The Economic Impact and Recovery of the Supply Chain Disruptions

advertisement

Very preliminary

Please do not quote

The Economic Impact and Recovery of the Supply Chain Disruptions in the Great

East-Japan Earthquake

June 2014

Joji TOKUI (Shinshu University and RIETI),

Tsutomu MIYAGAWA (Gakushuin University and RIETI),

Kazuyasu KAWASAKI (Tokai University),

.

* This paper is a revised version of the paper which was presented at the first workshop on the economic impacts

on the 3.11 earthquake at Tokyo. We thank Professors Robert Dekle (University of Southern California),

Jonathan Eaton (Pennsylvania State University), Theresa Greany (University of Hawaii) and Etsuro Shioji

(Hitotsubashi University) for excellent comments. The preliminary version of this paper was a part of RIETI

Policy Discussion Paper No. 12-P-004 “The Economic Impact of the Great East-Japan Earthquake: Comparison

with Other Disasters, the Supply Chain Disruptions, and the Electric Power Supply Constraint” (in Japanese).

This study is partly supported by a Grant-in-Aid for Scientific Research from the Ministry of Education, Culture,

Sports, Science and Technology (No.24530296 and No.22223004) of Japan

1

Abstract

The Great East-Japan Earthquake of March 11th, 2011 had a serious negative economic

impact on the Japanese economy. The earthquake substantially reduced production not

only in regions directly hit by the earthquake but also in the other part of Japan by the

propagated consequences of supply chain disruptions. We examine the economic impact

of the supply chain disruptions immediately following the earthquake using regional IO

tables, the JIP database and other statistics. Our estimate shows that the amount of

production loss caused by the supply chain disruptions would count 1.3% of Japanese GDP

at maximum level. We also analyzed the possible extent of the damage reducing effect by

building multiple supply chains to cope with potential natural disasters in the future. On

the other hand, economic linkage of the earthquake hit regions to the other regions of

Japan may promote early recovery from damages relying on affluent cooperation by

interested firms. We confirm this possibility using regional IO tables.

Key words: earthquake, economic damage, supply chain, regional IO tables,

JEL classification: L94, Q43, R11, R15

2

1. Introduction

The Great East-Japan Earthquake of March 11, 2011 had a serious negative economic impact on

the Japanese economy. The destructions in social infrastructures such as power plants, roads,

railways, and ports gave negative effects on economic activities in Tohoku and North-Kanto

areas. However, in the Great East-Japan Earthquake, as shown in Table 1 it is important to note

that the short-term production activities in the private sector were greatly influenced not only in

the earthquake hit area but also in the area that was not directly hit by the earthquake. Right

after the earthquake, even in the countries outside of Japan, especially in the automobile and

electronic equipment industries, the concern about the possible effect on their production

activities caused by the supply shortage of essential parts of their product was widely publicized.

[Table1]

Although the major part of this concern was resolved a couple of months later by the

devoted effort to restore the factories in the disaster-affected area and the substitution of the

supply sources, this incident raised the awareness of the potential risk of the propagation of the

disaster to the production activities outside of the disaster-affected area, transmitted by the

supply chain disruptions. Since the incident caused by the disrupted supply chains is one of the

phenomena caused by input-output interconnections of industries, we can analyze this incident in

the framework of an input-output model. Therefore, in this paper we estimate the magnitude of

such propagation effect as precise as possible using regional IO tables in the first place. Based

on this result we assess the potential extent of the damage reducing effect by building multiple

supply chains to cope with potential natural disasters in the future.

The previous studies on the economic impacts on the earthquake have focused on the

demand-side aspect of these interconnections; that is, the propagation to upstream industries of

3

the decreased input demand from the disaster-affected industries. On the other hand, our focus is

on the propagation to downstream industries of declined intermediate-output supply from the

disaster-affected industries. This supply-side propagation of input-output linkage is named

‘forward linkage’ by Miller and Blair (2009) while the demand-side linkage is named ‘backward

linkage’. Although the concept and the methodology of the ‘forward linkage’ is well established,

we need to slightly modify it to apply it to the case of the Great East-Japan Earthquake.

In the next section, we will explain how we estimate effects of supply chain disruption by

using input output tables. To apply ‘forward linkage’ to the 3.11 earthquake, we have to start to

estimate the damages in outputs by industry in the damaged areas. In the third section, we

estimate them by using regional production data by Japan Industrial Productivity Database and

estimated damage rates by Development Bank of Japan. In the fourth section, we move to

estimate effects of supply chain disruptions based on the measured damages in the disaster

affected areas. In the final section, we summarize our results.

2. The Methodology of the Forward Linkage Effect Estimation

As is well-known, the input-output table records how the outputs from the industries in the

column were used as intermediate goods for the industries in the rows. When we analyze the

demand-side linkage, we look at the rows of the table to capture the effect. On the other hand,

when we analyze the supply-side linkage, we read the columns of the table. Let X be an output

vector for each sector (X’ denotes its transpose), Z be an input-output matrix of the intermediate

goods and V be a factor cost vector (V’ denotes its transpose), the relationship along the column

of the input-output table can be expressed as

X’ = i’Z + V’.

