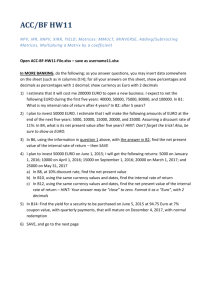

docx

advertisement

Will the implementation of euro currency bring financial stability to the Central and Eastern Europe countries? Keio University Takemori Shumpei Seminar International Finance team Jun Iwasaki Xiaoyanm Wan Sayaka Kawajiri Tasuku Koda Yutaro Sakata Naoya Togashi Yosuke Hiraga Introduction In this paper, we focused on the Central and Eastern Europe (CEE) countries and the financial situation that they are currently in, following the enormous financial turmoil brought by the sub-prime loan shocks and the Lehman shock of September 2008. Our aim of this paper is to seek the role that the euro currency had on stabilizing the economy of some CEE countries, and discuss how the implementation of euro would have had the same stabilizing effect for other CEE countries that has not yet introduced the euro. In the first half of this paper, we will briefly review the current situations surrounding the world, and CEE. We will also mention on the requirements for countries that seek to introduce the euro. In the second half of the paper, we will look at three CEE countries, Hungary, Latvia, and Slovakia, and examine their situations specifically and statistically. Review of the current situations Situation leading up to the financial crisis The financial crisis was caused by the securitized instruments and the rating agencies. In the United States, due to the housing bubble, even the people with subprime ratings had become able to get funding. This is because the lenders were able to collect their money by selling the mortgage, which had probably appreciated during the housing bubble. This caused a moral hazard to occur between the lenders, which made the increasing risk to be hidden. This mortgage loan was securitized as Mortgage Backed Securities and was repeatedly re-securitized and sold to many investors. Also, the so called slicing and dicing process were done by the banks and security firms to duplicate high rated securities from the low rated tranches. This fabrication of trust had occurred during the securitization process, and it had increased the risk which was not noticeable to the investors. The most important part of this case is that these duplicated securities eventually spread around the world as AAA rated securities, although its actual risk was much higher. This process had kept on working as long as the real estate prices had kept going up, but eventually the housing bubble burst, which caused the unnoticed risks of MBS and its CDS to suddenly appear all around the world, spreading the wave of shock. This unforeseeable catastrophe for the investors built up so many defaults and bankruptcies everywhere around the globe, which eventually brought about the serious situation now called the financial crisis. The effect on Europe Europe economy was damaged, because the connection between Europe and the United States was very close. Many financial institutions, especially in Western Europe, held immeasurable losses by the subprime loan crisis and European financial market fell into a credit crunch. Western European banks invested in Eastern Europe, which was an attractive emerging market to the investors, causing the money to continuously flow into this area. In Eastern Europe, many foreign companies established production bases and expected the growth of a large consumption market. However, the financial crisis forced western financial institutions to withdraw their subsidiaries from the Eastern Europe, causing its financial markets to dry up of liquidity, thus causing the liquidity crunch. Since the liquidity crunch, East Europe’s economy plummeted and largely depreciated their currency value. Euro/Dollar power balance Oct 2008; €1=$1.246 Jan 2009; €=$1.327 Since the financial crisis has ceased a little around December 2008, euro has gradually grown strong against the dollar. As this graph shows, euro has been keeping up its rate of increase in value up to this present day. It is seen that the United States economy will need much longer time to return to at least some extent of pre-crisis standards. That is not exactly the case for Europe, which is one of the main reasons why the euro is gaining power as the dollar is losing its credibility. This is seen as a chance for euro to become the new international currency. Central and Eastern Europe Background While Europe was harshly damaged everywhere since the financial crisis, it started to eventually take toll on Central & Eastern Europe (CEE). The primary causes for the financial damage in this area was the draining of money from the markets, which occurred when Western Europe’s financial institutions decided to withdraw their subsidiaries in the CEE area to strengthen their damaged parent institution. That could explain the reason for the shock state in CEE countries such as Hungary right after the Lehman Shock of September 2009, but we believe that the stability of financial sectors in CEE countries were very much affected by their weak currencies. Our hypothesis is that one of the main reasons why the CEE countries’ financial sectors were unstable in this financial crisis is because they are not implementing euro, the strong currency and is using their own weak small currencies. Graph 1 shows the currency exchange rates against the Euro for couple of the CEE countries from July 2007 to June 2009. 