2.0 Use of Common Good Properties

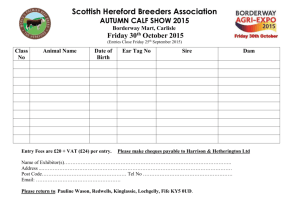

advertisement

North East Fife Area Committee Date 2nd September, 2009 Agenda Item No. 9 Administration of Common Good Land and Buildings Report by: Joint report by Executive Director, Performance & Organisational Support, Executive Director, Finance & Resources and Head of Asset and Facilities Management Wards Affected: 17 - Howe of Fife & Tay Coast 18 - Taybridgehead 19 - St. Andrews 20 - East Neuk & Landward 21 - Cupar Purpose To inform members of proposals relating to the administration of Common Good land and buildings held by the Council. Recommendation(s) The Committee is asked to: 1. 2. 3. 4. Note the work of officials relating to the administration of Common Good properties; Support the application of the guiding principles set out in Appendix D to this report; Contribute any comments they wish to make on the proposals for onward transmission to Policy, Finance & Asset Management Committee; and Note that the report will then be referred to the Policy, Finance & Asset Management Committee for final decision along with a note of all comments from Area Committees. Resource Implications Still to be fully assessed but it is likely that on balance some mainstream service revenue may require to be diverted towards payment of a “notional rent” in respect of Common Good properties occupied by Services. Conversely increased resources may be available for Common Good purposes in former burghs and greater efficiency in the use of Common Good assets may achieve financial benefits. Legal & Risk Implications/ Legal & Risk Implications There is no perceived risk in the proposals and legally it is proposed that the attached principles will meet the Council’s legal obligations in relation to Common Good. The legal position is discussed in more detail below. The general provisions relating to common good are now contained in the Local Government etc. (Scotland) Act 1994. This states that the local authority in administering such property must "have regard to the interests of the inhabitants of the area to which the common good related prior to 16th May, 1975." The Local Government (Scotland) Act 1973 introduced rules in relation to disposal of some common good property (disposal being both outright sale, lease, and other lesser types of disposal including demolition of buildings). However, there is no blanket prohibition on disposing of common good land. In certain cases the authority will need the consent of the Sheriff to dispose of the property. In determining whether to dispose of the property, the Sheriff will have regard to what is in the best interests of the inhabitants of the former burgh. In most cases the court has taken a very pragmatic view of what is in the best interests of the burgh and allowed the disposal. It should also be emphasised that the obligation to administer the property forming part of the common good of a former burgh is placed squarely in the hands of Fife Council. Common good property is owned by Fife Council in the same way that any other Council property is owned. Special features may relate to the obligation to administer such property having regard to the best interests of the inhabitants of the former burgh, and in relation to its disposal; however, the property title vests in Fife Council. Running parallel to the process of establishing principles for management of these properties is an exercise to identify the full extent of what properties are held on the common good account. It is clear that there has been significant under-reporting of common good assets in the records inherited from the former District Councils, and the records are now being updated in consultation with the local communities. This is a resource-intensive exercise which will be the subject of a separate report in due course. Policy & Impact Assessment The proposals are in line with the Council’s overall Asset Management principles in terms of policy. No equalities impact assessment has been carried out as it has not been considered necessary in this case. Consultation/ Consultation Services have been consulted and the proposals and the responses received are broadly supportive of the principle subjects to recognition of the potential increased costs which may arise from implementation. Consultation is ongoing with Community Councils and heritage organisations including Historic Scotland. 1.0 Background 1.1 This report addresses issues associated with the management of common good properties across Fife. The current position is a patchwork of historical arrangements with variations in practice not just between funds but within fund areas. The current arrangements require to be reviewed to ensure that common good properties are managed in accordance with modern asset management practices being applied throughout the Council. 1.2 A working group of officers from Performance & Organisational Support, Finance and Resources, and Asset and Facilities Management Services have been looking for some time now at the current practices and procedures relating to the administration and management of land and buildings held on the Council's common good account. 1.3 Local authorities are obliged by law to maintain separate common good accounts for each former burgh within their area. Property held on the Council's common good accounts - both land and buildings - constitute a significant proportion of the Council's land holdings in some instances in former burghs. A list of the former burghs in Fife is attached as Appendix A. 1.4 Common good properties in former burghs often include landmark buildings such as, for example, the City Chambers in Dunfermline and the Town House, Kirkcaldy. Key recreational areas such as Beveridge Park and Ravenscraig Park, Kirkcaldy, are also held on the common good account. The current list of common good properties relevant to this Area is attached as Appendix B. However, the working group has identified various issues relating to the way we currently administer these assets. 2.0 Use of Common Good Properties 2.1 2.2/ Properties within Fife are put to a variety of uses including administrative (e.g. Town House, Kirkcaldy), community halls (Corn Exchange, Cupar), sports and leisure facilities and open space which is not managed by any Service. The use of these properties for public services is regarded as complying with the legislative requirement to have regard to the interests of the inhabitants of the former burgh. 2.2 Other common good properties are leased to external lessees with the income generated being credited to the appropriate Common Good Fund. 3.0 Issues and Options 3.1 A number of issues were identified which seem to be blocking the most efficient use of these assets. These were: 3.2 a sense that common good property was detached from the mainstream asset management processes now being rolled out through the Council; in some cases a complete lack of management of common good assets, with no Services taking responsibility for the management of them; an inconsistency in the application of policies and practices between former district council areas on how common good property was maintained and managed; in particular, inconsistencies between repairs and maintenance responsibilities regarding properties which were held on the common good accounts but were occupied and used by mainstream Council Services: some examples of these inconsistencies are set out at Appendix C; a perception, both within and outwith the Council, that common good properties were "not ours"; a perception that it was never possible to dispose of common good property. Given the inconsistencies outlined above, the status quo is not considered a suitable option. The benefits of change are discussed below. 4.0 Benefits of Change 4.1 Given the difficulties outlined above at paragraph 3, the Group has spent some time identifying a set of baseline principles to guide the future administration of common good property. These are set out as Appendix D. 4.2 The proposed management arrangements will not just impact on the Common Good Funds themselves but will also have budgetary impacts for the Revenue Fund in terms of the Services who currently operate Common Good properties. 4.3 The main advantages of implementing the guiding principles set out in Appendix D are seen by the Group as follows: greater/ greater consistency of treatment of common good property throughout Fife; as a result, full integration with modern asset management practices being applied throughout the Council; the opportunity to deliver best value from common good property, retaining and strengthening those assets that are valuable to the local community whilst disposing of others that are surplus to requirements and incapable of supporting a beneficial use. 5.0 Conclusions 5.1 It is recommended that the guiding principles referred to at Appendix D be adopted by the Council in administering common good land and buildings as a way of delivering continuous improvement and best value in the administration of the Council's assets. Report Contact Andrew Ferguson, Solicitor, Team Leader, Performance & Organisational Support, 3rd Floor, Fife House, North Street, Glenrothes, KY7 5LT Telephone: 08451 55 55 55 + 442241 Email - Andrew.ferguson@fife.gov.uk CFP/NEW COMM/AREA COMM/REPORT/ADMINISTRATION OF COMMON GOOD LAND AND BUILDINGS/020909/AM