ANSWERS TO CHECKPOINT EXERCISES

advertisement

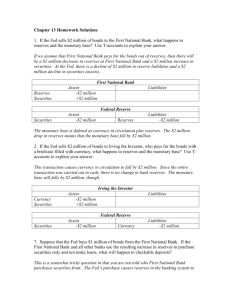

ANSWERS TO CHECKPOINT EXERCISES CHECKPOINT 12.1 How Banks Create Money 1. Explain to the bank manager that when the bank makes a loan, it creates a checkable deposit that previously did not exist. Because checkable deposits are part of M1, then we can safely say that making a loan is the equivalent of creating money. 2. The amount of new money that will be created by the $200 million new deposit is limited by the required reserve ratio. 3a. The bank’s excess reserves are $47.50. Excess reserves are equal to actual reserves minus required reserves. The $50 deposit creates $50 of new reserves. At the required reserve ratio of 0.05, the bank must set aside as required reserves 0.05 $50, which is $2.50. The remainder, $47.50, is excess reserves. 3b. The maximum amount of loans is $950. The maximum amount of loans that the banking system can make is equal to the increase in total deposits minus the initial deposit. So, to determine the loans, calculate the total deposits and then subtract the initial deposit. The increase in reserves times the deposit multiplier equals the total amount of deposits created. The money multiplier equals 1 (required reserve ratio), which is 1 0.05 = 20. So, the total amount of deposits equals 20 $50 = $1,000. The maximum amount of loans equals $1,000 $50, which is $950. 3c. The maximum amount of new money that can be created is $950. When a bank makes loans, it creates new money. The maximum amount of new money created by the banking system equals the maximum amount of loans that it can make. CHECKPOINT 12.2 Influencing the Quantity of Money 1. An open market operation occurs when the Fed buys or sells securities in the open market. Open market operations influence the monetary base by changing the amount of reserves in the banking system. 2. When the Fed buys government securities from banks, the Fed pays for the securities by increasing the reserves of the banks from which it buys the securities. Banks can then lend out these newly generated reserves, which will create deposits in the banking system. When the Fed buys securities from individuals, the Fed writes a check to the person and the person deposits the check with a commercial bank. The bank then presents the check to the Fed and the Fed credits the bank’s reserve account. These reserves are lent out in the same process described above. The entire process works in reverse when the Fed sells securities to banks or the nonbank public. 3a. If the Fed makes the sale to a bank, the monetary base decreases by $1 million. Ownership of the securities passes from the Fed to the bank. As a result, the Fed’s assets decrease by $1 million. When the bank pays for the securities, the Fed decreases the bank’s deposit with the Fed by $1 million. The Fed’s liabilities decrease by $1 million. The bank’s assets are the same, but their composition has changed. The bank has $1 million more in securities and $1 million less in reserves. If the Fed makes the sale to the nonblank public, reserves in the banking system still decrease by $1 million, the Fed’s liabilities decrease by $1 million, and the Fed’s assets decrease by $1 million. The monetary base decreases by $1 million. 3b. When the banks’ reserves decrease, their excess reserves also decrease and, in response, they decrease their lending. The decrease in lending decreases the quantity of money. 3c. The quantity of money decreases by an amount equal to the initial decrease in reserves ($1 million) multiplied by the value of the money multiplier. 3d. The magnitude of the money multiplier is inversely related to the size of the required reserve ratio and to the currency drain. ANSWERS TO CHAPTER CHECKPOINT EXERCISES 1a. Excess reserves = actual reserves required reserves. The new reserves created by the deposit are $2 million. This deposit requires (0.1) $2 million, which is $0.2 million in required reserves. The excess reserves are $2 million $0.2 million, which is = $1.8 million. 1b. The maximum amount of loans that the banking system can make is equal to the increase total deposits minus the initial deposit. The deposit multiplier = 1 (required reserve ratio) = (1 0.1). The total deposits created are (1 0.1) $2.0 million = $20 million. So loans equal $20 million $2 million, which is $18 million. 1c. The maximum amount of new money the banking system can create is the maximum amount of loans, which in part (b) was calculated as $18 million. 2a. Excess reserves = actual reserves required reserves. The reserves lost by the deposit withdrawal are $3 million. The deposit withdrawal removes (0.1) $3 million, which is $0.3 million in required reserves. So the excess reserves are $3 million ($0.3 million) = $2.7 million, that is, the banking system has lost $2.7 million in excess reserves. 2b. The reasoning used in the answer to Exercise 1b applies to this exercise, only here the banks are decreasing the amount of loans rather than expanding them. So the banking system must call in loans equal to (1 0.1) ($3 million) $3 million = $27 million. 2c. The reasoning used in the answer to Exercise 1c applies to this exercise, with the difference that in this exercise the quantity of money is contracting rather than expanding. The amount of money the banking system destroys is equal to the decrease in loans, $27 million. 3a. With the $1 million purchase of government securities, the monetary base increases by $1 million. 3b. Initially only the banks’ reserves change and they increase by $1 million. As additional rounds in the multiplier process occur, banks’ reserves decrease as people withdraw currency. So as these additional rounds occur, both banks’ reserves and currency change. 