Document

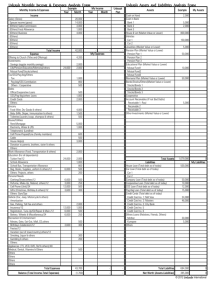

advertisement

What College Students Need to Know About Their Finances Ann House, MS, CFCS, CPFC, CEPF UASFAA April 17, 2012 For many students: • They will become well versed in Faulkner, microbiology, or Mandarin – but not even a basic command of personal finances. • Students start college with no real idea how much it will cost them to live, how much money they will have to live on and how to make up the difference and many report having the least amount of money in their lives. Emily and New York University senior: “All I had to do was sign on to the Sallie Mae web site, check off a few boxes and wait for the money to be disbursed. The thought of repaying it never really hits you until graduation is near.” Countdown http://www.youtube.com/watch?v=96KiSEMHy7Y Reality: • 2 of 3 undergraduates leave with student debt • Half who start never finish with a degree, but do have student debt • Student loan debt has surpassed credit card and auto loan debt - threatening our fragile economic recovery • Studies report that students want financial management information through their U College Board Study, 2008 College Students and Financial Literacy, 2006 Also reality: Students today need our help • What’s more expensive than college? Not going to college. – The typical income gap between the college graduate and the high school dropout has never been higher. Today college grads earn 80% more than people who didn’t finish high school. – $100,000 spent on college at age 18 would yield a higher lifetime return than an equal investment in stocks and bonds. Hamilton Project 5 Money Management Tips for Students 1. 2. 3. 4. We all have a money personality Students need a financial plan Students need to be organized Students need to build and keepuild and keep good credit 5. School is their first priority What can we do? 1. We all have a money personality • What are your financial habits? o What do you buy? o When do you buy? o Why do you buy? o Where do you buy? o What happens to your budget when you buy? o What effect does this purchase have on your goals? *How did you get this way?* The influence of family members is important and complex. Parents play a key role in students financial socialization. Parents’ politics and religious beliefs are most influential in their children's financial training. Most parents don’t know how to constructively talk to their children about financial management. • • • • • Money is a reward Money is control Money is love Money is happiness Spending is irresponsible • Money has no place in polite conversation 2. Students need a financial plan Define financial goals Make plans to reach these goals Take action to make the goals become a reality GOAL $ NEEDED BY (DATE) HOW I WILL REACH MY GOAL GOAL $ NEEDED BY (DATE) HOW I WILL REACH MY GOAL Emergency fund $500 July, 2012 Open a savings account (mark it for emergencies) deposit $167/month Books $450 Fall semester, 2012 Save $90 per month Car $4800 April, 2016 Open a long-term savings account (mark it for car) save $100/month This financial plan includes a school/career plan: • Many students do not complete school in 4 yrs due to failure to plan out required courses, add minors, switch majors, money & personal issues Students should meet with an academic advisor each semester. Compromise – employers care more about skills than specific major If working – studies suggest working on campus and graduation are highly correlated Unexpected Financial Problems? http://www.youtube.com/watch?v=ETMkub3NwK0 3. Students need to be organized • Select a record keeping format • • • • Mint.com, paper, etc. Cash flow = • income – expenses • As detailed as you want Do as much as you can with automatic deposit The more control, the more money you have Why people struggle with budgets: • No plan for expenses that don’t come every week • Don’t track spending 1. To know how much to plan on 2. To keep to the plan • No allowance for the unexpected • Vague expenditure categories • Don’t have an emergency fund etc. Pay attention to deadlines (avoid late fees) Separate needs from wants Check out banks and credit unions, online banks Save and invest Mitigate risk – insurance Receipts and warranties Taxes ID theft and fraud 4. Students need to build and keep good credit More important than ever before • Used to determine the interest rate on a loan • Used to determine your auto insurance rate • Used by potential employers • Used by potential landlords Credit information is used to see how you handle money and to evaluate your responsibility and integrity with your personal finances. Why are employers checking credit? • • • Shows if responsible, accountable, stable and honest on the job. Use of company cell phone or auto Differentiates students 5. School is their first priority Students financial situation in college can affect their academic performance. (1 in 3 on the edge of dropping out due to finances.) School is the most important job right now and a college education will be a big payoff down the road. Students need to take advantage of school resources that their fees are covering (counseling, health, financial help, legal aid, career advice). Lyons, 2003 Students need to be aware of loan and scholarship scams and deceptive offers. Students need to understand their financial aid: • “I don’t know if it is subsidized or not.” • “I thought I would buy a car with half my loan.” • “How do I find out how much I have in loans?” “I asked about the ‘capitalized Interest’ and found out that it was the interest on the loan that was accruing while I was in school. WOW! $17,000.00 accrued while I was sitting in class trying to figure out how to get ahead in this crazy world. And apparently- for the last several years, 90% of my payments have been going to interest. I really am ashamed to admit this all, but I can't hide anymore.” Students entering college today may very well be studying for jobs that won’t exist in a few years. o The top 10 in demand-jobs in 2010 were not even jobs in 2004. (Jeremiah Owyang, Industry Analyst in Silicon Valley) Without a plan, guidance, research, “putting your nose to the grindstone,” todays students may accrue much debt without a successful outcome. http://www.youtube.com/watch?v=IcXRV6stU8U What can we do? • Utah does have financial literacy standards in HS and integrated into K-10 Can colleges and universities build on this? • Most of todays research on students and financial literacy refers to credit card use Do we need a broader definition of financial literacy? • Need for educational resources for parents How can we deliver this? • Need for financial education on campus “Financial education is not part of your bachelor’s program, its part of your life.” Need for a GE requirement for personal finances? • Holistic approach to student needs Resources Financial counseling centers on campus Cude, Lawrence, Lyons, et al., 2006