Optimization and Climate Policy Transcription

advertisement

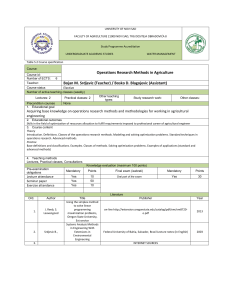

Weston Lecture: Optimization and Climate Policy Transcription Dr. Tom Rutherford, Professor of Agricultural and Applied Economics Introduction: Welcome to all of you who are normally at then round table and all of you who aren’t necessarily. I’ll just say that the roundtable is also a four credit class so please don’t forget to sign in before you leave. About the roundtables in general, they are sponsored by a donation from Roy Weston who is an alumnus of the university. His intention is to support community, research and teaching in environment sustainability, science and technology and policy. So that’s the theme of the roundtables it meshes well with the theme of the forum today. I’ll introduce our guest for this special Weston. It is Professor Tom Rutherford. He earned a PhD from Stanford University in 1987 from Alan Manne. He subsequently been a faculty member at the University of Western Ontario, the University of Colorado and the Swiss Federal institute of Technology in Zurich, before coming to UW in 2012, where he is a professor of Agricultural and Applied Economics, as well as part of optimization things happening at WID. Professor Rutherford’s research focuses with formulation, solution and application of solution inapplicable numerical models in environmental economics, international trade and economic growth. His interests are in global warming, the economic consequences of multi-regional trade agreements the economic effects of trade reform and small open economies. His research also involves methodological contributions related to the application of complementarity models in economics. Without further ado I’ll introduce Tom Rutherford. *Applause* Professor Rutherford: Thank you. This is my first time speaking at the Weston roundtables here, so I had, in preparing for this to think about who is my target audience gonna be. So I knew this was a class for credit so I decided to prepare this talk for a sophomore level engineer who wants to learn something about climate. So that’s what I had in my mind. I thought it’d be kind of interesting because I’m relatively new here at UW. I’m in Michael Farris’s optimization group here at WID and I thought it might be interesting to talk about optimization here as well. So my objective here is to give students a chance to see that computer based methods and modeling methods can be useful in understanding environmental changes and that is my general sort of objective here. I also want to talk about some of the new ideas and research ideas that relate to extensions of existing frameworks. The basic objective here will be to provide a survey after a brief introduction I’ll give you a bit of a feeling of the difference between exante and ex-post assessment. Sort of how we use analytic methods, what is this doing. I’ll do that through an example of the Golden Gate Bridge’s anniversary in another 50 years. So I’ll do that and then I’ll go in a little bit about local warming using optimization to identify climate change here and now. We’ll look at the climate record from Truax field here in Madison to see what the rate of change is using optimization methods. Then we’ll talk about integrated fields. I’m not going to talk about, I’m not going to do this kind of light, I have lots of slides I am going to go through, but I’m going to talk a little bit about that and then at the end I’m going to talk a little bit about discounting and the climate change debate and talk about the work I am doing with Michael Farris on new methods for thinking about how to do assessments of costs and benefits of climate change, in a way the accommodates a sort of social discounting at rates that are lower than what’s observed in the market. Okay so just the basic science, so again a lot of you here probably know more about this stuff than I do, I know that has been the case when I was teaching a freshman level class on climate economics this last term and I was really impressed with the students and how much they knew about these issues. So we know that the greenhouse effect is real, as it’s something we can understand from the back of the envelope calculations. It’s been born out in experiments and observations and there’s lots of evidence. We know this is caused by carbon dioxide. Carbon Dioxide has lots of forces, so we have to worry about energy generation, transportation, deforestation, methane- you know cows are responsible to some extent. We have think then about how to deal with this? There is a variety of instruments the typical type of paradigm that I think about is it is either mitigation, adaptation or geoengineering. Those are the typical type of approaches that we have to think about. There was a time that mentioning adaptation or geoengineering was verboten it was only mitigation. Now we seem to be talking about a range of issues. Despite our improved science there still remain lots of uncertainties about climate and the range of uncertainty about climate. So greenhouse effect again, I’m going to run through these slides, but I’m sure these are things that you’ve seen before. So greenhouse effect has to do with the carbon dioxide molecules reflecting thermal radiation in the infrared spectrum, so you end up heating up more molecules in the atmosphere over time. As I said it’s been understood for a long time it goes back to in 1827 and 1890, this has a long existence of study in the physical sciences and observations going back a large number of years. Demonstrated here you see the overall upward trend of the carbon trend in the atmosphere here. That is the one thing about climate change in the atmosphere here is that we can measure the amount of carbon there is in the atmosphere very precisely