What are the bundle of rights? Posession Control Enjoyment

advertisement

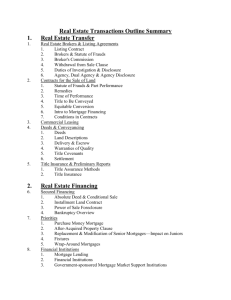

What are the bundle of rights? Posession Control Enjoyment Exclude Disposal Tests of a fixture vs. Real Property? Adaptation Contract – can be negotiated Intent Attachment Riparian? Littoral Rights? Flowing Water (Help: River) Non Flowing Water (lake or ocean) Prior Appropriation? Adjacent Land Owner State government administers the rights. Adverse Possession? Use of land without permission, for a period of time, Court awards OWNERSHIP. Adverse = Ownership Prescriptive Easement? Use of land without permission, length of time, court awards CONTINUED use. Prescriptive = Continued Use Tacking? License? Encroachment? Encumbrance? Erosion Accretion Avulsion Escheat? Combining periods of continued use to establish prescriptive Easement or Adverse Possession. Permission or Privilege to use one’s property. REVOCABLE Illegal use of one’s property (Discovered by SURVEY) Anything that affects the value of property (Lease, Lien, Gap in Chain) Gradual loss of soil or rock Gradual addition of soil or rock Sudden, violent loss of soil or rock (natural disaster) (Hint: Like a convulsion, fast and bad) Die Intestate (no will, no heirs and reverts to state) Property Tax Liens? Get paid back before any other lien. Eminent Domain: Power of the Government – Right to take private poperty What is the Process of Eminent Domain? CONDEMNATION DEEDS: General Warranty Deed QuiTclaim Deed - STRONGEST deed, Best for Grantee Warrants Seisen (in right mind), against undisclosed encumbrances and enjoyment now and forever. WEAKEST deed, best for Grantor. Warrants nothing Sherrifs Deed Deed given following foreclosure Limited or Special Deed Grantor will only guarantee their period of ownership. TO HAVE A VALID DEED: 1. Grantor (Seller) 2. Grantee (Buyer) 3. Granting Clause (Defines estate) 4. How Title was taken 5. Consideration 6. Legal Description 7. Grantor signature (Grantee not needed) Legal Description? Lot and Block, Rectangular Survey Sys., Metes and Bounds – PO Box and Address are invalid TITLE INSURANCE: CLTA (California Land Title Association) – Owner’s policy, protects Grantee Pay once and policy will cover duration of ownership and heirs If you pay cash, only need CLTA ALTA (American Land Title Association) – Mortgagee policy, protects lender TERMS OF TITLE: Patent Dedication Abstract of Title Chain of Title Cloud on Title Quite Title Government transfers realty to a private individual Private individual giving realty to the government (parks, utilities) EVERYTHING since the root of title. Should ALWAYS be accompanied by lawyers opinion Owners since Patent Impaired or unperfected title Court closing gap in title FREEHOLD Estate or OWNERSHIP Estates: Fee Simple ABSOLUTE: Highest Form of Ownership (includes all 5 bundle of rights) Fee Simple DETERMINABLE: “so long as” a condition is met. Ownership may be defeated if not met. ALL FUTURE owners must comply. Life Estate: Grantor creates., Grantee (Buyer) is the life tenant, Ownership reverts back to grantor (seller) upon death of life tenant. Remainder interest. Future interest is pre-determined- reversion upon death, Remainder- anyone else. GOVERNMENT: Gives police power for 1. Zoning 2. Agricultural, residential, commercial, industrial and mixed ENABLING Acts? Federal gives police power to state and local Assessments: Payment from benefiting homeowners for improvements Up Zoning: Rezone for greater use (res to comml) Down Zoning: Rezone for lesser use (comml to res) Buffer Zone: Green Belt Area – Park or land between comml and res. Non Conforming Use: Grandfathered in. Use old zoning once new zoning has been changed If you SELL, EXPAND, DESTROY/REBUILD or CHANGE USE… You MUST conform to new zoning. Conditional Use: Allows different use than zoning permits (doesn’t carry to new owner) Variance: Exempt to zoning due to hardship (Roof extended over). WILL carry to future owners. Spot Zone: Rezoning one parcel (church, school) Must continue use for the same thing or zoning WILL REVERT. WAYS TO TAKE TITLE: Severalty: One Person (Natural person) or single legal entity (Corporation holds title in severalty) Joint Tenants: (poor man’s will) HUSBAND and WIFE. Right of survivorship supersedes will Tenants in Common: Unequal interests, No ROS, Can be left in a will Tenants in the Entirety: MUST be married, ROS Community Property: All prop acquired during marriage is 50/50 Separate Property: Property owned prior to