Exam1-Spring-2014

FIN 470 Exam 1

1.

Capital budgeting (deciding whether to expand a manufacturing plant), capital structure

(deciding whether to issue new equity and use the proceeds to retire outstanding debt), and working capital management (modifying the firm’s credit collection policy with its customers).

2.

The recognition and matching principles in financial accounting call for revenues, and the costs associated with producing those revenues, to be “booked” when the revenue process is essentially complete, not necessarily when the cash is collected or bills are paid. Note that this way is not necessarily correct; it’s the way accountants have chosen to do it. Additionally, some

“expenses” are not true cash outflows but are simply ways of keeping track of expenses that occurred in previous periods (Depreciation) or expenses that have occurred but have not yet been paid (unpaid salaries and taxes).

3.

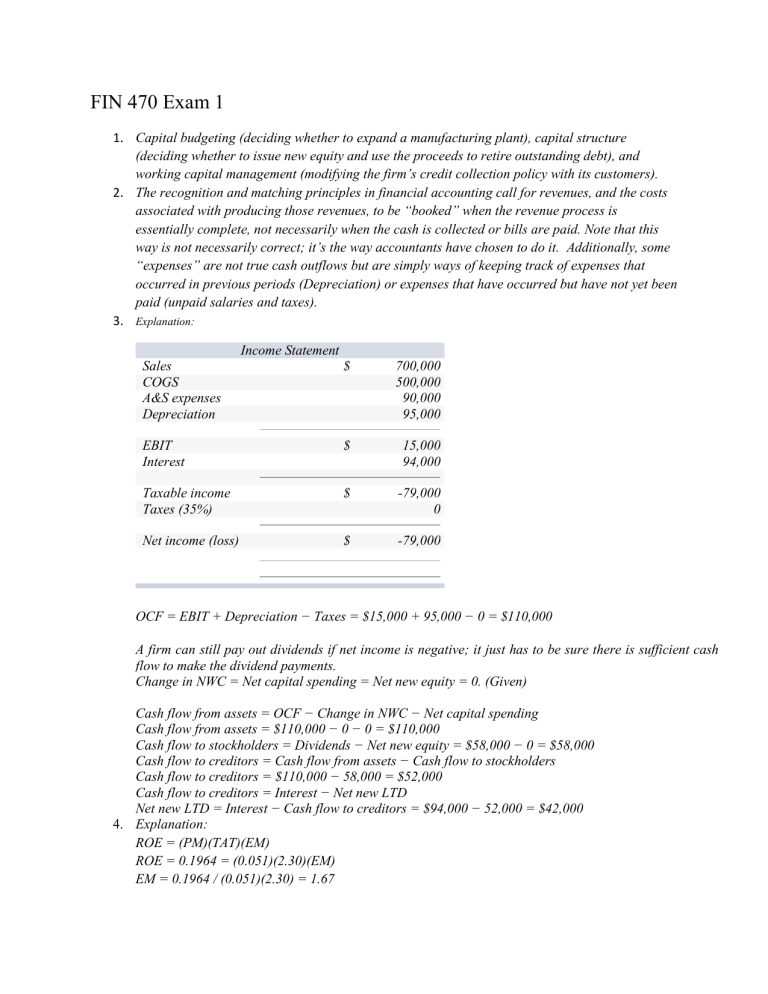

Explanation:

Sales

COGS

A&S expenses

Depreciation

EBIT

Interest

Taxable income

Taxes (35%)

Net income (loss)

Income Statement

$

$

$

$

700,000

500,000

90,000

95,000

15,000

94,000

-79,000

0

-79,000

OCF = EBIT + Depreciation − Taxes = $15,000 + 95,000 − 0 = $110,000

A firm can still pay out dividends if net income is negative; it just has to be sure there is sufficient cash flow to make the dividend payments.

Change in NWC = Net capital spending = Net new equity = 0. (Given)

Cash flow from assets = OCF − Change in NWC − Net capital spending

Cash flow from assets = $110,000 − 0 − 0 = $110,000

Cash flow to stockholders = Dividends − Net new equity = $58,000 − 0 = $58,000

Cash flow to creditors = Cash flow from assets − Cash flow to stockholders

Cash flow to creditors = $110,000 − 58,000 = $52,000

Cash flow to creditors = Interest − Net new LTD

Net new LTD = Interest − Cash flow to creditors = $94,000 − 52,000 = $42,000

4.

