The Australian Consumer Price Index

advertisement

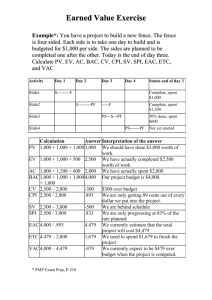

Paper received from the Australian Bureau of Statistics The Australian Consumer Price Index 1. The Australian Consumer Price Index (CPI) is designed to provide a general measure of price inflation for the household sector as a whole. In practice, the index is constrained to only measure the changes in prices faced by private households living in the six State capital cities plus Canberra and Darwin. While the CPI represents the average spending pattern of all households, it does not reflect the experience of any particular household or any particular population subgroup within the community. The basket of goods and services sampled for the CPI is chosen to represent the spending pattern of all private households in the capital cities. While the ABS has no direct role in deciding how its measures are to be used in relation to either wages or pensions, the CPI is a robust measure of general price inflation for the household sector and the best available broad measure of changes in the cost of living faced by Australian households. 2. The simplest way of thinking about the CPI is to imagine a basket of goods and services comprising items bought by Australian households. Now imagine the basket is purchased each quarter. As prices change from one quarter to the next, so too will the total price of the basket. The CPI is simply a measure of the changes in the price of this fixed basket as the prices of items in it change. 3. The total basket is divided into 11 major groups, each representing a specific set of commodities. The groups are food, alcohol and tobacco, clothing and footwear, housing, household contents and services, health, transportation, communication, recreation, education and financial and insurance services. 4. These groups are weighted according to the average expenditure on these items across all metropolitan households, with different patterns of expenditure in each capital city. In the case of the Australian CPI the methodology used involves devising a basket of goods and services representative of those acquired by metropolitan private households during the course of a full year. The annual basket used in the CPI is based primarily on data obtained from the Household Expenditure Survey (HES) which is the only authoritative source of data on the expenditures of different household types in each of the capital cities. The weights are updated periodically, most recently in September Quarter 2005, based on data from the 2003–04 HES. The collection of prices in each capital city is largely carried out by trained field staff. Prices are collected in the kinds of retail outlets and other places where metropolitan households purchase goods and services. This involves collecting prices from many sources such as supermarkets, restaurants, travel agents and schools. 5. The overall (or All groups) CPI provides a measure of the average rate of price change. In calculating an average measure of this type it is necessary to recognise that some items are more important than others. The composition of the basket and the relative importance of items in it relate to households as a whole – it represents the expenditures of all in scope households, not the expenditure pattern of an “average household” or of any particular household type or size. 6. In total, more than 80,000 separate price quotations are directly collected each quarter. The frequency of price collection by item varies as necessary to obtain reliable price measures. Prices of some items are volatile and for these prices frequent price observations are necessary to estimate a reliable average quarterly price. Between Series reviews, weights are held constant at the published expenditure class level but below this level the sample is updated frequently to ensure that it remains relevant to current expenditure patterns. The CPI takes account of any changes in the quality of the items priced to ensure that the index reflects only pure price change in the cost of purchasing the identical basket of goods and services since the previous quarter. The qualities and quantities of goods and services available for consumers to purchase in stores are constantly changing. The CPI identifies changes to item specifications and adjusts observed prices to eliminate quality differences. The ABS adopts a symmetric approach to quality adjustment in that quality improvements result in the CPI showing a lesser rate of increase than it otherwise would, and quality degradations result in the CPI showing a greater rate of increase than it otherwise would. A substantial proportion of the effort of compiling the CPI goes to assessing the effect on prices of these changes, making appropriate adjustments and assuring the integrity of this process before compiling the CPI. 7. As part of the long–standing process of periodic updating of the CPI, the ABS began the 13th Series Australian Consumer Price Index Review in 1997. After an extensive consultation process, in response to changing needs of the Australian community, the ABS made two significant changes to the CPI with the introduction of the 13th Series CPI in the September quarter 1998. The first change was to the measurement objective and the second to the population covered by the index. As a result of the consultation process, the ABS decided that the principal purpose of the CPI should be the measurement of price inflation for the household sector as a whole. This was due in part to the decline in the importance of the CPI for income adjustment purposes with the move away from a centralised wage determination system to a decentralised system, and that the importance of having a good measure of price inflation has increased since 1993 when the RBA introduced an inflation target. The population coverage of the CPI was expanded to cover all private households in the eight capital cities. This resulted in the population coverage increasing from 29% to 64% of Australian private households. The most significant change to the item coverage was the exclusion of mortgage interest and consumer credit charges from the index and the inclusion of expenditure on new dwellings (excluding land). The inclusion of social welfare beneficiary and superannuant households in the reference population better aligned the CPI for use in indexation of social security benefits and indexation of superannuation pensions respectively. The compilation of the CPI will be revisited in a thorough review of the index and its uses in consultation with users in 2009. Such reviews are conducted approximately every five years. 8. In addition to the CPI, the ABS currently produces a series of Analytical Living Cost Indexes (ALCIs), which are based on the outlays of households, as measured in the HES. The ALCIs are designed to measure the on–average impact of changes in prices on the out–of–pocket living costs experienced by four types of Australian households: Employee households (i.e. those households whose principal source of income is from wages and salaries); Age pensioner households (i.e. those households whose principal source of income is the age pension or veterans affairs pension); Other government transfer recipient households (i.e. those households whose principal source of income is a government pension or benefit other than the age pension or veterans affairs pension), and Self–funded retiree households (i.e. those households whose principal source of income is superannuation or property income and where the HES defined reference person is ‘retired’ (not in the labour force and over 55 years of age). 9. The ALCI for Employee households is similar but not identical to the pre–1998 CPI (based on wage and salary owner households). CPI weights are based on capital cities whereas the ALCI weights are calculated at the national level. The ALCIs also include mortgage interest and consumer credit charges. An average annual growth comparison of the CPI to the Employee households ALCI over a 10 year period (June 1998 to June 2008) shows growth in the employee ALCI measure exceeds the growth in the CPI by an average annual difference of approximately 0.3% per annum. A comparison for the selected household types is tabulated below. As a general measure of price inflation for the household sector as a whole, the CPI is the preferred measure. The exclusion of mortgage interest and consumer credit charges from the CPI results in an index that provides a better measure of changes in the cost of living of those households in receipt of social security benefits since only a small proportion of these households incur these expenditures. An acquisitions index is also assessed as providing a better indicator of the price experiences of other low income households. ALCI & CPI average annual growth rates (June 1998 - June 2008) Growth ALCI less CPI Employee ALCI 3.40% 0.30% Age pensioner ALCI 3.30% 0.10% Other government transfer recipient ALCI 3.30% 0.20% Self-funded retiree ALCI 3.00% -0.10% CPI 3.10%