Student Finance Problems: A Literature Review

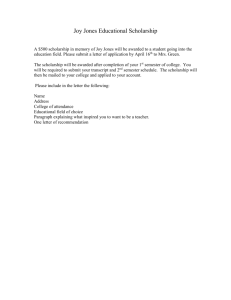

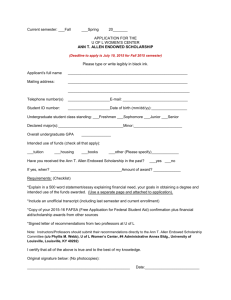

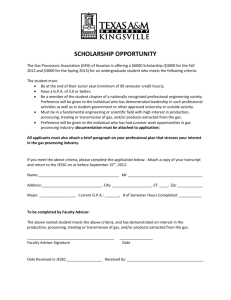

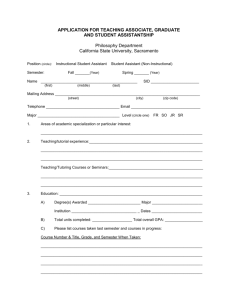

advertisement

CHAPTER 2: LITERATURE REVIEW 1.0 INTRODUCTION This chapter is about the literature reviews that have been reviewed based on the research topic. Literature is a report of a compilation and review means is in written forms on the research topic which write by those people with authority in the field. In this study, I want to find out the causes of student finance problems based on various resources such as book, newspaper article, website or magazine. So, by using all of the resources I can find more information about the causes of student finance problems and also provide some opinion about the situation. As we know, majority of students receive their scholarship or education loan at the beginning of each semester. So, they not have any problem at the beginning semester compare with last of each semester. Based on “Financial Behavior and Problems among College Students in Malaysia: Research and Education Implication” by Mohamad Fazli Sabri, there are many causes about student finance problems such as parent’s marital status and educational level, family income, sibling rank, types of college, residence and education fund (Mohamad Fazli Sabri et al, 2008). 1 2.0 CAUSES OF STUDENT FINANCE PROBLEMS 2.1 UNNECESSARY THINGS Today, we know that majority of students have money from their scholarship and education loan for each semester with cash and in a big amount. So they have a problem for planning their finance with more efficiently. It is because for each semester, they have many things for use in their study such as reference book, fees and more. The finding is supported by Mohamad Fazli Sabri et al (2008), “more than half of the respondents did not save any money when they received their scholarship or education loan. More than half of the students used their money for shopping. About 45% of them spent all their money before the end of the semester; 17% of students gifted some money to their family, and 13% used their money to repay debts”. My opinion about this situation is student must planning their finance from the beginning of each semester so that they just using the money for necessary things”. 2 2.2 THE INFLUENCE OF FAMILY MEMBERS The second causes of student finance problems are family aspect. This is because some student comes from low income families. Student had gifted some money to their family for help them from finance crisis. At the same time, this situation can make the student cannot manage their finance properly because they had to use their scholarship or education loan for another things. Sometimes, student can’t manage their finance because of a strong family influence. Base on “College Students and Financial Literacy: What They Know and What We Need to Learn” by Cude B. J, the influence of family members is important but complex. Most students reported hearing various messages about money from various family members. Most of the messages students shared related to controlling spending and avoiding or using credit wisely. In addition, many were very aware that they and a sibling approached financial management differently and wanted to be different from or like their sibling, depending on whether the sibling was more or less responsible. (Cude et al, 2006). Unlike the research from Cude B. J et al (2006), “the most significant influence on students’ money management behaviors was their parents (70.0%) reported parents together; 13.0% said mother, 6.0%, father). Few students identified as their most important influence a brother/sister (1.2%), grandparents (1.9%), and other family relative (1.2%)”. So, student should manage their finance with using their own opinion and ways. It is because they often influenced by their family and not confident to make own decision about their finance”. 3 In this case, student will lost focus for manage their finance because of family intervention. The effect of this situation is student will leave their finances managed by family. For another situation that related with this cause is family problem that can make the student having a problem in their finance. Mohamad Fazli Sabri et al (2008) clearly has noted, “students who have college graduate parents, higher family income, only child, tend to spend on more items, and have no saving were more likely to have financial problems. There is a negative significant difference between students who have late childhood consumer experience and financial problems. Also those who have had more financial socialization have fewer financial problems”. 2.3 FAILED TO MANAGE THEIR FINANCE PROPERLY The last cause is student failed to manage their finance properly. As we know, student attitude can give an impact to their finance management. Some student have positive attitude and another student have negative attitude. Refer to Cude B. J et al (2006), “one conclusion from the research is that some college students are not managing their finances well, because they have not adopted the set of recommended practices. Another conclusion is that some “recommended” practices should be modified to more accurately match ways in which college students responsibly manage their finances”. 