Let B be the matrix whose row is equal to each row of the input-output matrix Z divided by the

output of each sector. The entry of the matrix B={bji} in the j-th row and in the i-th column

4

represents the ratio of the i-th sector’s usage of the j-th sector’s output to the entire output of the

j-th sector.

B=[

Z11 ⁄X1

⋮

Zn1 ⁄Xn

⋯ Z1n ⁄X1

1⁄X 1

⋱

⋮ ]=[ ⋮

⋯ Znn ⁄Xn

0

Z11

⋯

0

⋱

⋮ ][ ⋮

⋯ 1⁄X n Zn1

⋯ Z1n

⋱

⋮ ] = diag(1⁄Xj )Z

⋯ Znn

−1

From the equation above, Z = [diag(1⁄Xj )] B = diag(Xj )B holds. Substituting this

relationship into the above equation yields

X1

(1) X’ = [1 ⋯ 1] [ ⋮

0

⋯

⋱

⋯

0

⋮ ] B + V′= X’B + V’

Xn

Thus the entry of the matrix B={bji} in the j-th row and in the i-th column shows us how

the decrease in the output in the j-th entry of X on the right-hand side leads to the decrease in the

output of the i-th entry of X’ on the left-hand side. In this sense, each entry of the matrix B

shows the magnitude of the first-stage forward linkage effect. If this propagation of the forward

linkage persists, the cumulative sum of the effects can be obtained by using an inverted matrix

and solving for X’ in (1).

X ′ = V′(I − B)−1

We denote the inverted matrix G. That is,

g11

G = (I − B)−1 = [ ⋮

g n1

⋯

⋱

⋯

g1n

⋮ ]

g nn

Using this new notation to re-write the equation above yields,

(2) X’ = V’ G.

Let us denote the i-th entry of X’ on the left-hand side Xi. Then from X i = V1 g1i + ⋯ + Vj g ji +

∂X

⋯ + Vn gni , we obtain ∂Vi = g ji . The entry of the matrix G in the j-th row and in the i-th column

j

shows the decrease in the output of the i-th sector in response to the one unit decrease in the

fundamental production input (labor and capital), measured in factor income, assigned to the j-th

5

sector. This represents the cumulative effect of the forward linkage on the i-th sector’s

production caused by the constrained factor inputs in the j-th sector.

This is the basic idea of the forward linkage explained in Miller and Blair (2009). For

our purpose, we modify this idea as follows. In our analysis, we replace the supply constraint

with the decrease in the outputs of the particular sector (the estimated damage in terms of the

value of output). This is easier than tracing back the damage to each fundamental factor of

production and converting the loss into factor income units. To express this idea, we take

advantage of the following relationships.

∆Xi

∆Vj

∆Xj

= g ji

∆Vj

= g jj

Combining these two equations, we obtain

∆Xi

∆Xj

=

∆Xi

∆Vj

gji

⁄∆Xj = g

jj

∆Vj

This leads to the following.

(3)

gji

∆X i = g ∆X j

jj

Using this relationship, the cumulative impact on the i-th sector’s production by the forward

linkage, or the disrupted supply chain, from the decrease in the j-th sector’s production due to the

earthquake, can be computed by g ji ⁄g jj .

As shown in Appendix 1, in the analysis of the forward linkage above explained, the

relationship between the intermediate goods input and the final output is assumed to be

represented by the Cobb-Douglas production function. In other words, we assume the

production technology with which the supply decrease in some intermediate goods can be

substituted by other input goods. For retail industry, for example, this assumption is realistic, as

an empty shelf due to the lack of the good from Tohoku region can be filled by the products

from the other area and the business can keep running. However, in the manufacturing sector,

where the final output consists of various parts, substitution will be difficult, at least in the short

6

run. Right after the Great East-Japan Earthquake, the inability to find the substitute parts of the

customized parts was revealed as the supply chain disruptions gathered attention.

Therefore, we compute the first-stage linkage effect by assuming that the decrease in the

total output of a particular manufacturer is driven by the bottleneck in production, or the

maximum decrease among all the intermediate goods from other manufacturers. The detail of

the methodology is presented in Appendix 2. On the other hand, in computing the cumulative

impacts after the first-stage linkage, we do not consider this extreme form of bottleneck effect

for the second-order effects and later.

When we consider the bottleneck effect in the first-stage linkage, we need to decide

whether the damage rates in Kanto and Tohoku regions should be treated jointly or separately.

When we treat Tohoku and Kanto regions as one area and use the worst damage rate as the

bottleneck, we assume no substitutability between inputs from Tohoku and Kanto industries.

That is, even if each region produces the intermediate goods classified as the same sector

products we regard they are essentially different goods. As an alternative assumption, by treating

Tohoku and Kanto separately and use the maximum damage rate in each region as a measure of

the bottleneck effect, we implicitly assume some substitutability in the same sector across

different regions. Whether which assumption grasp reality may depend on how much detailed

classification we use in input-output tables. To decide this selection problem, we compare two

different projection of regional production decrease induced by the first-stage forward linkage

under two different assumptions on substitutability to the actual production decline of

manufacturing in each region within a few months after the earthquake. As we see in the

following Section 4, we find that at least in the short period no substitutability assumption

between inputs from Tohoku and Kanto industries captures the reality.

