3. economic relations and prospects between china and costa rica

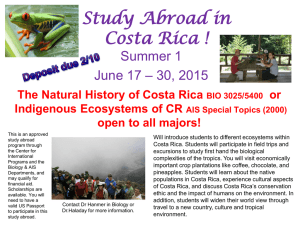

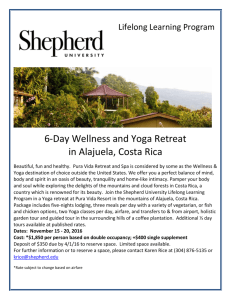

advertisement