marriage, a gift or inheritance during marriage. General Partnership: All partners participate, share liability Limited Partnership: General partners (share liability) + limited (silent) partners (Only liable up to investment) Cooperative: Corporation owns real property, tenants own stock and recv a lease- no deed CONDO: TOWNHOME: TWO TITLES: You own a Cube of air and % of common area. NEED your own insurance. You own land WAYS TO OBTAIN REALTY: Note? Mortgage? LOAN – creates the debt LIEN – Mortgagor is the borrower Mortgagee is the lender Clauses: Acceleration – Default, FULL balance due. Alienation – Sold or transferred full balance Prepayment – Terms for paying portion or full mortgage early (May be a penalty) Defeasance Clause – Payments complete – Mortgagee removes lien Equitable Redemption – definite period which borrower can make up payments prior to foreclosure sale. Statutory Redemption – Borrower may reclaim realty if back payments are made within so many days after foreclosure. Mortgage – 2 part instrument Trust Deed – 3 part instrument Trustor: Borrower Beneficiary: Lender Trustee: Impartial holder of title – Holds naked title (Full bundle of rights) Deed of Reconveyance – Loan is paid in full, trustee gives all rights back to trustor and removes lien. Trustee’s Deed: Deed issued after foreclosure By Will: Deceased (devisor) will devise property to devisee **Devise – Real Property Bequest – Personal Property ( Gifted in personal will)** Codicil: Can change will until death Probate: Overlooks distribution of deceased’s assets… w/ or w/out will. Ownership transfers immediately (CAN’T do anything with property until probate says) Points 1 point = 1% ex 2 ½ points = .025 (used to multiply against loan) LEASEHOLD ESTATES – NON FREEHOLD (Property reverts back to owner when lease expires. Estate for Years – Definite termination date (can be in months). No notice req’d, death will not terminate. Landlord dies, tenant can stay – Tenant dies, landlord can still collect $ per lease Periodic Estate – Month to Month, Week to Week, Notice of one period req’d. Death will not terminate. One more . due Estate at Will – Open ended – terminates by notice or death. Estate at Sufferance – Tenant holds over without consent – didn’t get out in time. Assign (SANDWICH or SUBLEASE) – Assign duties to assignee. Lessee remains LIABLE. If we rent out our house, we are still liable. Novation – RELEASE of liability – complete substitute TYPES OF LAND SURVEY Rectangular Government Survey: Base= East and West Meridian= North and South Township= Parallel to Base – 6 Miles N& S of Base Range Line= Parallel to Meridian- 6 Miles E&W of Meridi 6 MILES SQUARE, not sq miles 36 Sections 1 mile = 640 ACRES 1 ACRE= 43,560 sf Section 16 reserved for schools Metes: Measured in feet and inches Bounds: Includes angles *****MUST start and end at the POINT of Beginning to be valid Monument: Benchmark or Reference Point Lot & Block system: RECORDED Plat Map- group on contiguous lots bound by streets in a city block. Tax Formula Fair Market Value x assessment ratio = assessed value Assessed value x tax rate= annual property tax New commercial Code: More than 5 story buildings are prohibited. Pre existing= Nonconforming Use Suggested to Take Title as: Consult an atty Radon: Undetectable Judgment levied because borrower with foreclosure could not generate enough funds at sell… Deficiency Judgement Reconveyance Deed: trustee returned title to trustor Trustee Deed: Recv’d a Foreclosure (Sheriff’s Deed) Property tax lien is always paid back FIRST Freestanding = personal property Client wants to open business… CHECK ZONING A is owner, sells ranch to B with Leaseback… A is Lessee Leasehold is less than freehold (Fee Simple, Fee Determinable and Life Estate) Option Contract: Unilateral Contract Equitable Title = Legal Title Agent: Represents Interest of Another Broker: Agent to their client or principal Salesperson or BS: Agent to the broker they work under Subagent Broker: Broker from another firm, representing listing broker’s client Subagent Salesperson or BS: a salesperson or BS’s relationship to their Broker’s client Single Agency: Assigned Agency: Dual Agency: Special Agent: Represents Buyer or Seller- NEVER both Broker assigns one salesperson to buyer and one salesperson to seller. NO WRITTEN CONSENT Broker represents Buyer and Seller – Same Transaction MUST have WRITTEN CONSENT or illegal. Conflict of Interest Agent hired to do one thing and can not bind client. Seller to Broker or