Property Owner & Mailing Address - Lamar County Appraisal District

advertisement

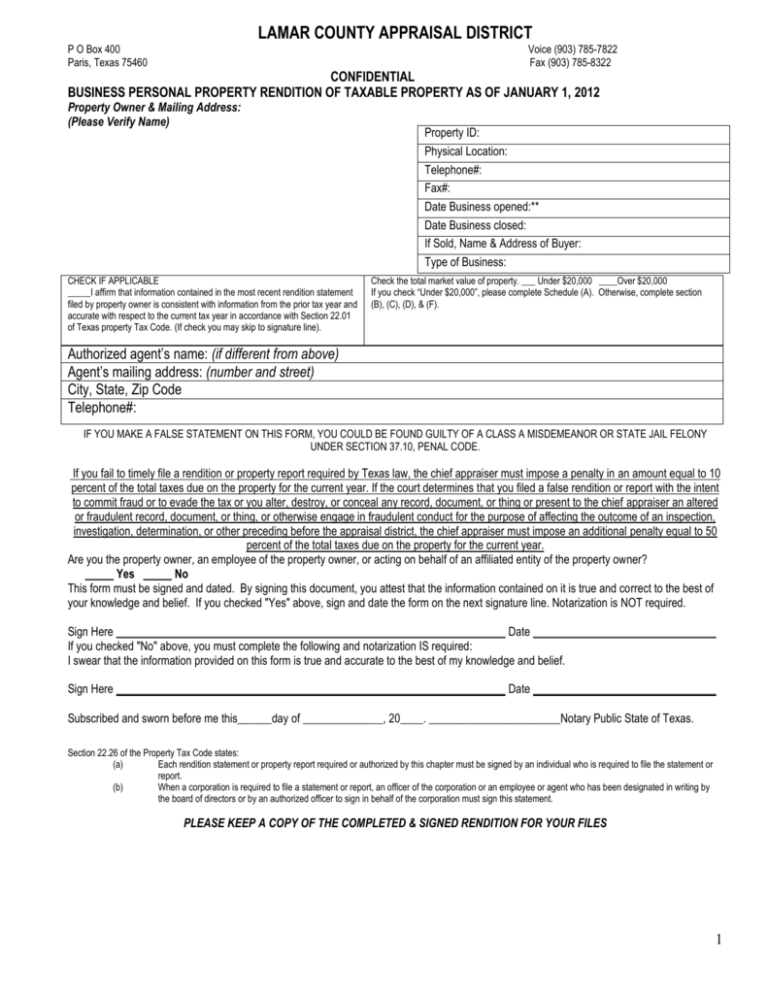

LAMAR COUNTY APPRAISAL DISTRICT P O Box 400 Paris, Texas 75460 Voice (903) 785-7822 Fax (903) 785-8322 CONFIDENTIAL BUSINESS PERSONAL PROPERTY RENDITION OF TAXABLE PROPERTY AS OF JANUARY 1, 2012 Property Owner & Mailing Address: (Please Verify Name) CHECK IF APPLICABLE _____I affirm that information contained in the most recent rendition statement filed by property owner is consistent with information from the prior tax year and accurate with respect to the current tax year in accordance with Section 22.01 of Texas property Tax Code. (If check you may skip to signature line). Property ID: Physical Location: Telephone#: Fax#: Date Business opened:** Date Business closed: If Sold, Name & Address of Buyer: Type of Business: Check the total market value of property. ___ Under $20,000 ____Over $20,000 If you check “Under $20,000”, please complete Schedule (A). Otherwise, complete section (B), (C), (D), & (F). Authorized agent’s name: (if different from above) Agent’s mailing address: (number and street) City, State, Zip Code Telephone#: IF YOU MAKE A FALSE STATEMENT ON THIS FORM, YOU COULD BE FOUND GUILTY OF A CLASS A MISDEMEANOR OR STATE JAIL FELONY UNDER SECTION 37.10, PENAL CODE. If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to 10 percent of the total taxes due on the property for the current year. If the court determines that you filed a false rendition or report with the intent to commit fraud or to evade the tax or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser an altered or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection, investigation, determination, or other preceding before the appraisal district, the chief appraiser must impose an additional penalty equal to 50 percent of the total taxes due on the property for the current year. Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner? _____ Yes _____ No This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowledge and belief. If you checked "Yes" above, sign and date the form on the next signature line. Notarization is NOT required. Sign Here ____________________________________________________________________ Date ________________________________ If you checked "No" above, you must complete the following and notarization IS required: I swear that the information provided on this form is true and accurate to the best of my knowledge and belief. Sign Here ____________________________________________________________________ Date ________________________________ Subscribed and sworn before me this______day of ______________, 20____. _______________________Notary Public State of Texas. Section 22.26 of the Property Tax Code states: (a) Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the statement or report. (b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must sign this statement. PLEASE KEEP A COPY OF THE COMPLETED & SIGNED RENDITION FOR YOUR FILES 1 (A) PERSONAL PROPERTY VALUED LESS THAT $20,000 List all taxable personal property by type/category of property. If needed, you may attach additional sheets or a computer generated copy listing the information below. If property is not at the business address listed above, please attach an additional sheet listing the location. Property owner name/address only if you control property as a General property description by *Good faith estimate of market fiduciary. type/category value(optional) (B) INVENTORY AS OF JANUARY 1ST TYPE/CATEGORY DESCRIPTION ESTIMATE OF CATEGORY **YEAR ACQUIRED NEW OR USED PURCHASE PRICE *GOOD FAITH ESTIMATE OF MARKET VALUE(OPTIONAL) INVENTORY/ MERCHANDISE RAW MATERIALS GOODS IN PROGRESS SUPPLIES TOTALS (C)FIXED ASSETS FURNITURE& FIXTURES, OFFICE OR STORE EQUIPMENT, DATA EQUIPMENT, ELECTRONICS PROPERTY ADDRESS OR ADDRESS WHERE TAXABLE GOOD FAITH ESTIMATE OF MARKET VALUE*(OR) HISTORICAL COST