Continuity Equations. - Rutgers Accounting Web

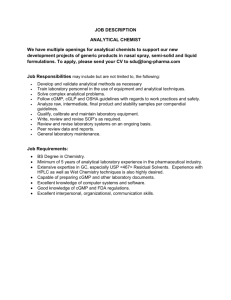

advertisement