here

advertisement

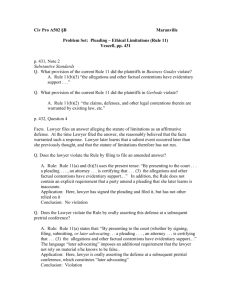

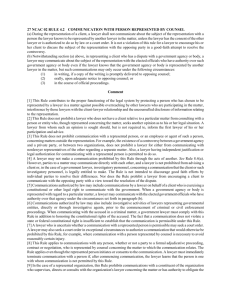

Scott Duggan 4/26/14 BLAW 201 Ethics Assignment An Unethical Act The case presented is a customer in a grocery store slipped and seriously injured herself in a store after ignoring the warning sign about a wet floor that had just been mopped. The state law in which this occurred states that a sign is reasonable warning that releases the store from any liability from negligent customers. The customer has sustained serious injuries that lead to large hospital bills and several months worth of missed work. In this case, the customer’s lawyer is going to sue the store for the damages. However, the lawyer states that if the employee testifies that there was no sign in place to warn the customer that the payment would be handled by the insurance company, forgoing attorney’s fees and not affect your position with the insurance company. There are many ethical dilemmas associated with this situation. The largest ones are most certainly the integrity and truthfulness dilemmas. If the employee were to go along with the attorney’s plan, the employee would be lying, not only to the insurance company, but also to their employer and possibly the courts. When you lie to the insurance company about something like this, it is insurance fraud, which is illegal. This would have huge repercussions if the insurance company were to find out. The employee, along with the injured customer and their lawyer would most likely be found guilty of soft fraud, which is a misdemeanor. This could lead to fines and possibly jail time for all parties involved in the crime. This also touches upon the fairness ethical dilemma. It is certainly unfair to the insurance company since they are being charged for something that they should not have to cover. The fair way to go about resolving this situation is to not lie to the insurance company, but instead remedy the situation through other legal means. When examining this situation from the perspective of the employee, it can be seen that they are in a tight spot. While the employee would most certainly feel bad for the injured customer and the option of forgoing attorney’s fees would sound appealing, it must be understood that they would be committing a crime if they were to lie. The only correct way to remedy this situation for the employee would be to not lie about the sign, because it is the right thing to do, both legally and morally. When examining this situation from the perspective of the injured customer, it can be seen how this situation could seem dire. They have been out of work for months and have incurred large hospital bills. Also, in this situation, there is no one to blame for the injuries than the customer herself. It is understandable why they customer would consider insurance fraud in this case, however they, like the employee, must do the right thing and tell the truth in this situation. When examining this situation from the perspective of the lawyer, it can be seen that they are simply trying to do what they feel is the right thing for their client. However, they must see that they are putting both their client and the employee of the store in harms way by suggesting that they lie about the situation. Also, the lawyer could lose their license to practice law if it were found out that they had suggested insurance fraud. Many times when dealing with an unethical situation, the parties involved who are condoning the behavior will try to rationalize said behavior to seem ethical. The first rationalization here is to sympathize with the injured customer. The insurance company is just some “big company” that can afford the loss, while she cannot. While it may be true that the insurance company can afford the loss here while she cannot, it does not excuse the fact that this would still be insurance fraud, which is illegal and unethical under positive law. Another rationalization here is the use of other state law in the case. In the state that the incident occurred in, the law states that a warning sign is not sufficient and that a complete barrier must be in place. While this situation may have turned out differently in another state, it does not mean that excuses the affected parties from following the law in their state. The fact is that a sign is sufficient warning and that the customer deliberately chose to ignore said warning – thus injuring herself. Since there are quite a few ethics models, there are quite a few ways that this situation could be resolved. When applying the Blanchard and Peale ethics model, this situation cannot get past the first question asked – is it legal? The fact of the matter is that it would be illegal for the employee to lie to the insurance company. This is insurance fraud, and as outlined earlier, if carried out, could end very badly for all parties involved. The other questions in the Blanchard and Peale model need not even apply in this situation. If the Front-Page-of-the-Newspaper model was applied here, it can understood that neither the employee, the employee’s employer, the customer or their lawyer would feel comfortable with their actions of insurance fraud being on the front page of the newspaper. If the Wall Street Journal ethics model were applied in this situation, the parties involved would again come to the same conclusion. The first question of the Wall Street Journal model is if the decision is in compliance with the law, which it is not. If the employee were to observe their situation through these models, they would most certainly see that what the lawyer was asking is unethical, and they would turn down the offer. The ethical thing to do is to go through the legal means of resolution. Also, the employee or even the customer may see it fit to report their lawyer to law enforcement, since they are suggesting and condoning illegal practices.