and we can observe this as something going on. And it goes on without historical precedence. And that is the thing that the general problem is, I mean we could quibble over the cost of the things and when things happen. But what’s unsaleable is the fact that carbon is going up to a level that is unprecedented in terms of history in the last thousands of years. So, jumping forward. Optimization on the other hand. Climate change I expect most of the audience to know something about. Optimization is something you may not be as familiar with. It is the general idea of trying to improve on things. Basically, given a set of constraint, how can we achieve a better outcome, given the instruments we have available? We can do this formally, we can use math, and you can use systems equations and talk about maximizing. F in this case would be a formal objective function that depends on a set of state variables say x, a set of instruments, t and you try to think about maximizing some outcome. So this is the formalization of the process. So I am going to try and give you four examples of how this would work in the climate setting. But before that, kind of just to fix ideas, let’s go back. I was an engineer originally as an undergrad and when I went to grad school I didn’t intend to learn economics, it kind of just happened, because I was just curious about things. I had never taken an economics class as an undergrad. And one of the examples in my undergraduate training that caught my eye was an example from David Luenberger and it was very tangible because it was right before the 50th anniversary of the golden gate bridge. And for the first time in the history of the bridge they were going to open it to undergraduate traffic, which posed a real challenge to engineers, because people can pack themselves together at about 450 kilograms per square meter. Whereas vehicles trucks and so forth can only have 150. So there’s this big difference. So the big debate at the time was, would the big be able to handle it at full load? I was particularly intrigued by this because I was in the Peace Corps and worked on suspension bridges and knew something about bridges so I found this an interesting challenge. And David Luenburger brought up the idea that there were a few different ways to go at this. So the loose form approach is the instrument the bridge as you see it and you keep a video of how many truck or cars are on the bridge and measure how much deformation you have. And you can use that to extend to see what would happen. So you can see where you’re gonna go. The other way is a structural approach where you develop a model that works as a physics principle for the general elements of the bridges or you evaluate a way in which it would happen in that setting. So if you look at this kind of standard approach you can look at the blue line as being this kind of reduced form model. And measuring the max strain on a point in the bridge and the strain, the gray line might be considered the threshold that you want to go beyond. And then along the horizontal axis we are increasing the load. And the point is that the red dots represent observations that you have. You can fit a reduced form model to those observations but it may not be very good in terms of extending outside of the observations that you have. If you want to go well beyond what you have observed, you need structural model. Because you really can’t rely on the in-sample observations giving a good perspective. I like this example because it applies in space and climate. We’ve observed thing carefully, so we can go back and see what things have happened. But we’re challenged to think ahead in a framework that’s beyond what we can simply interpolate. That’s one of the challenges here and that’s the reason the climate modeling you can say as a consequence we can do any modeling but instead rely on religion to tell us what to do. So the problem is that we have to rely on models but we have to recognize that we cannot just project from what we have. So if you look at this. So in the context of the golden gate bridge they had pictures from 1897. You can see differences in loading. And it did survive, it didn’t break down or fall. But if we think about this method of just projecting, something else could be used in terms of long term projecting. So I just say, this is an interesting terms just in terms of sideline, I just say evidently there are different ways in terms of doing things and the projection approach, sort-of reduced form method. King Hubbard was a geoscientist who worked for one of the oil companies and he made predictions in the 50’s when the U.S. peak oil productions would take place and it basically had a very simple kind of logistic curve to describe what would happen. This is actually a curve from his original paper. And the thing that’s kind of crazy is actually how precise this turned out to be, in term of predicting when the U.S.