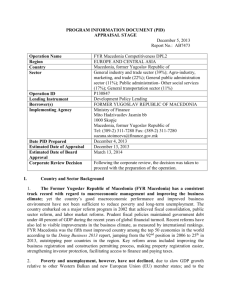

PROJECT INFORMATION DOCUMENT (PID)

advertisement

PROGRAM INFORMATION DOCUMENT (PID)

CONCEPT STAGE

Report No.: 97913

Operation Name

Region

Country

Sector (tentative)

Operation ID

Lending instrument

Borrower

Implementing agency

Date PID prepared

Estimated date of appraisal

Estimated date of board

approval

Concept review decision

Fourth Philippine Development Policy Loan for more

Inclusive Growth

East Asia and the Pacific

Philippines

General public administration sector (60 percent); Rural and

Inter-Urban Roads and Highways (10 percent);Health

(10%);General education sector (10 percent);General

agriculture, fishing and forestry sector (10 percent)

P155141

Development Policy Lending

Government of the Philippines

DOF, DBM, DPWH, DOT, DA, DTI, DSWD, DOH/PhilHealth,

DepEd

May 28, 2015

June 19, 2015

August 17, 2015

Following the corporate review, the decision was taken to

proceed with the preparation of the operation.

Other decision {Optional}

I.

Key development issues and rationale for Bank involvement

The Aquino Administration took office with a strong focus on governance. This was first

expressed in the president’s Social Contract with the Filipino people during the electoral

campaign. The Social Contract highlights better governance as a necessary condition to achieving

inclusive growth. Right from the start, the Aquino Administration embarked on a number of high

profile anti-corruption programs. The government’s economic program highlighted the challenge

of tackling the country’s longstanding economic underperformance, scaling up public

investments in ways that empowered the poor and the private sector, and above all striving to

create adequate opportunities for jobs and livelihoods at home.

Macroeconomic performance has been excellent, while high growth rates have recently begun

to become more inclusive. Starting 2013, economic growth translated into significantly stronger

job creation and faster poverty reduction. For instance, between January 2014 and 2015, more

than a million jobs were created as the unemployment rate fell to 6.6 percent, significantly lower

than the seven to eight percent recorded in the previous decade. The official poverty incidence

declined by three percentage points (ppt) between 2012 and 2013. The 2013 Annual Poverty

1

Indicators Survey suggests that the real income of the bottom 20 percent grew much faster than

the rest of the population through substantial growth of domestic cash transfers, confirming that

the government’s conditional cash transfer program is well targeted and reaching the poor.

Moreover, underemployment among the poor significantly decreased in the same period.

However, in 2014, preliminary data showed an increase in poverty incidence by 0.9 ppt, which

was partly attributed to the effects of Typhoon Yolanda. Nevertheless, this data point does not

substantially change the more inclusive trend of economic growth recorded in recent years.

Improved disaster risk management is one of the reform areas supported by the proposed

operation. In recent years, Typhoons Ondoy (Ketsana), Pepeng (Parma), Sendong (Washi), and

Pablo (Bopha) have claimed over 3,000 lives, affected more than 10 million people, and caused

economic damage and losses amounting to approximately PHP 256 billion (USD 5.8 billion).

Typhoon Yolanda (Haiyan) in 2013 is considered to be the deadliest in Philippine history claiming

more than 6,000 lives, while injuring around 30,000 people. Yolanda cost the economy around

PHP 367 billion (USD 8.6 billion) in damages (3.1 percent of GDP) and is estimated to have

hampered economic growth by about 0.9 percentage points in 2013, and another 0.3 percentage

points in 2014.

This proposed operation builds on the reforms achieved by the previous DPL series. The first

operation with the current administration was approved in 2011 (DPL I) to support the

government’s good governance agenda and reforms to continue to strengthen macroeconomic

stability. DPL II in 2013 focused on deepening governance reforms and improving social service

delivery, primarily through larger budget allocation and better targeting. In November 2013,

Typhoon Yolanda struck the Philippines. The Bank provided supplemental financing under DPL II

to address the unanticipated 2014 financing gap due to the immense damage and casualty

caused by the typhoon which risked jeopardizing the government’s reform program. Finally, in

2014, as the Philippines recovered from Yolanda, DPL III was provided to help the government

strengthen implementation of reforms to support inclusive growth.