WHEN NEW* YEAR ACQUIRED** % GOOD ** 2011 2010 2009 2008 2007 2006 2005 2004 2003&PRIOR 90% 80% 70% 60% 50% 40% 30% 20% 10% YEAR ACQUIRED** % GOOD ** 2011 2010 2009 2008 2007 2006 2005 2004 2003&PRIOR 90% 80% 70% 60% 50% 40% 30% 20% 10% REPLACEMENT COST NEW LESS DEPRECIATION VALUE*** TOTALS MACHINERY& EQUIPMENT HEAVY/ MANUFACTURING PROPERTY ADDRESS OR ADDRESS WHERE TAXABLE GOOD FAITH ESTIMATE OF MARKET VALUE*(OR) HISTORICAL COST WHEN NEW* REPLACEMENT COST NEW LESS DEPRECIATION VALUE*** TOTALS PLEASE KEEP A COPY OF THE COMPLETED & SIGNED RENDITION FOR YOUR FILES 2 (D) COMPUTERS COMPUTERS PROPERTY ADDRESS OR ADDRESS WHERE TAXABLE GOOD FAITH ESTIMATE OF MARKET VALUE*(OR) HISTORICAL COST WHEN NEW* YEAR ACQUIRED** % GOOD ** 2011 2010 2009 2008 2007 2006 & PRIOR 68% 44% 28% 10% 5% 2% REPLACEMENT COST NEW LESS DEPRECIATION VALUE*** TOTALS (E) PASSENGER VEHICLES, TRUCKS, TRAILERS AND BUSES YEAR MODEL MAKE/MODEL BODY TYPE VIN NUMBER APPORTION TAGS YES OR NO, IF YES MUST COMPLETE SPECIAL FORM YEAR ACQUIRED** HISTORICAL COST WHEN NEW* GOOD FAITH ESTIMATE OF MARKET VALUE* (OR) (F) LEASED, LOANED OR RENTED PERSONAL PROPERTY Name, address, phone # of Owner of item Description of Property Property address or address where taxable Good Faith estimate of Market Value*(or) HISTORICAL COST WHEN NEW* YEAR ACQUIRED** PLEASE KEEP A COPY OF THE COMPLETED & SIGNED RENDITION FOR YOUR FILES *Good faith estimate of market value is not admissible in a subsequent protest, hearing, appeal, suit or other proceeding involving the property except for: (1) proceedings to determine whether a person complied with rendition requirements; (2) proceedings for determination of fraud or intent to evade tax; or (3) a protest under Section 41.41, Tax Code. If good faith estimate is reported, year acquired and purchase price (historical cost when new) are not required, or vice versa. **Optional but important ********************************DUE DATE: APRIL 15, 2012******************************** 3 2012 RENDITION GUIDE Failure to file a timely rendition with this office will result in penalties being assessed. Please read all of the information provided below and on the rendition to ensure your compliance with the law. The following is provided to assist taxpayers in completing Section A through F of the rendition. Section B on the page two of the rendition form requests information on your inventory. Please indicate the basis of your figures by completing appropriate column. Section C through F requests information on the fixed assets used in your business. Please provide the total cost by year of acquisition for all property on hand as of January 1, 2012 in the historical cost column. You should report all property in use or on hand even if fully depreciated on your books or expensed. The rendition form includes the most often used percent good factors for business personal property. If you have specialized property you may contact the Lamar County Appraisal District for appropriate factors. The percent good factors are applied to the cost to arrive at “Replacement Cost New Less Depreciation” which is one of the areas weighed by the appraiser to arrive at an opinion of value. If you do not wish to perform the calculations in section B through E, you may fill only the original cost for appropriate year acquisition. The appraisal office will perform the calculation for you. The calculation example is as follows: Original cost when new X percent good = Replacement Cost New Less Depreciation (RCNLD) Below are guidelines that will assist you in placing property categories B through F shown on the back of the rendition form: Section C. Furniture & Fixtures, Office or Store Equipment, Data Equipment, Electronics and Machinery & Equipment Heavy/ Manufacturing Any Type of office furniture, retail fixtures, restaurant equipment, apartment and hotel goods and similar property. Building/contractor small equipment, automotive