- well there’s been changes of course, technological changes have occurred- but the overall thought wasn’t that far off. So this is an example of this model, this reduced form sampling method. So the question is “can we rely on this?” The interesting thing is that the whole thing was actually very precise with the U.S. oil production and this was similar. In fact, another name that it is known by is from the energy production game is the Stanley Jevens. The author of the Jevens paradox. The next question is when will the UK run out of oil or coal rather. So coal extraction is quite remarkable. They had to recognize that it was getting low, and sure enough the British Coal Production also follows this logistic structure quite nicely. And I’m just bringing this up as an example. If you do the same for anthracite extraction in Pennsylvania. And something that is entertaining to look at. I find these papers that look at this historically, the main paper is by David Rutledge from Cal Tech. He has his projections. His projections suggest that the coal productions, that coal will run out before the climate becomes a real problem. Which is an interesting sort of alternative take on this. I’m just pointing this out as an intriguing type of modeling exercise. I’m not saying I’ve obsessed it in great detail but I do find it kind of interesting. But let’s look at it in a different way, we can see in that model there is no optimization. Simply all we’re doing is fitting a trend. There is rule of prices or technology it’s simply saying we can match what we can observe. If we think about another approach by Robert VanderPuye, an optimization professor at Princeton who wrote a nice paper on local warming, that looks at data available from the 1950’s from NOAH and a number of stations available all around the world. You can get this data, but when you look at this data you find evidence of climate change that requires you to think critically about this kind of data because there is so much noise that goes on. Year to year there is so much CO2 in the area that we observe immediately, right now and this is something that further, year to year is remarkable. So if you look at the average McGuire air force base in New Jersey, in 55 years, then boy, the data is all over the place. How do you work with making sense of this? How do you take, for example, differences one year apart you get a mean trend where the differences is around 2.9 degrees Fahrenheit per century but the standard deviation is over 7.0 degrees Fahrenheit per century. So that means you’re not really getting a real good handle on it. And this is where optimization tends to be helpful, because you can set up a parametric model where you recognize that seasonal cycle is sinusoidal with a duration of 65.25 days you know something about the solar cycle and you can add to that simple little model a linear trend, so the parameter times one tells us the linear trend per day of how much warming we have going on as a consequence of climate change. And then we can minimize the epsilons or deviations per day observed to give us our best match. You can either use the least absolute differences to get nonparametric differences or use squares that give you basically the same answers. And that gives you a number that tells you what the rate of change is. What I find remarkable about this is that the number that comes out of this is from all these locations are that they are very stable and they agree with the physical models that are based on the greenhouse effect. The models give evidence that at the local level we have quite a bit of stability. Tis is looking at 4 years here at Truex field here in Madison and we see that the linear trend there and the actual sort of estimation. There is a bit of information here, but the big thing is that climate change- there’s strong evidence of this- this is the way the model looks you can write it down and then solve it, but you get 3.2 degrees per century and if you are responding to the New Jersey estimate it is about 3.6 so it is very close. So this says we can use optimization in a way that makes sense of local observations and we can concur with what comes out of the climate models. So now I’m going to go forward with talking about integrated assessment and the idea here is to give people an idea of what integrated assessment models are, what are the issues they are intended to address and how can they helps us in regards to making better climate policy? That’s the basic sets of questions I would like to think about here. And I’m going to go back, Alan Manne was my advisor and part of my project was finding the economics that were a predecessor to something called beta macro which was something I worked on a long time ago. I worked on and wrote several papers using this model. It goes back from a book from 1992 called Buying Greenhouse insurance which focused on uncertainty in the role of mitigation as a method of insurance policy. Now the insurance industry is talking about it, at the time these were academics thinking about the [17:05]abaypin measures it would in buying against future damages. The general structure is known as an internal temporal equilibrium model I’ll talk a little bit about what that means. The basic kind of framework of these integrative assessment models are they are typically original and we can look at tradeoffs between what happens in different countries and different policies. You can look at collaborations between countries to understand what the room is and gains from trade and coordinations of policies. This is a model that is known as a top-down model which means we’re gonna talk about a macro framework that talks about economic growth. And against that framework we’ll talk about energy use and what particular merge starts to focus on producing technologies that produce economic and non-economic policies. It has a variety of climate mitigation scenarios and captures in some sense the economy wide scope of carbon policy. 