Andrew Spicer - Darla Moore School of Business

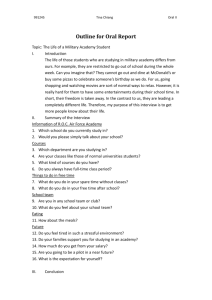

ANDREW SPICER

University of South Carolina

Moore School of Business

Sonoco International Business Department

1705 College Street

Columbia, South Carolina 29208

(803) 576-9900 aspicer@moore.sc.edu

Academic Positions

Associate Professor, University of South Carolina, Moore School of Business, 2008-

Present.

Associate Fellow, Said Business School, University of Oxford, 2012 – present.

(Honorary Appointment).

Assistant Professor, University of South Carolina, Moore School of Business, 2005 –

2008.

Assistant Professor, University of California, Riverside , A. Gary Anderson Graduate

School of Management , 1998-2005.

Education

The Wharton School, University of Pennsylvania, 1998, Ph.D. in Management.

Yale University, B.A., 1990, Soviet and East European Studies, Summa Cum Laude .

Journal Publications

Spicer, Andrew and Ilya Okhmatovskiy. (Forthcoming). “Multiple Paths to

Institutional-Based Trust Production and Repair: Lessons from the Russian Bank

Deposit Market” Organization Studies .

Ault, Joshua and Andrew Spicer. (Forthcoming). “The Institutional Context of Poverty:

State Fragility as a Predictor of Cross-National Variation in Commercial Microfinance

Lending,” Strategic Management Journal .

Earle, John S., Andrew Spicer, and Klara Sabirianova Peter. 2010. “The Normalization of Deviant Organizational Practices: Wage Arrears in Russia, 1992-1998,” Academy of

Management Journal, 53(2), 218-237.

Spicer, Andrew. 2009. “The Normalization of Corrupt Business Practices:

Implications for Integrative Social Contracts Theory (ISCT),” Journal of Business

Ethics, 88 (4): 883-840.

September 2014

Page 1 of 10

Bailey, Wendy and Andrew Spicer. 2007. “When Does National Identity Matter?:

Convergence and Divergence in International Business Ethics,” Academy of

Management Journal, 50 (6), 1462-1480.

Proffitt, W. Trexler, and Andrew Spicer. 2006. “Shaping the Shareholder Activism

Agenda: Institutional Investors and Global Social Issues,”

Strategic Organization , 42:

165-190. o Reprinted in Thomas Clark and Marie dela Rama (eds.). 2007. Fundamentals of Corporate Governance . Sage Publications, London. o Condensed version published in Best Paper Proceedings, Social Issues in

Management Division, Academy of Management Annual Meeting, 2005.

Spicer, Andrew, Thomas Dunfee, and Wendy Bailey. 2004. “Does National Context

Matter in Ethical Decision Making? An Empirical Test of Integrative Social Contracts

Theory,”

Academy of Management Journal , 47: 610-620. o Reprinted in Andy Crane and Dirk Matten (eds.). 2012. New Directions in

Business Ethics . Sage Publications, London.

Spicer, Andrew, and William Pyle. 2002. “Institutions and the Vicious Circle of

Distrust in the Russian Household Deposit Market, 1992-1999,” Advances in

Strategic Management , 19: 371-396.

Spicer, Andrew. 2002. “Revolutionary Change and Organizational Form: The Politics of Investment Fund Organization in Russia, 1992-1997,” Research in the Sociology of

Organizations, 19: 91-124.

Kogut, Bruce, and Andrew Spicer. 2002. “Capital Market Development and Mass

Privatization are Logical Contradictions: Lessons from the Czech Republic and

Russia,” Industrial and Corporate Change , 11: 1-37.

Spicer, Andrew, Gerald A. McDermott, and Bruce Kogut. 2000. “Entrepreneurship and Privatization in Central Europe: The Tenuous Balance Between Creation and

Destruction,”

Academy of Management Review , 25: 630-649.

Book Chapters and Policy Publications

Spicer, Andrew. 2012. “Deviations from Design: The Emergence of New Financial

Markets and Organizations in Yeltsin’s Russia.” In John Padgett and Woody Powell

(eds.), The Emergence of Markets and Organizations.

