EC4617 - University of St Andrews

advertisement

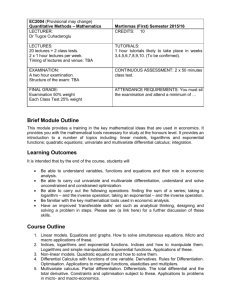

EC4617 Financial Economics: Asset Pricing LECTURER: Dr Leonidas Barbopoulos Martinmas (First) Semester 2015/16 CREDITS: 15 LECTURES: 18 lectures + 1-hour class test. 2 x 1 hour lectures per week (9 weeks). Timing of lectures and venue: TBA. TUTORIALS: 4 x 1 hour tutorials likely to take place in weeks 3, 5, 7 and 9. (To be confirmed). EXAMINATION: A two-hour examination. Structure: TBA. CONTINUOUS ASSESSMENT: 1 x 50 minutes Class Test; date TBA. 1 x 1500 words project, to be submitted by TBA. FINAL GRADE: Examination 60% weight Class Test 20% weight Project 20% weight ATTENDANCE REQUIREMENTS: you must sit the examination and attend a minimum of 4 tutorials to gain credit for this class. Brief Module Outline The main aim of this module is to provide a rigorous grounding in the theory and applications of finance; in addition this module is to provide a thorough synthesis of the most important current research in finance, with a particular emphasis on the applications of the principles. The ultimate aim is to provide students with a standard approach to define, measure, as well as predict the value of financial claims in a world of uncertainty. The standard notion of risk versus return is defined and analytical economic models of how risks and returns are determined and traded in financial markets. Both normative and positive aspects of financial theory will be investigated, together with supporting descriptive and empirical evidence. Learning Outcomes It is intended that by the end of the course, students will: Advanced knowledge and critical understanding of essential components of modern finance theory and associated current research. Explored, understood and appreciated the complexity and contradictions of the current academic literature and its implications for professional practice. Demonstrated ability to learn and work independently in finance, exercising critical judgment and discrimination in the resolution of complex problematic situations. Used highly specialized and advanced technical, professional, and academic skills in the analysis of relevant specific problems in finance. Had the opportunity to apply your problem solving and analytical skills to issues in finance in a complex specialized context. Course Outline 1. 2. 3. 4. 5. 6. 7. 8. The Role of Financial Theory and its Building Blocks Capital Markets, Consumption and Investment Capital Budgeting, Investment Decisions, and Valuation Theories The Theory of Choice under Uncertainty Portfolio Theory Equilibrium Asset Pricing Models I: CAPM and its recent developments Capital Market Efficiency, Market Anomalies and Behavioral Finance Introduction and Applications of Derivatives Instruments Main Reading The main textbook for this course is: Principles of Corporate Finance; 11th Global Edition, McGraw-Hill. Brealey Richard, Myers Steward, and Allen Franklin. More supporting/reading materials will be added at the end of each topic/lecture. 1