18:02 Typically in this setting you can use these type of models for two approaches. One is cost benefit that says given what we conjecture to be the damages due to climate change what is the optimal level of abatement we [18:23]filmotrate today to weight the costs of here and now and the long term benefits. Or we can also use the model for cost effectiveness analysis saying if we have the upper-bound of two or three degrees centigrade. What’s the most cost effective way to get to our target? These are equilibrium models that are typically solved as an optimization framework and typically incorporate multiple independent agents and D things are mostly represented as individual actors in this framework. But the key sort of outcome here that makes an integrative assessment model different from a conventional economic growth model it has the elements of an economic growth model in the sense you have capital accumulation investment and intertemporal decisions that are made about how much to invest and how much to consume but in addition it has an energy sector it has electric energy and furthermore it’s emissions translated through a simple little climate model to understand what the effects are on market and non-market damages that effect their welfare. So the fact that you have the red emissions and capture the climate means you are able to trace together what you put together in this system and it provides you the framework for assessing, in a simple framework if we know what these policies look like. The main sort of strength emerge in terms of other integrative assessment models is its ability to represent technology because it can be used to price out under different policy proposals, how much money does a particular technology help us save on the shelf. Now merge has made models that look at the actual conjecture trade-off between funding for research of RND and in terms of technologies generated. That is typically not how a merge is made. In a merge you’d say if we have this technology available you ask when will this technology become costeffective to use? At what magnitude will it come in and how valuable is that to the overall process? Of course the value of the technology is kind of setting ends off the policy constraint. That is one of the challenges I would submit, that is an important insight about climate change, is that fundamentally is this a public good or a public bad. Provision of this has to be done through government policies. One of the challenges is to incentivize innovation that produce new technologies when the market doesn’t do that. You know the incentive is given by government intervention in the market and that’s one of the things in my climate economics class, we begin reading Climate Change is a Super Wicked Problem. This is one of the things that makes it into a super wicked problem, this is generally a problem that happens over time. Virtues of integrative assessment models provide explicit representation of the problem incorporates a sense of behavioral responses, it is a framework for alternative approaches and trade off efficiency and equity. It has this logical appeal that is generally consistent with the idea that if the price goes up people will buy less of it, but by how much? These are things you need to consider. It incorporates both environmental and technology constraints. And it can address risk and uncertainty. I am not going to address that specifically but one of the interesting directions is accounting for potential catastrophic risk-risk and the process of learning over time. But these are a bunch of drawbacks. There’s often time misunderstanding and misrepresentation of what the model the forecasting device. Basically it is important to understand what models can do for you. And having a reliable model doesn’t make us understand how economic growth is changes with intervention. I’d say that is the biggest challenge for these models. If China doesn’t get on the game you are not going to solve the climate quality. But we don’t have a model that tells us how much it will cost China to get involved. Because economic growth in China has been remarkable. And there concerned about interfering with this process of industrial transformation. And that’s a fundamental shortcoming of these models. We don’t know how to do that very well. If we abandon selfish optimizing agents and go to a model structure that may be more appealing, that’s also tricky. The important thing to know is that having a model that points toward policy should be regarded as a necessary but not a sufficient condition for the validity of a given argument. In other words if you come to me and say carbon tax should be 150 dollars immediately and it should rise to 200 dollars. I feel as though it is possible to say show me how it is that you reached that conclusion. That’s not to say that the fact that you have a model means the conclusion is right, but the model provides a starting point for understanding what our assumptions are given rise to given types of arguments. So the basic sort of trade off there is important. The stylized model provides a framework for second order agreement. We may not argue about what the right assumptions are but we can agree that this provides a framework for thinking through what the consequences are. I think the role of models to focus policy discussion is important. 24:04 The problem with this model is it’s perceived as being helplessly complicated and a lot of times there’s this tendency to dismiss or accept things without really addressing them. So there’s lots of microeconomics that are involved. The problem is that in most conventional economics curriculums they tend to focus on econometrics and game theory and price theory and this market interaction stud tends to be a little old fashioned. Generally coming up with a paradigm that is both clean and able to address these issues is a challenge. For the students standpoint this is hell’s library and the bookshelf is full of story problem books. So it is all about how to solve story problems how to take problems you have and make sense of what they say. How to quantify that. I’ve had the last couple of days and we have two visitors from Bloomberg that have funded this project The Risky Business. They are trying to look at the cost-benefit of climate intervention. They are trying to build models to assess this thing. Here are the guys that are doing the assessment of this analysis. They