8 Lehman Shock 7 6 Bulgarian Lev 5 Lithuanian Litas Turkish Lira 4 Poland Zloty 3 Croatia Kuna Latvian Lats 2 1 0 2006/07/03 2007/07/03 2008/07/03 Graph 1 It is obvious from this graph that Croatian Kuna, Poland Zloty, and Turkish Lira’s exchange rates have all basically increased on quite a high rate since the Lehman Shock had occurred in September 2009, following 2 years of stable rates. What it means is that euro has grown increasingly strong against these small currencies, which is one intention of euro itself. From a small country’s perspective, choosing the euro, the same currency used in large developed countries like Germany and France, would mean that the credibility for the currency will increase compared to the previous currency. This will lead to a more stable exchange market for small countries implementing euro, such as Slovakia who joined the eurozone from the start of 2009. Empirically, the same exchange rates for Slovak Koruna, which had been joining the ERM-2, was much more stable than that of the previously mentioned countries. Europe Exchange Rate Mechanism-2, known as ERM-2, is a mechanism that limits the exchange rate fluctuation and it is a mandatory stage which countries must go through before implementing the euro. The fluctuation has been kept within 1 point, which is a very small rate considering the original rates differ. 33 32.5 32 31.5 31 30.5 30 29.5 29 28.5 28 27.5 27 2009/06/02 2009/05/02 2009/04/02 2009/03/02 2009/02/02 2009/01/02 2008/12/02 2008/11/02 2008/10/02 2008/09/02 2008/08/02 2008/07/02 2008/06/02 Slovak Koruna Graph 2 The basic arguments about why CEE countries should implement the euro currency in the first place can be explained from couple of views. The most important point that we would like to bring up is the risk of macroeconomic instability by being out of the eurozone. The recent economic developments in Europe have resulted in causing systemic problems where the current account deficits of CEE countries increase, because of the capital inflows from Western Europe. While it becomes hard to stop the inflow, the country becomes very susceptible to currency crisis. Also, in this state, we could not expect much out of the fiscal and monetary policies to control those situations. It is either those countries tolerate slow growth, or do nothing about the high exposure to the risk of currency crisis under the small currency situation. Thus, joining the eurozone will be the only way to be liberated from that trade-off of growth and risk for many CEE countries. As I have briefly mentioned, there are certain procedures to go through and certain conditions that need to be met for countries to newly enter the eurozone. The conditions are usually referred to as the Maastricht Criteria. There are five conditions that need to be met: 1) Inflation rate must be kept under 4.1%, 2) Government Budget Deficit must be less than 3% of its GDP, 3) Debt ratio must be less than 60% of GDP, 4) Long-term interest rates must be under 6.2%, and 5) Participation in the ERM-2 for the minimum of 2 years. Countries that seek to join the eurozone must meet each of these 5 conditions at the same time for a year. The existence of these criteria is another reason that CEE country’s economy would increase stability by implementing the euro. Simply put, by working to meet the demand of these criteria, that country’s economy will be fixed into a more strict and stable state. For example, tight fiscal policies and the strengthening of government finance will definitely be needed to reduce the budget deficit, but it will prevent the government from possible and useless overspending, which could show up as an increase in sovereign CDS spread. Also, since Long-term Interest rates are usually seen as the sum of assumed short-term rate average and the country’s risk premium, reducing this stat by a large amount cannot be achieved without cutting the risk premium. It means that this country must have a more stable a financial sector and economy. A path to euro introduction The very first step the country has to take is to affiliate with the EU. All of EU8(Poland, Czech, Slovakia, Hungary, Slovenia, Estonia, Latvia, Listonia) have already finished this step, the next step is fulfill all the ERM-II conditions. This step which requires countries to participate for at least 2 years, is very important to test the stability of the country. Every new member of EU must introduce this system at some time in order to join EU. ERM-II, or European Exchange Rate Mechanism-II, is a mechanism which aims to stabilize the currency’s exchange rate to euro before countries try to join the eurozone. The right to participate in ERM-II is not judged by legal standard, it is decided case by case. For