February 2014 - Wolters Kluwer Law & Business News Center

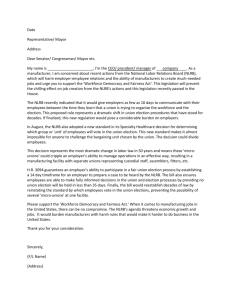

advertisement