Princeton University Press.

Ault, Joshua and Andrew Spicer. 2009. “Does One Size Fit All in Microfinance?:

New Directions for Academic Research.”

In A. Wuerth & T. Watkins (Eds.), Moving

Beyond Storytelling: Emerging Research in Microfinance. Amsterdam: Elsevier.

September 2014

Page 2 of 10

Kogut, Bruce, and Andrew Spicer. 2005. “Transition Economies” in J. Beckert and

M. Zafirovski (Eds.), International Encyclopedia of Economic Sociology . Routledge,

London

Kogut, Bruce, and Andrew Spicer. 2004. “Critical and Alternative Perspectives on

International Assistance to Post-Communist Countries: A Review and Analysis,” The

World Bank, Operations Evaluation Department Background Paper, available at: http://www.worldbank.org/ieg/transitioneconomies/docs/literature_review.pdf

Pistor, Katharina, and Andrew Spicer. 1997. “Investment Funds in Mass Privatization and Beyond.” In I. Lieberman, S. Nestor and R. Desai (eds.), Between State and

Market: Mass Privatization in Transition Economies . World Bank: Washington.

Teaching Cases

“Walmart’s Sustainability Strategy: Lee Scott’s Founding Vision” (with Laura

Lambdin).

“Walmart’s Sustainability Strategy: Andy Ruben’s Design of Strategic Goal and

Processes” Case (A) and (B), (with Laura Lambdin and David Hyatt).

“Walmart’s Sustainability Strategy: Defining Sustainable Products,” Case (A) and

(B), (with David Hyatt). (All cases available at the Walmart Sustainability Case

Project website: http://sustainabilitycases.kenexcloud.org/ ).

Working Papers

“The State as a Stakeholder in Hybrid Organization: Lessons from SKS Microfinance and Grameen Bank” (with Joshua Ault).

“Managing in and Around Institutional Voids for Sustainable Development: Lessons from Walmart’s Efforts to Sell Sustainable Products” (with David Hyatt)

“The State as Stakeholder in China: Evidence from Chinese Corporate Social

Responsibility Reports” (with Meng Zhao)

“The Moral Logics of Business: Integrating Institutional and Social Contracts

Theories”

“Institutions and Market Signals in Transition Economies: Deceptive Mimicry in

Russia’s Post-Communist Banking Industry” (with Livia Markoczy)

“Taking Account of Accountability: Academics, Transition Economics and Russia”

(with Bruce Kogut)

September 2014

Page 3 of 10

Presentations and Conferences

“Corporate Sustainability Strategy: Lessons from Walmart,” Closed-Loop Supply

Chain Conference, Charleston, SC, October 2013.

Keynote Speech, “Corporate Sustainability Strategy: Lessons from Walmart,” Green is Good for Business Conference, Columbia, SC, September, 2013.

“Ideals in the World: Exploring the Paradigm Question in Sustainability Research and

Practice,” Faculty Lecture, PhD Sustainability Academy, University of Western

Ontario, London, Ontario, October, 2012.

“Human Rights and International Business,” International Law and

Business Symposium, University of South Carolina Law School, Columbia, SC,

September 20, 2012.

“Institutional-Based Trust in Emerging Economies: Advantages of State Ownership in the Russian Bank Deposit Market,” Academy of Management Annual Meeting,

Boston, August 2012.

“Public-Private Boundaries in International Sustainability Research,” Panel

Presentation, Academy of International Business Annual Meeting, Washington DC,

July 2012.

“Institutional-Based Trust in Emerging Economies: Advantages of State Ownership in the Russian Bank Deposit Market,” Academy of International Business Annual

Meeting, Washington DC, July 2012.

“Corporate Sustainability: Lessons from Walmart,” Sustainability Conference: New

Perspectives and Opportunities, Wharton School of Business, Philadelphia, PA, April

2012.

“Corporate Sustainability: Lessons from Walmart,” Net Impact Undergraduate and

Graduate Chapters, Moore School of Business, University of South Carolina,

November 2012.

“Corporate Sustainability: Lessons from Walmart,” Keynote speaker, Corporate

Sustainability Conference, South Carolina Association of CPAs, Dec 2011.