are master’s degrees doing environmental science and environmental policy. But they are both computer science guys. These are guys who are interested in doing stuff and can work on the machine no problem. They show me stuff all the time, they are very, very good. So my basic point is that analytic methods are the not panacea that provide you with the solution to everything, but you have to have a seat at the table. You have to have a framework to argue that this makes sense. So having a model is a good idea. Defensive neoclassical versatility you can calibrate or estimate consistent with Occam’s razor you want to have a consistent as possible model so basically this is formulating models out of sample. This goes back to the golden gate bridge example. The problem is there is a lot of controversy. Climate change brings out a lot of controversy level. One of the more entertaining controversies in the last year has been this paper by Pindyck. The title if you can’t see it is climate change policy, what do the models tell us. And the first sentence has no verb. The first sentence says very little. Right? So there is this interesting sort of debate now about what’s the role of little models. Can they tell us anything? DO they have too much influence? I say the motivation for this paper is mostly because the Obama administration wants to bring in climate policy without having to go through Congress. So they monitored the social cost of carbon and this has been a big debate. Like how much should we charge when we are evaluating environmental policy? How much should we bill ourselves for involving carbon? And that price is currently being based on little models like this. And there’s a lot of people who thinks this does not make that much sense. So this is a legitimate point. At the same time if you are going to look at this paper, which is a fun paper to look at, you almost might want to look at Nordhaus’ most recent book. Nordhaus has been at this game for a long time. He’s really slick and knows his stuff. In terms of the climate he really knows what he’s talking about. In his most recent book it’s quite nice and quite accessible at a graduate level, it’s quite good. Finally if you don’t want to read the book you can read Proveman’s review of the book from the New York Times which is also very good. So this overall debate on climate change. I’m not trying to say something where there’s lots of dust still, you know about this. So let me give you an example of what a model might look like and be applied. This is a paper we wrote four or five years ago looking at what’s going on in China. And what do we expect. How much longer is this going to go on with Chinese emissions going up? It’s seem that this will probably be, Greg Nemet knows more about this than I, but local air pollution will probably stop their emissions, is my guess. But at the time we wrote this, there was a general tendency to underestimate the rate of change in China. It seemed as though every year there would be another surprise. My God, in 2006 the Chinese installed generating capacity. It was their new installation of generating capacity of power was one quarter of that of the US. In one year they installed that much. It was completely breathtaking how fast. And the carbon shadow of the generating units installed after 2000. That was the accumulative carbon emissions units is going to be more than they were from the beginning industrial area period. So it’s really breathtaking. And when we looked at this question we wanted to see why China is growing so fast. So theirs this Kaya Identity which is simply population multiplied by per capita income times the intensity of GDP times carbon intensity of energy equals emissions. So gives you a way to decompose things. As you can see, in China, emissions are the black line and a lot of this is being driven by per capita income. People get richer they want to have a cell phone. People get richer they want to have a car, right? So this is one of the things that happened. It’s not driven that much by population. But carbon intensity have been relatively flat. But energy intensity of GDP, that’s carbon intensity of energy and energy intensity of GDP had been going down. Actually quite perceptively. It was actually precedent. The efficiency improvements were actually remarkable. The main problems was that China’s emissions were growing faster than the other emissions in the world. They became the producer of all of these energy intensive products. The blue are represents all the electric and non-electric energies. The blue and the striped blue, as you can see that is the dominant effect. We’re in this world were we are trying to look forward and see, what is going to happen. One way to look at this is to say, historically, what has happened in comparable countries. That managed to turn the corner on economic growth. And enter into a period of sustained per capita income growth. Another example, in 2006 comparable to Malaysia in 1979 and Korea in 1977, Taiwan in 1973, Germany in 1959. If you queue them up, you can assess what the growth process is. 31:05 And here we have, the two white lines that represent upper and lower bounds, although out black line represents our central case and the dark area between represents the range of emissions intensities from those other countries. So you can see that sustained growth that continued growth that we’ve observed from 1990 to 2010 it’s completely plausible to keep going for a long time. If China follows the growth experience of these middle income transition equalities over the next 20 years, we will continue to see emissions go up dramatically. The gray area represents what the outcomes are, what the growth experiences are of the comparable Asian economies. And these lines