Even though short-term substitutability assumption between inputs from Tohoku and

Kanto regions confronts the reality, it provides an interesting simulation result on how much

7

extent supply chain diversification can mitigate the indirect damage caused by the forward

linkage effect of supply chain disruptions. We report the result of such simulation in Section 6.

3. Estimated Damage by Industry in the Disaster-affected Area

In order to estimate the impact of the disrupted supply chain by applying the forward linkage

methodology, as described above, we need to estimate the damage by industry in the disasteraffected area caused by the Great East-Japan Earthquake. Then, how do we estimate the damage

by industry in the area? We do this by first estimating the output by industry in the each

disaster-affected city or town, and then by multiplying these figures by the estimated damage

rates for each city and town.

We can obtain the number of employees by industry in each city and town from the

Economic Census 2009. We also have the country-level output per employee ratio and real net

capital stock per employee ratio by industry, from Japan Industrial Productivity Database

(JIP2010).1 If we assume that these two ratios for each industry are same all over Japan,

multiplying these ratios and the number of employees by industry in each city and town together

gives us the estimated output and real net capital stock for each industry and for each city and

town.

We obtain the damage rate for each city and town by applying the same methodology

devised by Tomoyoshi Terasaki of Development Bank of Japan. He estimates the loss of capital

stock in the earthquake hit four prefectures (Iwate, Miyagi, Fukushima and Ibaraki) dividing

each prefecture into coastal area and the inland area. In calculating this estimation, he uses both

the human damage rate (the ratio obtained by dividing the death toll and the number of missing

1

The JIP database consists of 108 industries. The website of the database is

http://www.rieti.go.jp/en/database/JIP2010/index.html. Fukao et al. (2007) explain how this database was

constructed.

8

and evacuees by the registered population in the area) and the corporate damage rate (the ratio

obtained by dividing the affected number of firms reported in the newspaper by the number of

corporate offices with the number of employees greater than or equal to 100) for each of coastal

and inland area in four prefectures. Next, he multiplies the adjustment coefficient obtained by

dividing the surveyed (that is, very close to actual) loss of capital stock in the Great HanshinAwaji Earthquake in 1995 by the estimated loss of capital stock applying the above described

methodology to the Hanshin-Awaji case. We use the number of human damage rate for each city

and town, and using the same numbers for the corporate damage rate and the adjustment

coefficient as Terasaki we get the damage rate for each city and town hit by the Great East-Japan

Earthquake.

Multiplying the estimated output and real net capital stock by industry at the city and

town-level by the above estimated damage rate for each city and town we obtain the value of the

damage (both for the output and the real net capital) by industry at the city and town-level. Then

we aggregate these values at the city and town-level for three prefectures in Tohoku region

(Iwate, Miyagi and Fukushima) to obtain the estimated damage for the Tohoku region. We do

the same for Ibaraki prefecture to obtain the estimated damage for the Kanto region.

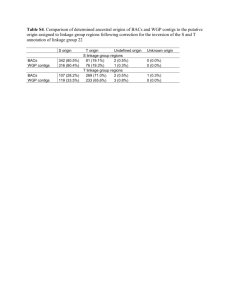

[Figure 1, Figure 2]

Figure 1 shows the bar plot of the estimated damage on the real net capital stock for each

industry. Each bar is the sum of the Tohoku and the Kanto regions and these two regions are

shown in different colors. Figure 2 shows the estimates on the output-level damage (at annual

level). In both figures, we can confirm that the damage for the Tohoku region exceeds that for

the Kanto region and that the Great East-Japan Earthquake hit the Tohoku region particularly

hard. Also, Figure1 shows that the damage on the real net capital stock concentrates on nonmanufacturing sectors, especially in the electricity industry. This reflects the fact that Fukushima

9

Nuclear Power Plants were seriously damaged and many non-manufacturing firms are located in

the coastal area where tsunami hit severely. On the other hand, Figure 2 shows that not only the

non-manufacturing sector (such as commerce) saw the loss in the outputs but also the

manufacturing sector, in particular the food industry, suffered a lot in terms of their output. The

annualized direct damage (where annualized means the value assuming the damage after the

earthquake persists at the same level for one year) is estimated to be 6.5 trillion Yen.

4. The Estimation on the Effects of Supply Chain Disruption

4-1 The Regional Propagation Pattern of Supply Chain Disruptions

As mentioned in the above Section 2, we choose short-term non-substitutability assumption of

intermediate inputs from the Tohoku and the Kanto regions by comparing estimated regional

propagation pattern of supply chain disruptions under two different assumptions with the

actually observed regional production decline pattern of manufacturing sector right after the

earthquake (as shown in Table 1). Figure 3 shows the comparison between estimated regional

propagation pattern of first-stage forward linkage under non-substitutability assumption and the

actual production decline right after the earthquake (that is, within 20days after March 11th).

[Figure 3]

Figure 3 shows that our estimates of production decrease is rather underestimation even

under the non-substitutability assumption. Referring to only two examples, in the Tohoku region

our estimate is 23 percent decline while actual manufacturing decline in the region is 53 percent,

and in the Kanto region our estimate of 15 percent decline falls short of actual 30 percent decline.

