Economic Growth in India and Bangalore

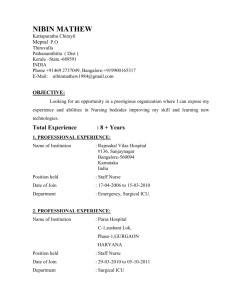

advertisement