industry tools, communication equipment, fast food equipment and electric powered office machines. Telephone systems, fax machines, copy machines, point of sale equipment, and alarm systems. Heavy equipment, manufacturing and processing equipment. Section D. Computers Mainframe computers, personal computers, and word processors. Section E. Passenger, Vehicles, Trucks, Trailers and Buses List all owned vehicles uses in the business. Leased vehicles should be reported Section F. Vehicles disposed of after January 1 are taxable for the year and must be reported. Trucks and Trailers with apportioned tags may require a special form that you may acquire at the appraisal district for allocation of value. Section F. Leased, Loaned or Rented Personal Property When required by the chief appraiser, you must render any taxable property that you own or manage and control fiduciary on January 1(Section 22.01(b), Tax Code). You must list any property leased, loaned or rented to you, regardless of tax liability. If necessary, attach additional sheets. If you have none, please write “NONE”. All property owned or used by the business should be reported regardless of age. ECONIMIC LIFE OF COMPUTERS AGE 1 AGE 2 AGE 3 AGE 4 AGE 5 AGE 6 & PRIOR 68% 44% 28% 10% 5% 2% DEPRECIATION SCHEDULE ECONIMIC LIFE OF FURNITURE& EQUIPMENT & MACHINERY/HEAVY EQUIPMENT AGE 1 90% AGE 2 80% AGE 3 70% AGE 4 60% AGE 5 50% AGE 6 40% AGE 7 30% AGE 8 20% AGE 9 & PRIOR 10% ECONIMIC LIFE OF PASSENGER VEHICLES AGE 1 AGE 2 AGE 3 AGE 4 AGE 5 AGE 6 & PRIOR 85% 70% 55% 40% 25% 10% ANY QUESTIONS ON PERSONAL PROPERTY PLEASE CONTACT: LAMAR CAD-STEPHANIE LEE 903-785-7822 4 LAMAR COUNTY APPRAISAL DISTRICT 521 BONHAM P O BOX 400 PARIS, TEXAS 75461-0400 903-785-7822 903-785-8322 FAX January 2012 Dear Business Property Owner: Enclosed is a Property Tax Rendition form to use to report taxable personal property you owned and used in your business on January 1, 2012. Examples of taxable personal property are inventory, supplies, machinery, equipment, furniture, fixtures, and vehicles you use in your business. Also, you will find on the back a depreciation schedule that the appraisal district uses to determine your depreciation value. It is required this year that you provide a year-end inventory list and fixed assets list showing acquisition cost and date of purchase. Texas Law requires all owners of business personal property in Lamar County to file a rendition with the Lamar County Appraisal District each year. Due to changes in the law, it is required that you complete and return the enclosed form. If you submit any other form than the enclosed form, it will be rejected. New penalties in property tax rendition laws are as follows: For late filing or failure to file, the penalty will be 10 percent of property’s annual taxes. For fraud or tax evasion, the penalty will be 50 percent of property’s annual taxes . In addition to your legal requirements, there are important reasons why you should file a rendition. By filing a rendition, you will place into the record your own opinion as to the value of your property. You will create a responsibility on the appraisal district to notify you if we increase your property’s value. You will also have the right to protest any unjustified increase in your property’s value to the appraisal review board. I encourage you to complete the enclosed rendition form and return it to the Lamar County Appraisal District Office. The deadline for filing a property tax rendition is April 15, 2012. If you have closed your business, please return rendition with it marked at the top of the form. We need for you, at your convenience to come by our office and fill out a form with information on your business closure. If you have any questions, please contact Stephanie Lee at the office. Thank you for your cooperation. Chief Appraiser Enclosure NOTE: THIS FORM MUST BE FILLED OUT THIS YEAR AND RETURNED BY: APRIL 15, 2012 5