Q3(2)

advertisement

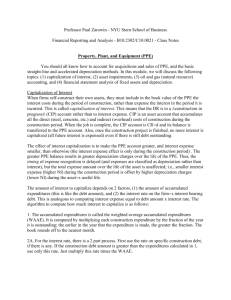

Chapters 7-9 Study Guide Accounting Quiz 3 Chapter Seven 1) Bank Reconciliation Definition: analysis of the items and amounts that result in the cash balance reported in the bank statement to differ from the balance of cash account in the ledger An adjusted cash balance determined in the bank reconciliation is reported on the balance sheet Review homework example including journal entries 2) Cash Equivalents Definition: when a company may temporarily have excess cash so the company normally invests in highly liquid investments in order to earn interest Examples: U.S. Treasury bills or money market funds Companies will report cash and cash equivalents on the balance sheet 3) Cash Short and Over Definition: when the amount of cash on hand differs from the amount of cash sales If there is cash over, Cash Short and Over is credited If there is cash short, Cash Short and Over is debited Debit balance in cash short and over is reported in miscellaneous expense on the income statement A credit balance is included in the other income section Journal entry for cash short: debit cash and cash short and over, credit sales Journal entry for cash short: debit cash, credit cash short and over and sales 4) Petty Cash Used when a company pays small amounts for items such as postage, office supplies, or minor repairs Replenished at periodic intervals when it is depleted or reaches the minimum amount Replenished: the accounts debited are determined by summarizing the petty cash receipts Petty cash is only debited when the fun is initially established or increased, and is only credited when the fund is being decreased Journal entry: debit petty cash, credit cash Journal entry to replenish: credit office supplies, store supplies, and miscellaneous administrative expense, credit cash 5) Internal Control Objectives Assets are safeguarded and used for business purposes Business information is accurate Employees and managers comply with laws and regulations 6) Cost Concept Definition: amounts are initially recorded in the accounting record at their cost or purchase price 1 Chapters 7-9 Study Guide Accounting Quiz 3 7) Objectivity Concept Definition: requires that the amounts recorded in the accounting records be based on objectivity evidence or final agreed-upon cost Chapter Eight 8) Percent of Sales Method Used to estimate uncollectible accounts The amount of the adjusting entry is the amount estimated for bad debt expense o The estimate is credited to the unadjusted balance of allowance for doubtful accounts Review the example on page 356 Journal entry: debit bad debt expense, credit allowance for doubtful accounts 9) Analysis of Receivables Method Based on the assumption that the longer an account receivable is outstanding, the less likely it will be collected Steps of the method i. The due date of each account receivable is determined ii. The number of days each account is past due is determined iii. Each account is placed in an aged class according to its due date iv. The totals for each aged class are determined v. The total for each aged class is multiplied by an estimated percentage of uncollectible accounts for that class vi. The estimated total of uncollectible accounts is determined as the sum of the uncollectible accounts for each aged class This process is referred to as aging the receivables Review examples on page 358-359 Journal entry: debit bad debt expense, credit allowance for doubtful accounts for whatever amount is needed to bring the net of AR-ADA to the estimated collectible amount as determined by the aging process. 10) Direct Write-off Method Bad debt expense is not recorded until the customer’s account is determined to be worthless then the customer’s account is written off– violates the matching principle Journal entry: debit bad debt expense, credit customer’s account receivable Collected later o Journal entry: debit customer’s accounts receivable, credit bad debt expense and debit cash, credit customer’s accounts receivable Primarily used by small companies 11) Allowance for Doubtful Accounts Estimates the uncollectible accounts receivable at the end of the accounting period o Bad Debt Expense is recorded by an adjusting entry based on the estimate Since it is an estimate, no specific customer account can be decreased or credited 2 Chapters 7-9 Study Guide Accounting Quiz 3 o Thus, Allowance for Doubtful Accounts is a contra asset account with a normal credit balance Journal Entry: debit bad debt expense, credit allowance for doubtful accounts Income statement: the amount of bad debt expense will be matched against the related revenues of the period Balance sheet: the value of the receivables is reduced to the amount expected to be collected or realized o This is called the net realizable value of the receivables Write-offs o The allowance account will have a credit balance at the end of the period, if the write-offs are less than the beginning balance o The allowance account will have a debit balance at the end of the period, if the write-offs are more than the beginning balance Study examples on page 354-355 Primarily used by large companies 12) Characteristics of Notes Receivable and Maturity Date Maker also called promisor is the party making the promise to pay Payee also called promisee is the party to whom the note is payable Face amount is the amount he note is written for on its face on an interest-bearing note this is the proceeds, on a non-interest bearing note the proceeds are the face amount less the interest (discount) Issuance date is the date a note is issued Due date or maturity date is the date the note is to be paid Term of a note is the amount of time between the issuance and due dates Interest rate is that rate of interest that must be paid on the face amount for the term of the note Study the example of the maturity date on page 362 Chapter Nine 13) Amortization Definition: the amount of cost to transfer to expense Results from: the passage of time or a decline in the usefulness of the intangible asset Used for: patents and copyrights and other intangible assets o Patents: normally computed using the straight-line method, recorded by debiting an amortization expense account and crediting the patents account 14) Depletion Definition: the process of transferring the cost of natural resources to an expense account Steps for depletion a) Determine the depletion rate 3 Chapters 7-9 Study Guide Accounting Quiz 3 Depletion rate = b) Multiply the depletion rate by the quantity extracted from the resource during the period Depletion expense = depletion rate *quantity extracted Journal entry: debit depletion expense, credit accumulated depletion 15) Depreciation spreads out the cost of an asset over its useful life Definition: recording of the cost of fixed assets as an expense over its useful life Adjusting entry depreciation debits depreciation expense, credits the contra asset called accumulated depreciation or allowance for depreciation Three methods of depreciation o Straight-line method: provides the same amount of depreciation expense for each year of the asset’s useful life Annual depreciation = o Partial each is annual depreciation multiplied by months used over twelve Units-of-production method: provides the same amount of depreciation expense for each unit of production Determine the depreciation per unit Depreciation per unit = Compute the depreciation expense as: Depreciation expense = depreciation per unit * total units of production used This method is used often when a fixed asset’s in-service time varies from year to year which matches depreciation expense with asset’s revenue o Double-declining-balance method: provides for a declining periodic expense over the expected useful life of the asset Determine the straight-line percentage using the expected useful life Determine the double-declining-balance rate by multiplying the straight-line rate by two Compute the depreciation expense by multiplying the double-decliningbalance times the book value of the asset Depreciation cost does not go below residual value 16) Disposal of Fixed Assets Discarding fixed assets o Study examples from homework and page 406 and web page T-accounts Selling fixed assets o Study examples from homework and page 407 and web page T-accounts 17) Intangible Assets Definition: assets that do not physically exist 4 Chapters 7-9 Study Guide Accounting Quiz 3 o o o o Patent: exclusive right to benefit from an innovation, estimated useful life not to exceed legal life, amortization expense Copyright: exclusive right to benefit from a literary, artistic, or musical composition Trademark: exclusive use of a name, term, or symbol Goodwill: excess of purchase price of a business over the fair value of its net assets (assets – liabilities) 5