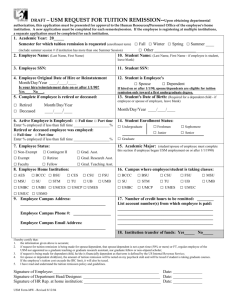

Tuition Remission

advertisement

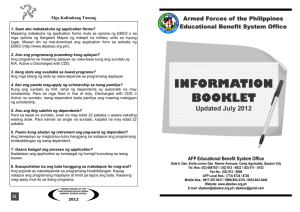

UNIVERSITY OF THE VIRGIN ISLANDS HUMAN RESOURCES DEPARTMENT TUITION REMISSION FORM DATE: _____________________________ SEMESTER/YEAR _____________ EMPLOYEE CLASSIFICATION REGULAR [ ] PROFESSIONAL [ ] FACULTY [ ] ADMINISTRATIVE [ ] EXECUTIVE [ ] RESEARCH [ ] NAME OF EMPLOYEE _________________________________ ID#___________________ HOW LONG EMPLOYED _____________ MAXIMUM CREDITS ALLOWED________ NAME OF EMPLOYEE’S SPOUSE/DEPENDENT________________________________________________ COURSE COURSE # DAYS TIME TOTAL CREDITS APPROVED_____________________________ CREDITS Human Resources Office SPECIAL PERMISSION SECTION ONLY EMPLOYEES REGISTERING FOR CLASSES DURING WORKING HOURS SHOULD COMPLETE THIS SECTION _________ I am a matriculated student and the course is required for my graduation in the current academic year. _________ My supervisor has determined as a part of my performance evaluation that this course is necessary to improve and upgrade my job performance. _________ Course not offered in the evening. WORK RELEASE APPROVAL __________________________________ ________________________________ Department Head Human Resources Manager SEE REVERSE SIDE FOR TUITION REMISSION GUIDELINES REV 11/06 TUITION REMISSION GUIDELINES ELIGIBILITY SCHEDULE: LENGTH OF REGULAR FULL-TIME EMPLOYMENT MAXIMUM CREDIT HOURS ALLOWED PER SEMESTER: Six (6) months to one year 4 One year or more 7 Two years or more 11 Professional and Regular Staff may begin taking courses after completing six (6) months of employment. Their spouse/dependents are eligible to take classes after five (5) years from the employees start date. Full-time faculty, research faculty, administrative, and executive staff and their spouse/dependents are eligible to take classes at the start of their employment. TAKING CLASSES DURING NORMAL WORK HOURS Employees may be granted time off from work to take a maximum of one course during regular working hours if the course in question is not offered in the evening, and: a. The course is required by employee’s supervisor to improve the employee’s skills and/or job performance; b. The employee is a matriculated student, the course is required for graduation in that semester, and no acceptable alternative course is being taught in the evening. TUITION Tuition fees associated with credit-hour courses will be waived for all courses for eligible employees. Spouses and dependents are eligible for tuition remission for undergraduate courses only. EXCLUSIONS The following fees are excluded from the tuition remission program and are the responsibility of the student to pay: a. Registration fee b. Laboratory fee c. other incidental fees are fines d. Fees for non-degree courses, seminars and workshops DEPENDENT CHILD Dependent children must meet following criteria to qualify for this benefit: ** a. Be the natural or legally adopted child of the qualified employee; b. Be under the age of twenty-five (25) c. Be claimed as a dependent on the qualified employees for Federal Tax purposes. VERIFICATION The following documents must be submitted to the Human Resources Office for purposes of verification of eligibility: SPOUSES: a. Marriage certificate. Must be submitted with initial registration form. DEPENDENTS: a. Birth certificate or certification of adoption. Must be submitted with initial registration form. b. Federal income tax form listing the child as a dependent. Must be submitted once a year at the beginning of the Fall Semester. ** Employees are required to report any changes in eligibility status of spouses or dependents to the Human Resources Office within thirty (30) days. **REGISTRATION PERMITS WILL NOT BE APPROVED FOR SPOUSES OR DEPENDENTS WITHOUT SUBMISSION OF PROPER VERIFICATION DOCUMENTS.