Buyer to Broker General Agent: Customer/ Consumer3rd DUTIES TO CLIENT: LIMITED Authority – Agent hired to do series of tasks – the agent has the ability to bind their client. EX: PM to Owner/Investor or Salesperson/BS to Broker You do not represent but must be: FAIR – HONEST – DISCLOSE ALL MATERIAL FACTS – PROVIDE SKILL AND CARE CARE – CONFIDENTIALITY (MOTIVATION, PRICE, TIME AND TERMS) OBEDIENCE ACCOUNTING LOYALTY - #1 DUTY DILIGENCE DISCLOSURE AGENCY (Represent their interest, not your own) Expressed Agency: Written or verbal: Listing Agreement – Exchange of Understanding Implied Agency: Actions create ie: looking at Homes. You agree to do something. Compensation DISCUSSED Listing Contracts Employment: Between Seller & Broker CONTRACTS: Exclusive Right to Sell: STRONGEST- Compensation no matter who sells. Maximum Protection, Maximum Effort Exclusive Agency: Seller find their own seller, no commission Open Listing: WEAKEST: Whoever finds buyer gets commission Net Listing: Broker recv’d all money over set selling price. MUST disclose true MV or it’s fraud. ****CONTRACT MUST HAVE TERM DATE. NO AUTOMATIC RENEWAL**** Listing Agreement terminates if: Bankruptcy or death or BROKER or SELLER Broker loses license Realty is destroyed They agree to terminate Price fixing going on in a meeting, what do you do? LEAVE Sherman Anti Trust Act No price fixing – kills competition – ILLEGAL Puffing: Exaggerated statement or opinion (NOT misrepresentation) OPTIONS: A seller(optionor) gives buyer (optionee) the right to by realty within a certain time frame. UNILATERAL CONTRACT- one promise for performance. Latent Defect: Patent Defect: Hidden from view- Owner is aware, agent and buyer can’t see Everyone can easily see the defect INSTALLMENT CONTRACT/ LAND CONTRACT/ CONTRACT FOR DEED Vendor: Vendee: Seller- Retains legal title until vendee pays in full Buyer- takes possession, makes periodic payments, has equitable title. Offeror: Offeree: Makes the offer Recv’d the offer. Offeror changes every time a counter offer is made. FRAUD: Fraud damages: Knowingly misrepresent Buyer pays 3 x’s the damages Misrepresentation: Unintentional misrepresentation Contract VOID if: No offer or acceptance Act of God (Disaster) or Government (Eminent Domain) Not Legal(ie: Zoning) No consideration Contract VOIDABLE if: Disadvantaged may be: Disadvantaged party involved Minor Under the influence Fraud Menace – force or threat Duress Undue influence – position of power Contract UNENFORCEABLE if: CLASSIFICATION OF CONTRACTS: Bilateral: Unilateral: Executory: Executed: Not in writing Statue of Frauds **Exception- One Year OR LESS lease (not less than one year) Two binding promises (expressed) One promise for performance (Seller making promise) Something remains to be done Complete (at close of escrow – not at signing TERMINATION OF SALES CONTRACT: Agreement Novation – New Deal Completion Death WILL NOT terminate BREACH Of Contract: Rescission – Liquidated Damagesmoney) DAMAGES= Return the parties to original position Stated in Contract (ie: seller keeps earnest Court involved Specific Performance: Sue to complete Contract FEDERAL LAWS: 1866 RACE- No exceptions 1968 Exempt Redlining, Steering and Blockbusting Owns 3 or less homes, has not sold one 24 months, not selling the one that they are living in…. Room Rental 1-4 unit dwelling…. Religious Organization Fair Housing Poster & Gender Familial status; pregnant, children under 18, adoption & Handicap One year to file complaint with HUD, 2 years with a civil suit in Federal Court 1974 1988 Compliance? 1992: ADA: Must comply with: American Disability Act 15 or more employees, Gov Buildings, public trans & Businesses open to public Lead Paint New Home Disc? ECOA Can’t discriminate on: Public Assist. RESPA 1. 2. 3. 4. 5. Homes built before 1978, found in soil most likely, Seller and listing agent responsible to give disclosure to buyer. Buyer has 10 days to inspect. Gaming districts: Updated within 6 months & Sewer and Water rates Equal Opportunity Employer Act Protected classes, Old age, Marital status or Up to 4 – Residential More than 4 – Commercial Consumers are aware of closings costs Must be given settlement booklet Good faith estimate – upon application or w/in 3 bus days HUD1 – Settlement Statement (FINAL ACCOUNTING) 1 day prior to closing NO Kickbacks, unless licensed Regulation Z Truth and Lending Law Laws on Advertisement Tax Rev 1997 No capital gains if: 1031 Exchange Who Handles? Changes to Lease? MUST BE? Lenders must provide