But the similarity of regional propagation pattern of supply chain disruptions to actual pattern

10

(the sole exception is the Chubu region) and the scale of the impact lead us to choose the nonsubstitutability assumption.

We can suggest a few possible reasons of the underestimation of our estimation method.

First, our estimation of the damage does not include damages on the public infrastructure such as

road and harbor, which may cause additional influence on production activities in the earthquake

hit region. Second, while we compare first-stage forward linkage with actual production decline

right after the earthquake, second-stage and further-stage linkage to downstream industries may

already take place. Third, actual input-output interconnections of industries may be more

complicated; that is, not only forward linkage but also backward linkage may come about at the

same time. For example, suppose Company A supplying parts to Company B is hit by the

earthquake, which stops production activities of both Company A and Company B. Suppose the

Company B also buys the other parts from Company C. Even if the Company C is free from the

earthquake damage and is upstream industry, the stop of operation of the Company B results in

the production decline of the Company C. In the Chubu region where automobile-related

industries are agglomerated this kind of interaction between forward linkage and backward

linkage may be biting, which explains exceptional underestimation in this region.

4-2. The Magnitude of the Supply Chain Disruptions

Now let us look at the magnitude of the supply chain disruptions and its influence to each

industry. Both first-stage forward linkage and the total forward linkage are calculated. As

explained in the above sections first-stage forward linkage is calculated assuming bottleneck

effect in the manufacturing industries and no substitutability between Tohoku and Kanto regions,

while in calculating further-stage forward linkages we assume no such special conditions.

[Figure 4]

11

Figure 4shows our calculated result of the first-stage forward linkage effect by industry.

A notable feature of the first-stage effect of the supply chain disruptions is that the effect is

particularly concentrated in the manufacturing industries while the direct damages by the

earthquake itself are highly concentrated in the non-manufacturing industries (as we see in

Figure 1 and Figure 2). In the manufacturing sector, the chemical material, steel, general

machinery, electric parts and automobile-related industries suffer a large loss, in addition to the

food industry which suffer a large direct damage. In particular, the automobile-related industries

suffer relatively less in terms of the direct damage by the earthquake while they are affected

significantly by the supply chain disruptions. This is due to the fact that a car consists of more

than several ten thousand parts and thus car manufacturing depends on a complex division of

labors, involving a web of subcontractors. When we aggregate theses first-stage forward linkage

effects of the supply chain disruptions the total amount count 27.3 trillion yen per year base.

The estimate is about four times as large as that of the direct damage, showing that the supply

chain disruption is crucial factor dragging Japanese economy significantly after the disaster.

[Figure 5]

Figure 5 shows the total forward linkage effect of supply chain disruptions; that is, the

cumulative effect assuming forward linkage effect continues infinitely. In this calculation, in

addition to the industries that suffered a lot from the first-stage effect, chemicals, machinery and

metal engineering show the large cumulative effects. It is notable that the automobile-related

sector has a significantly large cumulative effect. It is surprising that the estimated damage per

year base is as high as 142 trillion yen, a large number even in terms of the gross output.

We should be careful for the interpretation of our estimates. It is the simple aggregation

of numbers on gross output base, and based on the unrealistic assumption that the most severe

12

damage to the production right after the earthquake would continue the whole one year without

any recovery. To get more realistic numbers we should translate the numbers on gross output

base to those on value-added base, and reflect the actual recovery of production in the

earthquake hit regions. By multiplying the estimated numbers on gross output base by the ratio

of value-added to output for each industry, we can get numbers on value-added base. Our

estimated direct production damage by the earthquake is equivalent to 0.7 percent of GDP, firststage forward linkage effect is 1.7 percent of GDP, and total forward linkage effect is 8.9 percent

of GDP.

When we normalize the output loss in the damaged area right after the earthquake in

March to be 100, we can calculate the output loss in the following months from the

manufacturing productions index. The loss is 62 in April, 33 in May, and 20 in June, showing a

sign of recovery from the earthquake. Therefore, adding two thirds of the damage in March (the

quake occurred on March 11th) to the loss over the period between April and June gives us

1.82/12 =(1×2/3+0.62+0.33+0.20) /12 of the annualized loss. Converting the annualized

estimates to the 4 months estimates reflecting recovery (from March through June) using this

fraction yields the direct output loss by the earthquake to be 0.11 percent of GDP, first-stage

forward linkage effect to be 0.26 percent of GDP, and total forward linkage effect to be 1.35

percent of GDP. We can still confirm the large impact of forward linkage effect in comparison

with the direct production damage by the earthquake.

4-3. The damage reducing effect of building multiple supply chains

Since we observe the significant damage of forward linkage effect caused by the supply chain

disruptions, it is worthwhile to consider the damage reduction through building multiple supply

chains. What is needed first of all for this consideration is the estimation of the benefit of

multiple supply chains in the situation of natural disasters. How would be the damage from

13

forward linkage effect when we can count on the multiple supply chains from both Tohoku and

Kanto regions. Figure 6 and Figure 7 show respectively the first-stage effect and the total

forward linkage effect under such hypothetical situation.