represent our prediction from their model. And you can see that relative to what happened historically there’s reason to believe that this will continue to grow for a long time Well China has shown a remarkable interest in renewable energy and they’ve definitely recognizes that this is a problem. But the main challenge is that with this sort of framework is that if China grows in a method that is comparable to Taiwan and Korea and Japan, Climate will be a problem as far as we can see. What are some other insights? Integrative assessment models have been used in a number of different settings. The most common and most visible is most likely with the energy modeling form from Stanford that does model comparison. We can assess the likelihood of getting a two-degree target? Typically the models tell us that it is not likely to happen to reach two degrees unless we have something that is call biofuels with carbon capturing storage. So if you have carbon capturing storage hooked up to a unit. Reasoning is trying to connect that model to the interest rate that matches in the market and prescriptively saying no I really care about what happens to future generations. I want to know what good policies look like. That involve very low discounting of the future. This comes back to this guy Frank Ramsey, in terms of entertaining people from last century. He’s really close to the top of my list, he’s from Cambridge. Ramsey died at age 26 and he basically wrote three paper sin economics and then a bunch of stuff in philosophy that I can’t make sense of. But his model of investment tradeoffs is the main model that is used. And Alan’s analysis says, well I have this Ramsey model. I set the model up to match market interest rates. It has a social discount rate of three percent. If I take that model and just change the discount rate then what happens is the investment jumps. Because suddenly the discount rate I put on the model of three percent if I suddenly change it, then the model does not match what we observed in the market. The problem is what we observe in the market represents the interaction of people who want to save money and people who want to borrow money. So there’s basic interaction involved that determines what the interest rate is, I mean the standard. There are lots of macroeconomic stories that assess why interest rates are so low right now. It’s because there’s a bunch of us who are getting older now and we are worried about our pension. So everybody is looking for a place to put their money to make money for retirement. There’s more money chancing fewer investments. Lower interest rates. That’s the basic Ramsey model like that. The problem is you take the Ramsey model that describes interest rates as observed and you jack in an interest rate with a lower discount rate, you have a big disconnect. So logically challenged that climate policy analysts who council a low amount of time precedence fundamentally face this challenge. That if you lower a zero interest rate it is not going to be consistent with market interest rates. So in the Ramsey optimal growth framework, changes in the total preference produce and changes to plausible aggregate investment. 38:50 So it’s fundamental. Alan was found of this expression: “the model doesn’t pass the laugh test.” So the laugh test is if you look at the results and start laughing because it doesn’t make any sense then that means the model failed. So in integrative assessment, passing the laugh test means you run the model and you should be able to observe things that are consistent and should be able to see, what is GDP growth? What’s energy use? How do things evolve around the baseline? That’s passing the laugh test along the base line and that is important. Then along comes last year with Golder and Williams and they said, well maybe Alan had a point 25 years ago. Maybe we should think about separating prescriptive and descriptive discounting, so we have a social discounting of one discount rate which is social welfare or SW. And the finance equivalent discount rate are sub-f. So we have the agents in the model there’s discounting at a rate that is consistent with their impatience they basically, and that’s an interchange in capital markets. But when we run the model we want to be able to apply on the outcome our own discount rate which may be lower. Until now there has been a problem because integrative assessment modeling, every time they want to they always want to take these Ramsey models and lower the discount rate. On one hand you have much higher rates of intervention in the near term. Carbon tax rates are much higher. Basically good things happen but the model loses its plausibility, because it does match the macroeconomic factors. So this was a paper that didn’t propose a proposal of how to do this, but it laid out a pretty nice idea I thought. And that’s where Michael Farris’s approach comes in. So Michael Farris is a computer science professor here at WID and he has a nice framework for thinking about bi-level programing. Think about maximizing our social objective here subject to the fact that were only going to control t, we are not going to control x. X will be controlled by the market underneath, so that is a little bit abstract. Sorry I am talking to my colleagues. But basically in Michael’s approach we don’t have to do very much. You can basically set up a bi-level program and match my social welfare. Control only the rate of mission control and let the finance agent control everything else. And voila we have a model where investment does not just. So the blue line, red line that you can barely see is the original three percent line. If we solve the bi-level program with the climate change with a very low discount rate for future damages. We end up having exactly the same interest rate. Whereas if we looked at an investment and consumption, we can see if we simply drop the interest rate down to one-percent we fail to pass the laugh test. Whereas if we work in the bi-level framework we end up having basically the same consumption pattern a we do with the three percent rate, but the mitigation rate we observe is significantly higher. 