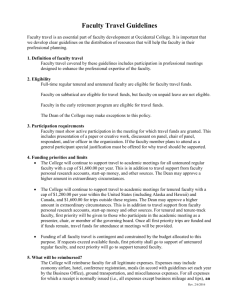

Reimbursement for Travel Expenses

advertisement

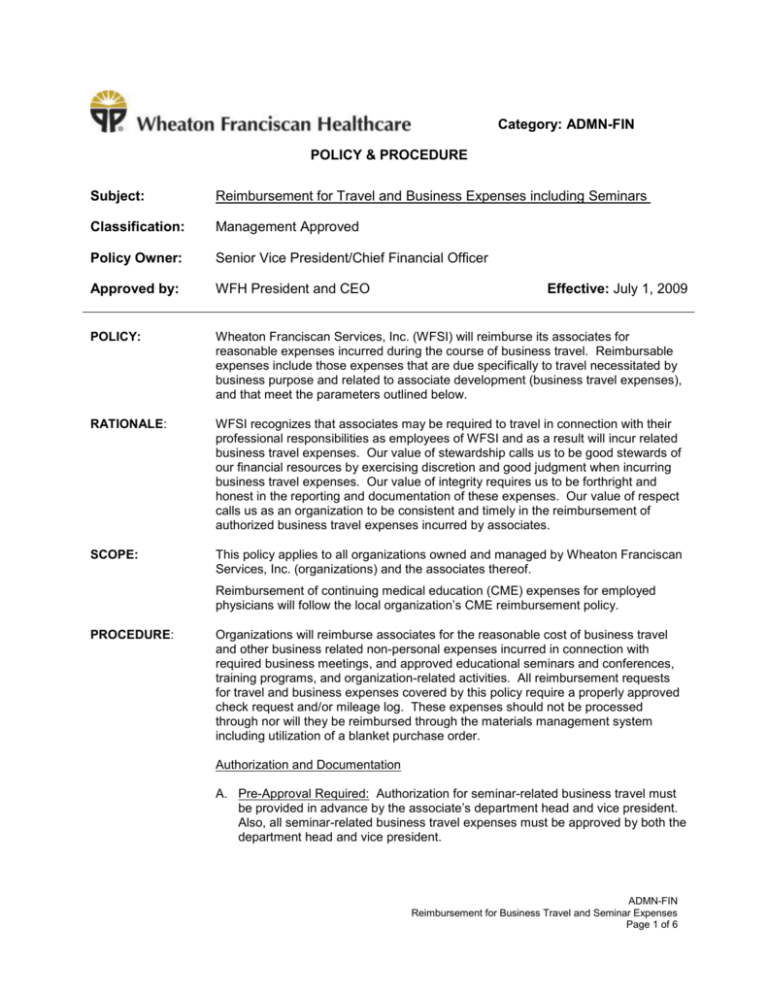

Category: ADMN-FIN POLICY & PROCEDURE Subject: Reimbursement for Travel and Business Expenses including Seminars Classification: Management Approved Policy Owner: Senior Vice President/Chief Financial Officer Approved by: WFH President and CEO POLICY: Wheaton Franciscan Services, Inc. (WFSI) will reimburse its associates for reasonable expenses incurred during the course of business travel. Reimbursable expenses include those expenses that are due specifically to travel necessitated by business purpose and related to associate development (business travel expenses), and that meet the parameters outlined below. RATIONALE: WFSI recognizes that associates may be required to travel in connection with their professional responsibilities as employees of WFSI and as a result will incur related business travel expenses. Our value of stewardship calls us to be good stewards of our financial resources by exercising discretion and good judgment when incurring business travel expenses. Our value of integrity requires us to be forthright and honest in the reporting and documentation of these expenses. Our value of respect calls us as an organization to be consistent and timely in the reimbursement of authorized business travel expenses incurred by associates. SCOPE: This policy applies to all organizations owned and managed by Wheaton Franciscan Services, Inc. (organizations) and the associates thereof. Effective: July 1, 2009 Reimbursement of continuing medical education (CME) expenses for employed physicians will follow the local organization’s CME reimbursement policy. PROCEDURE: Organizations will reimburse associates for the reasonable cost of business travel and other business related non-personal expenses incurred in connection with required business meetings, and approved educational seminars and conferences, training programs, and organization-related activities. All reimbursement requests for travel and business expenses covered by this policy require a properly approved check request and/or mileage log. These expenses should not be processed through nor will they be reimbursed through the materials management system including utilization of a blanket purchase order. Authorization and Documentation A. Pre-Approval Required: Authorization for seminar-related business travel must be provided in advance by the associate’s department head and vice president. Also, all seminar-related business travel expenses must be approved by both the department head and vice president. ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 1 of 6 B. Authorized Approver Responsibilities: All business related expenses must be approved by the associate’s department head and vice president. The authorized approvers are responsible for verifying the following: 1) Business purpose of the travel is valid and directly related to official business to and for the benefit of the Organization. 2) Total cost of the trip is within the approved budget. 3) Proposed expenses are reasonable. Exceptions: A regional vice president or above must approve exceptions to provisions of this policy. Approved exceptions must have written justification supporting the benefit to the organization and generally require the recommendation of the individual's manager. C. Associate Responsibilities: Associates have the responsibility to spend the organization’s funds prudently. Business travel expenses will be paid by the organization only if they are reasonable, necessary and in accordance with this policy. Individuals who incur business travel expenses should neither gain nor lose personal funds as a result of their business travel on behalf of the Organization. An associate is to request approval for seminar-related business travel expenses in advance by submitting a properly completed seminar preapproval form. Reimbursement forms will be available on each region’s intranet site and will be modified to reflect differences in accounting systems and authorization titles. D. Substantiation of Expenses: Following attendance at an approved business activity, an associate business expense reimbursement form is to be properly completed and approved by the appropriate department head and vice president. The reimbursement form must include original receipts or other supporting documentation where receipts are not available. This supporting documentation must state the business purpose and also include the following: a. A copy of the agenda and registration form for educational seminars and conferences, showing the following: i. Location of seminar or conference ii. Dates of conference iii. Registration fee b. A copy of the flight itinerary showing the following: i. Destination of flight(s) ii. Dates of flight(s) iii. Cost of airfare iv. Receipt indicating evidence of payment c. A copy of the original itemized hotel receipt or statement showing the following: i. Location of lodging ii. Dates of lodging iii. Amount of each night’s lodging iv. Evidence of payment d. Receipts for all meals showing the following: i. Date of meal ii. Name of individual(s) for whom the expense was incurred iii. Name of restaurant iv. Location of restaurant v. Amount of tip ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 2 of 6 e. Additional items reimbursed, such as mileage, rental car, registration fees, parking