“The National Context of Poverty: State Fragility and the Global Growth of

Microfinance,” C.K. Prahalad’s Legacy: Business for Poverty Alleviation,

Conference, University of San Diego, San Diego, California, September 2011

Program Chair, International Management Division Doctoral Consortium, Academy of Management Annual Meeting, San Antonio, Texas, August 2011

September 2014

Page 4 of 10

“The National Context of Poverty: State Fragility and the Global Growth of

Microfinance,” Indian School of Business Strategy Conference , Indian School of

Business, Hyderabad, July 2011

“Teaching about Sustainability: Lessons from the Page Prize,” AACSB Sustainability

Conference, Charlotte, NC, June 2011

“Teaching about Sustainability: Lessons from the Page Prize,” Global Business

School Network Annual Conference, IPADE Business School, Mexico City, Mexico,

June 2011

“Can the State be Trusted? The Antecedents and Consequences and Consequences of

Institutional-Based Trust in the Russian Bank Deposit Market”, Desautels Faculty of

Management, McGill University, Montreal, Canada, January 2011

Invited Discussant, Academy of Management Symposium, “The Role of

Organizational Theory and Practice in Poverty Alleviation: Commerce with

Compassion,” Academy of Management Annual Meeting, Montreal, Canada, August

2010.

Invited Discussant, Said Business School Management Department Annual Research

Conference, Oxford, England, June 2010.

“The Social Context of Ethics and Corruption in International Business,” Ivey Business

School, Western Ontario, Canada, June 2010.

“The National Context of Poverty: State Fragility and the Global Growth of

Microfinance, 1998-2007.” Harvard Business School International Research

Conference, Harvard Business School, Boston, MA, May 2010.

“The National Context of Poverty: State Fragility and the Global Growth of

Microfinance, 1998-2007.” Alliance for Research on Corporate Sustainability

(ARCS) Second Annual Conference , Harvard Business School, Boston, MA, May

2010.

“Deviations from Design: The Emergence of New Financial Markets and

Organizations in Yeltsin’s Russia,” Academy of International Business Annual

Conference on Research Frontiers, Charleston, South Carolina, December 2009.

“ International Business and Corporate Sustainability,” presenter and organizer,

Professional Development workshop (PDW), Academy of Management Annual

Meeting, Chicago, Illinois, August 2009.

Faculty Discussant, Junior Faculty Consortium, Social Issues in Management

Division, Academy of Management Annual Meeting, Chicago, Illinois, August 2009.

September 2014

Page 5 of 10

Faculty Discussant, Doctoral Student Consortium, Social Issues in Management

Division, Annual Meeting, Chicago, Illinois, August 2009.

Invited Discussant, Said Business School Management Department Annual Research

Conference, Oxford, England, June 2009.

“The Reconstitution of Public-Private Boundaries in Yeltsin’s Russia: The

Emergence of a New Securities Market,” Conference on the Emergence of Markets and Organizations, Santa Fe Institute, Schenna, Italy, April 2009.

“The Normalization of Corrupt Business Practices: Implications for Integrative Social

Contracts Theory,” Bocconi University, Management Group, Milan, Italy, 2009.

“Institutional Uncertainty and Market Signals in Transition Economies: Deceptive

Mimicry in Russia’s Post-Communist Banking Industry,” International Business

Department, George Washington University, March 2009.

“Institutions, Commercialization, and Development: A Comparative Perspective on the Growth of Microfinance, 1998-2006,” Academy of International Business Annual

Meeting, Milan, Italy, June 2008.

“Using Debates in Teaching International Business,” Academy of International

Business Annual Meeting, Milan, Italy, June 2008.

“Using Debates in Teaching International Business,” Consortium of Undergraduate

International Business Educators (CUIBE), Spring Conference, April 2008.

“When Does National Identity Matter?: Convergence and Divergence in International

Business Ethics,” Northeastern University, International Business and Strategy

Department, April 2008

“A Comparative Institutional Perspective on Bottom of the Pyramid Markets: The

Global Growth of Commercial Microfinance, 1998-2006,” Strategies, Practices, and

Institutions Group, Research Seminar, Oxford, England, December 2007.