[Figure 6]

Comparing Figure 6 with Figure4, we can see that the substitution in parts supply

between Kanto and Tohoku regions reduces the first-stage forward linkage effect significantly.

In this case, the first-stage forward linkage effect is estimated to be 6.1 trillion yen (at annual

base), which is slightly more than one fifth of the case without such substitution. For the

industry-level breakdown, we do not see any difference between relatively more affected

industries among the non-manufacturing sector, such as commerce and construction, and the

manufacturing industries. The most severely affected sectors among manufacturing include the

electric parts, food industries followed by the auto parts industries. Thus, we do not see any

prominent first-stage forward linkage effects on the overall automobile-related industries.

[Figure 7]

Figure 7 shows the total forward linkage effect with the substitution possibilities in parts

supply between Kanto and Tohoku regions. The impact on the automobile-related industries

becomes larger due to its complicated interdependence. However, the magnitude is still similar

to the food industry which faced the large direct damage and to some of the non-manufacturing

industries which suffered relatively large losses (such as commerce and construction). The total

14

forward linkage effect is 30.5 trillion yen (at annual base), which is slightly more than one fifth

of the corresponding value in Figure 5 with no substitution among Kanto and Tohoku regions.

The bottom line is that only by means of diversifying the parts supply sources to two

different regions, such as Tohoku and Kanto, we can mitigate the forward linkage effect from

supply chain disruptions to the level of one fifth in case of such huge natural disasters as the

Great East-Japan Earthquake. Applying this result to the estimated effects from March through

June after the 3.11 earthquake, the diversification in parts supply can mitigate the first-stage

forward linkage effect to the level of 0.05 percent of GDP, and total forward linkage effect to the

level of 0.3 percent of GDP, which are rather small compared with normal economic fluctuations.

The benefit from such diversification is important in the case that the recovery from earthquake

damage takes time, for the industries with complex web of supply chains such as automobilerelated industries.

5. Concluding Remarks

Though Japan’s land has been hit by many tremendous earthquakes in the past, the Great EastJapan Earthquake is unique in the sense that it hit large areas of Tohoku and Kanto where

complex web of supply chains exists. This situation raised concern about the propagated

consequences of supply chain disruptions right after the earthquake. Our calculation confirms

that such concern has a reason because estimated production decline in Japan caused by forward

linkage effect from supply chain disruptions is much larger than that caused by the direct

earthquake damage.

The experience of the Great East-Japan Earthquake reminds us the importance of damage

mitigation of natural disasters, the most vital of which is of course human life. But mitigating the

damage to economic activities should be noted. Our calculation suggests that the benefit of

supply chain diversification is quite significant.

15

Some firms may have already started to consider the supply chain diversification as a part

of their business continuity plans (BCP), based on the lessons from the Great East-Japan

Earthquake. But there also lie difficulties in the realization of such diversification plan. The very

reason that some intermediate goods are hard to substitute is that their production requires

intangible assets owned by a particular supplier. Therefore, it is not easy to diversify the source

of supply of such inputs. Building the system of supply chains that is robust to disasters requires

the innovation of the usage of intellectual property rights to circumvent this difficulty at the

same time.

It may not make sense for individual firms to spend resources to construct robust supply

chains to reduce the damage to one fifth in the rare disaster which occurs only once in a century.

Thus, it may be more realistic to make plans about how to recover from the damage smoothly

after the disaster. If the prompt recovery in the disaster-affected area is possible, supporting the

recovery effort is one of the most effective measures.

However, if the disaster is so serious that it is not easy to achieve a prompt recovery, then

one might have to find alternative factories to resume its operation. Without a prescribed plan, it

might take more than several months to resume business in the alternative factory. It should be

effective to exchange information between the industrial clusters or the regions located by large

factories which shares similar production technologies and to make agreements about renting

excess spaces in the factories to each other in case of a serious disaster. To this end, it is quite

essential that more than one area with vibrant manufacturing industries remain in Japan.

16

Appendix 1: Substitutability in the Standard Forward Linkage Model

We will explain the assumption about the production function on which the forward linkage

model described in Section 2 is based. We start from the equation that yields the forward

linkage.

X’ = X’B + V’

Taking difference for the both sides of the equation yields,

∆X ′ = ∆X ′ B + ∆V′.

Pre-multiplying diag(1⁄Xj ), we have,

∆X ′ ∙ diag(1⁄Xj ) = ∆X ′ ∙ diag(1⁄Xj ) ∙ diag(X j ) ∙ B ∙ diag(1⁄X j ) + ∆V ′ ∙ diag(1⁄Xj ).

Here, the term diag(Xj ) ∙ B ∙ diag(1⁄Xj ) corresponds to the standard input coefficient matrix A,

as shown in Appendix 3. Thus we can rewrite the equation above such that,

∆X ′ ∙ diag(1⁄Xj ) = ∆X ′ ∙ diag(1⁄Xj ) ∙ A + ∆V ′ ∙ diag(1⁄Xj ).

In other words, the following will hold.

