Title: Vietnam Governance, Economic Management and Social

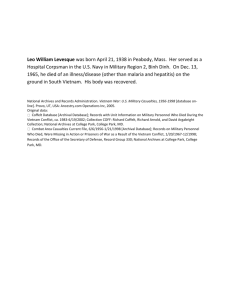

advertisement