Explanation:

ROE = (PM)(TAT)(EM)

ROE = 0.1964 = (0.051)(2.30)(EM)

EM = 0.1964 / (0.051)(2.30) = 1.67

D/E = EM – 1 = 1.67 – 1 = 0.67

5.

The firm has increased inventory relative to other current assets; therefore, assuming current liability levels remain unchanged, liquidity has potentially decreased.

6.

The internal growth rate is greater than 15%, because at a 15% growth rate the negative EFN indicates that there is excess internal financing. If the internal growth rate is greater than 15%, then the sustainable growth rate is certainly greater than 15%, because there is additional debt financing used in that case (assuming the firm is not 100% equity-financed). As the retention ratio is increased, the firm has more internal sources of funding, so the EFN will decline.

Conversely, as the retention ratio is decreased, the EFN will rise. If the firm pays out all its earnings in the form of dividends, then the firm has no internal sources of funding (ignoring the effects of accounts payable); the internal growth rate is zero in this case and the EFN will rise to the change in total assets.

7.

Explanation:

To determine full capacity sales, we divide the current sales by the capacity the company is currently using, so:

Full capacity sales = $540,000 / .94

Full capacity sales = $574,468

To find the new level of fixed assets, we need to find the current percentage of fixed assets to full capacity sales. Doing so, we find:

Fixed assets / Full capacity sales = $420,000 / $574,468

Fixed assets / Full capacity sales = 0.7311

Next, we calculate the total dollar amount of fixed assets needed at the new sales figure.

Total fixed assets = 0.7311($760,000)

Total fixed assets = $555,644.44

The new fixed assets necessary is the total fixed assets at the new sales figure minus the current level of fixed assets.

New fixed assets = $555,644.44 − 420,000

New fixed assets = $135,644.44

8.

Explanation:

Here we are finding the interest rate for an annuity cash flow. We are given the PVA, number of periods, and the amount of the annuity. We should also note that the PV of the annuity is the amount borrowed, not the purchase price, since we are making a down payment on the warehouse. The amount borrowed is:

Amount borrowed = 0.80($3,700,000) = $2,960,000

Using the PVA equation:

PVA = $2,960,000 = $17,800[{1 – [1 / (1 + r)360]} / r]

Unfortunately this equation cannot be solved to find the interest rate using algebra. To find the interest rate, we need to solve this equation on a financial calculator, using a spreadsheet, or by trial and error. If you use trial and error, remember that increasing the interest rate lowers the

PVA, and decreasing the interest rate increases the PVA. Using a spreadsheet, we find: r = 0.502%

The APR is the monthly interest rate times the number of months in the year, so:

APR = 12(0.502%) = 6.03%

And the EAR is:

EAR = (1 + 0.00502)12 – 1 = 0.0620, or 6.20%

9.

Explanation:

This question is asking for the present value of an annuity, but the interest rate changes during the life of the annuity. We need to find the present value of the cash flows for the last eight years first. The PV of these cash flows is:

PVA2 = $2,200[{1 – 1 / [1 + (0.06/12)]96} / (0.06/12)] = $167,409.48

Note that this is the PV of this annuity exactly seven years from today. Now we can discount this lump sum to today. The value of this cash flow today is:

PV = $167,409.48 / [1 + (0.10/12)]84 = $83,374.57

Now we need to find the PV of the annuity for the first seven years. The value of these cash flows today is:

PVA1 = $2,200 [{1 – 1 / [1 + (0.10/12)]84} / (0.10/12)] = $132,520.67

The value of the cash flows today is the sum of these two cash flows, so:

PV = $83,374.57 + 132,520.67 = $215,895.24

10.

Explanation:

Here we are finding the YTM of a semiannual coupon bond. The bond price equation is:

P = $1,020 = $45.00(PVIFAR%,16) + $1,000(PVIFR%,16)

Since we cannot solve the equation directly for R, using a spreadsheet, a financial calculator, or trial and error, we find:

R = 4.324%

Since the coupon payments are semiannual, this is the semiannual interest rate. The YTM is the

APR of the bond, so:

YTM = 2 × 4.324% = 8.65%

11.