∆X1

[X

1

⋯

∆Xn

]

Xn

∆X1

= [X

1

⋯

∆Xn

∆V1

]A + [ X

Xn

1

⋯

∆Vn

]

Xn

Let aji be the entry in the j-th row and the i-th column of the input coefficient matrix A. Then the

effect of the change in the first term of the right-hand side on the i-th sector in the left-hand side

can be computed as

(A-1)

∆Xi

Xi

= ∑nj=1 aji

∆Xj

Xj

Let us rewrite Xj on the right-hand side as Zj to clarify that it is an input, then the equation

becomes,

∆logXi = ∑nj=1 aji ∆logZj .

In other words,

a

a

X i = const ∙ Z1 1i ⋯ Znni .

17

Therefore, we can see that this model is based on the Cobb-Douglas production function with

coefficients aji.

Appendix 2: The Forward Linkage with the Bottleneck Effect in the First-Stage

When we assume the strong complementarity in parts input in manufacturing, the first-stage

forward linkage effect can be replaced from (A-1) to the following.

(A-2)

∆X 1st−stage

πi = ( X i)

i

∆Xj

= ∑j∈M aji ∙ maxj∈M [ X ] + ∑j∈N aji

j

∆Xj

Xj

,

where M and N in the subscripts stand for manufacturing and non-manufacturing respectively.

Here, we assume Leontief-type production function in the first-stage input-output only for the

input from manufacturing to manufacturing. This means that the input sector with the maximum

rate of decline is the bottleneck and force all the other input to fall at the same rate.

(1) The first-stage forward linkage effect, in addition to the direct damage

When we compute the first-stage forward linkage effect in addition to the direct damage, we use

the following three-step procedure.

Step 1: Based on (A-2), we compute the first-order spill-over effect on manufacturing, that is,

∆X 1st−stage

πi = ( X i)

i

∆X

= ∑j∈M aji ∙ maxj∈M [ X j ] + ∑j∈N aji

j

∆Xj

Xj

.

We compute πi for each manufacturing sector and multiply them by the output for each sector Xi

and obtain the change in the output after the first-stage forward linkage, ∆X i. Note that aji in the

above equation is a standard input coefficient.

Step 2: For non-manufacturing, we use (A-1), that is,

∆X 1st−stage

πi = ( X i)

i

= ∑nj=1 aji

∆Xj

Xj

,

which is the same as,

X

(∆Xi )1st−stage = πi X i = ∑nj=1 ( i aji ) ∆X j = ∑nj=1 bji ∆Xj

X

j

18

Step 3: We add the first-stage forward linkage effect for both manufacturing and nonmanufacturing to the direct damage.

(2) The total forward linkage effect, in addition to the bottleneck first-stage effect and the direct

damage

The total forward linkage matrix G in the equation (2) can be written as,

G = (I − B)−1 = I + B + B 2 + B 3 + ⋯ = I + B(I + B + B 2 + ⋯ ) = I + BG

When we assume that bottleneck effect as in (A-2) occur only in the matrix corresponding to the

̅, we obtain the total forward linkage matrix with first-stage

first-stage, which is denoted by B

bottleneck G as following,

̅ =I+B

̅(I + B + B 2 + ⋯ ) = I + B

̅G.

G

̅ above, we can rewrite the equation (2) as,

Using G

⋯

[∆X1

∆Xn ] = [∆V1

̅ = [∆V1

⋯ ∆Vn ]G

⋯

∆Vn ] + [∆V1

⋯

̅G.

∆Vn ]B

By applying the method of transforming the change in terms of factor income into the change in

terms of outputs with the diagonal elements of the matrix G, we obtain the followings,

(A-3)

[∆X1

∆X1

1

⋯ ∆X n ] = [∆X1

⋯ ∆X n ]diag ( ) + [ g

g

11

jj

⋯

∆Xn

̅G.

]B

gnn

̅ in the second term of the right-hand side of the

Step 1 & 2: Since the part where we multiply B

X1

g11

Xn

B , is nothing but the first-stage forward linkage with

g nn

equation (A-3), that is

bottleneck, which we know above. That is, for non-manufacturing,

X

∆X

∆Xj

jj

gjj

(∆Xi )1st−stage = πi X i = ∑nj=1 ( i aji ) j = ∑nj=1 bji

X

g

j

,

and for manufacturing, using

∆Xi 1st−stage

)

Xi

πi = (

= ∑j∈M aji ∙ maxj∈M [

∆Xj

gjj Xj

19

] + ∑j∈N aji

∆Xj

gjj Xj

we compute πi X i.

Step 3: Substituting these into the equation (A-3) above to carry out the rest of the computation,

we get the total forward linkage effect with first-stage bottleneck. That is,

[∆X1

⋯

∆Xn ] = [∆X1

1

⋯ ∆X n ]diag ( ) + {1st − stage effect of step 1&2}G

g

jj

Appendix 3: The Relationship between Matrices A and B

The standard input coefficient matrix A is defined as follows.

