The Independent Insurance Agents of America, Inc.

FREQUENTLY ASKED QUESTIONS

ABOUT THE CONSUMER PRIVACY REQUIREMENTS

MANDATED BY THE GRAMM-LEACH-BLILEY ACT

(Supplement to IIAA’s SUMMARY OF CONSUMER PRIVACY

REQUIREMENTS MANDATED BY THE GRAMM-LEACH-BLILEY ACT

dated April 16, 2001)

June 20, 2001

These Frequently Asked Questions are not intended to provide specific advice about individual legal, business or other

questions. They were prepared solely for use as a guide, and are not a recommendation that a particular course of

action be followed. If specific legal or other expert advice is required or desired, the services of an appropriate,

competent professional, such as an attorney, should be sought.

The information provided below is based on federal law. States may have adopted more specific requirements, which

IIAA members can learn about from their state association.

Frequently Asked Questions

1.

Q:

What are the GLBA privacy notice requirements for groups covered by

the same insurance policy?

A:

The GLBA privacy notice requirements for groups covered by the same

insurance policy vary from state to state, and depend on the type of insurance

product. An insurer providing workers’ compensation through a group plan is

only required to provide privacy and opt out notices to a beneficiary of the plan if

the insurer shares nonpublic personal information (NPI) for a non-excepted

purpose about that beneficiary with unaffiliated third parties. (In this case, the

beneficiary is the individual consumer.) If the insurer does not share NPI with

unaffiliated third parties, the insurer only needs to provide a copy of its privacy

notice to the plan sponsor, but it must do so on an annual basis. It is important to

note that state laws differ in their treatment of groups covered by the same

insurance policy. Consequently, agents must determine and comply with the

requirements of the states in which they do business.

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

1

Ver. 062001

2.

Q:

In the context of group insurance, if the agency is not required to send a

privacy notice to the individual insured, does that individual ever receive a

privacy notice, and if so, from whom?

A:

An individual insured under a group policy is not required to receive a

privacy notice from the agency. The agency is only required to provide the

policyholder offering the group insurance with a privacy notice, and the

policyholder can choose to provide a copy of it to the insured, but is not required

to do so. If the individual insured is eligible to opt out of disclosure by the agency

to unaffiliated third parties, then the individual must be given an opt out notice by

the agency.

3.

Q:

When an agency writes policies in different states for the same

customer/policyholder, which state’s privacy laws govern?

A:

An agency must comply with the privacy laws of the state or states in

which the risk of loss is located. For example, if a New York agency has a

customer/policyholder with a primary residence located in New York and a

vacation home in New Jersey, the New York agency must comply with the

privacy laws of New York as to the policy on the primary residence and with the

privacy laws of New Jersey as to the vacation home. Agencies that conduct

business in multiple states may be able to create one privacy notice that complies

with the laws of each state in which the agency conducts business.

4.

Q:

How many privacy notices must an agency send to: (1) an individual

customer/policyholder with multiple personal lines policies; and (2) joint

customers/policyholders?

A.:

An agency is required to send only one privacy notice to each

customer’s/policyholder’s household, regardless of the number of policies written

for that customer/policyholder, provided that the privacy policy applies to all of

the customer’s/policyholder’s personal lines placed with the agency. Similarly,

an agency is required to send only one privacy notice to one of the joint

policyholders, unless any of the other joint policyholders request his/her own

separate notice, in which case, whoever requests a separate privacy notice should

be provided with one.

5.

Q:

How many opt out forms must an agency send to: (1) an individual

customer/policyholder with multiple personal lines policies; and (2) joint

customers/policyholders?

A:

An agency is required to send only one opt out form to each

customer’s/policyholder’s household, regardless of the number of personal lines

policies written for that customer/policyholder, provided that the opt out form

(and accompanying privacy notice) covers all of the customer’s/policyholder’s

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

2

Ver. 062001

personal lines placed with the agency. Similarly, an agency is required to send

only a single opt out notice if two or more consumers have a joint policy, unless

any of the joint customers/policyholders request a separate opt out notice. If only

one opt out notice is sent to joint policyholders, the opt out notice must specify

how it treats all policyholders based on an opt out direction by any one of the joint

policyholders. For example, will the agency regard an opt out by one of the joint

policyholders as applying to all of the joint policyholders, or will the agency

regard such an opt out as applying only to that specific joint policyholder? The

agency must make a determination in advance as to how to treat the opt out

direction on jointly held policies when exercised by fewer than all of the

policyholders, and communicate that information in the opt out notice.

6.

Q:

To whom does an agency that writes life insurance policies send the

privacy notice and opt out form? How many notices are required to be sent to a

single household if there are several different policyholders who reside at the

same address? Does it make any difference if the policyholder is not the insured?

A:

For life insurance policies, the policyholder is the “customer” and thus is

entitled to the initial and annual privacy notices and opt out form (if applicable

because NPI will be shared with unaffiliated third parties for a non-excepted

purpose). The beneficiary is a “consumer”, and is only owed a privacy notice and

opt out if his/her NPI will be shared with nonaffiliated third parties for a nonexcepted purpose. In a household in which multiple policyholders reside, only

one privacy notice and opt out form need be sent (See FAQs 4 and 5, above). The

regulations, however, do not address the circumstance in which both the

policyholder and beneficiary are owed notices and share the same residence.

While it may be sufficient in this case to provide a single notice to both, the most

prudent course would be to provide separate notices to each.

7.

Q:

Is professional liability insurance written through an association excluded

from GLBA?

A:

Yes. GLBA only applies to insurance services or products to be used

primarily for personal, family or household purposes. Professional liability

insurance is obtained for a business purpose and thus, GLBA does not apply.

8.