example, countries with complete floating exchange system or cooling peg will face difficulties joining ERM-II. The timing and period of the implementation is very different by countries. Estonia, Latvia, Lithuania and Slovenia introduced ERM-II in 2004 just after their participations to EU. Where on the other hand, Slovakia joined ERM-II after one and half year. Table 1 As a preparation for ERM-II participation, policies related to price liberalization or reconstruction of economy must be adjusted before fixing the exchange rate, because if those adjustments are not made, each country might face different policy goals which will cause a economic confusion. Also as it is said above, the economy must be able to withstand small shocks when fully implemented of the euro, because those markets can be easily affected by negative external shock. Next step is getting evaluated by the ECB and European Committee and achieve ERM-II conditions, this assessment is conducted every two years. These two institutions analyze the properties in different ways. European Committee mainly evaluate whether applying countries satisfy those required conditions, where on the other hand, ECB assesses the sustainability of the economy. European Committee makes a proposal and board of directors will decide whether participants are really suitable for the implementation According to the results. Board of directors also decides the exchange rate of the local currency to euro. The achievement levels of Maastricht Treaty by CEE countries HICP Inflation rate 5 4.2 4 3 2 1 3.1 3.9 3.7 0.7 Maastricht Treaty standard 0.8 0.2 HICP Inflation rate 0 -1 -0.5 Graph 3 Graph above shows the average inflation rate per year in Eastern European countries and how far they are from the required level. All the countries above have kept their inflation rate below the line, but this was probably achieved due to the current financial crisis which caused some deflation among those countries. Therefore, it can be said that keeping this level for two years would be a difficult task. In general, countries with a smaller economy have more difficulties achieving the required inflation level. Government Deficit rate 0 -1 Maastricht Treaty standard -2 -3 -4 -2.8 -3.6 -2.8 -3 -2.5 -3.2 -3.2 Government Deficit rate to GDP(%) -5 -6 -7 -6.3 Graph 4 Countries that met -3% requirements were only Slovakia, Lithuania, Czech and Estonia in 2009, while more countries satisfied the conditions in the past. This was because the governments had spent huge amount of money on stimulus packages to cope with the financial crisis. Gross Debt 80 70 60 50 40 30 20 10 0 Maastricht Treaty standard Gross Debt(%) Graph 5 There aren’t many difficulties to achieve this criterion, since only Hungary hasn't achieved it at least for the past three years. Other countries have succeeded in decreasing the debt ratio to its GDP. Long-term Interest rate 16 14 12 10 8 6 4 2 0 Maastricht Treaty standard Long-term Interest rate (%) Graph 6 Next condition is the long term interest rate. This condition assesses the sustainability of economic contraction. The main reason for high level of long term interest rate in many countries is due to the current crisis. The current financial crisis has increased the government deficit and default risk to a higher rate. Country Comparison Introduction The financial crisis sweeping across the globe hit the Central and Eastern European countries hard without a doubt. But the degree of the blow differed from county to country. This section will go over the current situation of several Central and Eastern European countries and analyze whether the introduction of the euro had any positive effects on the economy. We will go over the current situation of the economy by observing several financial indicators. The indicators that were used are the GDP growths of the country, the exchange rate against the euro, yield rates of government bonds, CDS spreads, government policy interest rates, and current account deficits. The countries to be looked at are the Slovakia, Hungary, and Latvia. Slovakia is a country that is in the euro community and is performing relatively well in this financial crisis compared to other Central and Eastern European countries. Hungary was chosen to compare against Slovakia, due to the fact that it has not introduced the euro yet. How much damage did the financial crisis bring about in Hungary? Latvia is a country in transition. The ERM-II is in effect in Latvia and we will analyze whether just pegging down the minor currency against the euro could prevent a catastrophe. Hungary What happened and the Current Situation Last year’s financial crisis has taken a large toll on the Hungarian economy. This happened even though the Hungarian banking system had little direct exposure to the sub-prime market in the United States. But as seen from the graph below, the GDP growth rate of Hungary suffered a large drop immediately after the crisis had taken place, dropping well below average EU country. GDP Growth Rate Change GDP Growth Rate 10.0 5.0 Hungary 0.0 