The macroeconomic policy framework is adequate and suitable for the purposes of this

operation. The Philippines continues to exhibit strong macroeconomic fundamentals

characterized by robust economic growth, low and stable inflation, healthy current account

surplus, and a falling debt burden. Globally this strong performance was recognized by all three

major credit rating agencies with sovereign credit rating upgrades to two notches above

investment grade and by a record USD 6 billion in foreign direct investment in 2014 (the highest

in decades). Backed by solid macroeconomic trends, the country now has room to focus on the

structural reforms which will sustain growth, create jobs, and reduce poverty.

II.

Proposed objective

This program proposes a single tranche stand-alone development policy loan (DPL IV) with

embedded catastrophe transaction to the Republic of the Philippines for USD 300 million. Its

objective is to sustain the momentum of the inclusive growth agenda of the Aquino

Administration by i) strengthening public investment delivery, ii) improving the investment

2

climate by reducing the cost of doing business, iii) developing the human capital of the poor, iv)

strengthening fiscal transparency and good governance, v) enhancing fiscal management

through improved revenue mobilization, and vi) improving financial inclusion and resilience to

natural disaster. As this operation builds on and deepens the reforms supported in the previous

DPL series, it adopts its five pillars, while adding the sixth pillar that supports policy reforms to

increase the country’s resilience to natural disasters and complements the catastrophe

transaction. The proposed operation also incorporates lessons learned from the previous DPL

series in advancing the implementation of institutional reforms and seizing reform opportunities.

III.

Preliminary description

The prior actions of the proposed operation were selected to deepen reforms supported in the

previous DPL series and to help institutionalize them past the current administration. The

proposed operation builds on a comprehensive set of analytical underpinnings ranging from

technical assistance projects, economic and sector work, capacity building programs, as well as

lending operations.

Pillar I. Public investment delivery strengthened

Prior action 1. This prior action builds on the DPL III prior action on farm-to-market roads (FMRs)

by clarifying the roles and responsibilities of four national government agencies (i.e., DA, DBM,

DPWH, and DILG) with respect to the prioritization of FMRs through a memorandum of

agreement (MOA) scheduled to be signed in June 2015. The MOA prioritizes the construction and

maintenance of all FMR projects, both foreign-assisted and locally-funded, and implemented by

DA and other agencies such as DAR, DILG, and LGUs.

Prior action 2. This prior action deepens the initiation of geo-tagging and disclosure supported

under DPL III by institutionalizing this practice beginning in 2015 to support bottom-up feedback

from intended beneficiaries. Moreover, by using open government outlets, the prior action also

allows overlaying of the DA regular FMR program with both the Philippine Rural Development

Project (PRDP) FMR program and the Tourism Road Infrastructure Program (TRIP) to determine

how various road programs are inter-connected.

Pillar II. Investment climate improved by reducing the cost of doing business

Prior action 3 extends DPL III reforms in reducing the cost of doing business for sole proprietors

to corporations. It involves the signing of four landmark memoranda of agreement among nine

national government agencies and one local government, to streamline the steps in starting a

corporate business. If implemented fully, the number of days needed to start a business is

expected to fall from 34 to 8 and the number of steps from 16 to 6.

Prior action 4 complements the previous prior action by reducing business start-up cost at the

local level. Since July 1, 2014, 10 cities (mostly secondary and tertiary cities) passed executive

orders codifying reforms in simplifying their respective business permit licensing system. The

3

reforms are expected to reduce the number of steps in registering a business to as few as two

steps and time needed to as quick as 35 minutes.

Pillar III. Human capital of the poor developed

Prior action 5. Under this prior action, the government undertakes the first update of the national

household targeting system for poverty reduction (NHTS-PR – Listahanan) covering about 15.3

million households by preparing for and launching the registration survey nationwide. To target

the poor accurately, Listahanan needs to be updated periodically. Current regulations stipulate

that the update is to be done every four years. The update was initially planned for 2014 but was

postponed to 2015 as the government needed to focus resources on mitigating the impact of

Typhoon Yolanda. DSWD has undertaken major preparatory steps for the Listahanan update.