Q:

How do GLBA’s privacy requirements apply to insurance agencies and

brokers handling surplus or excess lines?

A:

GLBA only applies to insurance to be used primarily for personal, family

or household purposes. If the surplus or excess lines insurance is for commercial

or business purposes, the privacy notice requirements do not apply.

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

3

Ver. 062001

9.

Q:

How do GLBA’s privacy requirements apply to insurance agencies and

brokers handling health insurance?

A:

Since health insurance is regarded as a financial product under GLBA,

insurance agencies and brokers selling health insurance are considered financial

institutions and must comply with GLBA’s privacy provisions in the same way as

other agencies subject to GLBA requirements. There may be separate state laws

that impose additional privacy protections on consumer health information, so

agencies and brokers selling health insurance should familiarize themselves and

comply with applicable state laws. Agencies and brokers also may be required to

comply with additional Health Insurance Portability and Accountability Act

(HIPAA) privacy rules by April 2003, and IIAA intends to distribute a separate

memorandum addressing those requirements.

10.

Q:

What is the “agent exception” and how does it apply?

A:

The “agent exception” is a limited exception to GLBA’s privacy notice

requirements. This exception primarily benefits agents who do not share NPI

with anyone other than the insurance company (or its affiliates) that the agent

represents. In order for the agent exception to apply, the agent must represent

another insurance licensee (principal) and the principal must provide the

necessary privacy and opt out notices to consumers and customers. The exception

applies as long as the agent represents the principal with respect to that customer

and no NPI is shared. If the agent solicits competitive bids or renewals, then NPI

about that customer will be shared with other insurance companies, and the agent

exception is no longer applicable.

11.

Q:

What is required of a managing general agent under GLBA?

A:

GLBA does not impose separate privacy notice requirements on MGAs

because the customers of MGAs are the distributors of the insurance products and

not the insureds themselves. If, however, an independent agency discloses NPI

about a consumer to a MGA, the agency must include this fact in its privacy

notice to the consumer and the MGA may not use it for any non-policy related

purpose without providing an opt out notice to the consumer.

12.

Q:

Are third-party claimants and beneficiaries treated as consumers under

GLBA?

A:

Under GLBA, consumers include third-party claimants and beneficiaries

under life insurance policies and employee benefit plans. If the insurer discloses

NPI about the beneficiaries and/or third-party claimants for a non-excepted

purpose, the beneficiaries or third-party claimants must receive a privacy notice

and opportunity to opt out. If a beneficiary or third-party claimant submits a

claim and chooses a settlement option that involves an ongoing relationship with

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

4

Ver. 062001

an insurer, these individuals become “customers” and also are owed an annual

privacy notice and opt out notice.

13.

Q:

When can the “short form” privacy notice be used?

A:

The federal rules permit agencies to provide a short form initial privacy

notice along with the opt out notice but only to consumers with whom the agency

does not have a customer relationship. The short form notice, along with the opt

out, must clearly and conspicuously state that the disclosure containing

information about the agency’s privacy policy is available upon request, with

directions on how the consumer can obtain a copy. Since state laws may differ

from the federal rules regarding the use of short form notices, it is important that

agencies understand what is required in the states in which they do business, and

if the state laws are more restrictive, comply with them.

14.

Q:

Must the consumer or customer sign the privacy notice?

A:

The federal rules do not require that the privacy notice be signed by

consumers or customers. If an agency wants to ensure that its preference for

resolving disputes through binding arbitration is followed, then the agency should

include an arbitration clause in its privacy notice, and the consumer or customer

must sign the privacy notice, if the notice is given in written form, and must

electronically agree to the privacy notice if it is given electronically.

15.

Q:

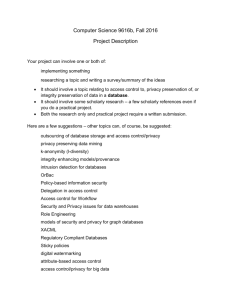

What are the various types of physical, electronic, and procedural

safeguards that may be used to protect the customers’ NPI?

Examples of physical safeguards include physical security of office space, and

locking file cabinets. Examples of procedural safeguards include restricting

access to files to employees with a need to know the information at issue in order

to perform their job duties, compliance audits, and employee training about

appropriate treatment of information about customers and consumers. Examples

of electronic safeguards include maintaining and protecting information through

security-enhancing software (such as intrusion detection software), password

protection on database access for employees, and establishment of backup and

recovery procedures.

16.

Q:

Is an agency agreement a “joint marketing agreement” that qualifies for an

exception to GLBA’s opt out requirements?

A:

An agency agreement can qualify as a joint marketing agreement but to do

so, it must contain language that requires the nonaffiliated third party to maintain

the confidentiality of the information that the agency discloses. Typical contract

clauses that would satisfy this requirement limit the third party’s disclosure or use

of NPI to the purpose for which the agency disclosed the information. This

limitation is designed to prevent recipients of information under this exception

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

5

Ver. 062001

from sharing NPI pursuant to a chain of third party joint marketing agreements.

Because agency agreements impose varying degrees of restrictions on the use and

disclosure of NPI by insurance companies, typically through ownership of

expirations clauses, it is impossible to determine which agency agreements

qualify as joint marketing agreements. Therefore, the most prudent course is for

an agency to develop a privacy policy that includes an opt out. It should be noted

that for agencies with agency agreements that qualify as joint marketing

agreements, the agency must disclose in its privacy notice the categories of third

parties with which it shares NPI.

17.

Q:

What does an agency do if a consumer or customer decides to opt out?

A:

The agency must not disclose any of the consumer’s or customer’s NPI to

a nonaffiliated third party, except pursuant to an exception.

*****

Copyright 2001 ©

Independent Insurance Agents of America, Inc.

All rights reserved.

6

Ver. 062001