understandable finance info. Any info other than APR or price will need a full disclosure unless vague with no numbers owned and occupied as principal Residence for 2 of previous 5 years Single max 250,000 – Married max 500,000 Realty exchanged to delay BOOT (Capital gains tax), No money in pocket Intermediary (Middle Man) to handle exchange Handwritten changes to priority over typed Initialed and original crossed through (initial & date, best) Zoning at time of contract? Binding Interest Cap in Contract If interest rate goes above cap, Contract terminated Expressed bilateral agency? Listing Why Trust Account needed? Avoid Comingling and conversion Disclose Agency Relationship Licensee part owner of title company Commission negotiable? ALWAYS negotiable between broker and client Physical charecteristics of Land Immobile, Indestructible and Heterogeneous or non homogenous (unique) Situs: Location MAI Member of Appraisal Institute Leverage: Using someone else’s money for profit (HIGH RISK INVESTMENT) Economic Good for Real Estate: 1. Demand- purchasing power 2. Utility- Usefulness 3. Scarcity- desirable at location 4. Transferability- Title clear (more value) 5. Not a liquid asset Environmental Concerns: 1. 2. 3. 4. 5. Asbestos Lead Base Paint – 1977 and before Urea Formaldehyde Radon (wood shed or basement) – undetectable Underground storage tanks Price: Value: Amount paid Most probable price Appraisal Steps (3): Define Problem, Gather Data and Reconcile Highest and Best Use: condo – apt Most profitable use is not always present use – Supply and DEMAND: Must have demand to have value Regression/ Progression: Re pulls value down, pro pulls it up Contribution: Nothing to do with costs: what something added adds to value Plottage: The ended value of adding contiguous parcels for a greater value than individually Process: Assemblage APPROACHES TO VALUE: Market/Sales Comparison- Compare similar and make adjustments What needs to be considered: 1.Location 2. Amenties 3. Date of Sale 4. Terms and Conditions of Sale (mother to Dau) Adjust Subject Property: NEVER Cost Approach (Summation) Used for: New Homes and Special Use Special Use?: Church or School Replacement cost & Depreciation Land Value What is Physical Depreciation Functional Obsolescence Anything Broken design that is outdated=outmoded Economic/External Obsol. Outside of the property, ALWAYS INCURABLE Curable: Incurable: Cost Effective Not cost effective to Fix Income Approach FORMULA Net Operating income Income Producing properties Property is valued by income it generates Capitalization Rate = Expected rate of return Rate x Value= NOI Mortgage Broker Mortgage Banker Makes the match between broker and lender Funds the Loan w/ their money FHA Insures loans, does not make them Insures lender against default MIP – Mortgage Insurance Protection Low Down Payment 3 ½% contribution Owner Occupied, no prepayment penalty VA Guaranteed from Gov’t if Lender defaults NO DOWN PAYMENT DD214- Cert of eligibility CRV – Certificate of Reasonable Value Owner occupied, no prepayment penalty Certificates Req’d: 3/1/88 lender approval recq’d to assume loan Conventional NO Gov’t backing Based on ability to repay PMI – Private mortgage insurance Secondary Lending FNMA GNMA FHLMC Fannie Mae (The HO, she does EVERYTHING) Government – Buys All loans Ginnie Mae (The Madam) – Covers Fannie Freddie Mac- Generally only does conventional – Standard Forms Usury: Cap on consumer interest rates – we have no usury Monthly P&I Factor Loan amount/1000 x Factor Loan/1000 / monthly payment GRM Gross Rent Multiplier sales Price/montly rent MORTGAGE PAYMENT PLANS Budget or PITI Amortized Partially Amortized Straight/Term Wraparound Blanket Package Construction: InterimTake OutGraduated Payment Subordination Pricinpal, Interest, Tax and Insurance Constant payment of interest and principal until paid off Begins amortized, ends lump sum Begins interest only, ends lump sum Buyer creates a new loan created around existing debt. Seller financing around existing debt Combining 2 or more pieces of property on one loan, partial release Combine personal property and realty on loan short term for the construction phase permanent after construction is complete Lower payments at beginning of loan – does not even cover payment. Negative amortization – Debt will rise Reversiving lien position (ie: refi’ing 1st loan, not second) Capitalization rate increases, value remains the same, income will increase Equity Value-debt= equity… Nothing else matters