Prior action 6. The action is supporting efforts to achieve universal health coverage (UHC) which

will allow everyone, irrespective of their ability-to-pay to get the health services they need

without suffering undue financial hardship. Achieving UHC depends both on demand-side

measures to remove financial barriers to accessing health care and supply-side investments to

ensure the availability of quality care. This prior action addresses the first challenge by expanding

PhilHealth primary care benefits to include services and medicines to address the prevention and

early treatment of the bulk of the health conditions accounting for a substantial burden of

disease in the country, including non-communicable diseases.

Pillar IV. Fiscal transparency and good governance strengthened

Prior action 7. Building on the launch of an open data portal that DPL III supported, this prior

action supports further openness and publication of data utilizing the OpenBUB platform. This is

expected to help ensure that all regional offices of national government agencies (NGAs) update

and publicly disclose the quarterly status of projects funded through the Bottom-up Budgeting

(BUB) Program to help strengthen accountability across all government levels.

Prior action 8. While the guidelines for electronic bidding (e-Bidding) were approved by the

Government Procurement Policy Board in July 2013, its effectiveness and implementation only

started in late 2014, with two pilot agencies, the Procurement Service for goods and the

Department of Public Works and Highways (DPWH) for works. The Procurement Service has

completed the procurement of four contracts using the e-Bidding guidelines and the functionality

of PhilGEPS. The DPWH will test the system in at least one contract by mid June 2015. Once pilottesting is completed by the Procurement Service and DPWH, the e-Bidding functionality will be

implemented nationwide.

Pillar V. Fiscal management enhanced through improved revenue mobilization

Prior action 9. This prior action builds on the sin tax reform that DPL III supported by helping to

ensure that potential revenue leakages from the illicit sales of cigarettes are mitigated through

the introduction by BIR of an internal revenue stamp with multi-layered security features that

4

covers up to 80 percent of stock.1 This security feature is needed to ensure that higher excise tax

rates from the sin tax reform do not lead to more smuggling.

Prior action 10 supports the government’s move to expand the scope of taxpayers who are

mandated to file income tax returns electronically and use the e-forms to improve tax

administration. This reform is a step towards BIR’s goal of 100 percent electronic filing for all

taxpayers to capture data more efficiently, provide accurate statistics, improve filing efficiency,

increase filing channels to taxpayers, and maximize the use of new technologies.

Pillar VI. Financial inclusion and resilience to natural disasters enhanced

Prior action 11. Adoption of the National Strategy for Financial Inclusion (NSFI) provides an

organizing framework for implementing a number of reforms required to expand access to basic

financial services. It seeks to provide an enabling environment for market-based solutions that

would lead to broader access to responsive and responsible financial products and services by

all, particularly the unserved and underserved markets such as the low-income and marginalized

households, MSMEs, and the youth. Improving access to basic financial services for these

segments of the population would directly contribute to the achievement of the Bank’s twin goals

by facilitating access to finance and greater economic opportunities for bottom 40 percent and

reduce vulnerability of the poor to income shocks.

Prior action 12. The launch of the Credit Support Fund, is one of the actions set out in the Financial

Protection Strategy of the government. The Department of Finance developed a comprehensive

Disaster Risk Financing and Insurance Strategy which sets out to increase the resilience of the

country across three levels: i) national government, ii) local governments, and iii) the poor and

vulnerable households, and MSMEs. An associated action plan sets out next steps to implement

the strategy. The embedded catastrophe transaction implemented through this operation is also

a priority action identified in the strategy for the national level. This prior action, like the one

before, supports the government’s actions to protect the poor and vulnerable from the effects

of natural disasters and to increase financial inclusion.