1 2 3 4 5 6 7 8 9 10 11 12 -5.0 -10.0 EU in total Month Graph 7 Along with this, the value of the Hungarian forint went down by nearly 20% while the yield rates of the bonds issued by the government shot up. The main reasons for this were the weakening of the forint and the unusually high foreign owned government debt compared to its GDP. Graph 8 As the crisis was unveiling itself in the fall of 2008, many people downgraded the credibility of emerging countries, and Hungary was no exception. This caused the forint to weaken and the retreat of foreign credit flow from the Hungarian economy. This was a serious problem for Hungary because a large proportion of the government financing relied on foreign investors. Lower credibility means higher interest rates for Hungarian bonds and higher CDS spreads. This is because investors wanted to sell their bonds rather than buy new ones. The interest rates went up to a level of nearly 12%. The following three graphs show the changes in yield rates and spreads explained above. Graph 9 The current debt of the government is about 65% of its GDP. Although the situation had slightly eased since the peak of 90%, it is still very high compared to neighboring countries such as Czech Republic and Poland with 30% and 50% respectively. This high level of government debt was caused due to the fact that manifests of the elections held earlier in the decade included policies for pensioners to receive 13 months of payment and 50% wage raises for workers in labor intense industries. Of course, this policy is no longer in effect due to the circumstances. Having one of the largest government debts and net external liability positions among the EU countries makes it very difficult to provide liquidity in the market once it has dried up. A total of $24.4 billion in loans had to be made from the IMF, EU, and the World Bank in order to prevent a full-scale financial crisis from occurring in Hungary. The last resort capital injection was mainly used to provide liquidity in the banking system once more and to strengthen the risk management system of the government. The effects of the rescue package are yet to be seen. For now, the Hungarian government is focused on trying to mop up the mess caused by the financial crisis and doesn’t have euro adoption as their top priority. Besides the current financial crisis, there are several issues to be solved before being able to adopt the euro. The first is the budget deficit at an alarmingly high level. At over -7%, the debt of the government is increasing year by year. As for the total outstanding government debt, Hungary isn’t doing so well in this criterion either. The gross government debt should stay under 60% of the country’s GDP in order to be able to put the ERM-II into effect, but Hungary has debts totaling over 70%. The third criterion, the inflation rate, is also very high in this country too. While the other V-3 countries keep their inflation rates under 3%, Hungary has one over 7%. Hungary also has very high interest rates. Since the financial crisis started rocking the world, it only worsened. 5-year government bond interest rates are as twice as much as the other potential euro adopting countries. As for the last criterion, the exchange rate, Hungary fails once again to stay within the normal fluctuation margins of the ERM. From the data listed above, it seems to be that the Hungarian government has a lot of things to do before it can fully integrate itself into the euro community. But if the government wants to avoid another financial catastrophe like this one, it will need to focus on stabilizing the economy as soon as possible. Latvia 1. Overview The world-scale financial crisis last year hit many European countries’ economies. Unfortunately Latvia is one of the countries that have been hit the hardest. In 2008, after years of booming economic success, the Latvian economy faced a serious downturn. Its GDP growth dropped 10.3% in the final quarter of 2008, which is a far higher rate Graph 10 than other European countries. Even worse, the country’s GDP shrank by 18% in the first three months of this year and a further contraction of 15% is also estimated in the next nine months. Latvia has received a large amount of direct investment from the neighboring countries such as Sweden, Germany, and Russia, which led to the rapid growth in the recent years. In fact, its economy grew at an average of 10% per year, after it had joined EU. However, the global credit crunch has overwritten the well-polished scenario. Investors became risk-averse and stopped investing in the developing sectors. At the same time, Latvia’s recession is gaining pace after the real estate boom ended, domestic demand collapsed, and the government began trimming expenditure and cutting state wages. In April 2009, Latvian unemployment was at 16.8%, more than double the value of last December, which was at 7%. As riots take place in the capital city of Riga, it indicates that the “crisis” hasn’t ended yet. 2. Financial Credibility As the economy has been rapidly