fees, ground transportation such as taxis, etc., should follow the same guidelines where an original receipt is submitted including location, date, cost, and any other relevant information. Additionally, these items should be reasonable in amount, necessary, and show a clear business purpose. Business Expenses Reimbursement Guidelines Business expenses are expected to be paid directly by the associate who will be subsequently reimbursed by the organization for qualifying business expenses. Exceptions include pre-approved and pre-paid registration fees that may be paid directly to the vendor in advance by the organization. It is the responsibility of the associate to submit a detailed account of the expenditures (including receipts) within 90 days following the completion of the business travel or the educational activity. Reimbursement for qualifying business expenses will be provided to the associate on a timely basis following the receipt of appropriate documentation and approvals. A. Transportation 1) Air Travel All travel reservations should be made as far in advance as possible in order to take advantage of reduced fares. The organization will reimburse or pay only the cost of the lowest coach class fare actually available for direct, non-stop flights from the airport nearest to the associate’s home or office to the airport nearest the destination. Frequent flyer benefits can accrue for personal use, but should not compromise the decision to obtain the least expensive fare. Unavoidable airline reservation change fees will be reimbursed. 2) Ground Transportation Associates are expected to use the most economical ground transportation appropriate under the circumstances and should generally use the following, in this order of desirability: a. Courtesy Cars Many hotels have courtesy cars which will take guests to and from the airport at no charge. The hotel will generally have a wellmarked courtesy phone at the airport if this service is available. Associates should take advantage of this free service whenever possible. b. Airport Shuttle or Bus Airport shuttles or buses generally travel to and from all major hotels for a small fee. At major airports such services are as quick as a taxi and considerably less expensive. c. Taxi or Limousine Service When courtesy cars and airport shuttles are not available, a taxi is often the next most economical and convenient form of transportation when the trip is for a limited time and minimal mileage is involved. d. Rental Cars Car rentals are expensive, so other forms of transportation should be considered when practical. Associates will be allowed to rent a car while out of town provided that the appropriate vice president has given advance approval and that the cost is less than alternative methods of transportation. The lowest rental rate available among major providers (e.g. National, Avis, Hertz, Budget, etc.) is reimbursable. Opting for a higher rate to obtain frequent traveler benefits is not a legitimate consideration. Reimbursement will be ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 3 of 6 allowed for mid-size or compact cars. When a group is traveling together, the rental cost of a full-size automobile will be reimbursed. Rental cars should be driven only by associate(s). WFSI carries insurance for business car rentals within the United States. Extra insurance offered by car rental companies for rentals within the U.S. is not reimbursable. When traveling outside of the U.S. it is recommended that associates purchase the insurance coverage offered by the rental company which will be reimbursable. In lieu of using your personal automobile, rental cars will be reimbursed for business travel when the total charges are approximately equal to or less than the amount reimbursable under the mileage reimbursement section of this policy. Car rental expenses, including any applicable insurance, incurred during an extended stay not considered business related is an expense of the associate. 3) Mileage Reimbursement When using personal automobiles for business purposes, associates will be reimbursed at the federal standard mileage rate set by the Internal Revenue Service (IRS). Commuting miles to the associate’s primary business location are not reimbursable expenses. By following these IRS guidelines, we are able to exclude mileage reimbursement as taxable income to associates. The appropriate forms must be completed (Mileage Log or Associate Expense Report) documenting the location, dates and business purpose. Reimbursement requests must be submitted within 90 days of business travel. Definitions for Reimbursable Mileage: Commuting is the distance you travel from home to your regularly scheduled primary place of work and back. Primary Place of Work (regular or main job) is your regularly scheduled place of business or where you regularly perform work duties. Examples Related to Mileage Reimbursement: Example 1. – Your primary places of work are WFH – St. Joseph on Monday, Wednesday and Friday and at WFH-Elmbrook on Tuesday and Thursday. You will not be reimbursed for any mileage because all would be considered commuting. Example 2. – Your primary place of work is WFH-St. Joseph. You are asked to attend an early meeting at WFH-All Saints, a meeting at WFH-St. Francis, a meeting at WFH-Glendale Corporate Services and return to WFH-St. Joseph. Your round trip commuting mileage is 44 miles. If you actually traveled 123 miles during the entire day you should submit a mileage log to be reimbursed for 79 miles (123-44=79) 4) Parking and Tolls Parking and toll expenses, including charges for hotel parking, incurred by associates traveling on business will be reimbursed. The cost of parking tickets, speeding tickets, fines, car washes, valet service, etc. are the responsibility of the associate and will not be reimbursed. ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 4 of 6 B. Lodging Associates traveling on behalf of the organization may be reimbursed for the reasonable cost of hotel accommodations. The convenience and proximity to other venues on the associate’s itinerary will be considered in determining reasonableness, along with the availability of other hotel accommodations in the same vicinity. Associates shall make use of available discount rates for hotels and are encouraged to check with local WFSI organizations concerning the availability of corporate rates in their area. Nonstandard room (suites or luxury) hotel rates will not be reimbursed. If an additional overnight stay results in a cheaper airfare, the extra day’s expenses (e.g. hotel, transportation, meals, etc.) will be reimbursed to the extent that there is a net savings to the organization. The savings must be documented and approved in advance by the appropriate vice president. The requesting associate is responsible for securing hotel accommodations. Extended Stay - Except as noted above, in cases where an associate has elected to take days of vacation before or after a business trip, the associate will be reimbursed for the cost of lodging only for those days resulting directly from the travel on behalf of the Organization. C. Meal Allowances. Associates traveling on behalf of the organization and with an overnight stay will be reimbursed for the actual cost of meals. The cost of meals must be reasonable in the marketplace but in no circumstances exceed an aggregate for all meals of $100 per day. Meals will only be reimbursed when there is an overnight stay associated with the business travel. Receipts substantiating the cost of the meals must be provided in accordance with IRS guidelines. Exception: An overnight stay is not required for reimbursement of meals for employees traveling to Iowa from Illinois and Wisconsin or from Iowa to Illinois and Wisconsin. D. Tips. Associates will be reimbursed for reasonable gratuities provided while on business travel or while attending organizationally sponsored functions. E. Telephone and Fax Services. Associates will be reimbursed for the cost of communication expenses incurred on behalf of the organization while traveling on business. Associates are expected to use the most economical means of communication (e.g. cell phones instead of hotel service) that is appropriate in the circumstances. Personal phone calls are not reimbursable. Refer to WFSI’s Remote Wireless Devices policy for more information on cell phones. F. Gifts Associates will not, under normal situations, be reimbursed for the cost of gifts or entertainment for themselves or others. Refer to WFSI’s Gifts, Gratuities & Business Courtesies or the Associate Recognition and Achievement Awards policy for more information. G. Laundry Associates will not be reimbursed for cleaning and laundry expenses incurred while traveling for business purposes. H. Miscellaneous Occasionally, an associate may incur a de minimis expense that cannot be identified within any of the categories previously described in the ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 5 of 6 policy (e.g. postage for mailing seminar materials back to the organization). If such an expense is incurred on behalf of the organization, the associate will be reimbursed subject to general standards of reasonableness and within the discretion of the associate’s manager or vice president, as applicable. Non-Reimbursable Expenditures Travel expenses that are not business related and/or that could be perceived as lavish or excessive are not appropriate and will not be reimbursed. Examples of expenses that are not reimbursable include but are not limited to the following: Insurance costs such as life insurance, flight insurance, travel insurance, personal automobile insurance and baggage insurance First class tickets or other upgrades (air, hotel, car, etc.) Hotel mini bar charges Participation or attendance at golf, tennis, or sporting events without the advance approval of a designated officer Spa, personal grooming or recreational activities (including massages, saunas, barbers, hairdressers, shoe shines, gym and other recreational fees) Clothing purchases Laundry service Valet service Car washes Parking tickets Fines Child care Corporate card delinquency fees or finance charges In-room movies Spouse Travel When a spouse accompanies the associate on a business trip, the transportation costs and all other travel expenses (including meals, travel and accommodations) associated with the spouse are not reimbursable and must be personally borne by the associate. Replaces: Regional travel reimbursement policies Cross reference: Gifts, Gratuities & Business Courtesies Remote Wireless Devices Associate Recognition and Achievement Awards Professional Memberships, Seminars, Continuing Educational Programs Review Period: Two (2) years Original Policy Date: July 1, 2005 Dates Updated: July 1, 2009 ADMN-FIN Reimbursement for Business Travel and Seminar Expenses Page 6 of 6