The embedded catastrophe (CAT) risk transaction offers a financing innovation to provide

immediate budget support liquidity to the government in the case of a parametrically and ex

ante defined severe natural disaster. The main rationale is to allow the government to transfer

to the private markets the risk of disasters that are rare but have severe impact. This is in

accordance with the government’s National Disaster Risk Financing and Insurance Strategy,

which relies on an optimal layering of catastrophe risk, including the establishment of reserve

funds, contingent credit, and financial instruments such as reinsurance and catastrophe bonds.

As part of increasing the post-disaster financing capacity of the government, the Bank would

provide a separate USD 500 million catastrophe deferred drawdown option contingent loan

(CAT DDO II) in addition to the proposed DPL IV with embedded catastrophe transaction. The

1

Initially, this is not 100 percent as the old stock will not be getting the new stamps.

5

two operations complement each other. The CAT transaction is a risk transfer instrument with a

hard trigger (based on modeled loss) that will provide protection against rare but severe events.

The CAT DDO, on the other hand, is a risk retention instrument with a soft trigger. The CAT DDO

can be triggered by a less severe natural disaster upon the declaration of a state of emergency

by the president. Both operations, while processed separately, complement each other by

significantly augmenting the financing options available to the government in the immediate

aftermath of disasters of different frequency and severity.

IV.

Poverty and social impacts, and environmental aspects

Poverty and social impacts

The operations’ prior actions were selected to enhance long-term welfare of the poor and

bottom 40 percent of the population through better job opportunities and enhanced income

protection. Three of the prior actions have direct poverty and social impact: farm-to-market

roads, social protection, and the sin tax reform. First, better transparency and targeting of farmto-market roads is expected to provide better economic opportunities to the bottom 40 percent

and the extreme poor as three out of four poor people in the Philippines live in rural areas.

Meanwhile, the prior action related to the update of the National Household Targeting System

for Poverty Reduction aims to ensure that the database of poor and vulnerable Filipino

households is accurate and up-to-date. Finally, the sin tax reform prior action benefitted from a

poverty and social impact assessment (PSIA) analysis both in the design and implementation

phase.

Environmental aspects

The DPL supports disaster risk management (DRM) which entails addressing institutional

barriers and improving access to finance. DRM and climate change are now mainstreamed into

the planning and budgeting processes at the national and local levels. The country systems on

environmental and social safeguards are also improved to adequately manage the anticipated

environmental and social effects in the execution of actual projects, including those due to

climate variability and extremes and other natural disasters. The Cabinet Cluster on Climate

Change Adaptation and Mitigation has put forward its Risk Resiliency Program as a convergence

platform among agencies. The government has also established a system to identify climate

change expenditures, enabling policymakers to take stock of the national climate change

response and assess the institutional readiness for scaling up climate change financing.

Alongside, reforms are being undertaken by government to reduce the impacts of disasters to

communities and infrastructure by taking a comprehensive multi-hazard approach needed for

effective prevention, response, and recovery.

V.

Tentative financing

The IBRD loan, in an amount equivalent to USD 300 million, will be disbursed in one tranche upon

effectiveness. The interest payment for the loan will include a spread over IBRD’s lending rate,

6

which will be used to finance a catastrophic risk transaction on the international market. This

transaction will provide the country with immediate budget support liquidity in the event of a

parametrically-defined severe disaster (typhoon or earthquake). If such an event occurs,

contingent payouts of up to USD 300 million will be made available to the Philippines.

VI.

Contact points

World Bank

Contact: Karl Kendrick Chua

Title: Senior Country Economist

Tel: 5776+2529

Fax: 632 + 465-2505

Email: kchua@worldbank.org

Location: Manila, Philippines (IBRD)

Contact: Saeeda Sabah Rashid

Title: Senior Public Sector Specialist

Tel: 5776+2663

Fax: 632 + 465-2505

Email: srashid@worldbank.org

Location: Manila, Philippines (IBRD)

Borrower

Borrower: The Republic of the Philippines through the Department of Finance

Contact Person: Stella Laureano

Title: Director, International Finance Group

Tel: 523-9223

Email: slaureano@dof.gov.ph

VII.

For more information contact:

The InfoShop

The World Bank

1818 H Street, NW

Washington, D.C. 20433

Telephone: (202) 458-4500

Fax: (202) 522-1500

7