Joint Working Paper Template

advertisement

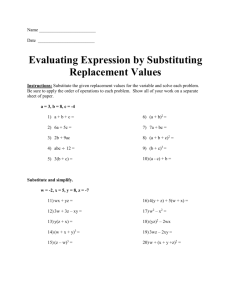

WORKING PAPER Technical report: replacement rates invalidity benefits 2010 General documentation Josephine Foubert Ghent University Participation, Opportunities, Structures WP Nr: 5 Versie: 1 23 september 2015 REPLACEMENT RATES INVALIDITY BENEFITS 2010 Technical report: Replacement rates invalidity benefits Josephine Foubert Ghent University 23 September 2015 Abstract The purpose of this technical report is to provide more information on the data sources and calculations of the replacement rates of disability benefits as used in Foubert, Halvorsen, and Van Rossem (2015). REPLACEMENT RATES INVALIDITY BENEFITS 2010 One of the main challenges of comparative research on disability policy concerns the collection of comparative data related to the countries’ social protection systems. One option is the use of social expenditure data. In this approach, differences in welfare states are operationalized in terms of public spending on different programs and services (Ferrarini, Nelson, & Sjoberg, 2014). The main advantage of this approach is that these data are publicly available from international organizations (OECD, Eurostat) for a larger number of countries and years. Although a certain amount of economic resources is necessary to provide quality services and benefits, the poor validity of social expenditure data to account for welfare state structures is also well known (Esping-Andersen, 1990; Ferrarini, et al., 2014; Gilbert, 2009). Social expenditures are not only heavily influenced by welfare needs, but they are also sensitive to changes in the gross domestic product (GDP) which is the most widely used denominator to report the spending rates. Moreover, the same amount of economic resources can be spent in different ways: on benefits and services for a limited group in society or on broader populations groups with increased availability and coverage of services and income maintenance schemes (Ferrarini, et al. 2014). As a response to these problems, comparative welfare state research has established a focus on the development of social rights via the welfare state and looks into the institutional organization of specific policies and programs (Ferrarini, Nelson, Korpi, & Palme, 2013; Korpi, 1989). With regard to income maintenance programs, these organizational features can be summarized in two main dimensions: coverage (or the proportion of the relevant population eligible for benefits) and the generosity of the benefits (the replacement rate) (Palme, 2006). In comparison with the social expenditure approach, an institutional focus is sensitive to the fact that programs are often organized along different principles and gives to a greater extent insight in what it means for an individual to live in a certain institutional and programmatic context. Although there are datasets available that gather data on the institutional features of the main social insurance programs (unemployment, sickness and old age) of European and OECD countries (e.g. Social Citizenship Indicator Program, Welfare entitlements Dataset), disability benefits are not included therein by default. To the best of my knowledge, only one research report (Palme, Nelson, Sjöberg, & Minas, 2009), published replacement rates of disability benefits before. For that report, the focus was on the year 2005. In my paper on disability policy types across Europe (Foubert, et al., 2015), the focus lies on 2010. As an institutional approach gives a more detailed insight in the programmatic features of the income maintenance policy, I wanted to calculate the replacement rates of disability benefits. Fortunately, I could draw on the calculations made earlier for the report published in 2009. In the following paragraphs data sources and calculation methods are described more systematically. Mainly, I drew on two information sources: the MISSOC and the SPIN databases. The MISSOC (Mutual Information System on Social Protection) was established by the European Commission and provides up to date information on social protection systems on 32 countries and 12 areas of social protection, including invalidity (European Commission, 2015). It provides information on the main outline of the benefit systems, the calculations of the height of the benefits, whether the benefits are taxed and social security contributions have to be paid. Every half year the data are updated, but the user can select the main themes, countries and periods of interest. The SPIN (Social Policy Indicators) database provides the foundation for longitudinal and comparative research on welfare states, based on T.H. Marshall’s ideas of social citizenship (Swedish Institute for Social Research, 2015). The SPIN makes data on social rights and duties of citizen’s available and is oriented towards analyses of institutions as manifested in the social policy legislation. Within the SPIN database, the SIED (Social -1- REPLACEMENT RATES INVALIDITY BENEFITS 2010 Insurance Entitlements Dataset) stores data on three social insurance programs (sickness, unemployment and old age pensions) and information on wages and benefit recipients for all EU Member States for two data waves: 2005 and 2010. The SIED is a continuation of the SCIP (Social Citizenship Indicators Program) database, which covers the years 1930 till 2005. Following the example of previous research making used of the SPIN databases (e.g. Ferrarini, et al., 2013; Palme, et al., 2009), I made use of a type-case approach to get insight in