4 Student also failed to manage their finance with more efficiently because not prepare to face some possibility that can giving bad effect to their finance. Base on “Changing College Students’ Financial Knowledge, Attitudes, and Behavior through Seminar Participation” by Borden L. M, young adults also may be unprepared to effectively manage the psychological costs associated with high debt; for example, increased levels of stress and decreased levels of psychological well-being (Borden L. M. et al, 2008). 5 3.0 CONCLUSION As a conclusion, student should to know about financial knowledge, responsible attitudes and finding their weakness in finance problem. They must try to manage their finance without any intervention from outside such as family, friends and more. Others can also help students in financial management by establishing some of activities that can attract their interest. According to Cude B. J et al (2006), “other options available to campus administrators include workshops and seminars, financial counseling centers on campus, peer education, and Internet resources. However, parents also should to have knowledge about finance management so that can conduct or discuss with their children. Also refer to Cude B. J et al (2006), “parent’s needs to be aware of the major role that they play in the financial socialization of their children and that this process occurs at a very early age. Resources are needed to educate parents about how to constructively talk to their children about financial management issues”. So, all parties should cooperate in this matter so that students can focus on their study. 6 4.0 REFERENCES LIST Financial Behavior and Problems among College Students in Malaysia: Research and Education Implication. Consumer Interests Annual. Volume 54, 2008. Retrieved 2008, from consumerinterests.org/images/56.SabriMasudHiraMacdonaldPaim.pdf. Borden L. M, Lee S. A, Serido J, Collins D (2008), Changing College Student’s Financial Knowledge, Attitudes, and Behaviour through Seminar Participation. J Fam Econ Iss (2008) 29: 23-40. Retrieved November 2007, from www.springerlink.com/index/f69v62227391vr43.pdf Cude B. J, Lawrence F. C, Machtmes K, Lyons A. C, Metzger K, LeJeune E, Marks L (2006), College Students and Financial Literacy:What They Know and What We Need to Learn. Eastern Family Economics and Resource Management Association. Conference (2006). Retrieved 2006, from http://mrupured.myweb.uga.edu/conf/22.pdf 7 RESEARCH QUESTIONS: What are the causes of finance problem among FSKKP students? POSSIBLE ANSWER: The causes of finance problem among FSKKP students are when receiving a scholarship or education loan, they always buy an unnecessary things, the influence of family members and failed to manage their finance properly. Author’s Name Cude B. J, Lawrence F. C, Machtmes K, Lyons A. C, Metzger K, LeJeune E, Marks L (2006) Unnecessary Things The Influence of Family Failed to Manage their Members Finance Properly In recent years, educators, The most significant A number of students policy makers, and influence on students’ described using online university officials have money management banking and online access focused on one aspect of behaviors was their to their credit card college parents (70.0% accounts. These students students’ financial reported parents together; were not writing checks or practices – their use of 13.0% said mother, 6.0%, balancing checkbooks. credit, and most father). Few students However, they did have specifically credit cards. identified as their most systems for Increased use of credit important checking their bank cards by influence a brother/sister account balances (usually college students has (1.2%), grandparents to avoid over drafting) and generated a concern (1.9%), other family managing their credit card among many that credit relative (1.2%) or friend charges in relation to their card debt puts college (1.5%). A small credit limit students at greater risk for percentage (5.2%) financial problems after reported “other,” which graduation included boyfriend, girlfriend, husband, wife, 8 teacher, self, personal experience, church, and classes. Borden L. M, Lee S. A, Serido J, Collins D (2008) Some researchers have Student often begin their suggested that lower college careers without income families may not be aware of college financing options (Olson 1982) or may be uncomfortable using credit for college expenses (Churaman 1992) ever having been solely responsible for their own personal finances unprepared to effectively manage the psychological costs associated with high debt Mohamad Fazli Sabri, MacDonald M, Hira T. K, Jariah Masud, Paim L, Mohd. Amin Othman (2008), uncertain about where students from a rural area, More than half of the money is spent (2.58); buy parent marital status is respondents did not save unnecessary things (2.36); widow, low family any money when they lend money to friends income, middle child, received their scholarship (2.27); and skip meals to public university, or save money (2.17) stay on campus, GPA education loan. More than between 2.5-3.74, and tend half of the students used to spend on more items their money for shopping. were likely to report About 45% of them spent engaging in more effective all their financial behaviors money before the end of the semester; 17% of students gifted some money to their family, and 13% used their money to repay debts. 9