealing with charges every day. However, for small non-operators the cost may far outweigh the benefits. Spending $500 to look up the answer to infrequent questions may be prohibitive. Therefore, if COPAS bulletins are to be considered the source of industry custom and practice, they must be readily available to all parties to the contract. If they are not available, then the custom and practice cannot be implied to all parties, and will not be binding. If all parties are not bound, then the benefits of a common source for answers to costing disputes will not be realized. IX. Conclusion The benefit with creating a clear and airtight accounting procedure is that it will reduce the need for litigation. The prohibitive costs of litigation often prevent fairness that an individual society is composed mainly of operators. Here are examples of estimates for society operator composition: Denver – 90%, San Antonio – 57%, Corpus Christi – 57%, Salt Lake City – 83%, Wichita Falls – 74%, and Ohio – 59%. Note: these are approximations. 44 Jolisa Melton from being achieved because the wronged party cannot afford to litigate. The major cost of litigation is “expert witnesses, which are often required to testify regarding accounting and billing procedures, industry standards, proper operations and petroleum engineering” and can amount to more than the potential recovery of the suit.155 Both parties would prefer to avoid litigation, and maintain smooth relations. In addition, “clearer and tighter standards also reduce the area of disagreement and confusion. …they will reduce the occasions for lawsuits and should make this industry more inviting for outside investors.” John Burritt McArthur, A Twelve-Step Program for COPAS to Strengthen Oil and Gas Accounting Protections, 49 SMU L. REV. 1447, 1506 (1996). Tightening up the COPAS accounting procedure is one way to decrease the amount of litigation. Increasing the use of COPAS bulletins is another. Using industry custom and practice would be fair to all parties. COPAS provides a source of industry custom and practice. The bulletins could be used as the definitive source for costing disputes - reducing the need to resort to the courts to settle such disputes. A consistent front must be forwarded by the courts to show that they will follow COPAS, or the bulletins must be referenced in the accounting procedure to make them part of the Joint Operating Agreement. If this occurs, then the parties to the Joint Operating Agreement will know that COPAS bulletins will be used to settle the costing disputes, so the parties would benefit through decreased litigation costs by attempting to resolve their conflict through the bulletins before resorting to the courts. Why? Because the courts should reach the same decision as the parties if the COPAS bulletins are applied. 155 Gary W. Davis ET AL., 5 BUSINESS AND COMMERCIAL LITIGATION IN FEDERAL COURTS §79.4 (West Group 1998). 45 Jolisa Melton Another way to achieve decreased litigation expenses would be arbitration. An arbitration clause could be added to the Joint Operating Agreement or the attached COPAS accounting procedure. Perhaps the arbitration panel could include a COPAS member or officer who could assist with the application of industry custom and practice and attempt to ensure that consistent results are achieved. In whatever way COPAS is incorporated into the resolution of cost disputes, COPAS' knowledge of industry custom and practice in the field of petroleum accounting will be an asset. One benefit will be decreased litigation costs. Another, will be consistency of decisions because one source - COPAS - provides the answer. A final benefit is the opportunity for all industry participants to join in the formulation of industry custom and practice. Participants can join a COPAS society and participate in the bulletin and accounting procedure development and approval process. 46