and deeply shrinking in Latvia, the international community regards Latvia as less stable than before. Its budget deficit has reached 4% of GDP in 2008, and economists think will be even worse this year. This harsh CDS Spreads In T he Baltic States 1 400 1 200 Basis Points 1 000 Latv ia 800 Estonia 600 Lithuania 400 200 2009/7/26 2009/5/26 2009/3/26 2009/1/26 2008/11/26 2008/9/26 2008/7/26 2008/5/26 2008/3/26 2008/1/26 2007/11/2 2007/9/26 2007/7/26 0 Graph 11 circumstance forced the Latvian government to ask the International Monetary Fund and the European Union for an emergency bailout loan of 7.5 billion Euros. On the other hand, the government nationalized the Parex Bank, the country’s second largest bank. Taking these elements into account, Standard & Poors downgraded Latvia’s credit rating to non-investment grade BB+. The credit deterioration is also clear when you see sovereign CDS spreads. The Credit Default Swap (CDS) is a kind of financial product to hedge against credit risk. So the higher the spread is, the more likely the country is going to default. The Latvian CDS spread was the highest last February, and after that it seemed to have settled down, but it is still higher than other countries in the region. This shows that the global market thinks Latvia is relatively easy to default. 3. Latvia and the Euro Latvia has aimed to join the Euro-area since they joined the European Union in 2004. They adopted European Exchange Rate Mechanism (ERM-II), which pegs national exchange rate to the Euro to some extent. Specifically the rate is pegged at 1 EUR = 0.702804 LVL since 2004, and a small fluctuation is allowed. Generally the Euro is introduced after 2 years of ERM-II period. However, the crisis has dimmed the road to the integration of the Euro. It is desperate for the Baltic nation to achieve various numerical targets needed to introduce the Euro. First, the budget deficit has seriously increased. According to the estimates, the government deficit could leap to 11.6% of its GDP, much higher than 3.0% required in the Maastricht criteria. Second, the long-term interest rate should be below 6.5%, while that of Latvia stays high as much as 12.75% in June 2009. Finally, the Latvian Lat is under pressure to be devaluated. Even though the Lat is pegged to the Euro, its real value has been slashed after the financial turmoil. Indeed, in the future market, the Lat will be dealt at half of the current value. As one might imagine, the Latvian government is now on the edge. In order to receive a rescue package from the IMF and the EU, they need to cut government expenditures even further. But on the other hand, bailing out Latvia under these circumstances could make it stuck in the mud. The introduction of the Euro is sure to be postponed for a certain time. Slovak Republic Introduction The Slovak Republic introduced the euro currency on January 1st, 2009. The previous year, the year 2008, was a year of turmoil. The financial crisis coming from the sub-prime mortgages in the United States shocked the world. This past year has been a great time to investigate the pros and cons of Central and Eastern European countries adopting the euro as their official tender. The pros of the integration By adopting the euro, a country can raise credibility in the international community because being able to join the euro mean that the economy has cleared the minimum requirements set by the Maastricht Treaty. To be more specific, inside eurozone, you won’t have to worry about currency risks anymore. Also, a country will have a better opportunity to invest and be invested when many countries are using the same currency. This will help stabilize the economy. Along with this, the transaction fees will be spared, meaning domestic firms will be able to act more freely and actively. The republic was once known as an agricultural country. But the growth of recent years was backed up by investments from foreign automotive companies such as Peugeot from France and Kia from South Korea. The new millennium has seen Slovakia growing at an unprecedented pace, performing the best out of the main CEE countries (see Chart 1). Chart-1: GDP(yoy %) 12 10 8 6 4 2 0 Czech Republic Hungary Poland Romania Slovak Republic 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 20 0 09 8 Ex p -2 -4 -6 -8 Graph 12 Facing the Crisis According to the IMF, the current financial crisis has brought a devastating blow on the yearly GDP growth rates on Slovakia, dropping from 10.4% to -2.1% in just two years. Global shocks damage on large durable goods, indicating the automotive industry inside the country paid a large price. But on the other hand, Slovakia’s exchange rate has been stable ever since putting the ERM2 into effect (see Chart 2). The country’s CDS spreads are relatively low compared to other CEE countries (see Chart 3). The strength of the euro currency helped Slovakia avoid a catastrophe. Chart-2: Major CEE FX Rate against Euro (Jan 1 2007 = 100) 130 120 Slovakia Koruna Czech Koruna Poland Zloty Hungarian Forint 110 100 90 80 2007 2008 