the generosity of the invalidity benefits. This means the calculation of the benefits is based on the social rights provided to model family constellations in each respective country. The benefits are thus calculated based on the rules governing the social insurance systems of the countries. In the case of the invalidity benefits, the calculation is based on the case of a 55-year old man who receives invalidity benefits due to a 100 percent incapacity to work. In countries were the benefits entitlement is related to the insurance record, 25 years of contributions are assumed. Calculations were made for both a single earner household and a single-earner with a non-working spouse. No other benefits (such as those related to rehabilitation or long-term care) were taken into account. The replacement rates are calculated in two steps. In a first step, the gross replacement rates, without taking into account the fiscal system of a country are established. The gross replacement rates are calculated by relating the amount of the benefit to the wage level of an average production worker. An average production worker (APW) works in manufacturing or the metal industry and has received earnings equal to the Average Production Worker’s Wage (APWW). When different protection systems cover different types of workers, the program with the largest coverage among workers in manufacturing has been coded. In countries where different occupational categories (such as salaried employees, self-employed and farmers), programs covering salaried employees are used to calculate the replacement rates. The sum of the invalidity benefits the type-case receives in one year is the numerator. For the denominator, the yearly earnings of an APW are used. In a second step, the fiscal system of a country is taken into account. Both the benefits and the wages are calculated net of taxes and social security contribution. Consequently, the net replacement rate is the ratio of the net yearly benefit amount to the net yearly wage of the average production worker. In the paper, we use the average of the replacement rates for the two model households described previously. By calculating both gross and net replacement rates, it is possible to see the effects of the tax system and transfers. Formally, the rates are calculated as follows: nr nr nr dissi= disnetsi/netapwsi disfa= disnetfa/netapwfa dis = (nrdissi + nrdisfa)/2 Where si = single person fa = family with single-earner and non-working spouse dis = disability benefit (52w) nr = net replacement rate apw= average production worker. The data concerning the gross and net APWW’s are gathered from the SIED-database. Information on the calculation of the benefits is predominantly taken from MISSOC (update of 01/07/2010). For more information on country-specific calculations that were made, I refer you to the document listing the decisions for each country. -2- REPLACEMENT RATES INVALIDITY BENEFITS 2010 Acknowledgments The research leading to these results has received support under the European Commission’s 7th Framework Programme (FP7/2013-2017) under grant agreement n°312691, InGRID – Inclusive Growth Research Infrastructure Diffusion. I am grateful to the SOFI institute for hosting me for two weeks in Stockholm and providing me access to the SPIN-database and previous calculations on disability benefits. I would like to thank Laure Doctrinal, Maria Forslund and Daniel Fredriksson for their enthusiasm while answering my many questions on the calculations and for digging in the past, Katharina Wesolowski and Ola Sjöberg for their previous work on replacement rates of disability benefits in 2009, and Kenneth Nelson for discussing my research approach in general. References European Commission. (2015). Social Protection Systems - MISSOC. Retrieved 22/09/2015, 2015, from http://ec.europa.eu/social/main.jsp?catId=815&langId=en Esping-Andersen, G. (1990). The three worlds of welfare capitalism. Cambridge & Oxford: Polity press. Ferrarini, T., Nelson, K., Korpi, W., & Palme, J. (2013). Social citizenship rights and social insurance replacement rate validity: pitfalls and possibilities. Journal of European Public Policy, 20(9), 12511266. Ferrarini, T., Nelson, K., & Sjoberg, O. (2014). Decomposing the effect of social policies on population health and inequalities: An empirical example of unemployment benefits. Scandinavian Journal of Public Health, 42(7), 635-642. Foubert, J., Halvorsen, R., & Van Rossem, R. (2015). Disability policy in Europe: a fuzzy set ideal-type analysis of approaches towards active citizenship. Ghent University. Gilbert, N. (2009). The Least Generous Welfare State? A Case of Blind Empiricism. Journal of Comparative Policy Analysis, 11(3), 355-367. Korpi, W. (1989). Power, Politics, and State Autonomy in the Development of Social Citizenship - Social Rights during Sickness in 18 Oecd Countries since 1930. American Sociological Review, 54(3), 309-328. Palme, J. (2006). Welfare states and inequality: Institutinal design and distributive outcome. Research in Social Stratification and Mobility, 24, 387-403. Palme, J., Nelson, K., Sjöberg, O., & Minas, R. (2009). European Social Models, Protection and Inclusion. Stockholm: Institute for Future Studies. Swedish Institute for Social Research. (2015). Social Policy Indicators (SPIN). 2015, from http://www.sofi.su.se/spin/ -3- JOINT WORKING PAPER -2- Universiteit Gent Vakgroep Sociologie Ghent University Department of Sociology Korte Meer 3-5 9000 Gent België - Belgium +32 (0)9 264.67.96 +32 (0)9 264.69.75 socio@ugent.be