“Empirical Research in Ethical Decision Making,” Doctoral Student Speaker Series,

Legal Studies and Business Ethics Department, Wharton School of Business,

Philadelphia, PA., October 2007

“Institutional Uncertainty and Market Signals in Transition Economies: Deceptive

Mimicry in Russia’s Post-Communist Banking Industry,” Academy of Management

Annual Meeting, Philadelphia, August 2007.

“Institutional Governance and Market Signals: Deceptive Mimicry in Russia’s Post-

Communist Banking Industry,” Transatlantic Business Ethics Conference, Wharton

School, University of Pennsylvania, Philadelphia, October 2006.

September 2014

Page 6 of 10

“Institutional Contingencies and Market Signals: Deceptive Mimicry in Russia’s

Post-Communist Banking Industry,” Sonoco International Business Department

Lecture Series, Moore School of Business, University of South Carolina, Columbia,

SC, November 2005.

“When does National Origin Matter in Ethical Decision-making?: An Extension of

Integrated Social Contracts Theory,” Academy of Management Annual Meeting,

Honolulu, August 2005.

“Shaping the Shareholder Activism Agenda: Institutional Investors and Global Social

Issues,” Academy of Management Annual Meeting, Honolulu, August 2005.

“The Future of Institutional Theories,” Symposium, “Whither Institutional Theory?”

Academy of Management Annual Meeting, Honolulu, August 2005.

“When does National Identify Matter in Ethical Decision-Making?: An Empirical

Extension of Integrated Social Contracts Theory,” Conference, Contractarian

Approaches to Business Ethics: The Evolution of Integrative Social Contracts

Theory, Wharton School, University of Pennsylvania, Philadelphia, November 2004.

“Community Norms and Organizational Practices: The Legitimization of Wage

Arrears in Russia, 1992-1999,” Symposium, American Sociological Association

Annual Meeting, San Francisco, August 2004.

“Community Norms and Organizational Practices: The Legitimization of Wage

Arrears in Russia, 1992-1999,” Academy of Management Annual Meeting, New

Orleans, August 2004.

“A Topology of the Impossible: The Emergence of Capital Markets in Post-

Communist Russia,” Symposium, Academy of Management Annual Meeting, New

Orleans, August 2004.

“Global Models and Local Practice: Dishonest Signals in Russian Banking

Industry,” Symposium, Academy of Management Annual Meeting, New Orleans,

August 2004.

“Shaping the Agenda of Shareholder Activism: Institutional Investors and Global

Corporate Social Responsibility,” International Workshop on Corporate Social

Responsibility and the Politics of Stakeholder Influence, Bergen, Netherlands, April

2004.

“Shaping the Agenda of Shareholder Activism: Institutional Investors and Global

Corporate Social Responsibility,” Workshop on Corporate Social Responsibility,

University of Illinois at Chicago, Chicago, April 2004.

September 2014

Page 7 of 10

“The Institutionalization of an Illegitimate Organizational Practice: Wage Arrears in

Russia, 1992-1999,” Kellogg School of Management, Institutions, Conflict and

Change conference, Evanston, Illinois, September 2003.

“Does National Context Matter in Ethical Decision Making? An Empirical Test of

Integrative Social Contracts Theory,” Academy of Management Annual Meeting,

Seattle, August 2003.

“Does National Context Matter in Ethical Decision Making?: An Empirical Test of

Integrative Social Contracts Theory,” 8 th

Ethics in Accounting Symposium at the

American Accounting Association Annual Meeting, Seattle, August 2003. (Winner of

Best Paper Award).

“The Co-Evolution of State and Market: The Emergence of Russian Bank-Led

Financial Industrial Groups,” The Santa Fe Institute, Co-Evolution of States and

Market workshop, Santa Fe, May 2003.

“Critical and Alternative Perspectives on International Assistance to Post-Communist

Countries: A Review and Analysis,” Claremont McKenna College,

The Keck Center for International and Strategic Studies, “Evaluating Success and Failure in Postcommunist Reform,” Claremont, California, 2003

“Institutions and the Vicious Circle of Distrust in the Russian Household Deposit

Market, 1992-1999,” Business and Society Program of the Aspen Institute and the

William Davidson Institute of the University of Michigan, Globalization and Trust

Research Project. Pre-conference: November 2002, Ann Arbor. Conference: March

2002, Aspen.