42:03 So I think this is quite a promising approach and it shows the virtue of being a aware of modern computing techniques is quite important. I think it has the potential to have a contribution to the debate of what is appropriate for the social cost of carbon and how much we should charge for it. So my claim is that it provides a very useful method for assessing optimal policies with very low discount rates. And in principle, as an analyst we can discuss which discount rates could make sense in what makes sense in terms of the interest rate. The user of the model should be able to say what they think about the trade-offs between different generations. What’s fundamentally in play here in terms of climate is how much here do we want to mitigate in terms of what the uncertain returns are for the future. I know I didn’t talk about the uncertainty but the main objective here is to have better control and to provide a framework for second order agreement, where I think this is quite promising. I guess the message to students is that when I was an undergraduate or a master, one of my favorite books, which led me to Alan Manne was Soft Energy Paths by Henry Levins back at Earth Day. It was the same kind of idea that with technological change we can do things smarter. It’s all great to be aware of what the issues are but also good to learn some tools and computer science and optimization in particular is something that it does not provide sort of a magic – bullet, solving all problems. But it provides you with a framework for understanding what matters and you can draw your own conclusions from this, and it is very fun as well. So that’s the conclusion. *Applause* Question: Professor Rutherford everybody. And if you are conjugating for a second, I have a question. I only had a couple of engineering classes in my grad career. But hey had a lot to do with cost/benefit of rates and I’ve always thought it was fascinating. Does this extremely low discount rate that applies to climate change optimization, does it climate change considerations in a certain class of things that have extremely low discount rates. Could that have any resonance for people? Climate change investment and policy, will it be like x or y or other things we care about? Professor Rutherford: We think of market interest rates as reflecting, sort of, decision-making in the here and now. There’s no place you can buy and annuity over 100 year horizon. So whenever you work on these environmental problems that have very long horizons, the idea that the market rate of interests should govern your decisions, there’s no economic reason why that’s the case. I’d say again, since moving back to Madison I’ve been struck by the similarities of climate change and utrification of lakes, because Lake Mendota has gotten a lot worse than it was when I lived here in the early 70s. One of the things I’ve learned about moving back is that this is a problem that has many similarities to climate change, because it is very long horizon. You can drop off all of the pollutants going into the lakes and cutoff all of the fertilizer and it might take 100 years they say to clear the water. SO we have these decisions that are long term and have choices in the long term and I don’t think there is a reason exante to choose any interest rate that we want. It’s not to say that there is an argument that says one is better than the other, but personally I think there is an argument that we can ask that question. Question: I work for a solar energy installer and one of the things is that our inverters have a 10 year warranty and you can extend it out to 20 years, but we normally don’t recommend that people do, because we figure in 10 years that new inverters would be a lot better and a lot cheaper than if they pre-pay now. So what I want to know is how do these types of models take into account these technological advances and investment. Is the forward path of technological innovation you would think is getting much better for carbon abating technology? Professor Rutherford: So one of the things we introduced in Merge in 1999 was vintage technology. So basically the model recognizes what technology is available and when. So it makes a decision. It may postpone investment abating that cheaper things will be on the horizon. The problem in your game is that it is not known with certainty. How to cope with uncertainty and how to capture that is always something that’s a game. But in this setting, if you have vintage technology then the cost coefficients and the technology are based on the year in which the investment was made. 47:49 Question: So you talk about these low interest rates exante. What does that translate to in a policy sense? You kind of have to create the appearance that these interest rates and discount rates are working to help people to make decisions about investments? Professor Rutherford: The key topic is to think about not being able to control the divisions of finance yeas. All we have control over is the carbon tax rate and how many aversions we can permit. And so if you are in this bi-level framework. We may assess outcomes and if we could control investment rates and we have a much lower investment rate, we would invest as much as we could. But if we only have access to the carbon tax, what is means is that you can raise the carbon tax and justify it in the basis of a given social outcome. So it means that you can’t dismiss model results that are based on a low discount rate as they are implausible. Because the model I present there with the low discount rate passes the laugh test. The macroeconomics does not fail to match up with what we see in practice. The model from an optimization standpoint it justifies. From a cost/benefit standpoint invention in carbon markets can be justified on the concern from future generations. 