Explanation:

To calculate this, we need to set up an equation with the callable bond equal to a weighted average of the noncallable bonds. We will invest X percent of our money in the first noncallable bond, which means our investment in Bond 3 (the other noncallable bond) will be (1 − X). The equation is:

C2 = C1 X + C3(1 − X)

8.85 = 7.10 X + 12.60(1 − X)

8.85 = 7.10 X + 12.60 − 12.60 X

X = 0.68182

So, we invest about 68 percent of our money in Bond 1, and about 32 percent in Bond 3. This combination of bonds should have the same value as the callable bond, excluding the value of the call. So:

P2 = 0.68182P1 + 0.31818P3

P2 = 0.68182(112.4062) + 0.31818(146.81250)

P2 = 123.35369

The call value is the difference between this implied bond value and the actual bond price. So, the call value is:

Call value = 123.35369 − 109.53125 = 13.82244

Assuming $1,000 par value, the call value is $138.22

12.

Future values grow (assuming a positive rate of return); present values shrink.

13.

A freshman does. The reason is that the freshman gets to use the money for much longer before interest starts to accrue. The subsidy is the present value (on the day the loan is made) of the interest that would have accrued up until the time it actually begins to accrue.

14.

Bond issuers look at outstanding bonds of similar maturity and risk. The yields on such bonds are used to establish the coupon rate necessary for a particular issue to initially sell for par value.

Bond issuers also simply ask potential purchasers what coupon rate would be necessary to attract them. The coupon rate is fixed and simply determines what the bond’s coupon payments will be. The required return is what investors actually demand on the issue, and it will fluctuate through time. The coupon rate and required return are equal only if the bond sells exactly at par.

15.

𝑃𝑉 =

𝐿𝑒𝑡: 𝑎 =

𝐶

(1+𝑟)

+

𝐶

(1+𝑟) 2

𝐶

(1 + 𝑟)

1

𝐿𝑒𝑡 : x =

(1+𝑟)

+

𝐶

(1+𝑟) 3

+ ⋯ +

𝐶

(1+𝑟) ∞

𝑃𝑉 = 𝑎 + 𝑎𝑥 + 𝑎𝑥

2

+ 𝑎𝑥

3

+∙∙∙ 𝑎𝑥

∞

Multiply both sides by x to get:

𝑃𝑉𝑥 = 𝑎𝑥 + 𝑎𝑥

2

+ 𝑎𝑥

3

+ ⋯ + 𝑎𝑥

∞

Subtract PVx from PV:

𝑃𝑉 − 𝑃𝑉𝑥 = 𝑎

Factor out PV and divide both sides by 1 – x:

𝑃𝑉 = 𝑎

1 − 𝑥

Substitute back in for a and x, then simplify to get:

PV = C/r

16.

Investors believe the company will eventually start paying dividends.

17.

Here we have a stock that pays no dividends for 10 years. Once the stock begins paying dividends, it will have a non-constant growth rate of dividends. We must first calculate all the dividends that will occur before the firm begins a constant growth rate.

D

10

= $2

D

11

= D

10

× (1 + g

1

) = $2 × 1.15 = $2.30

D

12

= D

11

× (1 + g

1

) = $2.30 × 1.15 = $2.645

D

13

= D

12

× (1 + g

1

) = $2.645 × 1.15 = $3.04175

D

14

= D

13

× (1 + g

2

) = $3.04175 × 1.10 = $3.345925

D

15

= D

14

× (1 + g

2

) = $3.345925 × 1.10 = $3.680518

After the dividend at time 15 the growth rate falls to a constant 5% forever, so we can find the value of the stock at time 14 using the constant growth formula.

P

14

= D

15

/(R – g c

) = $3.680518 / (.11 - .05) = $61.34196

The value of a series of cash flows is always found one period prior to the first cash flow, so

𝑃

𝑃

9

9

=

=

𝐷

10

(1 + 𝑅)

2

(1.11)

+

+

𝐷

2.30

11

(1 + 𝑅)

(1.11) 2

+

2

+

𝐷

2.645

(1.11) 3

12

(1 + 𝑅)

+

3

+

(1.11)

𝐷

3.04175

4

13

(1 + 𝑅)

+

4

+

𝐷

14

+ 𝑃

14

(1 + 𝑅) 5

3.345925 + 61.34196

(1.11) 5

= $46.00

The question asks for the price today, so the value at time 9 must be discounted back 9 periods.

P

0

= P

9

/ (1 + R)

9

= $46.00 / (1.11)

9

= $17.98

![Question 1 [20 marks, maximum one page single space] : a. Explain](http://s3.studylib.net/store/data/008883393_1-14479a605669534bb5d3f64edee995a3-300x300.png)