X=Z+F

A = [aij ] = [

Z11 ⁄X1

⋮

Zn1 ⁄X1

Z11

⋯ Z1n ⁄X n

⋱

⋮ ]=[ ⋮

Zn1

⋯ Znn ⁄X n

⋯ Z1n 1⁄X1

⋱

⋮ ][ ⋮

⋯ Znn

0

⋯

0

⋱

⋮ ] = Z ∙ diag(1⁄Xj )

⋯ 1⁄X n

On the other hand, B matrix of the forward linkage is B = diag(1⁄Xj ) ∙ Z. Solving for Z, we

obtain Z = diag(Xj ) ∙ B. By substituting this, we have,

A = diag(X j ) ∙ B ∙ diag(1⁄Xj ),

or

B = diag(1⁄Xj ) ∙ A ∙ diag(Xj ).

20

References (In Japanese)

Development Bank of Japan (2011a), “Higashi Nihon Dai Shinsai Shihon Stock Higaikingaku Suite nit

suite: Area betsu (ken-bestu/nairiku, engan-betsu ni suikei)”, DBJ News, April 28, 2011

Development Bank of Japan (2011b), “Daishinsai ga Chiiki Keizai ni Ataeru Eikyou ni Tsuite: HanshinAwaji Daishindai wo Case Study to shite”, December 22, 2011

References (in English)

Fukao, K., S. Hamagata, T. Inui, K. Ito, H. Kwon, T. Makino, T. Miyagawa, Y. Nakanishi, and J. Tokui

(2007) “Estimation Procedure and TFP Analysis of the JIP Database 2006 (revised) ”, RIETI

Discussion Paper Series 07-E-003, the Research Institute of Economy, Trade and Industry, Tokyo.

Miller, Ronald E. and Peter D. Blair (2009), Input-Output Analysis: Foundations and Extensions 2nd

edition, Cambridge University Press.

21

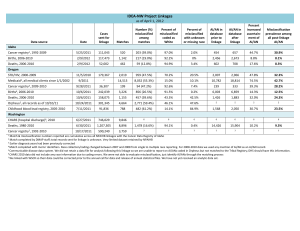

Table 1 The actual production decline right after the Great East-Japan Earthquake by region

Index of Industrila Production (Feb.-March, 2011)

(2005=100)

Hokkaido

Tohoku

Kanto

Chubu

Kinki

Chugoku

Shikoku

Kyushu

Feb. 2011

97.0

99.7

91.5

100.3

101.7

97.4

102.0

105.6

March 2011

91.1

64.7

73.3

82.1

96.6

91.0

103.6

97.1

Index of Industrila Production (March, 2011)(2005=100)

Before March 10(a)

97.0

99.7

91.5

100.3

101.7

97.4

102.0

105.6

(Source) Regional IIP published from each branch of Ministry of Economy, Trade, and Industry

22

After March 11(b)

88.2

47.2

64.2

73.0

94.1

87.8

104.4

92.9

1-(b)/(a)

0.1

0.5

0.3

0.3

0.1

0.1

0.0

0.1

0

Agriculture, forestry and fishery

Mining

Coal mining , crude petroleum and natural gas

Beverages and Foods

Textile products

Wearing apparel and other textile products

Timber, wooden products and furniture

Pulp, paper, paperboard, building paper

Printing, plate making and book binding

Chemical basic product

Synthetic resins

Final chemical products

Medicaments

Petroleum and coal products

Plastic products

Ceramic, stone and clay products

Iron and steel

Non-ferrous metals

Metal products

General machinery

Machinery for office and service industry

Electrical devices and parts

Other electrical machinery

Household electric appliances

Household electronics equipment

Electronic computing equipment and accessory…

Electronic components

Passenger motor cars

Other cars

Motor vehicle parts and accessories

Other transport equipment

Precision instruments

Miscellaneous manufacturing products

Reuse and recycling

Construction

Electricity

Gas and heat supply

Water supply and waste disposal business

Commerce

Finance and insurance

Real estate

House rent (imputed house rent)

Transport

Other information and communications

Information services

Public administration

Education and research

Medical service, health, social security and nursing…

Advertising services

Goods rental and leasing services

Other business services

Personal services

Others

Figure 1 Loss of real net capital stock in Tohoku and Kanto regions

2,500,000

2,000,000

1,500,000

Millions of JPY

1,000,000

500,000

Tohoku

23

Kanto

Figure 2 Gross output lost by the direct damage of Great East-Japan Earthquake in Tohoku and Kanto regions

900,000

800,000

700,000

600,000

500,000

Millions of JPY

400,000

300,000

200,000

100,000

0

Tohoku

24

Kanto

Figure 3 Comparison of our estimates (the first-stage forward linkage effect) with actual production decline by region

60%

50%

40%

30%

20%

10%

0%

Hokaido

Tohoku

Kanto

Chubu

Kinki

Chugoku

Shikoku

Kyusyu

-10%

Estimation (Forward Linkage model, no substitution case)

Real data(Index of Industrial Production)