49:34 Question: I appreciate the two-level discount rate. My concern is that it has a theoretical backing, but it might be an example of Texas sharpshooting, where you have the target you are looking for and draw the factors around it. So I guess it passes the laugh test theoretically, but what is the empirical evidence that supports the two-level discount rate. Professor Rutherford: Well it is empirical evidence if can convince someone that it is a reasonable approach. I’d say that my reaction would be, rather than reading Frank Ramsey’s 1928 paper about optimal saving, they should read his 1920 paper about optimal taxation. Because this is really something that is the classic approach of how do we design taxes? So tax design is about designing an instrument. Recognizing how individuals respond to change in that instrument. In optimal taxation you want to tax things that have a low overall elasticity and you also want to be careful not to tax factors of production. That’s the argument for low taxes on capital. You don’t want to interfere with economic growth. You want to use the same logic that is used in public finance for taxes and take it over and apply it to integrative assessment. So whether or not we can sell this to legitimize the analysis of low-carbon proposals, I don’t know. Were right in the paper now, so we’ll see how this goes. There’s quite a few people who are frustrated with the current dialogue about integrative assessment models. The things is this doesn’t solve the problem. Pindyck’s other argument is that most of our investments in climate protection are largely driven not by low damages, But the potential for high consequence events. So we have run away to thermal hailing situation we have problems with methane outgassing. These runaway events are what drives things. It does not address all of Pindyck’s problems. 52:00 Question: Regarding the gentleman a few people back about might we have more technologies in the future, that might make saving the money now for a future investment would make more sense. My understanding is keeping carbon the in the ground is a lot more effective under any standard how it is current understood than the cost that would be incurred in trying to pull it back out of the atmosphere. When the IPCC did their report on climate change, the most recent one, some scientists asked, well wait where is the focus on methane releases in the arctic? This is a huge area and it’s a huge area of the unknown. We see it bubbling up. Has it been bubbling up for forever, or is this new and this is going to be a positive feedback loop. The IPCC said they didn’t include it because we didn’t know what those numbers are. And the scientists are saying certainly those numbers must be large. And they said yea but because we don’t know what they are, we didn’t include them in our model. So a lot of this is a bit out of my league but my understanding is if you frame the problem as we are very near a tipping point and we don’t know it. Or we’ve got that hundred year return on investment that you talk about and we don’t know that either. It is hard for any model to predict very effectively what the outcome will be, because we don’t really understand the playing field. Professor Rutherford: There’s lots of models so the main problem is that there is lots of uncertainty. So does that mean we don’t want to observe lots of models? My view on it is, when we hear about all these tipping point events. I have a student, Charlie Chang, and I are working with folk with Epri and Klaus Keller from Penn State on tipping point sort of events. That is something that we are asking exactly. What are some of the tipping point events estimates? The problem is if you watch Chasing Ice, it’s really a great movie. It’s about sort of the disappearance of glaciers in Greenland and around the world. The problem with these tipping point things is the scientists truly don’t know. Stuff happens and they aren’t sure how fast it happens and why. So there’s a lot of uncertainty still. So my thinking is it is better to have a model there and make an assumption about what matters in the here and now. Ultimately with these models we start to question of where do we go in 150 years of the model and what does the model tell us the right action is today, given the range of uncertainties and that’s the best we can do. 55:00 Question: How much can your agents in your models being non-rational, how much can that throw a spinner in the works of the outcome? Professor Rutherford: There is a lot of enthusiasm for agent based models. We have rules of thumb for characterizing people’s behavior. And these models have lots of applications that are very affectively applied. I myself was trained in an era where the assumption of optimization was such an appealing thing, because it makes it relatively simple. If you control the environment it is relatively straightforward. When you have met agents that can do all kinds of crazy stuff, the question is how many times do you have to do that and what happens? But my own training is just like that. I’ve look at specifically price signals and electricity and how they reflect these agent based models. They are quite intriguing, but I claim ignorance about effective ways to use these tools. Conclusion: Thanks everybody for your great questions and thank to Professor Rutherford for your very interesting talk.