2009 Graph 13 Chart-3: Major CEE CDS Spread (Sovereigns 5-year) 900 800 700 Slovakia Hungary Czech Poland Romania 600 500 400 300 200 100 0 2007 2008 2009 Graph 14 Slovakia’s current account deficit is about average among CEE countries (see Chart 4). But much of financing was through direct investment, which helped keep liabilities to a minimal amount (see Table 2). The benefits of the euro are apparent. Chart-4: Current Account Balance/GDP (%) -16 -14 -12 Czech Republic Hungary Poland Romania Slovak Republic -10 -8 -6 -4 -2 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Exp 0 Graph 15 Table 2 Major CEE External Debt/GDP (%) 2008Q3 2008Q4 2009Q1 Slovakia Loans + deposits (national sources) 24.1 25.5 29.9 Loans + deposits (creditor source) 20.4 21.0 9.8 Debt securities (national source) 11.3 10.8 7.7 Debt securities (market source) 5.6 5.4 5.4 Trade credits (national source) 5.4 4.3 3.8 Loans + deposits (national sources) 44.5 53.3 54.6 Loans + deposits (creditor source) 38.4 49.4 52.5 Debt securities (national source) 37.2 32.0 27.2 Debt securities (market source) 24.8 24.0 22.9 Trade credits (national source) 3.1 2.3 2.4 Hungary Poland Loans + deposits (national sources) 18.1 22.9 21.8 Loans + deposits (creditor source) 11.9 16.0 14.4 Debt securities (national source) 13.8 13.6 11.9 Debt securities (market source) 7.7 8.1 8.1 Trade credits (national source) 3.1 3.4 3.0 Loans + deposits (national sources) 22.8 21.3 19.4 Loans + deposits (creditor source) 15.8 14.5 12.8 Debt securities (national source) 9.5 7.8 7.1 Debt securities (market source) 5.9 5.7 5.7 Trade credits (national source) 3.1 2.6 2.3 Czech Wrap up At this point, the benefits of the euro such as the increase in direct investment, smart governing, stable exchange rates, and the increase in euro land support are apparent in the financial indicators. But the current financial crisis is a global one and effects of the decrease in demand inside EU and financial institutions are inevitable. The competitiveness of Slovakia’s exporting industries are disadvantageous to that of other CEE countries where their value of currency has dropped significantly. Also, giving up the power of financial policies to the ECB might have bad results too if the recovery of the Slovakian economy is slower than expected. For now, Slovakia will need to focus on reinforcing the economic foundation that helped it join the euro club and make use of the stability of the financial indicators to get the economy back on it’s feet. In order to tackle the problem of the relatively high valued currency among CEE countries, Slovakia must raise the production efficiency of her industries. Only by realizing this, will the benefits of the introduction of the euro be truly proved. Conclusion The difference of the damage dealt by the financial crisis is evident among the countries analyzed above. Although there are some risks in introducing the euro, having the euro as the official currency will bring stability to the economy. But for most CEE countries, there are numerous numbers to clear before being able to introduce the euro. The governments will need to focus on stabilizing their own economies for now. Conclusion As we have examined, the current situation of the CEE country economies are not looking well right now. In the countries that we picked up, Slovakia, which had already implemented the euro, has had rather stable situations in that area. However, for Latvia and Hungary, the situation is quite devastating, especially in Latvia. We can say that this was due to the fact that they had not yet implemented the euro. But when we examine if these countries, or other CEE countries that has not implemented the euro, the current situation keeps them from quickly advancing their process of euro implementation. This is due to the fact that these countries must carry out stimulus package plans to cease the situation of their current economy, and doing so would work against them in tightening their governmental financing to meet the Maastricht Treaty standards for euro implementation. This leads us to the conclusion that euro implementation is very much beneficial to the CEE countries in providing them financial stability, but it seems unrealistic for these countries to accelerate their implementation process because of their concern in domestic situations. References <Data> Eurostat website, http://epp.eurostat.ec.europa.eu/portal/page/portal/eurostat/home/ European Central Bank website, http://www.ecb.int/home/html/index.en.html JETRO website, http://www.jetro.go.jp/world/ IMF country information, http://www.imf.org/external/country/SVK/index.htm JEDH website, http://www.jedh.org/jedh_comparator.html Bloomberg website, http://www.bloomberg.co.jp/ <Papers> Rostowski, Jack “When Should the Central Europeans Join EMU?” International Affairs, Vol. 79, No. 5 (Oct., 2003), pp. 993-1008, Blackwell Publishing IMF Country Report No. 09/105 Hungary p.5-34 Horvath, Julius “2008 Hungarian Financial Crisis” CASE Network E-briefs IMF Country Report No. 09/223 Euro Area Policies p.6-41