3c. The change in the quantity of money equals (money multiplier) (change 1 in the monetary base). The money multiplier is , where L = (1 C) (1 L) (1 R) with C equal to the currency drain and R equal to the required reserve ratio. L = (1 0.20) (1 0.05) = 0.76. The money multiplier equals 1 (1 0.76) = 4.17, so the change in the quantity of money equals (4.17) ($1 million) = $4.17 million. 3d. One way to determine how much of the increase in money is in currency and how much is in deposits relies on two observations. First, note that c + d = $4.17 million (where c is currency and d is deposits) so that by rearranging, d = $4.17 million c. Then, the second observation is to note that the entire $1 million increase in the monetary base must be held as either currency or reserves. Reserves equal the required reserve ratio times the amount of deposits, or (0.05) d. Thus $1 million = c + (0.05) d. Now, use the first formula for d, namely d = $4.17 million c, in the second formula to give $1 million = c + (0.05) ($4.17 million) (0.05) c. Solve this last formula for c and the result is c = 0.83 million. As a result, d equals $3.34 million. 4a. There is no change in actual reserves—they remain equal to $200 billion. Required reserves decrease from $200 billion to $100 billion and so excess reserves increase to $100 billion. 4b. Assuming that there is no currency drain, the change in deposits equals the change in excess reserves times the deposit multiplier. The deposit multiplier equals 1 (required reserve ratio) and so, after the reduction in the required reserve ratio, the deposit multiplier equals 1 0.05. So the change in deposits is (1 0.05) $100 billion = $2 trillion. 4c. If there is no currency drain, the change in the quantity of money equals the change in deposits, $2 trillion. 5a. The bank’s total deposits are $200. So, the bank’s required reserves are 0.05 $200, which is $10. The bank’s reserves are the sum of its reserves at the Fed plus its cash, so the bank has $40 in reserves. The bank’s excess reserves are $40 $10 = $30. 5b. The deposit multiplier is 1 (required reserve ratio), so the deposit multiplier is 1 0.05, which is 20. 5c. The bank will loan the amount of its excess reserves, $30. 5d. If all the loans are deposited in the bank, the bank receives $30 in deposits and reserves. Of these deposits, it must keep 0.05 $30, which is $1.50 as reserves. So the bank now has excess reserves of $30.00 $1.50, which is $28.50. 5e. The bank has reserves of $40. The deposit multiplier shows us that the total deposits will be $40 (1 0.05), which is $800. The bank already has $200 in deposits, so it will make an additional $600 in loans. Total loans will be $600 plus the original $100, which equals $700. 5f. The bank has reserves of $40. The deposit multiplier when the required reserve ratio is 0.02 is equal to 1 0.02. So the total deposits will be $40 (1 0.02), which is $2,000. The bank already has $200 in deposits, so it will make an additional $1,800 in loans. Total loans will be $1,800 plus the original $100, which equals $1,900. 6a. The bank’s total deposits are $200. So, the bank’s required reserves are 0.05 $200, which is $10. The bank’s reserves are the sum of its reserves at the Fed plus its cash, so the bank has $5 in reserves. The bank’s excess reserves are $5 $10 = $5. 6b. The bank has a $5 shortage of reserves. 6c. The bank needs to gain an additional $5 of reserves. So the bank will not renew $5 of loans. 6d. If all the loans are repaid out of deposits, after the loan is repaid, the bank has deposits of $195. With $195 in deposits, the bank needs reserves of 0.05 $195, which is $9.75. The bank still has $5 in reserves, so the bank has a shortage of reserves of $9.75 $5.00, which is $4.75. 6e. To decrease required reserves by $5, the bank needs to decrease its loans by $5 (1 0.05), which is $100. The bank decreases its loans and deposits by $100. So when the bank has no excess reserves, loans will be $10 and the amount of deposits will be $100. 7. If the Fed wants to decrease the quantity of money, it sells government securities in the open market. This sale decreases banks’ reserves as either banks, or their customers, pay for the government securities. When banks’ reserves decrease, they must call in loans, which decreases the amount of deposits, and the quantity of money decreases. 8a. Excess reserves decrease by $100,000, the amount of the sale by the Fed. 8b. The banks call in loans of $100,000. The currency drain is 10 percent, so deposits decrease by $100,000 .90, which is $90,000. 8c. Currency in circulation decreases by $100,000 .10, which is $10,000.. 9a. The Fed has no control over currency drains. 9b. If the Fed decreases the required reserve ratio, the banks can increase their lending, which increases the quantity of money. Reserves do not change and so the monetary base does not change. 9c. If the Fed decreases the discount rate, the banks pay a lower price for reserves that they borrow from the Fed. So banks are more willing to borrow reserves and increase their lending. The Fed would not do this because the monetary base increases. 9d. The Fed cannot conduct an open market operation and increase the quantity of money while keeping the monetary base constant. Open market operations change the quantity of money by changing the monetary base. So it is impossible to use an open market operation to change the quantity of money while keeping the monetary base constant. 10a. Reserves increase by the amount of the open market purchase of securities, $1 billion. 10b. The deposit multiplier is 1 0.05 so deposits increase by (1 0.05) $1 billion, which is $20 billion. Of the $20 billion increase in deposits, the initial $1 billion is created by the open market purchase. The rest of the $20 billion is created by an increase in loans. So loans increase by $20 billion $1 billion, which is $19 billion. 10c. The deposit multiplier is 1 0.05 so deposits increase by (1 0.05) $1 bil