25

0

Agriculture, forestry and fishery

Mining

Coal mining , crude petroleum and natural gas

Beverages and foods

Textile products

Wearing apparel and other textile products

Timber, wooden products and furniture

Pulp, paper, paperboard, building paper

Printing, plate making and book binding

Chemical basic product

Synthetic resins

Final chemical products

Medicaments

Petroleum and coal products

Plastic products

Ceramic, stone and clay products

Iron and steel

Non-ferrous metals

Metal products

General machinery

Machinery for office and service industry

Electrical devices and parts

Other electrical machinery

Household electric appliances

Household electronics equipment

Electronic computing equipment and accessory…

Electronic components

Passenger motor cars

Other cars

Motor vehicle parts and accessories

Other transport equipment

Precision instruments

Miscellaneous manufacturing products

Reuse and recycling

Construction

Electricity

Gas and heat supply

Water supply and waste disposal business

Commerce

Finance and insurance

Real estate

House rent (imputed house rent)

Transport

Other information and communications

Information services

Public administration

Education and research

Medical service, health, social security and nursing care

Advertising services

Goods rental and leasing services

Other business services

Personal services

Others

Figure 4 The first-stage forward linkage effect by industry (non-substitutability between Tohoku and Kanto)

3,500,000

3,000,000

2,500,000

millions of JPY

2,000,000

1,500,000

1,000,000

500,000

26

0

Agriculture, forestry and fishery

Mining

Coal mining , crude petroleum and natural gas

Beverages and foods

Textile products

Wearing apparel and other textile products

Timber, wooden products and furniture

Pulp, paper, paperboard, building paper

Printing, plate making and book binding

Chemical basic product

Synthetic resins

Final chemical products

Medicaments

Petroleum and coal products

Plastic products

Ceramic, stone and clay products

Iron and steel

Non-ferrous metals

Metal products

General machinery

Machinery for office and service industry

Electrical devices and parts

Other electrical machinery

Household electric appliances

Household electronics equipment

Electronic computing equipment and accessory equipment…

Electronic components

Passenger motor cars

Other cars

Motor vehicle parts and accessories

Other transport equipment

Precision instruments

Miscellaneous manufacturing products

Reuse and recycling

Construction

Electricity

Gas and heat supply

Water supply and waste disposal business

Commerce

Finance and insurance

Real estate

House rent (imputed house rent)

Transport

Other information and communications

Information services

Public administration

Education and research

Medical service, health, social security and nursing care

Advertising services

Goods rental and leasing services

Other business services

Personal services

Others

Figure 5 The total forward linkage effect by industry (non-substitutability between Tohoku and Kanto)

12,000,000

10,000,000

8,000,000

Millions of JPY 6,000,000

4,000,000

2,000,000

27

0

Agriculture, forestry and fishery

Mining

Coal mining , crude petroleum and natural gas

Beverages and foods

Textile products

Wearing apparel and other textile products

Timber, wooden products and furniture

Pulp, paper, paperboard, building paper

Printing, plate making and book binding

Chemical basic product

Synthetic resins

Final chemical products

Medicaments

Petroleum and coal products

Plastic products

Ceramic, stone and clay products

Iron and steel

Non-ferrous metals

Metal products

General machinery

Machinery for office and service industry

Electrical devices and parts

Other electrical machinery

Household electric appliances

Household electronics equipment

Electronic computing equipment and accessory…

Electronic components

Passenger motor cars

Other cars

Motor vehicle parts and accessories

Other transport equipment

Precision instruments

Miscellaneous manufacturing products

Reuse and recycling

Construction

Electricity

Gas and heat supply

Water supply and waste disposal business

Commerce

Finance and insurance

Real estate

House rent (imputed house rent)

Transport

Other information and communications

Information services

Public administration

Education and research

Medical service, health, social security and nursing care

Advertising services

Goods rental and leasing services

Other business services

Personal services

Others

Figure 6 The first-stage forward linkage effect by industry (if there would be substitutability between Tohoku and Kanto)

500,000

450,000

400,000

350,000

300,000

Millions of JPY 250,000

200,000

150,000

100,000

50,000

28

Millions of JPY

0

Agriculture, forestry and fishery

Mining

Coal mining , crude petroleum and natural gas

Beverages and foods

Textile products

Wearing apparel and other textile products

Timber, wooden products and furniture

Pulp, paper, paperboard, building paper

Printing, plate making and book binding

Chemical basic product

Synthetic resins

Final chemical products

Medicaments

Petroleum and coal products

Plastic products

Ceramic, stone and clay products

Iron and steel

Non-ferrous metals

Metal products

General machinery

Machinery for office and service industry

Electrical devices and parts

Other electrical machinery

Household electric appliances

Household electronics equipment

Electronic computing equipment and accessory equipment…

Electronic components

Passenger motor cars

Other cars

Motor vehicle parts and accessories

Other transport equipment

Precision instruments

Miscellaneous manufacturing products

Reuse and recycling

Construction

Electricity

Gas and heat supply

Water supply and waste disposal business

Commerce

Finance and insurance

Real estate

House rent (imputed house rent)

Transport

Other information and communications

Information services

Public administration

Education and research

Medical service, health, social security and nursing care

Advertising services

Goods rental and leasing services

Other business services

Personal services

Others

Figure 7 The total forward linkage effect by industry (if there would be substitutability between Tohoku and Kanto)

1,600,000

1,400,000

1,200,000

1,000,000

800,000

600,000

400,000

200,000

29

30