“Institutions and the Vicious Circle of Distrust in the Russian Household Deposit

Market, 1992-1999,” 2 nd Annual Conference, International Business in Transition

Economies, Vilnius, Lithuania, September 2002.

“Ideas, Economists and Economic Policy: Privatization and the Russian

‘Transition’,” The Santa Fe Institute, Co-Evolution of States and Market workshop,

Santa Fe, June 2002.

“Ideas, Economists and Economic Policy: Privatization and the Russian

‘Transition’,” The Center for European Studies, Harvard University, Cambridge,

April 2002.

“Revolutionary Change and Organizational Form: The Politics of Investment Fund

Organization in Russia, 1992-1997,” Organization Science Winter Meeting Pre-

Conference, Hayden, Colorado, February 2002.

September 2014

Page 8 of 10

“Ideas, Economists and Economic Policy: Privatization and the Russian

‘Transition’,” UC Davis Sociology Department, Lecture Series on Globalization,

Davis, California, April 2001.

“Institutions and the Vicious Circle of Distrust in the Russian Deposit Market, 1992-

1999,” Columbia University Business School, New Institutionalism in Strategic

Management Conference, New York, March 2001.

Globalization and Institutions Workshop. One of 25 scholars invited for workshop on issues of globalization, institutional change and economic research. Sponsored by the

Business and Society Program of the Aspen Institute and the William Davidson

Institute of the University of Michigan. Aspen, September 2001.

“Revolutionary Change and Organizational Form: The Politics of Investment Fund

Organization in Russia, 1992-1997,” Kellogg School of Management, Institutions,

Conflict and Change conference, Evanston, Illinois, December 2000.

“Entrepreneurship and Privatization in Central Europe: The Tenuous Balance

Between Creation and Destruction,” SITE - Stockholm Institute of Transition

Economics and East European Economies, Stockholm, September 2000.

Service

Editorial Review Boards

Editorial Review Board, Strategic Management Journal, 2013 – present

Editorial Review Board, Journal of International Business Studies , 2012 – present.

Editorial Review Board, Management and Organization Review, 2007 – present

Professional Development Programs

AACSB Global Management Capabilities Seminar, Tampa, Florida, February 2014.

Instructor for day-long seminar designed for professors and professionals who wish to learn about strategies of globalizing business school curricula and programs.

Faculty Development in International Business (FDIB), International Business

Survey Course, Moore School of Business, Columbia, SC. Lead Instructor for fiveday course, 2006-present. Course designed for professors and professionals who wish to learn about teaching an introductory survey course in international business.

Moore School Service

Faculty Director, MBA Program, 2013 – present. Oversee MBA academic programming, scheduling, staff and students.

September 2014

Page 9 of 10

Director, Sustainable Enterprise and Development Initiative, 2008-2012. Worked with members of the Moore School faculty and staff to develop curricula and courses on the topics of sustainable enterprise and development; identify and support related research; and forge relationships with relevant institutions and organizations.

Moore School Director, The Walmart Sustainability Case Project, 2010-2013. Helped to lead a team of diverse faculty from the University of Arkansas and the Moore

School of Business to write a series of cases about Walmart’s efforts to introduce new sustainability standards into their global operations and product offerings.

(See http://sustainabilitycases.kenexcloud.org/ ).

Faculty Advisor, Net Impact Student Group, Moore School of Business, 2006 – present.

International Business Doctoral Student Steering Committee, 2011 – present.

International Business Major Undergraduate Steering Committee, Moore School of

Business, 2006 - 2013.

Student Orientation/Recruiting Events, “Globalization and the Future of International

Business” o International Masters in Business Administration, 2007, 2008, 2009, 2010 o Masters in International Business, 2009, 2010, 2011 o Undergraduate International Business Majors, 2009, 2010

Undergraduate Scholastic Standards and Petitions, Moore School of Business, 2006-

2009; Chair, 2007 - 2009.

September 2014

Page 10 of 10